SuperTradeShub Users Need to Know This

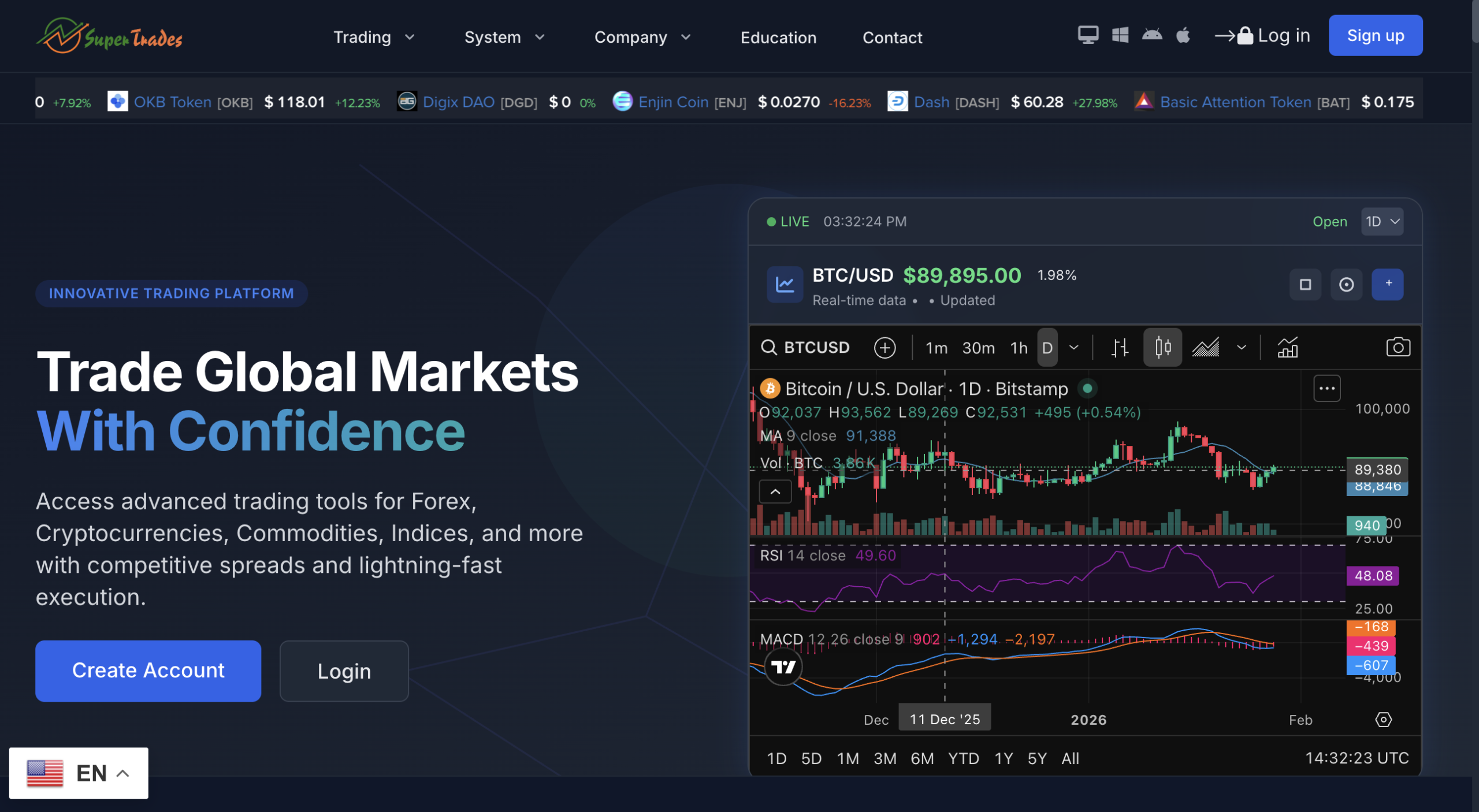

When new online trading and investment platforms appear, they often promise easy access to markets, fast profits, and low barriers to entry. SuperTradeShub.com is one such site that markets itself as a trading or financial service platform. However, a closer look at the platform’s online footprint and trust signals reveals several red flags that suggest it may not be a secure or legitimate place to trade or invest.

