Royalcapital.app Trust Overview

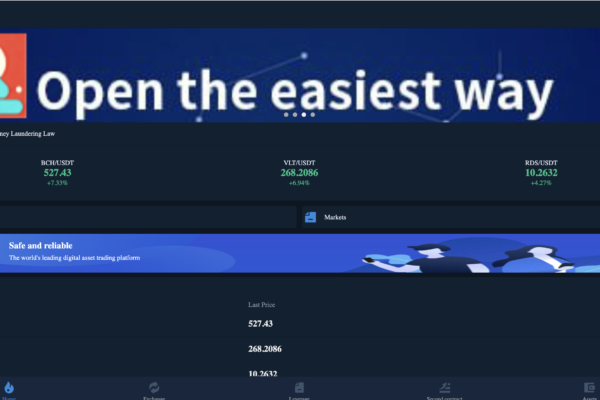

In today’s digital age, countless online platforms promise easy access to financial services, crypto investing, and wealth growth. One name that has been circulating in investment circles recently is Royalcapital.app. At first glance, its slick interface and promises of financial growth might seem appealing — but when you dig deeper, there are serious concerns around credibility, transparency, and legitimacy that every potential user should be aware of.

This review breaks down what’s known about Royalcapital.app, examines user feedback and online assessments, and explains why approaching this platform with caution is advisable.

What Royalcapital.app Claims to Offer

Royalcapital.app markets itself as a comprehensive investment platform tailored to a broad audience, offering digital financial services, investment tools, or portfolio solutions. Platforms like this often advertise easy onboarding, intuitive dashboards, and attractive return options to draw in users eager to grow their money quickly.

However, claims made in marketing content should always be verified independently — especially when actual regulatory compliance, operational records, and documented user experiences are hard to confirm.

Lack of Independent Verification

A major issue with Royalcapital.app is that there’s no readily accessible, verifiable regulatory information from recognized financial authorities about the platform or the entity behind it. Legitimate investment services typically provide clear licensing details, registrations with financial bodies, and documentation that users can check independently.

Platforms that do not disclose hard regulatory data — such as registration with ASIC in Australia, the FCA in the UK, or SEC in the US — leave users without established layers of consumer protection or oversight, making it much harder to validate whether the service operates under financial rules that protect client funds.

In cases where regulatory info is absent or vague, that’s usually a strong signal to investigate thoroughly before considering any financial engagement.

