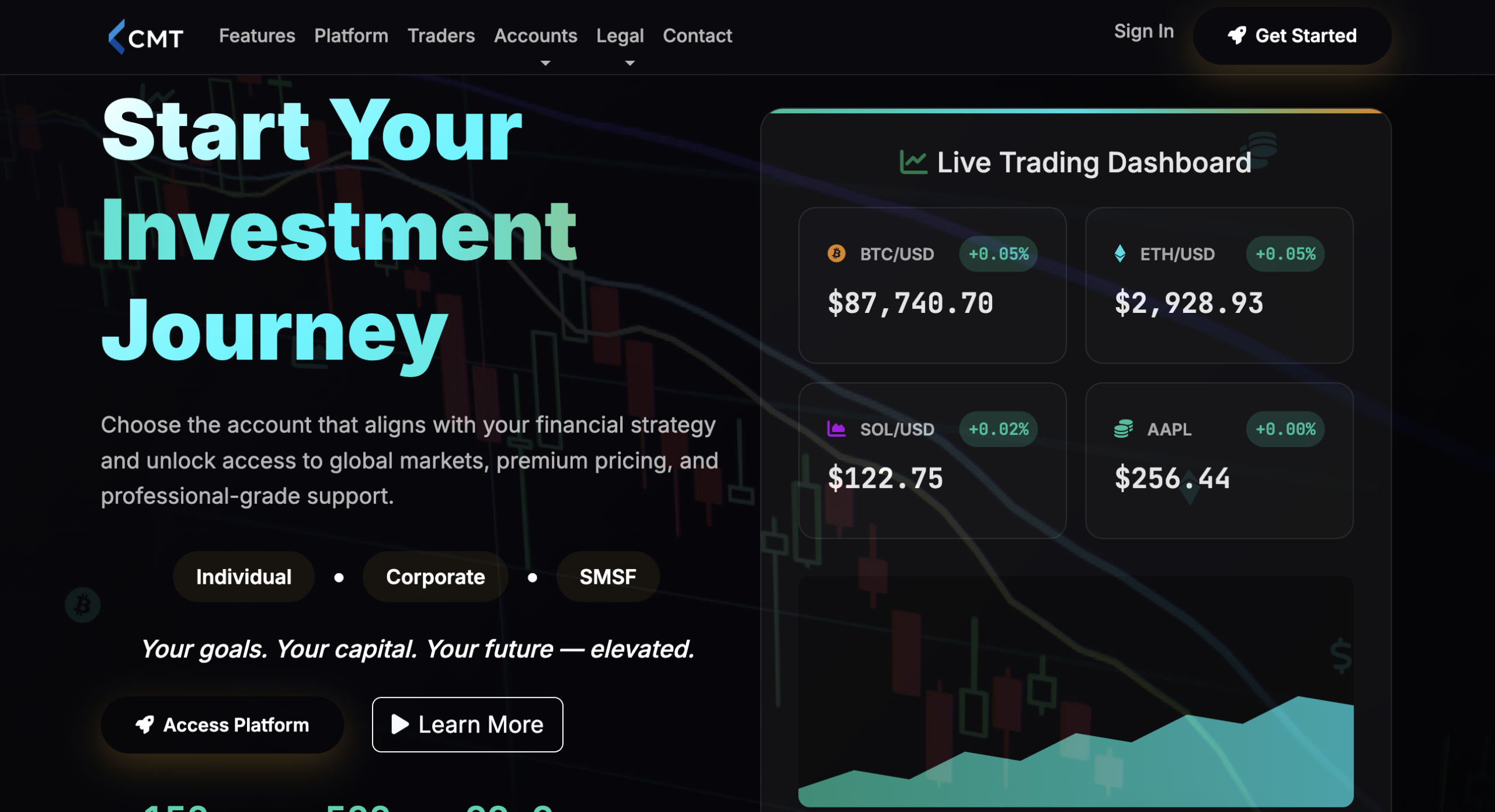

CapitalMarginTrade.com: A Platform Analysis for Traders

In the crowded world of online trading platforms, new websites frequently appear promising high returns on forex, cryptocurrency, and CFD trading. One such platform gaining attention is CapitalMarginTrade.com. At first glance, it may seem like a professional and legitimate trading service, but a deeper investigation reveals multiple red flags that should make any potential investor think twice before depositing funds.

