Aonuoc.com Review and Insights

In the vast online world of investment platforms and financial services, not every site that claims to help you grow your money is legitimate. One name that has recently drawn attention is Aonuoc.com — a site that markets itself as a gateway to online trading and financial opportunities. However, when you step back and examine the available evidence, it becomes clear that this platform has numerous characteristics commonly associated with untrustworthy services, and many experts advise extreme caution before interacting with it.

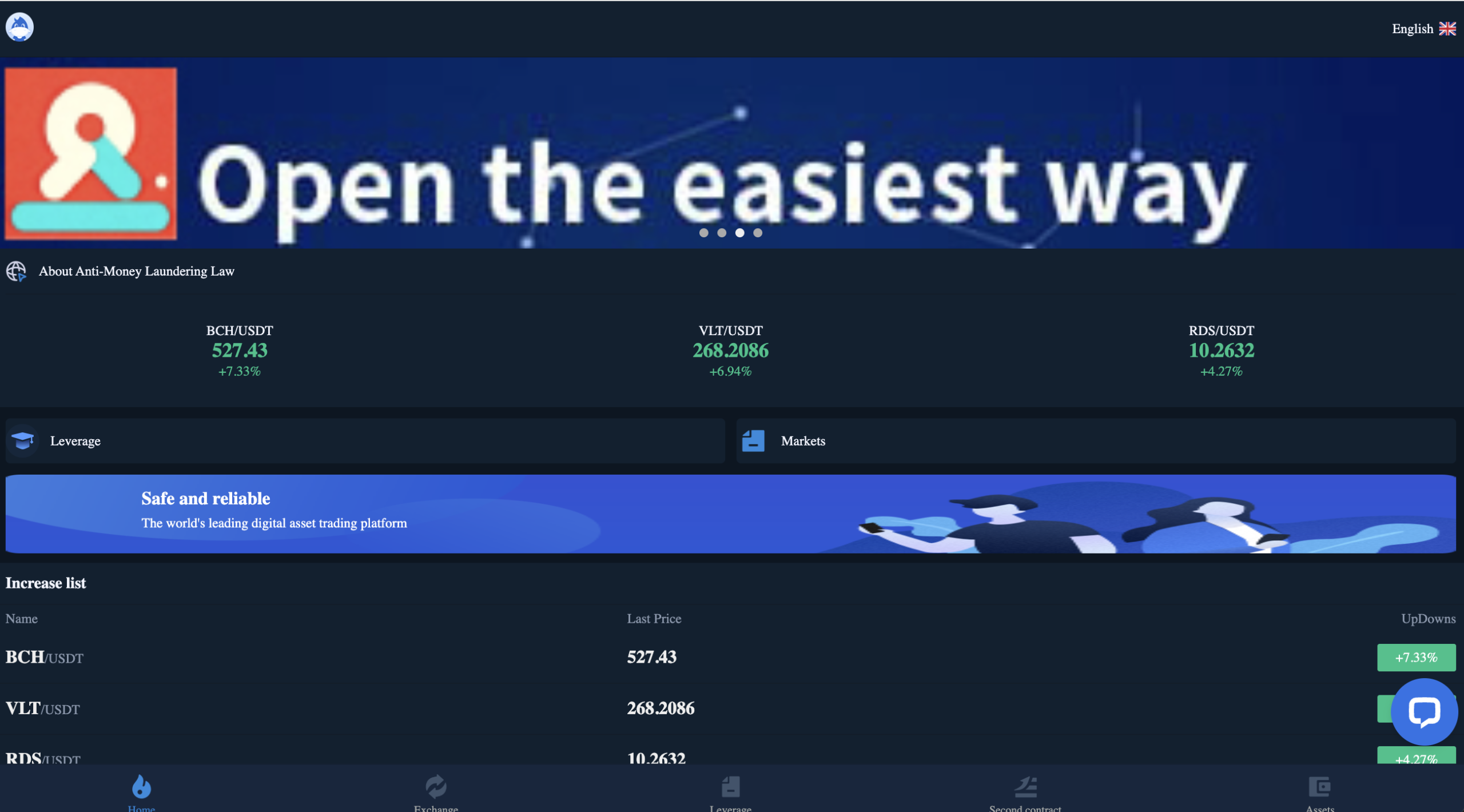

How Aonuoc.com Presents Itself

Aonuoc.com appears to position itself as an online investment hub, promising access to trading tools, fast execution, and opportunities in markets like forex and cryptocurrencies. The website’s marketing language emphasizes profit potential and advanced trading technology — claims that can seem appealing to both novice and seasoned investors.

