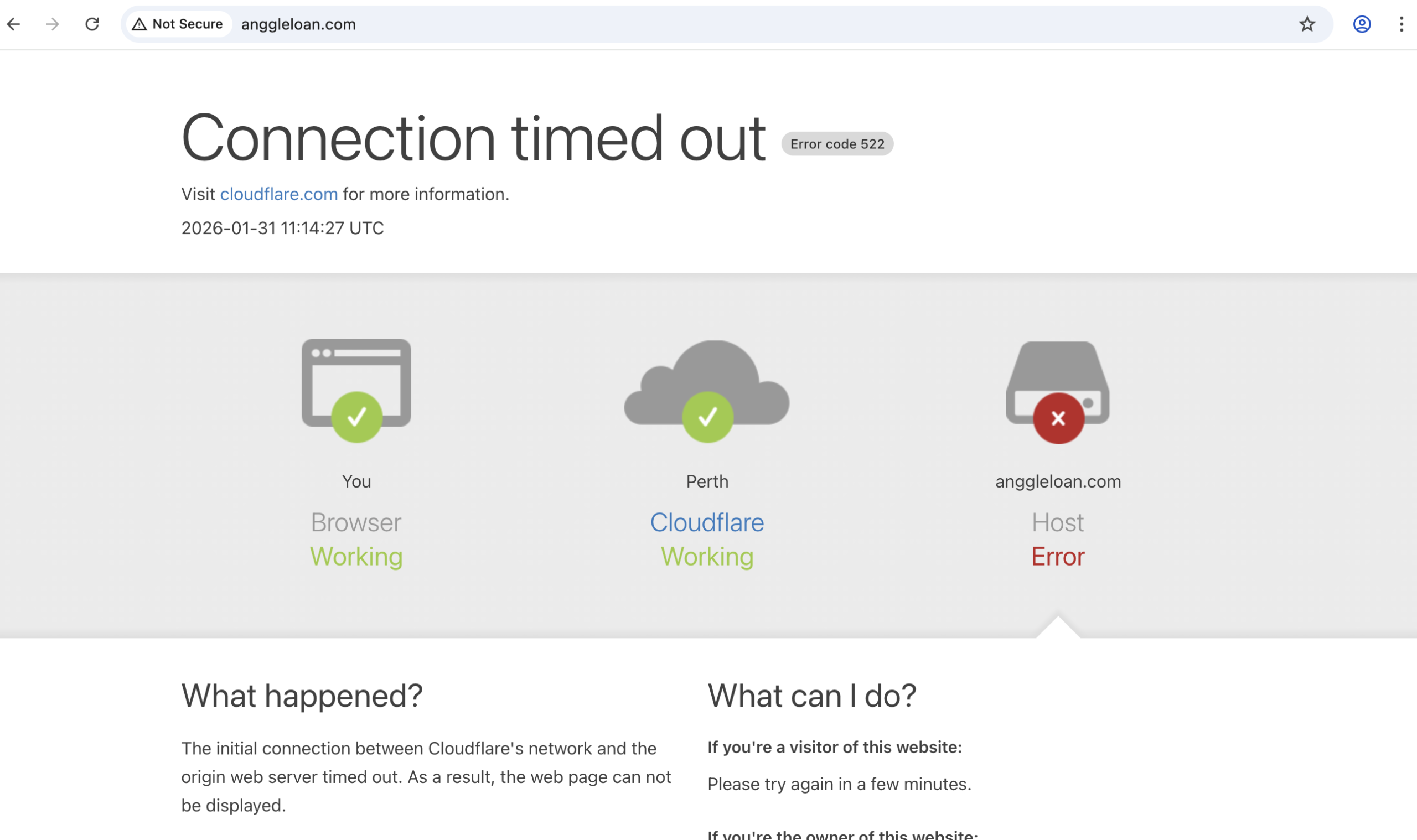

AnggleLoan Review: Important Alert

When you’re in need of quick financial assistance, it’s natural to look online for lenders that promise fast and easy loans. Unfortunately, not every online lending site operates legitimately, and anggleloan.com is one such platform that has drawn serious scrutiny from financial regulators. This review digs into what’s known about the platform, its risk signals, and why borrowers should be extremely cautious before interacting with it.

