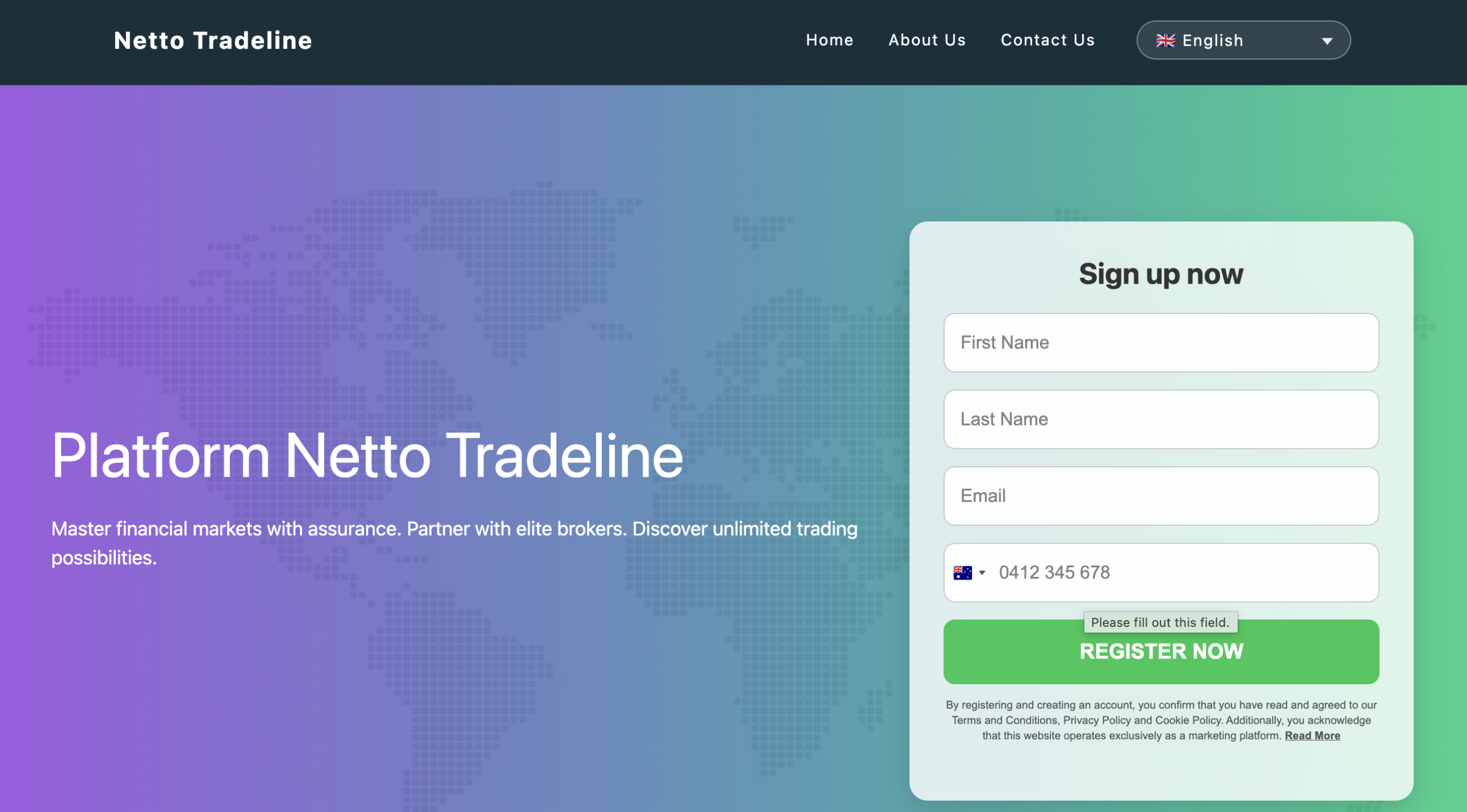

Nettotradeline.com Trading Review 2026

Nettotradeline.com positions itself as an online investment and trading platform offering opportunities in financial markets such as forex, cryptocurrencies, and digital assets. At first glance, the website attempts to project professionalism through modern design, confident wording, and claims of expertise. However, when examined more closely, Nettotradeline.com raises numerous concerns that should not be overlooked by anyone considering investing funds through the platform.

