247ExcessMarket.com: A Cautionary Review

In the rapidly expanding world of online trading and financial markets, investors are constantly inundated with new platforms promising easy returns, advanced tools, and professional support. One such platform that has recently attracted attention — and significant concern — is 247excessmarket.com. At first glance, the website presents itself as a full-service trading platform offering access to CFDs, forex, commodities, and other financial instruments, but a deeper investigation reveals that many of the claims made by the platform are misleading at best and potentially fraudulent at worst. This review examines why 247ExcessMarket should be treated with extreme caution and why individuals need to steer clear entirely.

Superficial Marketing Versus Reality

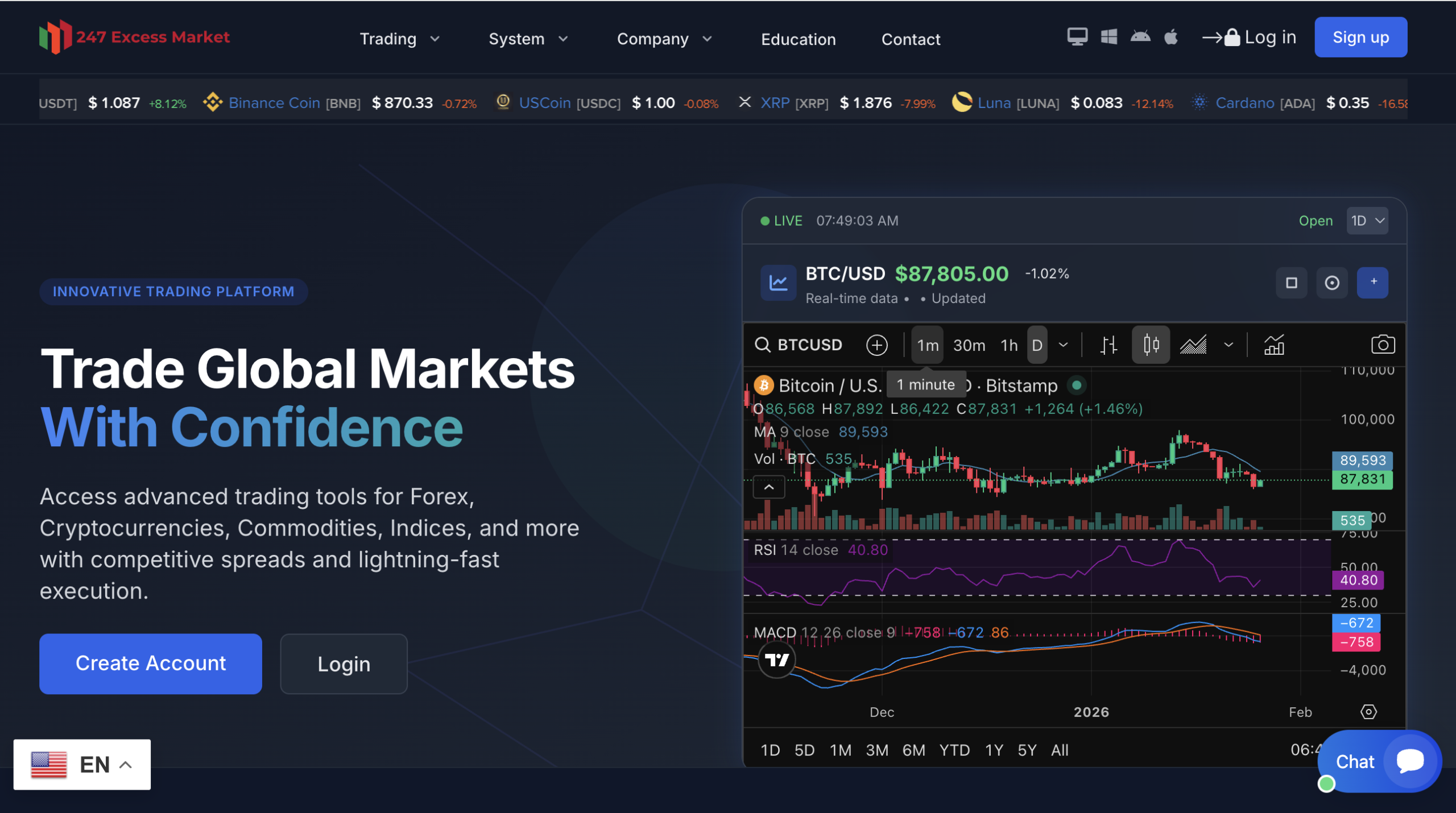

The homepage of 247excessmarket.com is designed to look professional. It features polished graphics, testimonials from purported “satisfied traders,” and bold claims about high returns and advanced trading strategies. The site asserts that users can trade a wide range of assets, from forex and indices to oil and gold, and implies that even novice traders can make significant profits using its interface. Testimonials boast extraordinary gains within very short timeframes.

