Parthenongrpllc Platform Review

In an age where online investment platforms and boutique “global financial services” firms proliferate, it’s essential to differentiate legitimate operators from potential scams. One name that has recently surfaced in regulatory warnings is ParthenonGroupLLC — a company behind the website parthenongrpllc.com. Despite glossy marketing claims on the site, independent regulators and warning lists suggest this platform is high-risk at best and potentially fraudulent at worst. In this review, we break down the evidence, flag dangerous signals, and explain why you should steer clear of this platform.

The Website’s Claims vs Reality

At first glance, parthenongrpllc.com presents itself as a global investment bank and management consultancy, supposedly specializing in capital markets, mergers and acquisitions, asset management, and international financial services. The homepage markets the firm as having a “global reach” and being an industry leader in SPAC and IPO advisory for America, Europe, and Asia, with alleged awards and global offices. It also lists a seemingly legitimate New York address — 10 Hudson Yards, New York, NY 10001.

However, real scrutiny exposes glaring gaps between these promotional assertions and verifiable facts.

Regulatory Warnings: The Biggest Red Flag

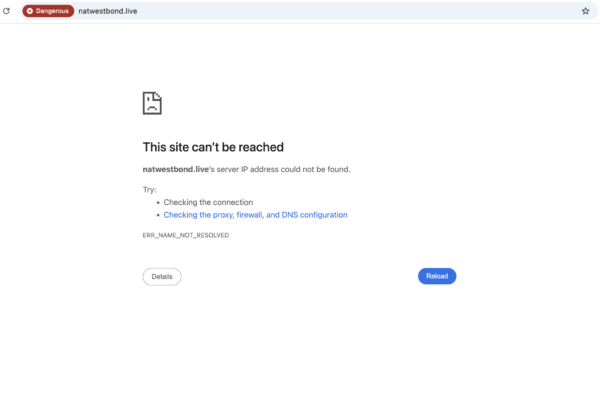

The most critical piece of evidence against parthenongrpllc.com comes from the UK’s Financial Conduct Authority (FCA) — the regulator responsible for supervising financial services activity in the United Kingdom. The FCA has officially placed ParthenonGroupLLC on its Warning List, stating that:

-

The firm is not authorised or registered by the FCA to provide financial services in the UK.

-

It may be providing or promoting financial services or products without permission.

-

Consumers are explicitly advised to avoid dealing with this firm and beware of potential scams.

The FCA warning is significant because one doesn’t end up on such a list without regulators having cause to question a firm’s legitimacy. The purpose of these warnings is to protect consumers from fraudulent or unauthorized financial entities that could mislead investors and put their capital at risk.

No Verifiable Track Record

A legitimate investment bank or asset manager will have a documented operating history, is typically registered with multiple regulators (depending on jurisdiction), and provides transparent disclosures about its legal status, track record, team credentials, and audited financials. None of this exists for parthenongrpllc.com:

-

A search through regulatory databases (such as Financial Industry Regulatory Authority or SEC databases in the U.S.) yields no confirmed registration for Parthenon Group LLC as a broker-dealer, investment adviser, or licensed financial institution.

-

The FCA warning highlights that contact details (address, phone, email) could be fabricated or misused to impersonate legitimacy.

Without verifiable registration with recognized financial authorities (like the SEC or FINRA in the U.S., the FCA in the U.K., or equivalents in other countries), there is no regulatory oversight protecting potential clients.

Typical Scam Traits in the Presentation

Aside from regulatory red flags, the content and framing of the company’s website matches common characteristics found in fraudulent financial schemes:

-

Grandiose Claims Without Substantiation — The homepage claims awards and global leadership without citing independent verifiable sources. Fraudulent sites often inflate credentials to impress unsuspecting visitors.

-

Professional Branding Without Real Proof — Just because a website looks polished does not mean the business behind it is real. Many scam sites invest in professional design to mask a lack of substance.

-

Using Reputable-sounding Names — “Parthenon” is a term that evokes stability and history, and using it alongside phrases like “Global Investment Bank” is designed to impart trust without any backing.

-

No Confirmed Offices or Personnel Outside The Site — Legitimate financial institutions publicly list key executives, management teams, compliance officers, and audited financials. There’s no independent confirmation of such details for this firm.

Why This Matters — The Risk to Consumers

Engaging with unregulated and unauthorized financial firms exposes individuals to several serious risks:

-

No Legal Protections: If a regulated investment adviser fails, there are protocols and compensation schemes that protect clients. With unregulated firms, there are no guarantees.

-

High Probability of Loss: Without regulatory oversight, firms like this may engage in deceptive marketing, misrepresentation of performance, or outright fraud.

-

Potential Identity & Financial Theft: Untrustworthy sites may request personal information, financial details, or upfront payments under false pretenses, exposing clients to identity theft and financial loss.

-

Operational Uncertainty: A legitimate investment bank must undergo rigorous checks before serving clients — background checks, capital requirements, compliance with anti-money-laundering laws, etc. None of this oversight exists here.

Separate From Similarly Named Firms

It’s worth noting that there are legitimate companies with names including “Parthenon” — for example, The Parthenon Company, a medical supply business with thousands of positive reviews online, or EY-Parthenon, a well-known global consulting group under Ernst & Young. These are completely unrelated entities and should not be confused with parthenongrpllc.com. conflating them could mislead readers.

Conclusion: A Platform to Avoid

Based on authoritative regulatory warnings, lack of verifiable licensing, and common scam indicators, parthenongrpllc.com / Parthenon Group LLC should be avoided by anyone considering investing or engaging their financial services. The FCA’s explicit warning that the firm is unauthorised and may be running scams is not trivial — it’s a serious signal that this platform does not operate within established financial regulatory frameworks.

If you encounter this company through cold outreach, unsolicited emails, ads, or social media, treat the encounter with extreme skepticism. Do not share personal, banking, or investment information, and do not send funds or make deposits based on promises from this site. Your financial security and peace of mind are worth protecting, and steering clear of unverified and unauthorized entities like this one is an essential first step.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to parthenongrpllc.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as parthenongrpllc.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.