At present, there is no widely recognized independent review or authority verification available for SuperTradeShub.com — which by itself should prompt caution. In the absence of clear regulatory transparency or third‑party validation, the safety of putting money or sensitive personal data into the platform is highly questionable.

New and Unverified Domain Status

SuperTradeShub.com lacks significant historical data or long‑term online presence. Platforms that are newly registered or have minimal verifiable activity often do not have the track record needed to prove legitimacy. While new services do emerge, established financial platforms typically display clear licensing information, regulatory disclosures, and verifiable operational histories — all of which seem to be absent for SuperTradeShub.com.

Without a strong digital footprint or authoritative mentions on reputable financial portals, the site remains unverified in terms of both operational legitimacy and legal compliance.

Lack of Clear Regulation and Licensing

One of the strongest indicators of a trustworthy trading platform is public, verifiable regulatory oversight from recognized authorities — such as the U.S. Securities and Exchange Commission (SEC), the UK’s Financial Conduct Authority (FCA), or equivalent bodies in Europe or Asia.

To date, SuperTradeShub.com does not publicly disclose any authoritative licensing information that can be cross‑checked against such regulatory databases. No license number, jurisdictional supervision, or compliance documentation is prominently available on the site. This absence makes it impossible to confirm whether the platform is legally authorized to handle client funds or offer investment services.

Opaque Ownership and Contact Information

Legitimate financial service providers must disclose:

-

Registered business names

-

Corporate location and headquarters

-

Executives and operational leadership

-

Licensed regulatory status

Platforms with legitimate financial services make these details publicly accessible to build trust and satisfy compliance obligations. SuperTradeShub.com’s ownership and business registration data are not transparent or verifiable publicly, making it impossible to determine who actually controls the platform or under what legal framework it operates. This lack of ownership transparency is a major concern for anyone considering engaging with the site.

No Verifiable Customer Feedback from Reputable Sources

A key part of evaluating any financial platform’s legitimacy is the presence of credible user reviews on independent sites or forums, especially from users who have attempted deposits, trades, or withdrawals.

In the case of SuperTradeShub.com, there is no established set of verified independent customer reviews available on major review platforms (such as recognized financial review sites). When a platform lacks visible, high‑quality feedback from a broad customer base — particularly feedback verified over time — it raises serious doubts about its operations and trustworthiness.

Similarity to Known High‑Risk Patterns

While specific trust‑score analysis results for SuperTradeShub.com are not readily available, the shop’s structure and lack of transparency resemble patterns commonly seen in other high‑risk or potentially fraudulent financial platforms:

-

Lack of regulatory licensing or verification

-

Minimal public reputation

-

Opaque ownership data

-

Unclear business model and claims

-

Absence of verifiable user testimonials

These elements have historically been associated with platforms that leave investors without recourse when problems arise.

Unclear Business Model and Claims

Websites in the financial and trading niche that do not clearly define their business model — especially in terms of risk, commissions, and regulatory protection — should set off alarm bells. Legitimate brokers and investment firms are required not only to disclose risks but also to operate under regulations that protect clients’ funds and provide dispute resolution frameworks.

SuperTradeShub.com’s public presentation lacks these crucial details, instead seeming to rely on generic promotional language without substantiated operating credentials.

The Importance of Verified Due Diligence

Before engaging with any online trading or investment platform — particularly one that is not clearly regulated or well‑known — you should ensure:

-

The platform holds a valid, publicly verifiable license from a recognized financial regulator

-

Regulatory registration numbers and details are published and cross‑checked

-

Customer reviews exist on reputable independent sites

-

Business ownership is transparent and backed by verifiable corporate data

In the absence of these signals for SuperTradeShub.com, the level of risk remains elevated.

Final Assessment

Because SuperTradeShub.com currently lacks independent verification of regulation, transparent ownership, verifiable user feedback, and a clearly defined operational history, it exhibits many of the warning signs that analysts associate with high‑risk or potentially untrustworthy online trading platforms.

Individuals should apply thorough due diligence and exercise extreme caution with sites that present no authoritative or verifiable proof of legitimacy — particularly when personal data or funds are involved.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to supertradeshub.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as supertradeshub.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.