Alt-CBFinex Review: Think Twice

Online trading platforms that promise easy access to global markets and “high-probability profits” can appear attractive — especially when they feature slick websites and bold claims of superior trading conditions. However, not all platforms operate with transparency, regulation, or consumer protections. alt-cbfinex.pro is one such platform that has drawn serious warnings from financial regulators and presents multiple risk signals that should prompt caution. This review examines what we know about the platform, its risk indicators, and why most investors would be wise to steer clear.

1. Lack of Proper Regulation

A key piece of evidence about alt-cbfinex.pro comes from the UK Financial Conduct Authority (FCA). The FCA has placed the platform on its Warning List because it is not authorised to provide or promote financial services in the UK. According to the FCA, the firm may be targeting UK residents without permission — meaning it is operating outside the regulatory framework that protects consumers.

This matters because regulated firms are required to meet strict standards for:

-

Capital adequacy and solvency

-

Transparent disclosures of fees and risks

-

Consumer complaint handling and redress mechanisms

Without regulatory oversight, clients of the platform do not have access to the Financial Ombudsman Service or similar dispute resolution bodies, nor are they covered by compensation schemes if things go wrong.

2. Independent Site Risk Scores Are Very Low

Independent site-safety aggregators like ScamAdviser assign alt-cbfinex.pro a very low trust score based on several factors:

-

The domain has hidden WHOIS information

-

The site’s server hosts multiple low-reviewed websites (which can be a red flag for linking multiple high-risk or fraudulent operations)

-

Limited traffic and poor visibility relative to legitimate financial brands

-

Inability to fully analyse the site’s content due to blocking or technical limitations

While SSL certificates (which encrypt data between user and server) are standard for legitimate sites, they are also trivial for fraudulent operations to obtain. A secure connection alone does not equate to a trustworthy or regulated financial service.

3. Website Claims vs. Reality

The live site for alt-cbfinex.pro markets itself as a versatile trading platform offering access to forex, cryptocurrencies, indices, stocks, and commodities — and includes promises of “globally licensed & regulated” services and high-probability trading signals.

However, these kinds of claims should be approached with skepticism for several reasons:

-

They conflict with the FCA’s official warning that the platform is not authorised or regulated.

-

Platforms that make broad claims of global licensing without providing verifiable licence numbers or links to regulator registers are inconsistent with best practices for financial service disclosures.

-

Others in this category often use vague language about risk management and profitability that cannot be independently verified.

These discrepancies between promotional language and regulatory fact suggest the platform’s marketing may be designed more to attract deposits than to inform users accurately.

4. Risk Signals Common to High-Risk Financial Sites

While detailed user reviews specifically for alt-cbfinex.pro are scarce, there are some patterns found in comparable unregulated or unauthorised trading platforms that overlap with Alt-cbfinex’s profile — such as:

a. Lack of transparent company and regulatory information

Platforms that do not clearly list a registered corporate entity, licence number, or public audit reports often leverage anonymity to avoid scrutiny.

b. Vague licensing claims

Claims of “global regulation” without specifics are used to imply legitimacy without evidence.

c. Promotion without formal authorisation in key jurisdictions

Being on an official warning list like the UK FCA’s is one of the strongest signals regulators can issue short of legal enforcement.

Financial authorities around the world — including ASIC in Australia and other regulators — emphasise that dealing with unregistered or unauthorised financial firms puts customers at financial risk.

5. What It Means for You

If you are considering opening an account or depositing funds with alt-cbfinex.pro, you should be aware of the following implications:

-

Your funds may not be protected if the platform fails or engages in malfeasance.

-

You may not be able to pursue formal complaint or dispute resolution through official channels.

-

There may be limited transparency about how your funds are used or held.

-

Marketing claims of high returns or “expert signal trading” may not align with real-world performance.

These conditions create an environment where risk outweighs potential benefit for most retail investors — particularly those who cannot absorb losses or lack experience with highly speculative markets.