This review examines what CapitalMarginTrade.com claims to offer, why it falls short in terms of credibility, and the signs that make it a platform best avoided.

What Is CapitalMarginTrade.com?

CapitalMarginTrade.com markets itself as a global trading platform, providing tools for CFD and forex trading with supposedly advanced analytical features. Its website emphasizes user-friendly dashboards, supposedly profitable trading algorithms, and promises of fast execution.

While these claims sound appealing, appearance and marketing alone do not confirm legitimacy. Real, trustworthy platforms are fully transparent about their regulatory status, corporate identity, and user safeguards. CapitalMarginTrade.com, however, fails in each of these crucial areas.

No Clear Regulatory Oversight

One of the most important factors when choosing a trading platform is regulatory authorization. Licensed platforms operate under the supervision of financial authorities, ensuring that client funds are protected, trading practices are monitored, and complaints can be resolved through official channels.

CapitalMarginTrade.com does not appear to be registered with any recognized financial regulator. This absence means users cannot verify whether the platform meets required standards for compliance, risk disclosure, or operational transparency. Platforms without regulation leave investors exposed to practices that are often misleading or outright fraudulent.

Hidden Ownership and Limited Transparency

Another major concern is the lack of verifiable ownership. CapitalMarginTrade.com’s domain registration is hidden through privacy protection services, meaning no one can easily identify the people or companies behind it.

Legitimate trading companies provide clear information about their corporate structure, location, and licensed executives. Hiding ownership details is a common tactic among platforms that intend to operate without accountability, making it impossible for users to know who they are actually dealing with.

Website and Technical Red Flags

Technical evaluations of CapitalMarginTrade.com raise additional concerns:

-

Recently registered domain with no long-standing track record.

-

Low traffic and minimal online presence, indicating it is not widely used or verified.

-

Connections to other suspicious websites, suggesting it may be part of a network of questionable operations.

While none of these alone prove wrongdoing, combined they create a pattern similar to other untrustworthy online trading sites.

High Return Promises and Withdrawal Issues

CapitalMarginTrade.com often markets itself with claims of fast, high returns, a hallmark of aggressive trading promotions. Real trading carries risks, and regulated platforms always disclose them. Overpromising profits is a common tactic to lure inexperienced investors.

Reports from similar platforms show that once deposits are made, withdrawal processes are often delayed or complicated with arbitrary fees. While there may not yet be documented cases for CapitalMarginTrade.com, its structure and marketing approach mirror these high-risk models, signaling caution.

Absence of Verified User Feedback

Another critical warning sign is the lack of verified reviews or testimonials from independent sources. Legitimate trading platforms leave an observable trail of user experiences online. CapitalMarginTrade.com, in contrast, has very little presence on forums, social media, or credible review sites. This absence makes it difficult for potential users to validate its operations or performance claims.

Why This Platform Warrants Caution

The combination of unverified ownership, lack of regulation, minimal user feedback, and aggressive profit claimsplaces CapitalMarginTrade.com firmly in the category of platforms that require extreme caution. Investors should always prioritize platforms that demonstrate transparency, regulatory compliance, and verifiable track records.

Even for experienced traders, engaging with platforms like this exposes one to uncertainty, potential financial loss, and limited avenues for recourse.

Conclusion: Avoid CapitalMarginTrade.com

CapitalMarginTrade.com currently lacks the fundamental attributes that would make it a trustworthy online trading platform. Its opaque operations, absence of regulatory oversight, and structural similarities to other unregulated trading services suggest that it is not a platform that should be trusted with investor funds.

Prospective users are advised to seek out regulated and transparent trading platforms, where their funds are protected, practices are monitored, and performance claims are verifiable. In the online trading space, caution is essential, and CapitalMarginTrade.com fails to meet the basic standards of legitimacy.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to capitalmargintrade.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as capitalmargintrade.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.