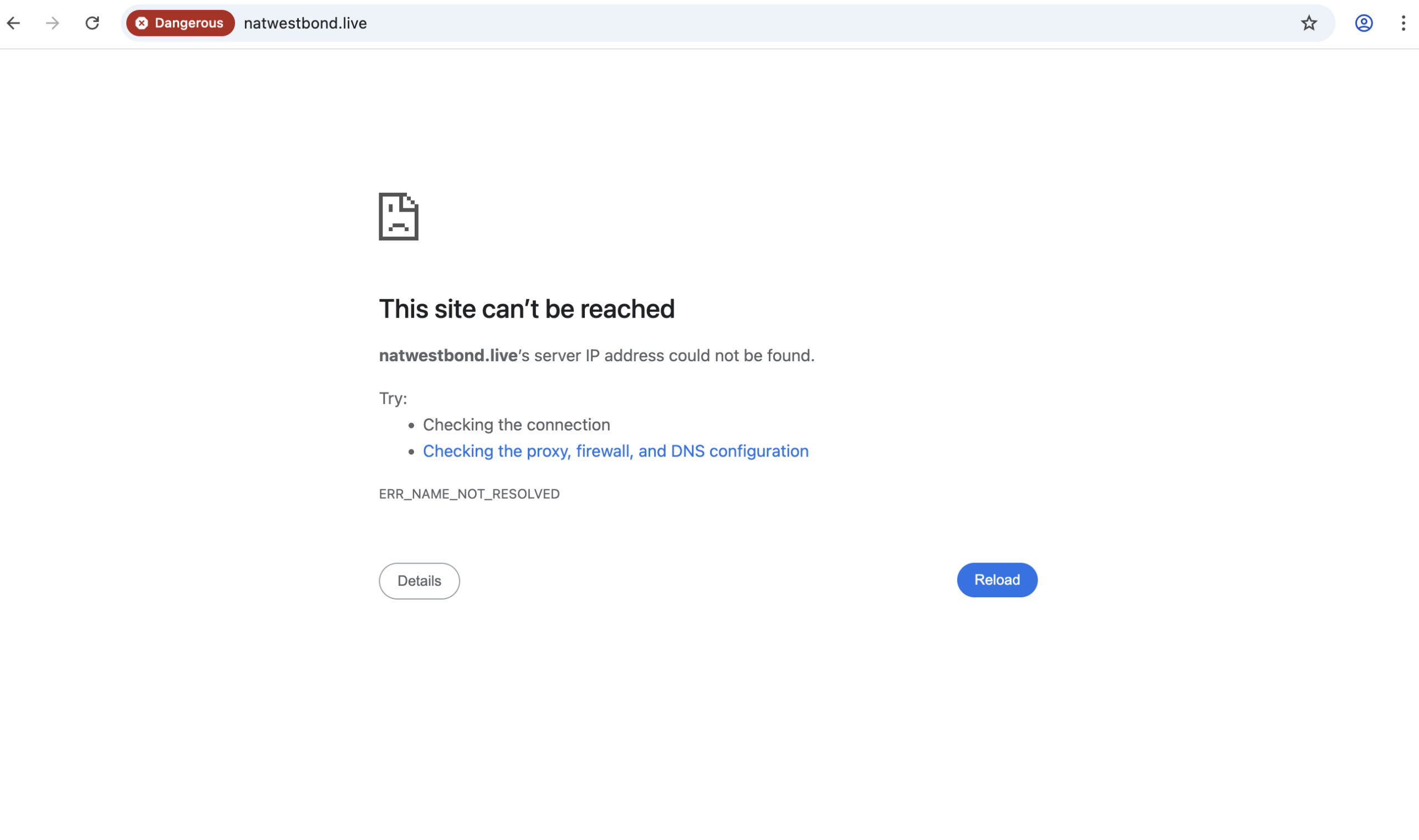

NatWestBond.live Services at a Glance

Online investment platforms offering attractive financial opportunities are everywhere, but not all of them are trustworthy. natwestbond.live is one of the latest entrants in the financial services space that presents itself as an advanced investment and trading platform. Despite its professional look, a closer examination shows multiple issues that make this service highly questionable. Here’s an in‑depth look at the platform and why you should think twice before engaging with it.