6. Final Assessment: Avoid Engagement

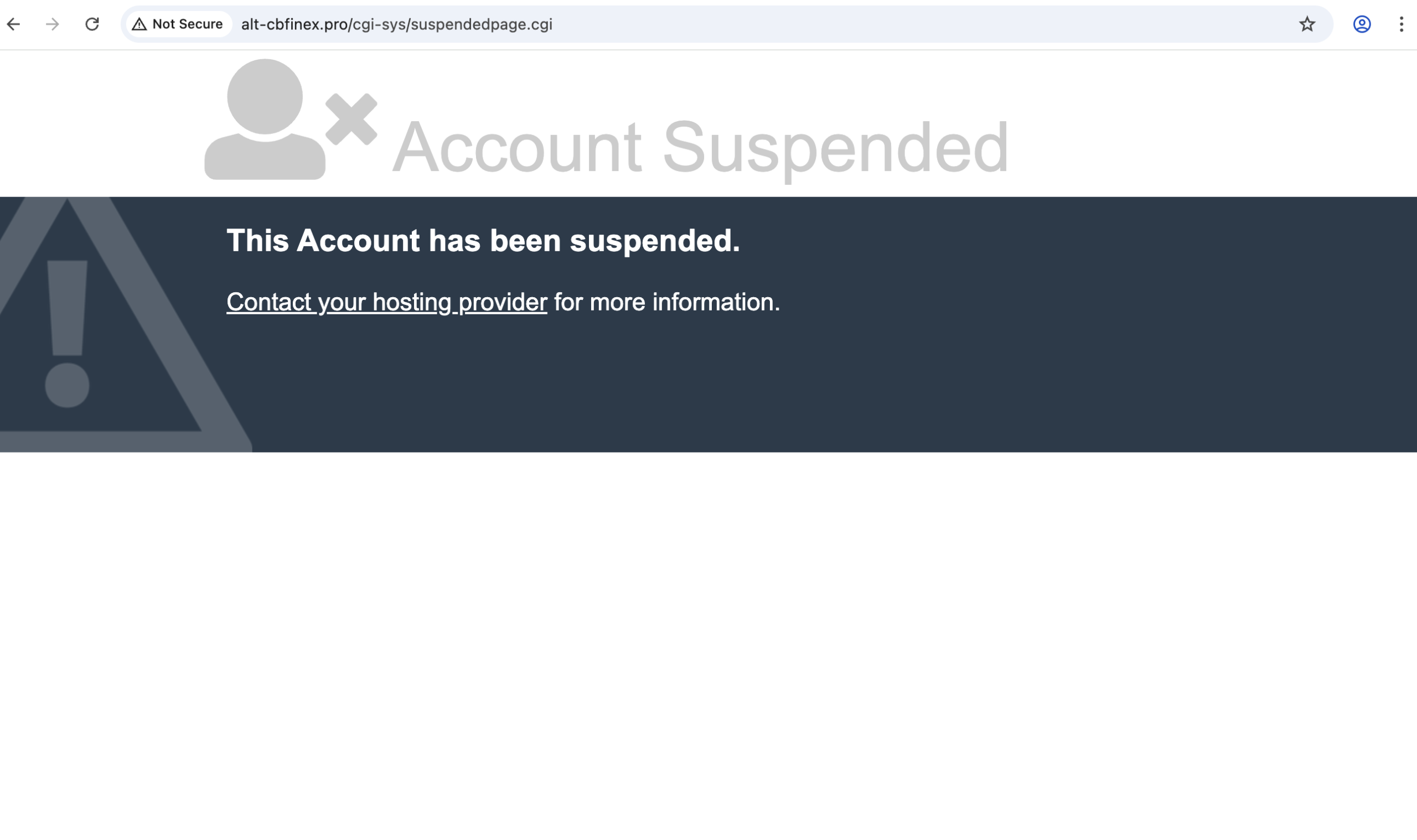

Taken together, the regulatory warnings from the FCA and the low trust metrics from independent evaluators paint a clear picture: alt-cbfinex.pro is an unauthorised financial platform with significant risk indicators and limited protections for customers.

For individuals thinking about investing or trading with an online broker or financial services provider, it is strongly advisable to prioritise:

-

Regulated platforms with verifiable licences in respected jurisdictions

-

Transparent fee structures and audit disclosures

-

Clear access to consumer protection and complaint resolution mechanisms

When even a single regulator issues a public warning, that should be cause for serious concern — let alone multiple risk signals that collectively point to a high-risk and untrustworthy service.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to alt-cbfinex.pro, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as alt-cbfinex.pro continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.