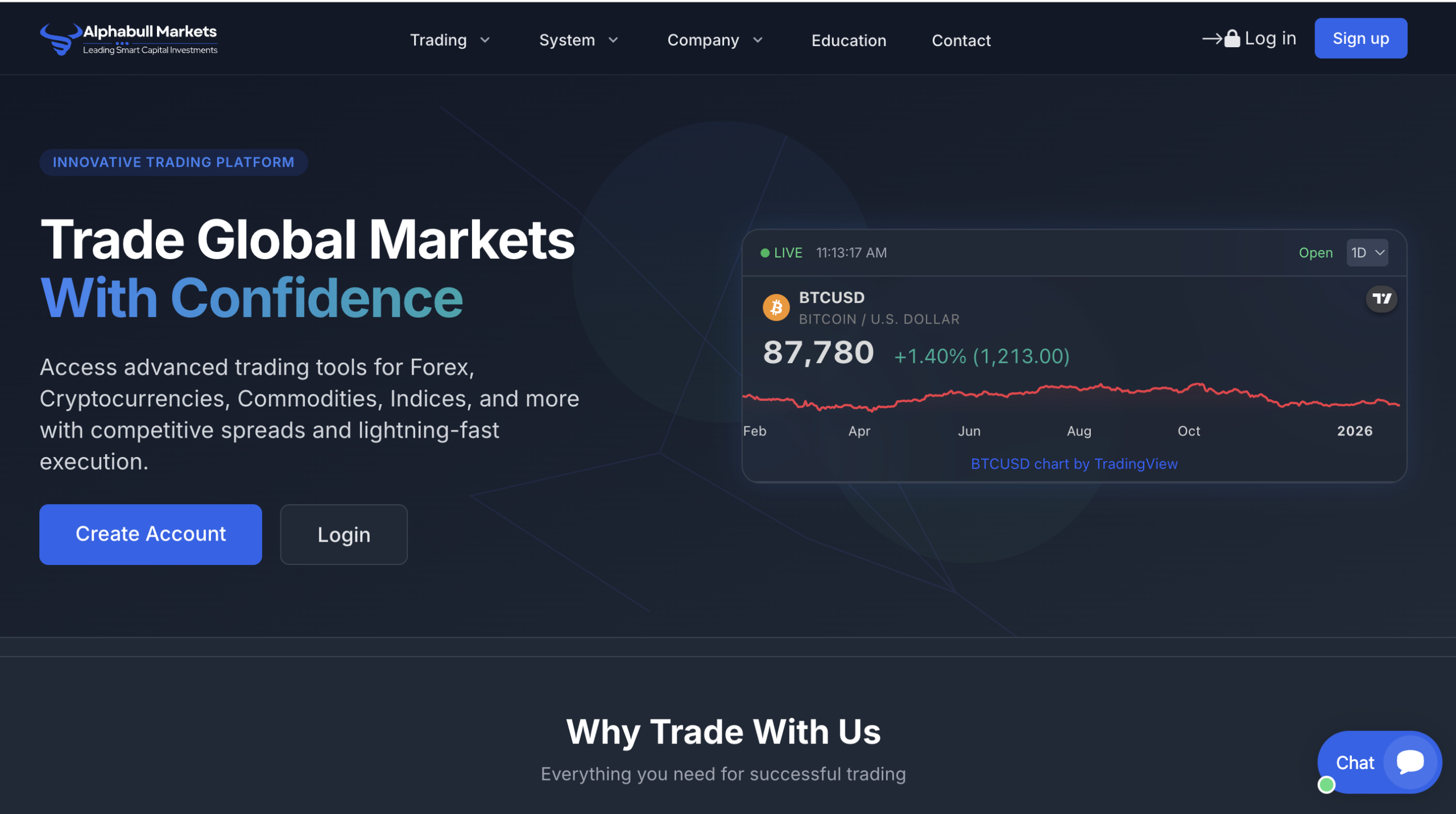

AlphaBullMarkets.com Trading Site Analysis

In the crowded ecosystem of online brokerages and digital trading platforms, investors often seek out opportunities that appear innovative and promising. However, not all platforms operate with transparency, accountability, or proper regulatory oversight. AlphaBullMarkets.com is among the names that have surfaced in discussions related to unregulated and potentially unsafe trading services. A closer look at the platform’s structure, claims, and public reviews reveals significant issues that should make potential investors hesitate before engaging with it.

Anonymity and Lack of Verifiable Corporate Identity

One of the first indicators that a trading platform may not be operating legitimately is the absence of clear information about its corporate origin, leadership, and regulatory compliance. AlphaBullMarkets.com fails to provide verifiable details about its management team or licensed status with any recognised financial authority. Legitimate firms are required to display licensing information and corporate registration details clearly, often including registration numbers, governing jurisdiction, and links to the regulator’s official listings.

