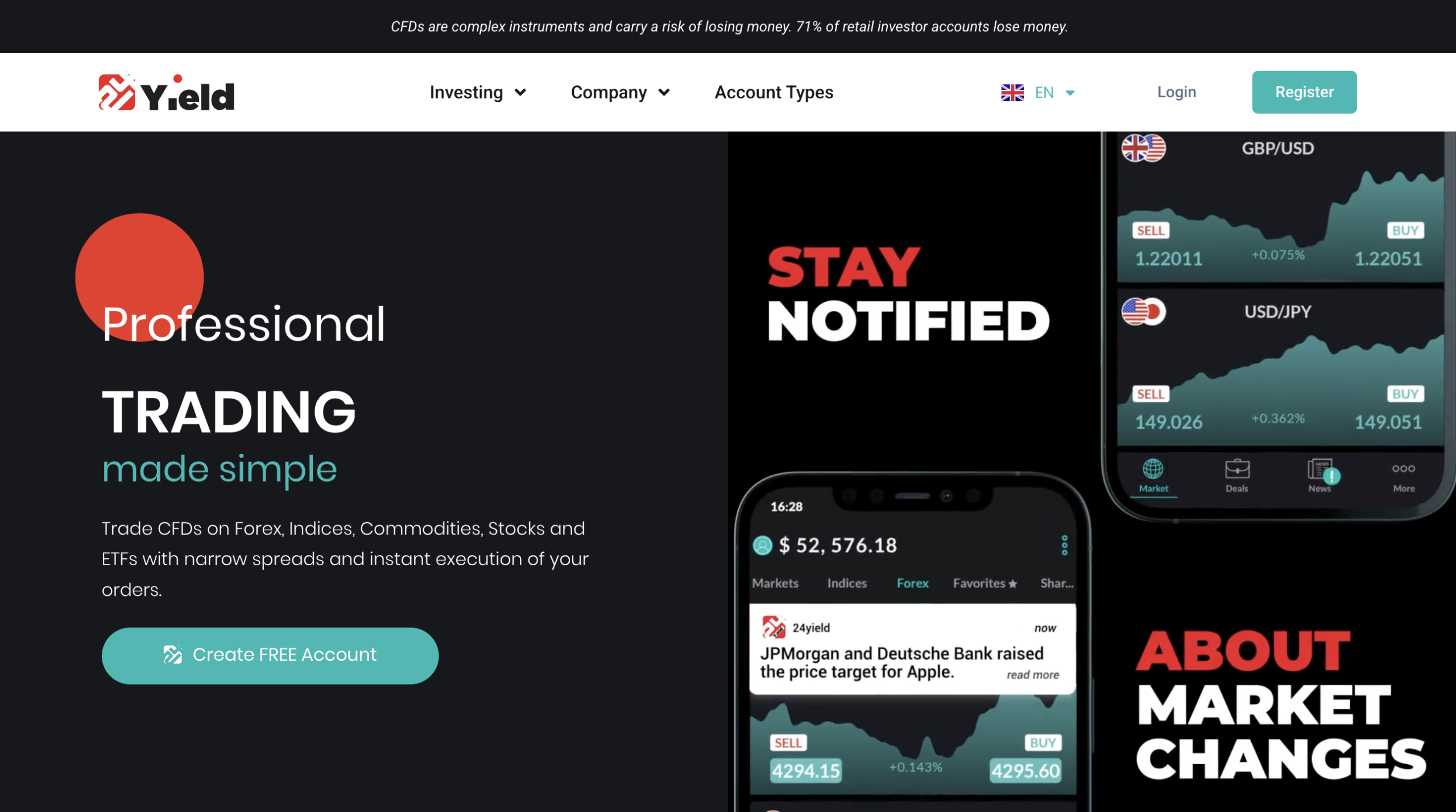

24yield.com Complete Platform Examination

Online trading and investment platforms promise access to financial markets, diverse assets, and potential profits — but not all of them deliver what they advertise. 24yield.com is one such platform that has generated mixed signals and significant concerns from users, independent reviewers, and financial watchdog analyses. A deeper look at this platform reveals a pattern of opacity, regulatory issues, user complaints, and operational red flags suggesting that 24yield.com may be far from a reliable or trustworthy broker.

1. Claims vs. Regulatory Reality

On the surface, 24yield.com appears to position itself as an online trading broker offering trading access across financial instruments such as forex, stocks, commodities, and crypto assets. However, multiple independent analyses indicate it operates without valid licensing from recognized authorities. According to external reviews, the platform is not registered with major regulators like the UK’s Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC), and it has been added to blacklists by at least one European regulator for offering unregistered financial services.