However, these marketing elements fall into classic patterns of high-pressure financial solicitation. The use of stock images, generic testimonials, and unverified success stories are hallmarks of online schemes that seek to attract interest without backing claims with verifiable evidence. Genuine regulated brokers typically provide documented performance histories and transparent risk disclosures. In contrast, what you see on 247ExcessMarket’s site lacks independent verification and raises immediate red flags.

Lack of Legitimate Regulation

The most serious concern regarding 247ExcessMarket.com is its regulatory status — or lack thereof. According to recent investor alerts, the United Kingdom’s Financial Conduct Authority (FCA) has explicitly placed 247 Excess Market on its Warning List of unauthorised firms. The FCA states that the firm may be providing or promoting financial services or products without the necessary regulatory permission, and that investors should avoid dealing with it. Notably, firms offering controlled financial instruments in the UK must be authorised; without this approval, there is no legal protection for consumers engaging with the platform.

This warning alone should be sufficient to deter anyone from investing or opening an account. Operating without authorisation means the platform does not adhere to the stringent regulatory standards required of legitimate financial institutions. Furthermore, the contact addresses and telephone numbers listed on the site have been flagged as potentially unreliable, which is consistent with other scam operations that use fabricated or misleading contact information.

Poor Trust and Safety Indicators

Independent website safety scanners also provide corroborating signs that 247excessmarket.com is untrustworthy. Tools such as ScamAdviser assign the site a very low trust score, indicating a high likelihood of being unsafe. The reasons for this poor rating include:

-

The site’s domain is relatively young, which is common for scam operations that may only be online briefly before disappearing or relaunching under a new name.

-

The platform is hosted on a shared server with multiple other websites that also have low trust ratings — a known tactic used by scammers to reduce costs and mask operations.

-

The presence of high-risk financial keywords, including references to cryptocurrency and speculative trading, which are often leveraged by fraudulent brokers to entice investors with promises of rapid wealth.

Importantly, while having an SSL certificate (the small “lock” icon in the browser) is technically required for any modern website, this alone does not indicate legitimacy. Fraudulent platforms routinely obtain basic encryption certificates for free to create a superficial sense of security.

Misleading Claims and Fake Licensing Statements

247ExcessMarket’s own FAQ and marketing material contain claims of global regulation and registration in places like the United Kingdom. Yet, these assertions do not hold up under scrutiny: the FCA’s official register does not list this company as authorised, and independent checks show no verifiable licences held by the platform for forex or CFD trading.

This inconsistency between the company’s claims and verified regulatory data is a critical indicator of misconduct. Legitimate brokers are proud to display their regulatory status and will provide clear evidence of licensing from recognised authorities. In contrast, unregulated platforms like 247ExcessMarket often make vague or deceptive references to “global regulation” without the supporting documentation.

Conflicting User Feedback and Suspicious Reviews

Because 247ExcessMarket has not claimed social media profiles or established a credible presence on major review platforms, actual customer feedback is sparse. On Trustpilot, a related domain associated with this brand shows minimal reviews and presents a low average score, further suggesting that there is insufficient trustworthy user experience data to support the platform’s claims.

Additionally, mixed or purchased reviews are a common tactic among fraudulent sites. These can include a small number of highly positive ratings buried among many complaints or generic statements that cannot be independently verified.

How Scam Investment Platforms Operate

Understanding the broader pattern of how investment scams function helps clarify why 247ExcessMarket’s structure is problematic:

-

Promises of Unrealistic Returns: Scams often lure victims with testimonials claiming extraordinary earnings with no substantiation.

-

Upfront Deposits Without Protection: Fraudulent platforms may require users to deposit funds before trading access is granted, and once funds are sent, withdrawal barriers often appear.

-

Fake Testimonials and Stock Content: Fraud sites frequently use fabricated success stories to create a veneer of legitimacy.

-

High-Risk Financial Hooks: Cryptocurrencies and CFDs, due to their inherent volatility and complexity, are common vehicles for fraud because they offer plausible deniability and layers of technical jargon that can confuse less experienced investors.

These tactics create a cycle in which investors are enticed by glossy promises, only to encounter resistance when attempting to access or withdraw their funds.

Final Verdict: Steer Clear

Based on regulator warnings, independent trust evaluations, and the overall lack of credible oversight or transparent evidence of legitimate operations, 247ExcessMarket.com exhibits multiple red flags consistent with online financial scams. There is no verifiable registration with major financial regulators, the platform has a poor trust rating, and its marketing claims contradict the available regulatory data.

Individuals seeking to engage in online trading or financial investment should prioritise platforms with clear, verifiable licensing and transparent operating histories. Entities that lack these qualities pose an unacceptable risk to your capital and personal information.

Conclusion: Treat 247ExcessMarket.com with the highest degree of skepticism. This platform has all the hallmarks of a high-risk or potentially fraudulent operation. Investors and traders are strongly advised to avoid opening accounts, depositing funds, or engaging with this platform in any capacity. The safest course of action is to choose regulated, well-established brokers with reputable track records and legitimate oversight.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to 247excessmarket.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as 247excessmarket.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.