In the case of AlphaBullMarkets.com, such disclosures are either missing or unverifiable, meaning investors have no way of confirming who runs the platform or under what legal framework it operates. This lack of transparency is a consistent characteristic of unregulated brokers and fraudulent operations.

Unregulated Status and Offshore Claims

AlphaBullMarkets.com purports to operate in offshore jurisdictions, sometimes suggesting incorporation in places like Saint Vincent and the Grenadines. However, these jurisdictions are notorious for allowing companies to register without offering real regulatory oversight. A review by industry analyst sites shows that even the alleged corporate registrations and claimed regulatory associations do not appear in official registries. This means the platform is functionally unregulated — a significant concern for anyone entrusting their capital to it.

Regulation is not merely bureaucratic paperwork; it acts as a safeguard ensuring that brokers are subject to financial audits, capital adequacy requirements, customer asset protections, and adherence to market conduct rules. A lack of regulation effectively leaves investors exposed with no recourse if problems arise.

Marketing Promises and Unrealistic Returns

Like many platforms that raise concern, AlphaBullMarkets.com uses marketing language designed to attract investors quickly. Promises of high returns, access to a wide range of assets including forex, commodities, and cryptocurrencies, and invitations to take advantage of cutting‑edge trading tools are common on the site. These claims are not backed by independent performance data or audited financial results — and promising returns that exceed typical market performance without risk should always trigger caution.

Platforms that rely on broad, unverified claims to entice investments often do so because they lack the substance of regulated brokers. This approach can create a misleading perception of opportunity while masking operational shortcomings.

User Reviews: Conflicting Experiences and Common Complaints

When reviewing a trading platform, independent user feedback can provide valuable context. In the case of AlphaBullMarkets.com, reviews are mixed but include a notable number of negative experiences, especially relating to accessing funds.

On public review sites, some users report initial profitable account activity only to encounter barriers when attempting to withdraw deposits or profits, often involving demands for additional deposits or unexplained account holds. One reviewer noted that after consistent gains, the platform requested a deposit upgrade before allowing access to funds — a common strategy used to extract more money from investors before permitting withdrawals.

While there are also some positive reviews, these should be weighed carefully. Platforms with limited regulatory status and anonymous operations may attract fabricated or incentivised positive feedback, which can be used to counterbalance real complaints and create a false sense of legitimacy.

Withdrawal Issues and Customer Support Failures

A consistent pattern among complaints relates to problems with customer support and withdrawal processes. Investors frequently describe difficulty in contacting support or receiving meaningful responses. These issues often become most acute at the point when a user seeks to withdraw funds. Delays, requests for additional documentation, or complete silence from support teams are widespread themes in negative user reports.

Reliable brokers typically provide multiple support channels — including phone, email, and live chat — with clear escalation paths for issues related to account access or funds. The lack of responsive and transparent support at AlphaBullMarkets.com further weakens its credibility.

Potential Pressure Tactics and Aggressive Outreach

Another concern commonly associated with unregulated platforms is the manner in which potential investors are solicited. According to analysis of the platform’s promotional strategies, techniques such as cold calls, unsolicited messages, and urgency‑driven language (“act now before this opportunity expires”) are used to prompt rapid deposit decisions. These high‑pressure tactics often serve to shorten the investor’s decision‑making process before they fully evaluate the risks involved.

Investments, especially in volatile markets like forex and cryptocurrencies, demand thoughtful deliberation and due diligence. Pressure to act quickly is rarely a trait of reputable financial institutions.

Independent Broker Assessments and Classification

Industry review sites have evaluated AlphaBullMarkets.com on objective criteria such as regulatory status, transparency, and operational legitimacy. Many of these assessments categorise AlphaBullMarkets as unregulated and unreliable, emphasising that the platform does not meet the standard expectations for financial intermediaries. One independent broker directory has explicitly labelled it as a higher‑risk or scam entity based on its lack of regulatory oversight and absence of verified operational credentials.

Key Takeaways for Investors

-

Transparency Gaps: No verifiable information about corporate leadership or regulatory licensing.

-

Unregulated Status: Operates offshore without oversight by recognised authorities.

-

Withdrawal Complaints: Multiple reports of blocked or delayed withdrawals.

-

Customer Service Issues: Limited responsiveness and unclear support channels.

-

Questionable Marketing: High returns promised without evidence or risk disclosures.

Conclusion: Proceed With Caution

AlphaBullMarkets.com displays many of the traits commonly associated with unregulated and potentially unsafe trading platforms. From the lack of regulatory oversight and limited corporate transparency to recurring withdrawal and support issues, the platform fails to demonstrate the accountability and reliability expected from legitimate brokers.

Before engaging with any online trading platform, investors should prioritise verification of regulatory licences, review independent performance data, and seek out brokers that provide clear disclosures and protections. Platforms without these foundational elements expose users to undue financial jeopardy and should be approached with caution — or avoided entirely.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to alphabullmarkets.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as alphabullmarkets.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.