MyCovertime.com Clone Firm Assessment

When dealing with online services that involve money, insurance, or financial products, legitimacy and regulatory oversight are essential. MyCovertime.com is currently listed by the UK’s Financial Conduct Authority (FCA) as a clone firm — meaning fraudsters are using its name and details to impersonate a legitimate company and trick people into trusting them.

This review breaks down what’s known about MyCovertime.com and why it should be treated with scepticism and concern.

1. Clone Warning by the UK Financial Regulator

On January 27, 2026, the FCA issued an explicit warning about “mycovertime.com” being a **clone of an FCA‑authorised firm.”

A clone firm uses the identity of a real, regulated business — in this instance Covertime Limited — to create a fake version that appears genuine. The FCA defines a clone firm as a business pretending to be an authorised or registered entity to convince customers they are dealing with a legitimate service.

According to the warning:

-

The clone uses the same or very similar details as the authorised business.

-

Contact information such as email addresses, phone numbers, and firm references may be falsified.

-

The clone operator may change these details frequently to avoid detection.

This is a serious red flag — not just an ambiguous reputation issue.

2. The Real Company vs the Clone

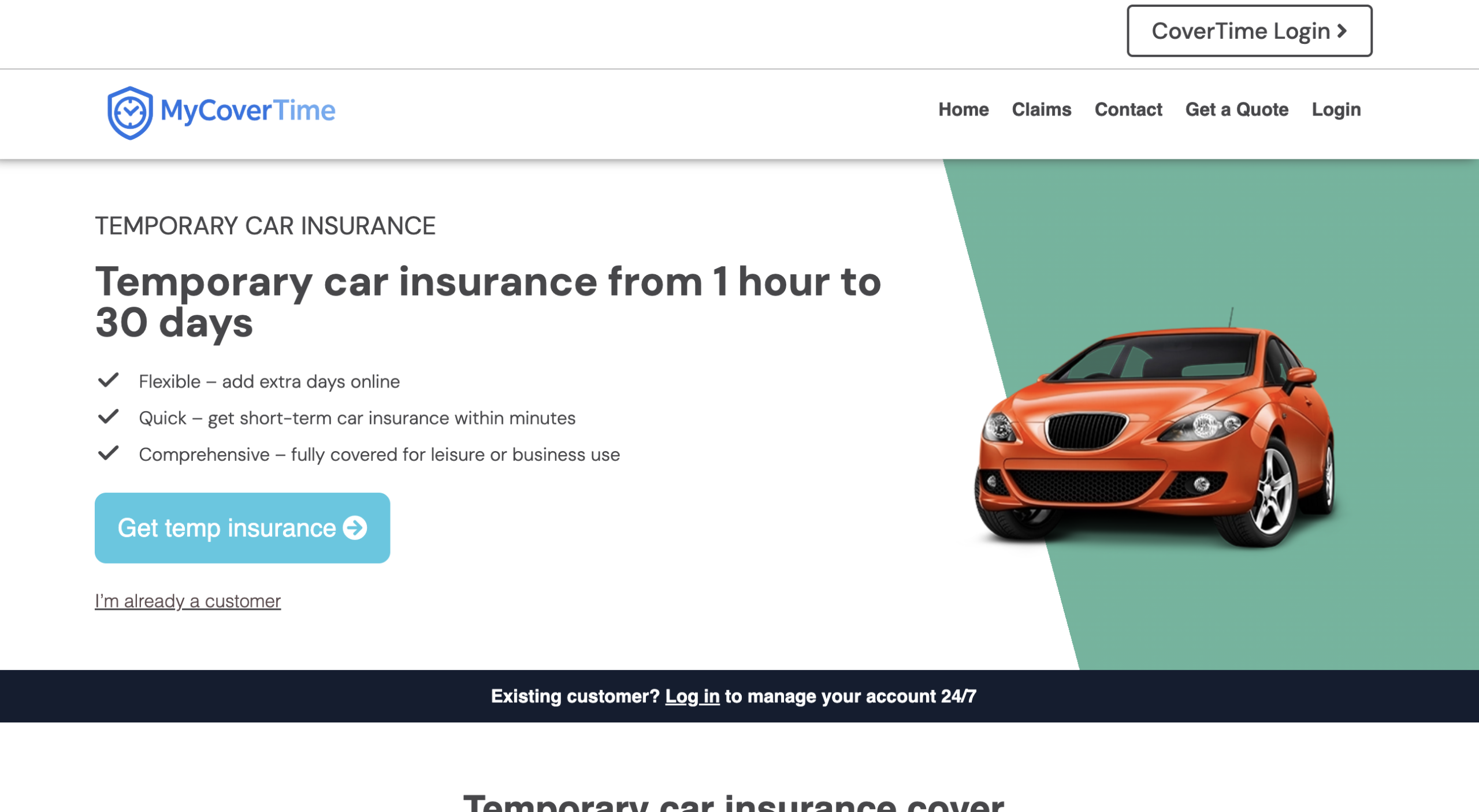

The genuine entity that MyCovertime.com is impersonating is Covertime Limited, which is authorised and regulated by the UK’s Financial Conduct Authority and appears on the FCA’s official register.

That legitimate company offers short‑term car insurance and has a different official website (covertime.com).

However:

-

The clone site (MyCovertime.com) is not authorised by the FCA.

-

Users dealing with it will not benefit from UK financial protections, such as access to the Financial Ombudsman Service or the Financial Services Compensation Scheme — protections that apply to regulated financial services.

This distinction matters because the clone can mislead people into believing they’re protected when they are not.

3. Why Clone Firms Are Dangerous

Clone firms are often designed to mimic trustworthy companies so that unsuspecting users hand over money, personal information, or bank details believing they are dealing with a regulated service.

A few key issues with clone operations:

-

False legitimacy: Using the name, branding, and contact details of a real company to build trust.

-

Lack of protections: Money sent to a clone is not covered by regulatory safeguards.

-

High potential for fraud: Clone sites often collect payments for services that are never delivered.

Unlike the genuine Covertime service, which focuses on temporary car insurance, the clone may attempt to sell products or services with no clear legal obligations or regulatory compliance.

4. Discrepancy Between Online Reviews and the Clone Site

The real Covertime service — not the clone — has a high number of positive customer reviews on independent platforms like Trustpilot, where users describe fast and straightforward purchase of temporary car insurance, intuitive forms, and good value for money.

But those positive reviews pertain to the genuine Covertime.com service, not the clone MyCovertime.com. Because the clone site is pretending to be the same company, someone seeing those reviews might assume they also apply to MyCovertime.com, which is misleading.

5. How Clone Websites Trick Consumers

Clone sites like this often follow a similar playbook:

-

Copy a legitimate business’s name and branding.

-

Set up a similar URL that can easily be confused with the real one.

-

Use contact details that mimic the official company.

-

Rely on users not checking with the real regulator’s register.

Because of this duplication of identity, many consumers may think they are dealing with a trusted firm when they are not.

Final Thoughts on MyCovertime.com

The key reason MyCovertime.com should be treated with extreme caution is because the FCA itself has identified it as a clone of an authorised firm — meaning fraudsters are leveraging the trust and legitimacy of a real provider to mislead users.

Clone firms are not just poorly reviewed or unknown businesses — they are deliberately constructed to exploit trust. Interacting with them can lead to financial loss, exposure of personal information, and a lack of any real legal recourse.

If you encounter a website that seems to be connected with a well‑known or regulated service, always check the official regulatory register in your jurisdiction — such as the FCA’s — to confirm its legitimacy.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to mycovertime.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as mycovertime.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.