What initially appears to be a legitimate trading service quickly begins to resemble a high-risk operation with minimal transparency and questionable credibility.

Vague Business Model and Undefined Services

One of the most noticeable problems with Nettotradeline.com is the lack of a clearly defined business model. While the site frequently references trading, profit generation, and market access, it fails to explain how these activities are actually carried out.

Key details are missing, such as:

-

Who executes the trades

-

What strategies are used

-

How profits are generated

-

What role the user’s funds play

Instead of clear explanations, the platform relies on generalized statements and marketing phrases. This lack of specificity makes it impossible for users to properly evaluate the legitimacy or sustainability of the investment offerings.

No Verifiable Company Identity

Another major concern is the absence of verifiable company information. Nettotradeline.com does not clearly disclose:

-

The legal company name

-

Corporate registration details

-

Physical office location

-

Names or credentials of management

This anonymity removes accountability entirely. Legitimate financial platforms are transparent about who operates them because trust is foundational in the investment space. When a platform conceals its identity, users have no way to verify experience, qualifications, or legal standing.

Unrealistic Confidence and Marketing Language

Nettotradeline.com uses highly confident language to promote its services, often implying that profits are easily achievable through its system. This style of messaging is a classic red flag. Financial markets are inherently volatile, and any platform that downplays uncertainty or complexity is not presenting a realistic picture.

Rather than educating users on potential downsides or risks, the site focuses almost exclusively on positive outcomes. This imbalance suggests the platform is designed more to attract deposits than to inform investors responsibly.

Regulatory Silence

Perhaps one of the most critical issues is the lack of clear regulatory status. Nettotradeline.com does not openly state that it is licensed or supervised by any recognized financial authority. There are no licence numbers, no regulator names, and no compliance documentation visible on the site.

Without regulatory oversight:

-

There is no independent monitoring of operations

-

Client funds are not guaranteed to be protected

-

Disputes cannot be escalated to a financial authority

-

The platform operates entirely on its own terms

This places all responsibility and risk squarely on the user.

Questionable User Experience Patterns

Platforms similar to Nettotradeline.com often follow a predictable pattern: smooth onboarding, strong encouragement to deposit funds, and enthusiastic communication at the beginning. Problems tend to arise later, particularly when users attempt to withdraw funds or question account activity.

While individual experiences may vary, the overall structure of the platform suggests a strong focus on fund intake rather than long-term client service. Limited transparency around withdrawal policies and account terms only increases uncertainty.

Generic Website Structure and Content

A closer look at Nettotradeline.com’s content reveals language that feels generic and interchangeable. Much of the text could easily appear on dozens of similar websites, with little evidence of originality or depth.

This templated approach is often associated with short-lived platforms that are launched quickly, promoted aggressively, and later abandoned or rebranded once complaints increase. Established financial firms typically invest heavily in unique documentation, disclosures, and educational material — something notably absent here.

Why Caution Is Essential

Trust in online investing is built on transparency, regulation, and verifiable history. Nettotradeline.com does not convincingly demonstrate any of these fundamentals. Instead, it relies on polished presentation, vague claims, and limited accountability.

When essential details are missing, investors are forced to operate on assumptions rather than facts — a dangerous position when money is involved.

Final Verdict

Nettotradeline.com displays numerous characteristics commonly associated with unreliable and potentially deceptive investment platforms. From hidden ownership and unclear operations to regulatory silence and unrealistic marketing, the warning signs are difficult to ignore.

For anyone seeking legitimate investment opportunities, it is far safer to choose platforms with proven regulatory status, transparent leadership, and a well-documented track record. Nettotradeline.com does not meet these standards.

The most prudent decision is to steer clear of this platform and avoid exposing your funds to unnecessary uncertainty.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to nettotradeline.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as nettotradeline.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.