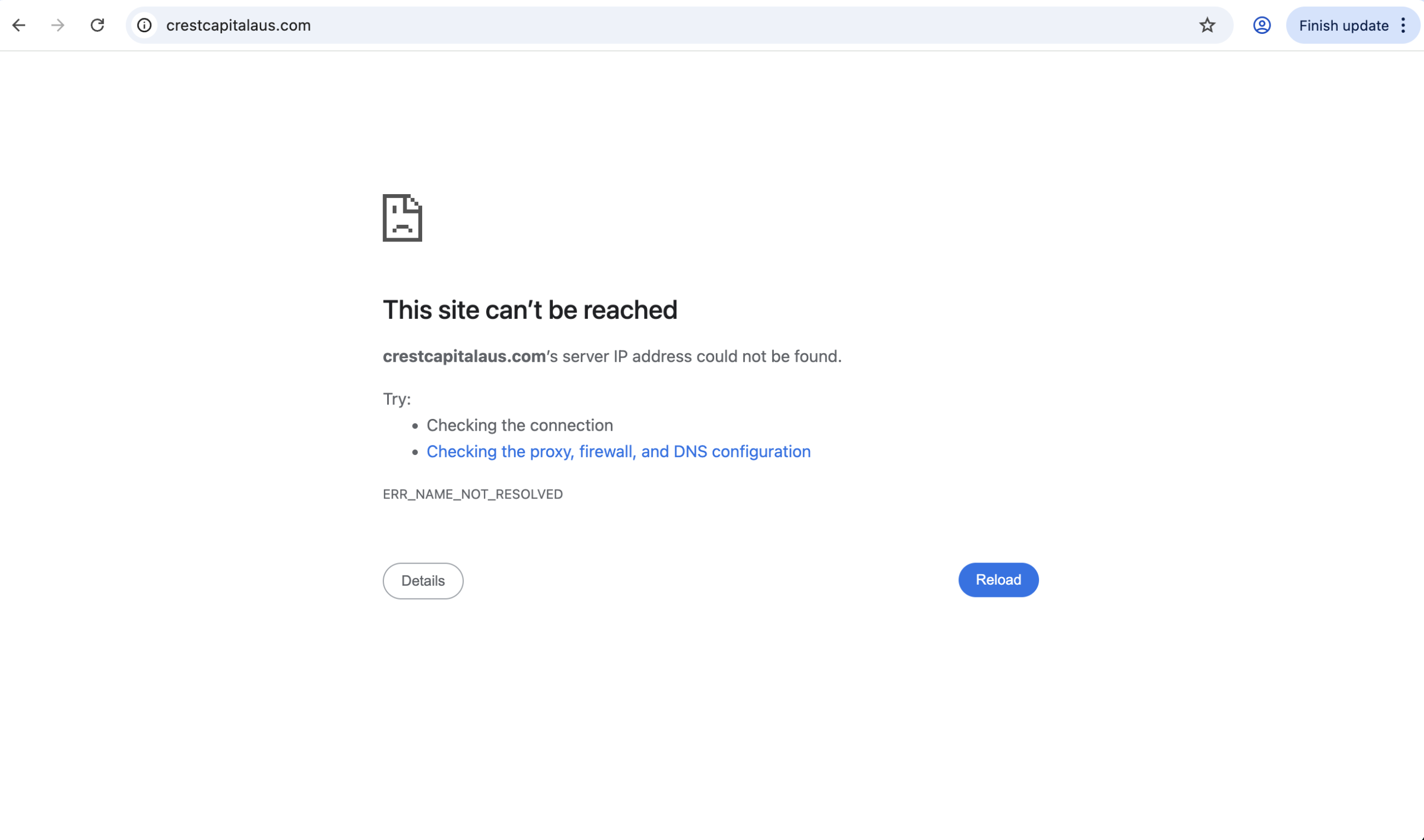

CrestCapitalAus.com Review 2026

CrestCapitalAus.com styles itself as an investment and trading services provider, featuring a professional-looking website and contact details that include an Australian address in Subiaco, WA. On the surface, this might give casual visitors the impression of a legitimate financial service. However, multiple independent evaluations and patterns associated with deceptive platforms suggest that CrestCapitalAus.com is neither transparent nor safe to engage with.