1. Ultra‑New Domain With No Track Record

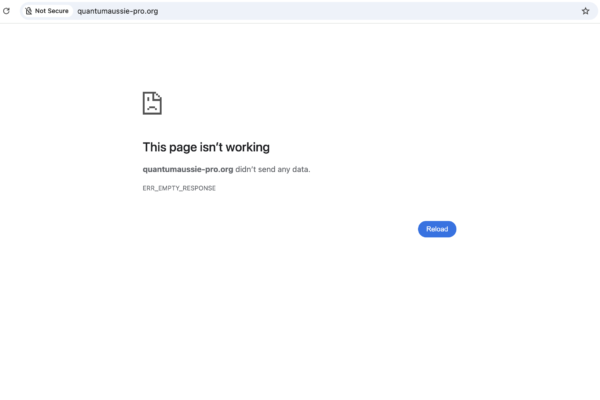

One of the most basic red flags for any online financial platform is the age and history of its domain. natwestbond.live was registered only recently, which means it has no long‑term presence or track record in the market. Platforms with a short digital history often lack credibility because they have not had time to establish performance data, user experiences, or a reputation that can be independently verified.

In contrast, established financial services typically have years of operational history, public profiles, and user feedback spanning multiple years — aspects that this platform simply lacks.

2. Extremely Low Trust Ratings From Security Tools

Independent website security and reputation tools have flagged natwestbond.live with very low trust scores. According to one analysis, the platform received a score of 18.8 out of 100, indicating significant concerns related to online safety and trustworthiness.

Another security evaluation assigned the site a 1 out of 100 trust score, noting it as unsafe and identifying indicators typical of fraudulent financial sites, including limited external references and questionable on‑page content.

These automated systems consider many factors — including web traffic, domain reputation, content reliability, and potential ties to suspicious online properties — and the consistently poor results indicate that natwestbond.live does not align with what you’d expect from a legitimate investment platform.

3. Claims That Mimic Genuine Investments

natwestbond.live markets itself as offering a wide array of financial services — from cryptocurrency and forex to bonds and real estate investments. It also touts “AI‑powered” technology and sophisticated trading tools.

Unfortunately, these claims are generic buzzwords that many illegitimate platforms use to appear cutting edge. Without verifiable evidence of actual technology, proven investment strategies, audited returns, or transparent operational practices, such marketing language is superficial at best and deceptive at worst.

4. No Clear Regulatory Information

Reputable financial firms operate under the supervision of recognized regulators such as the U.K.’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or equivalent bodies in major financial markets. Regulatory oversight is critical because it subjects companies to stringent compliance requirements, including client asset protections, reporting standards, and operational transparency.

natwestbond.live does not provide any publicly verifiable licensing information tied to major financial authorities. The absence of such information suggests that the platform is not regulated by any recognized financial watchdog, leaving users without basic protections that legitimate investors rely on.

5. Limited and Negative User Feedback

When researching natwestbond.live, available user feedback is sparse and problematic. On Trustpilot, the platform has a profile with only a couple of reviews, and the overall score is low with 1‑star input dominating the feedback.

While this feedback might not represent a large sample, the issues raised — including negative experiences and concerns around financial dealings — add to the picture of a platform with little trust or satisfaction among real users.

6. Signs of Common Deceptive Practices

Several characteristics associated with natwestbond.live align with patterns typical of deceptive investment sites:

-

Reliance on highly generic promises and buzzwords without substance.

-

Domain registered very recently, with no archival records or long‑term user history.

-

Limited external traffic and references, suggesting the site is not integrated into a broader financial ecosystem.

-

Use of professional‑sounding wording designed to create a veneer of legitimacy.

Platforms that lack transparency and rely on superficial messaging often seek to exploit investor trust rather than deliver genuine financial services.

7. Confusion With Established Brand Names

The name natwestbond.live may give some users the impression of an association with established financial institutions (e.g., NatWest Group). However, there is no credible linkage between this website and any major bank or regulated financial firm. Legitimate financial services linked to recognized brands typically operate from official domains (e.g., natwest.com) and have easily verifiable corporate histories.

Using names or terms that appear professional is a common tactic to capitalize on brand recognition and mislead users into mistaking a fraudulent site for a legitimate one.

Conclusion: Serious Concerns Around natwestbond.live

After analyzing available data from multiple independent tools and user feedback sources, it’s clear that natwestbond.live does not demonstrate the markers of a trustworthy financial platform. The key concerns include:

-

Extremely short domain history with no established track record.

-

Very low trust scores from reputable reputation checkers.

-

Claims of advanced financial services without proof or regulatory backing.

-

Very limited and negative user feedback.

-

Professional branding that may misleadingly resemble established financial names.

For these reasons, anyone considering engaging with natwestbond.live should proceed with extreme caution and thoroughly verify all claims independently — starting with regulatory validation and transparent contact information.

Given the indicators above, this platform does not align with industry standards for legitimate financial services and should be avoided.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to natwestbond.live, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as natwestbond.live continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.