AddisInvestment Investment Warning

Overview

Online investment platforms continue to multiply, each promising easy profits and professional expertise. AddisInvestment positions itself as one such opportunity, advertising managed investments and steady returns for users willing to deposit funds. However, when the surface-level marketing is stripped away, AddisInvestment reveals multiple warning signs that experienced investors will immediately recognize.

This rewritten review examines AddisInvestment from a fresh angle, focusing on operational behavior, credibility gaps, and investor risk exposure rather than repeating standard industry critiques.

First Impressions and Platform Presentation

At first glance, AddisInvestment attempts to project legitimacy through polished language and confidence-driven messaging. The platform emphasizes simplicity, claiming that users can earn without needing market knowledge or trading experience.

Key selling points promoted include:

-

Hands-off investment management

-

Stable profit generation

-

Professional oversight

-

Secure handling of funds

While these claims may appear attractive, they are presented without supporting evidence. No performance data, third-party verification, or audited results are provided to validate the platform’s assertions.

Absence of Verifiable Business Identity

One of the most striking issues with AddisInvestment is its lack of a clear business identity. Legitimate investment platforms disclose who they are, where they operate, and under which legal framework they function.

AddisInvestment does not clearly publish:

-

A registered company name

-

Legal incorporation details

-

Physical office location

-

Executive or management information

This level of anonymity significantly increases investor risk. When a platform hides its identity, users have no reliable way to confirm legitimacy or pursue accountability if problems arise.

Regulatory Silence and Investor Exposure

Regulatory oversight is a fundamental requirement for platforms handling investor funds. AddisInvestment does not demonstrate that it is licensed or supervised by any recognized financial authority.

There are:

-

No regulatory statements

-

No license numbers

-

No compliance disclosures

Operating outside regulation allows platforms to control user funds without independent oversight. This creates an environment where rules can change arbitrarily, accounts can be restricted, and withdrawals can be delayed without explanation.

Investment Claims That Defy Market Reality

AddisInvestment promotes investment outcomes that appear overly predictable. The platform’s messaging suggests that users can expect steady growth regardless of broader market conditions.

In real-world investing:

-

Returns fluctuate

-

Losses are unavoidable

-

Market volatility affects outcomes

Platforms that downplay risk while emphasizing consistency often rely on perception rather than performance. AddisInvestment’s marketing language minimizes uncertainty, which can mislead users into believing the platform operates with guaranteed success.

Unclear Use of Investor Funds

Another major concern is the lack of clarity regarding how deposited funds are actually used. AddisInvestment does not clearly explain:

-

Which assets are traded

-

Whether trades occur in live markets

-

How risk is managed

-

How profits are generated

Users are typically shown internal account dashboards displaying balances and growth. However, without independent verification, these figures cannot be confirmed as the result of real trading activity. In many questionable platforms, such dashboards serve more as visual reassurance than proof of genuine investment operations.

Withdrawal Barriers and Account Restrictions

Withdrawal behavior is often the clearest indicator of a platform’s true intentions. AddisInvestment has been associated with patterns that raise concern, including:

-

Prolonged withdrawal processing times

-

Additional charges introduced at withdrawal stage

-

Temporary account restrictions following profit accumulation

-

Requests for repeated verification without resolution

These obstacles tend to surface only after users attempt to access their funds, suggesting that deposits are prioritized over withdrawals.

Sales Pressure and Psychological Tactics

AddisInvestment appears to rely on persuasive communication strategies designed to increase deposits. Users may encounter:

-

Frequent encouragement to upgrade plans

-

Claims of limited-time opportunities

-

Suggestions that higher deposits unlock better outcomes

Such tactics leverage urgency and fear of missing out rather than informed decision-making. Professional investment firms typically focus on transparency and suitability, not pressure-driven upselling.

Limited Support and Accountability

When issues arise, responsive customer support becomes critical. AddisInvestment offers limited support channels and lacks visible escalation pathways.

Concerns include:

-

Slow or inconsistent responses

-

No publicly listed phone support

-

No identifiable client service structure

This lack of accountability leaves users vulnerable, particularly during disputes involving funds or account access.