Below is an in-depth breakdown of key issues that raise serious questions about the platform’s integrity and reliability.

1. Very New Domain With Hidden Ownership

Independent technical analysis reveals that CrestCapitalAus.com was registered only recently — in late 2025 — and still has a very young domain age. New domains with limited online presence often lack the operational history that helps establish credibility in financial services.

In addition, domain ownership details are intentionally masked using privacy protection, which makes it harder to verify who actually runs the business, where they are based, and whether they are subject to any oversight.

This anonymity is a red flag: reputable investment platforms typically provide clear corporate information, including directors, registration numbers, and public verification of licensing.

2. Website Hosted With Low-Trust Sites and Shared Servers

The platform is hosted on a shared server alongside several other websites that have low trust scores. Shared hosting with unknown or low-trust sites can increase security risks — especially for platforms claiming to handle financial data.

While a shared server alone doesn’t prove malicious intent, combining this with a lack of verified regulation and domain anonymity significantly erodes confidence in the platform’s credibility.

3. Lack of Verifiable Regulation or Licensing

One of the most troubling aspects of CrestCapitalAus.com is the absence of clear, independently verifiable regulatory licensing. Legitimate brokers and investment service providers should be authorised by recognised financial regulators (e.g., the Australian Securities and Investments Commission, Financial Conduct Authority in the UK, or equivalent).

Without a confirmed regulator:

-

There is no guaranteed oversight on how client funds are managed.

-

Investors have no statutory protections if disputes arise.

-

The company is free to operate outside enforceable compliance standards.

Platforms that operate without this level of accountability are fundamentally riskier and more likely to engage in unethical practices.

4. Negative User Feedback on Withdrawals and Support

Multiple independent reviews and user testimonials cited in online complaint registries highlight serious dissatisfaction with withdrawal processes and customer interactions. These complaints frequently mention:

-

Repeated delays or rejections when users tried to withdraw funds

-

Unresponsive or slow customer support staff

-

Pressure to deposit more money after initial investment

-

Unclear explanations of fees or account terms

These kinds of patterns are common in problematic financial platforms, particularly those with no real regulatory accountability.

5. Marketing Promises That Don’t Reflect Market Reality

The platform’s marketing materials reportedly include alluring profit claims with insufficient discussion of inherent market risk. Legitimate investment firms are typically careful to disclose risk factors comprehensively because regulators require these disclosures.

By contrast, CrestCapitalAus.com advertises high-return scenarios without adequate transparency about potential losses, fee structures, or the methodology behind claimed trading strategies.

This is a classic tactic used to lure uninformed investors into committing funds before they fully understand the limitations of the platform.

6. Lack of Independent Third-Party Verification

When evaluating financial service providers, experienced investors look for third-party verification:

-

Presence in regulatory databases

-

Coverage in established financial press

-

Independent rating agencies

-

Long-term user feedback on respected platforms

None of these elements are verifiable for CrestCapitalAus.com. There is no confirmed listing on an official regulator’s register, and very limited authoritative third-party reporting on the company’s operations or performance history.

7. Should You Engage With This Platform?

Given the combination of:

-

very recent domain registration,

-

hidden ownership,

-

shared hosting with low-trust sites,

-

absence of confirmed regulation,

-

documented user complaints,

-

and opaque marketing materials,

there are legitimate reasons to question the legitimacy and trustworthiness of CrestCapitalAus.com.

Investors should be especially cautious about entrusting any capital to platforms that do not clearly demonstrate accountability, transparent compliance with regulatory standards, or a verifiable track record of user satisfaction.

Final Assessment

CrestCapitalAus.com exhibits multiple attributes commonly associated with untrustworthy investment platforms:

-

Hidden ownership and lack of transparency

-

Young, low-profile domain history

-

Mixed or negative user reports regarding fund access

-

No confirmed regulator oversight

-

Unrealistic promotional language

For these reasons, individuals considering any financial relationship with CrestCapitalAus.com are advised to exercise extreme caution and undertake additional due diligence — particularly confirming regulatory status through official channels before transferring funds.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to crestcapitalaus.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as crestcapitalaus.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.