But that’s where the first major concern arises: the platform offers very little substantive or verifiable information about who runs the business or how it actually operates. Legitimate financial services typically disclose corporate registration, leadership profiles, and regulatory compliance — all of which are missing or vague for this site.

No Clear Regulatory Credentials

A key benchmark for any financial service platform is whether it’s properly licensed or regulated by recognized authorities. For example, in Australia, platforms must register with the Australian Securities and Investments Commission (ASIC), and in the UK, the Financial Conduct Authority (FCA) oversees financial services. These regulatory bodies ensure platforms meet legal standards, maintain transparent operations, and provide some level of investor protection.

For Aonuoc.com, there’s no verifiable listing with any recognized financial regulator despite claims and marketing content suggesting it offers investment services. The absence of a regulatory license means users are not protected by official oversight or compensation schemes, and there’s no independent entity ensuring the platform follows fair conduct rules.

Interactivity Concerns and Operational Red Flags

Experts who analyze online platforms note several troubling signs when evaluating Aonuoc.com:

-

Opaque Ownership: Domain registration details are hidden behind private registration services, making it difficult to establish who owns or manages the platform.

-

Unverified User Engagement: There is no substantial pool of independent user reviews that can confirm the platform’s operations over time. Sites without an identifiable track record often lack accountability.

-

Generic Marketing Language: Features such as “high returns” and “cutting‑edge technology” are used without clear evidence, performance data, or independent verification — which are staples of reputable investment services.

These structural issues make it unusually difficult for potential users to validate whether the platform functions as promised, leaving many questions unanswered.

User Experiences and Withdrawal Problems

One of the most concerning patterns reported about Aonuoc.com in independent analyses relates to withdrawal difficulties and account access issues. Multiple sources highlight that users who deposit funds often face barriers when attempting to access those funds, including delayed processing, account freezes, or evasive responses from support teams.

In some online community reports, individuals describe scenarios where platforms similar to Aonuoc.com accept deposits but do not process legitimate withdrawal requests, or keep users waiting indefinitely — a common complaint associated with disreputable investment sites.

Marketing Tactics and Unrealistic Promises

Another point of concern is the site’s promotional approach. Reports indicate Aonuoc.com uses aggressive marketing language and promises of high returns that do not align with typical financial market realities. Such tactics include:

-

Messaging that highlights “exclusive profit opportunities”

-

Portraying returns that defy realistic market behavior

-

Encouraging quick decisions without proper due diligence

These strategies are often used by services aiming to capture money quickly before users have time to investigate properly.

Why Transparency Matters

Transparent operation is crucial when choosing a financial platform because it allows users to:

-

Verify legal status with regulators

-

Validate the background of the service and its leadership

-

Understand terms, fees, and withdrawal policies

-

Assess the legitimacy of market claims

Without these elements, it is extremely difficult to distinguish a trustworthy service from one that is merely presenting itself as legitimate without substantive backing.

With Aonuoc.com, these transparency fundamentals are absent or incomplete, leaving potential users without the key information needed to make informed financial decisions.

Final Thoughts

When evaluating online investment and trading platforms, the key to avoiding potential losses is due diligence and verification of credibility. Aonuoc.com’s lack of regulatory credentials, opaque ownership, unclear operational practices, and reported difficulties with fund access all contribute to serious concerns about its trustworthiness.

Rather than risking money or personal information with a platform that does not provide clear, accredited, or verifiable backing, investors should consider well‑regulated alternatives and seek platforms with established compliance and transparent practices. These checks may seem burdensome, but they are essential for protecting your financial well‑being in an increasingly complex online investment space.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to aonuoc.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as aonuoc.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.