1. Regulatory Warning from the UK Financial Conduct Authority

One of the most significant pieces of information available about anggleloan.com comes from the UK’s Financial Conduct Authority (FCA). According to the FCA’s Warning List, anggleloan.com is not authorised to provide financial services in the UK but has been posing as a clone of a legitimately authorised firm. Clone firms mimic the identity or details of real authorised companies to appear credible while offering no actual regulation or oversight.

The FCA specifically states that anggleloan.com has been contacting people pretending to be an FCA-authorised firm, using false details and potentially other misleading contact information. Anyone engaging with such a clone firm risks being misled into believing they are dealing with a regulated lender — when in reality they are not.

2. What a Clone Firm Means for You

A clone firm may use the name or details of a legitimate business to make itself seem trustworthy. But these operations typically do not hold proper licences and cannot offer legally protected financial services. For UK consumers in particular:

-

You won’t be covered by the Financial Services Compensation Scheme (FSCS) if something goes wrong with your money.

-

You won’t have access to the Financial Ombudsman Service to resolve disputes if the platform fails to deliver on its promises.

-

Any payment you make or personal information you provide could be misused or lost with limited legal recourse.

These protections are fundamental safeguards designed to protect consumers in regulated financial markets. Their absence should be taken very seriously.

3. Common Loan Scam Tactics Your Should Be Aware Of

Even without detailed public reviews about anggleloan.com specifically, established indicators of unreliable or fraudulent online lenders apply here and are worth understanding before you consider any engagement:

Upfront Fees:

Lenders that demand payment before loan funds are released — often disguised as processing, insurance, or administrative fees — are almost universally fraudulent. Legitimate lenders deduct fees from the loan amount or incorporate them into repayments, not require you to pay first.

Impersonation & Contact Methods:

Scammers frequently use cloned identities or fake communications that mimic legitimate firms to deceive borrowers into providing sensitive data or payments. These communications can come via phone, email, or SMS, and often include urgent prompts to act quickly.

Lack of Clear Licensing:

A legitimate online lender will openly display its licence details, including regulatory registration numbers, and often links directly to verifiable financial authority listings. A failure to provide clear licensing information is a key warning sign.

Unsolicited Offers:

If you never applied for a loan but receive messages claiming you’re pre-approved, this can be a tactic used by fraudulent operators to lure in victims.

These tactics don’t guarantee all bad operators are caught, but they are common patterns seen in countless problematic loan offers confirmed by consumer protection groups and law enforcement agencies.

4. Risks of Sharing Personal Information

Any online loan application requires some degree of personal and financial data — things like your name, date of birth, contact details, and bank information. With unregulated or impersonating platforms:

-

Your personal information may be harvested for identity theft or sold on data markets.

-

Sensitive banking details may be used to access accounts or facilitate unauthorized transactions.

-

You may find yourself targeted later for additional fraudulent offers or extortion attempts.

These kinds of breaches can have serious, long-lasting consequences well beyond the original loan process.

5. Why You Should Look to Regulated Alternatives Instead

The world of legitimate online lenders includes companies that operate under strict regulatory oversight, offering:

-

Transparent terms and fees

-

Clear compliance with financial laws

-

Consumer protections for disputes and losses

-

Responsible lending practices

Responsible lending environments emphasise verifying the borrower’s ability to repay, clear disclosure of all costs, and secure handling of personal data. These are not present with unregulated clone or suspicious platforms.

Final Verdict: Avoid Engagement with AnggleLoan.com

Based on the FCA’s explicit warning that anggleloan.com is an unauthorised clone operation designed to mimic a regulated lender, this platform should be regarded as high-risk and untrustworthy. This is not just a question of poor service — it’s a situation where consumers seriously lack the basic legal and financial safeguards they deserve when dealing with major money decisions.

If you are considering any online loan service, always:

-

Verify regulatory status using the official financial authority register for your country.

-

Check for transparent licensing and compliance information.

-

Avoid any lender that wants payment before releasing funds.

-

Be cautious of unsolicited offers or communications.

Your financial security and personal data deserve protection — and unregulated sites like anggleloan.com do not provide that.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to anggleloan.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as anggleloan.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.