Operating without regulatory approval means there’s no external authority monitoring its conduct, protecting user funds, enforcing transparency, or ensuring compliance with investor safeguards. This situation leaves any client’s capital vulnerable if problems arise.

2. Very Low Trust Indicators From Website Risk Analyses

Third-party website trust tools have flagged 24yield.com with very low trust scores, indicating serious concerns about its legitimacy and safety as an online service. For example, ScamAdviser assigns a near-zero trust score to the domain, highlighting that the site uses privacy masking for WHOIS data and may be associated with risky operations.

Although the site appears to have been registered for some time, older domain age alone does not guarantee reliability — especially when combined with hidden ownership and lack of transparent business data. In the world of online financial platforms, opaque ownership and masked contact information are classic signals that investors should treat with caution.

3. Mixed and Highly Conflicted User Feedback

Customer reviews of 24yield.com tell a conflicting story, with polarizing accounts from users. Some testimonials tout high returns and positive experiences with dedicated account managers, while many others describe serious problems such as withdrawal difficulties, loss of funds, and pressure to deposit more money.

Specifically, a significant portion of reviewers describe situations where:

-

They were encouraged to use copy trading or account managers who initially showed profits but then led to losses.

-

Withdrawal requests became restricted or blocked altogether.

-

Account managers pressured them to deposit additional funds with promises of bonuses or better returns.

-

Customer service response diminished after deposits or during withdrawal attempts.

These patterns — especially when numerous independent reviewers report them — are worrying signs of uneven platform behavior that prioritizes increased deposits over user protection.

4. Alleged Aggressive Outreach Practices

Aside from withdrawal and trading complaints, some former users report that 24yield.com engages in unsolicited contact or aggressive outreach tactics. Accounts on investor forums describe being repeatedly contacted by representatives despite rejecting offers, with persistent calls urging deposit activities.

While not all outreach results in fraud, persistent unsolicited communication is a common tactic among questionable brokers that aim to circumvent informed investor decision-making. Investors targeted in this way should treat the approach as a warning sign.

5. Opaque Corporate Structure and Offshore Associations

Independent evaluations have also noted that 24yield.com may be tied to a complex structure of offshore entities and intermediary roles in jurisdictions with minimal financial oversight. These include mentions of entities in places like Mauritius, Comoros, and the Marshall Islands that act as introducing brokers or counterparties.

Entities based in such locations are often used by unregulated platforms specifically to avoid rigorous licensing and compliance requirements. Without clear documentation of oversight, segregated account protection, or verified corporate governance, investors have minimal assurance their funds are handled responsibly.

6. High-Risk Financial Products Amplify Concerns

The services offered — including automated tools, copy trading, and leveraged positions — are inherently complex and high-risk even when provided by regulated brokers. Without clear regulatory oversight, transparent pricing, and independent compliance audits, these features can become mechanisms that expose investors to greater financial loss. This risk is compounded when early profits are shown in account interfaces to cultivate trust, only for withdrawal issues to emerge later.

7. General Lack of Independent Verification

One of the strongest markers of a legitimate broker is transparent, independent verification of trading operations and licensing. In the case of 24yield.com, third-party reviews, regulatory blacklist mentions, and analysis tools consistently point out the absence of such verification.

This means there is no reliable, unbiased confirmation of:

-

Actual assets under management

-

Valid trading execution through regulated counterparties

-

Segregated client funds

-

Compensation or complaint resolution mechanisms

Without these, there is no safety net for users who entrust their funds to the platform.

Final Assessment: Avoid Engagement With 24yield.com

When considering the totality of available information, 24yield.com displays several strong warning signals that differentiate it from transparent, regulated investment services. The absence of valid regulatory licensing, very low trust scores from website analysis tools, serious and repeated user complaints — particularly around withdrawal issues — and promotional practices that include unsolicited outreach collectively suggest that this platform operates outside the norms expected of legitimate brokers.

For those evaluating online trading opportunities, it’s essential to prioritize platforms with clear oversight, verified licensing, transparent fee structures, and documented performance history. Anything less exposes investors to scenarios where capital is vulnerable and recourse options are limited or nonexistent.

Given the current profile of 24yield.com, the safest stance for individuals is to avoid investing with this platform and seek out regulated alternatives where your funds are protected and your rights as an investor are upheld.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to 24yield.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as 24yield.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.