2139.one Scam Review: Alarm Bells for a Risky Platform

In the high-stakes world of online investments, it can be tough to distinguish between legitimate opportunities and cunning traps. 2139.one belongs squarely in the latter category—part of a network of platforms formally flagged by regulators and plagued with user complaints. Despite its professional trappings, it’s a textbook financial scam, and here’s why you need to avoid it.

1. Blunt Regulatory Alerts from Italy’s CONSOB

Italy’s financial regulator, CONSOB, has taken direct and forceful action against 2139.one. On October 9, 2024, it issued an order to block access to the site, alongside other related domains like 2139.nl, 2139a.com, and 2139.lol, on the grounds of illegally offering financial services without proper authorization.consob.it+1consob.it+1

This explicit action isn’t mere oversight—it’s a red flag indicating that the platform has violated financial law.

2. Deceptive Claims and False Legitimacy

Despite CONSOB’s action, 2139.one continues to promote itself using misleading credentials. It claims registration with respected entities like ACRA in Singapore and the U.S. SEC, none of which are verified. Its claim of being an MSB with FinCEN doesn’t confer legitimacy or legal approval.BrokersViewreportscam.netnathanreclaimllc.com

This kind of misrepresentation is often used by fraudsters to cloak their real intent in false credibility.

3. A Network of Sites With the Same Scheme

2139.one isn’t isolated—it belongs to a broader “2139 Exchange” network. These platforms share identical designs, even using the same look, email contact, and web content across domains like .lol, .nl, .fun, and .q.com.CONSOB even notes their content is “identical” to related scam portals.consob.it+1consob.it+1

That consistency across domains makes it clear this is a coordinated, large-scale operation designed to evade blocks by quickly shifting domains.

4. Alarmingly Low Trust Scores

Fraud prevention tools like Scam Detector give 2139.one a very low trust rating of 4.3 out of 100, labeling it Young, Unsafe, and Warning. The algorithm flagged issues like a high phishing and malware score, blacklisting, and suspicious domain patterns—all signals that point to a high-risk operation.Scam Detector

5. Repeated Complaints and Disappearing Funds

User reports paint a consistent picture of deception: withdrawals are delayed or blocked, customer support vanishes, and complaints go unanswered. Many describe being lulled in by early fake profits, only to be locked out once they tried to withdraw funds.forteclaim.comAlertTrade.netreportscam.net

Then, without warning, the site collapses and users are left empty-handed. A classic scam cycle.

6. Community Warnings Confirm the Threat

On community forums like Reddit, users share grim firsthand observations. One user noted:

“This Crypto investment called ‘2139 Exchange’ claims you can earn $5–7 a day on a $300 investment… The website looks pretty good … but I couldn’t find anything about the owner.”Reddit

These voices are invaluable—guardians of truth among digital noise—amplifying the need for skepticism.

7. A Scam Script Unfolding: The Typical Lifecycle

2139.one follows the classic financial fraud formula:

-

Attractive entry: low-barrier signup, professional design, promises of reliable profits.

-

Short-term wins: simulated dashboards build trust.

-

Escalation: pressure to deposit more via limited-time offers.

-

Withdrawal delays: requests are met with obstacles or disappearances.