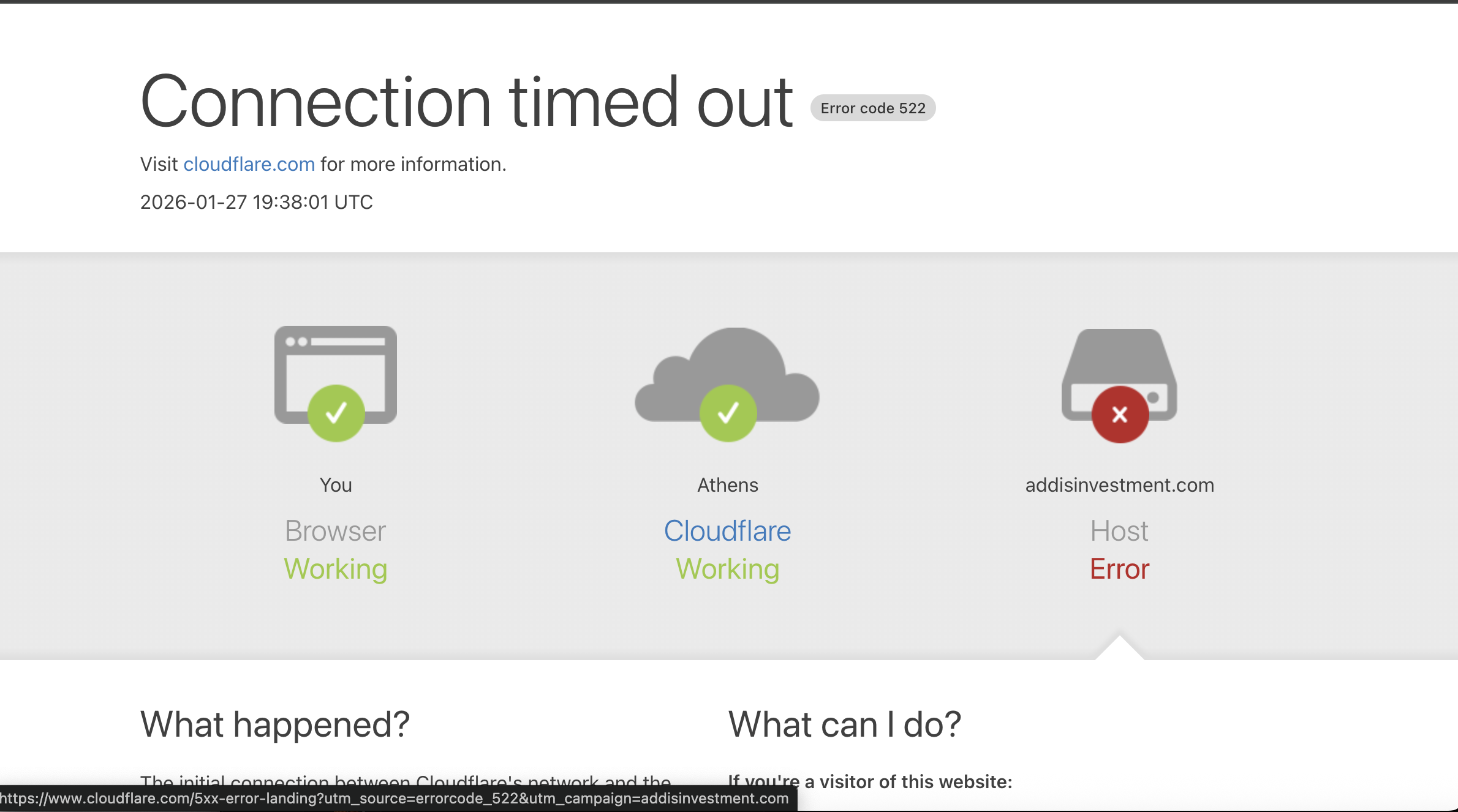

Website Signals and Operational Quality

Beyond functionality, AddisInvestment’s website exhibits characteristics commonly associated with short-term or high-risk platforms:

-

Broad, non-specific service descriptions

-

Generic financial terminology

-

Minimal legal clarity

-

Poorly defined risk disclosures

While design alone does not determine legitimacy, combined with other red flags, these elements contribute to a troubling overall picture.

How AddisInvestment Stacks Up Against Trusted Platforms

Established investment services typically provide:

-

Clear regulatory oversight

-

Public corporate records

-

Transparent fee models

-

Documented risk explanations

-

Verifiable performance history

AddisInvestment does not align with these standards, placing it outside the norms of credible financial service providers.

Final Thoughts

AddisInvestment may appear appealing to users seeking simple and profitable investment solutions, but its operational opacity, lack of regulation, unrealistic messaging, and withdrawal-related concerns suggest a platform that carries significant risk.

In the investment world, trust is built through transparency, accountability, and regulation. AddisInvestment offers very little of these foundations. Investors are best served by remaining cautious and avoiding platforms that prioritize promises over proof.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to addisInvestment, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as addisInvestment continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.