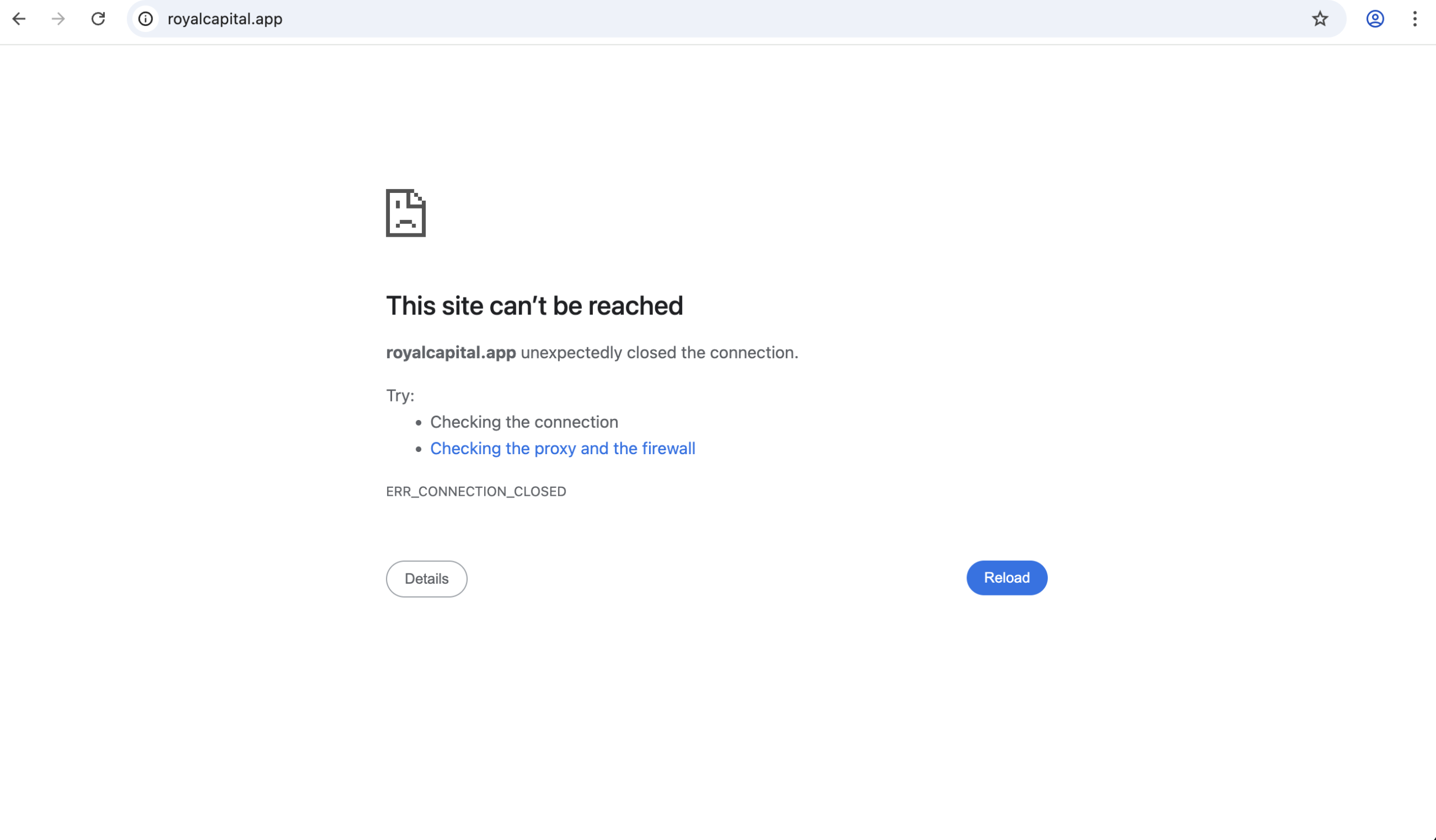

Domain and Technical Transparency Issues

Independent web reputation tools often analyze factors like domain age, ownership visibility, server history, and global traffic. When a site has a very young domain, hidden WHOIS ownership details, and low web traffic, those characteristics raise serious questions about the platform’s credibility and longevity.

Sites with these traits have been flagged in automated assessments as having low trust scores and potential safety concerns. This doesn’t definitively prove fraud, but it does indicate that there is limited data to support confidence in the platform’s longevity or operational legitimacy.

These kinds of indicators often appear with online services that have not built a long track record or independent presence, which in turn makes due diligence difficult.

User Feedback and Independent Reviews

While specific user reviews for Royalcapital.app itself are scarce due to its limited online footprint, similar names tied to “Royal Capital” investment services (such as those reviewed under related domains) have generated mixed feedback on platforms like Trustpilot and other review sites. Some users report issues with delayed withdrawals, unresponsive support, and broken promises of returns. Others have given positive feedback, describing good experiences or helpful tools.

This mix of opinions — particularly when negative experiences reference inaccessible funds or communication breakdowns — should be taken seriously when evaluating any financial platform.

Even when reviews come from sites associated with similar brand names, the absence of consistent, positive, verifiable feedback directly tied to Royalcapital.app suggests there isn’t a strong foundational user trust record.

Why Transparency Matters in Finance Platforms

When dealing with financial platforms — whether for investing, crypto management, or trading — transparency is crucial. Legitimate services typically feature:

-

Clear business registration data

-

Details on regulatory oversight

-

Corporate leadership information

-

Open audit and compliance policies

-

Active community or third‑party verification

If a platform lacks these components, it limits your ability to confirm its authenticity and safety — especially when your financial data and funds could be at stake.

Common Patterns With Dubious Platforms

Several recurring features appear in websites that later prove problematic for users:

-

Hidden or private domain ownership – Real companies typically make corporate information public.

-

Minimal independent review traction – Few verified user reviews or long‑term testimonials.

-

Lack of clear regulatory listings – No listings on financial authority databases.

-

Inconsistent or limited customer support channels – Hard‑to‑reach teams and unclear contact details.

These elements often converge around services that are either very new and unproven or have not established proper compliance and credibility structures.

What This Means for Potential Users

Before relying on any platform like Royalcapital.app for financial activity, you should consider several due diligence steps:

-

Search for official licensing or regulation in respected financial jurisdictions.

-

Look for strong third‑party reviews and detailed user experiences.

-

Check domain history and ownership transparency through independent record tools.

-

Evaluate how easy it is to contact real support with verifiable credentials.

Only with a solid verification trail should you consider using a platform for managing or investing money.

Final Summary

Royalcapital.app currently presents significant unknowns regarding who operates it, where it is regulated, and whether it meets standard financial safeguards expected by serious investors. Combined with limited independent user feedback and unclear transparency, this means that the platform cannot currently be regarded as established or reliably documented.

When it comes to your financial decisions, it’s prudent to choose platforms that have built a verified track record, clear regulatory status, and a transparent public presence. At this stage, Royalcapital.app does not meet these criteria based on available information.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to royalcapital.app, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as royalcapital.app continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.