-

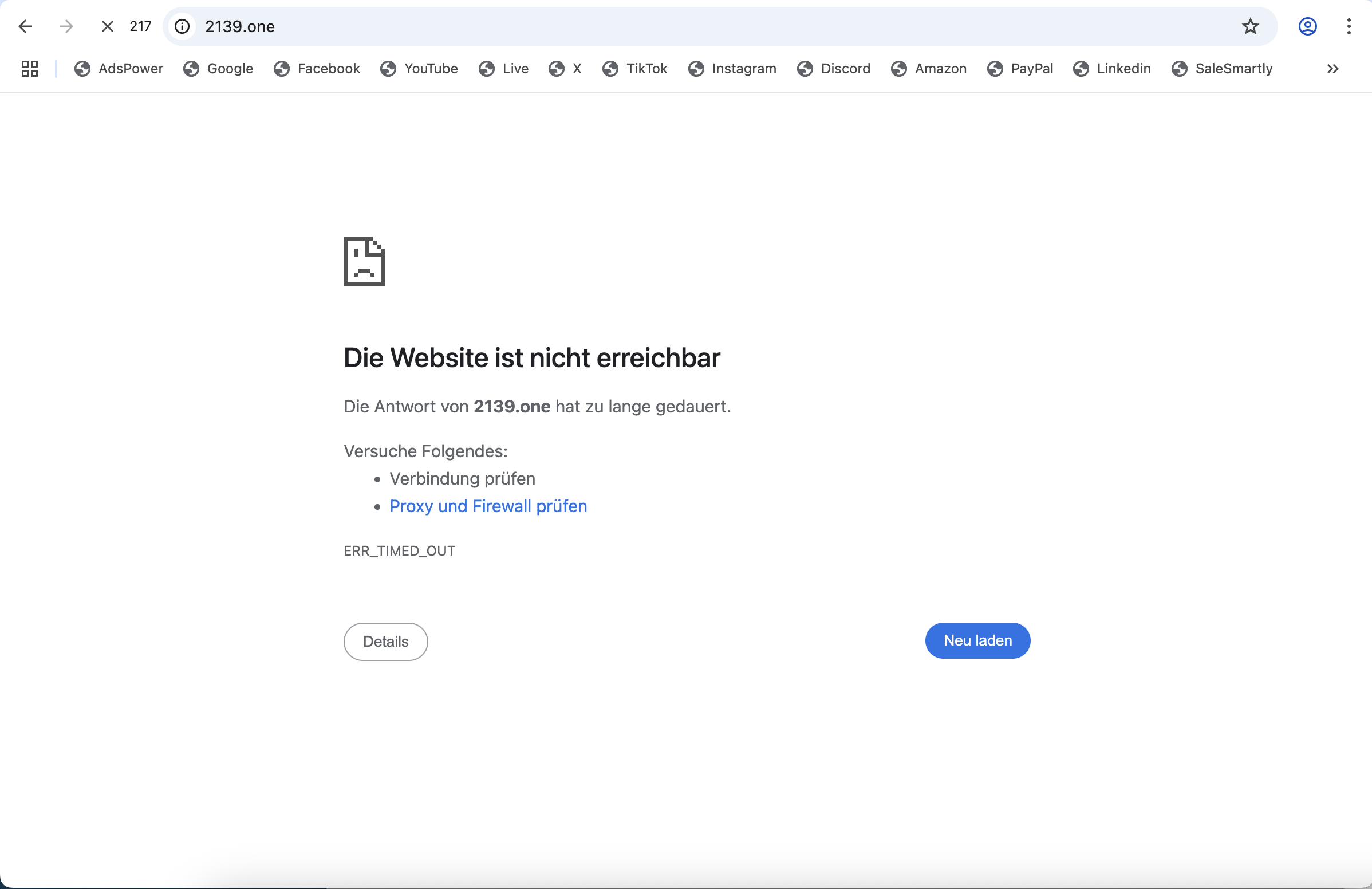

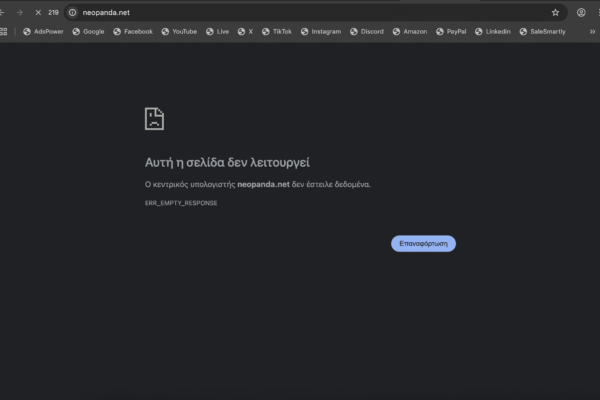

Site shutdown: domains go dark, leaving users stranded with no recourse.

This playbook has been replicated across countless scams—and 2139.one fits right in.

8. The Danger Isn’t Just Financial

Victims often face more than lost money:

-

Emotional drain: betrayal, stress, shame, regret.

-

Lost trust: skepticism toward even legitimate financial platforms.

-

Network damage: those who promoted the platform to friends face backlash and guilt.

The intangible fallout often outlasts the monetary damage.

9. How to Stay Safe From Platforms Like This

Here are your best defenses:

-

Always check regulation using official directories (e.g., FCA, CySEC, ASIC).

-

Pause at unsolicited praise, especially via private messages.

-

Search for credible third-party reports—not testimonials on the site.

-

Attempt small withdrawals early, before investing more.

-

Avoid platforms claimed to be blocked or sanctioned by regulators.

A little due diligence today can prevent a lifetime of regret tomorrow.

10. Final Verdict: Avoid 2139.one at All Costs

2139.one is far more than sketchy—it’s a confirmed high-risk scam. With formal regulatory bans, fabricated credentials, built-for-scam network infrastructure, abysmal trust scores, and real user losses, it’s one of the more brazen schemes out there.

Any platform flagged by CONSOB—or similar regulators—is one to avoid completely. Your financial future—and peace of mind—deserves transparency, regulation, and accountability.

Stay informed. Stay cautious. Don’t let slick design cover deception.

-

Report Incore-investment.net And Recover Your Funds

If you have lost money to incore-investment.net, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like incore-investment.net continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.