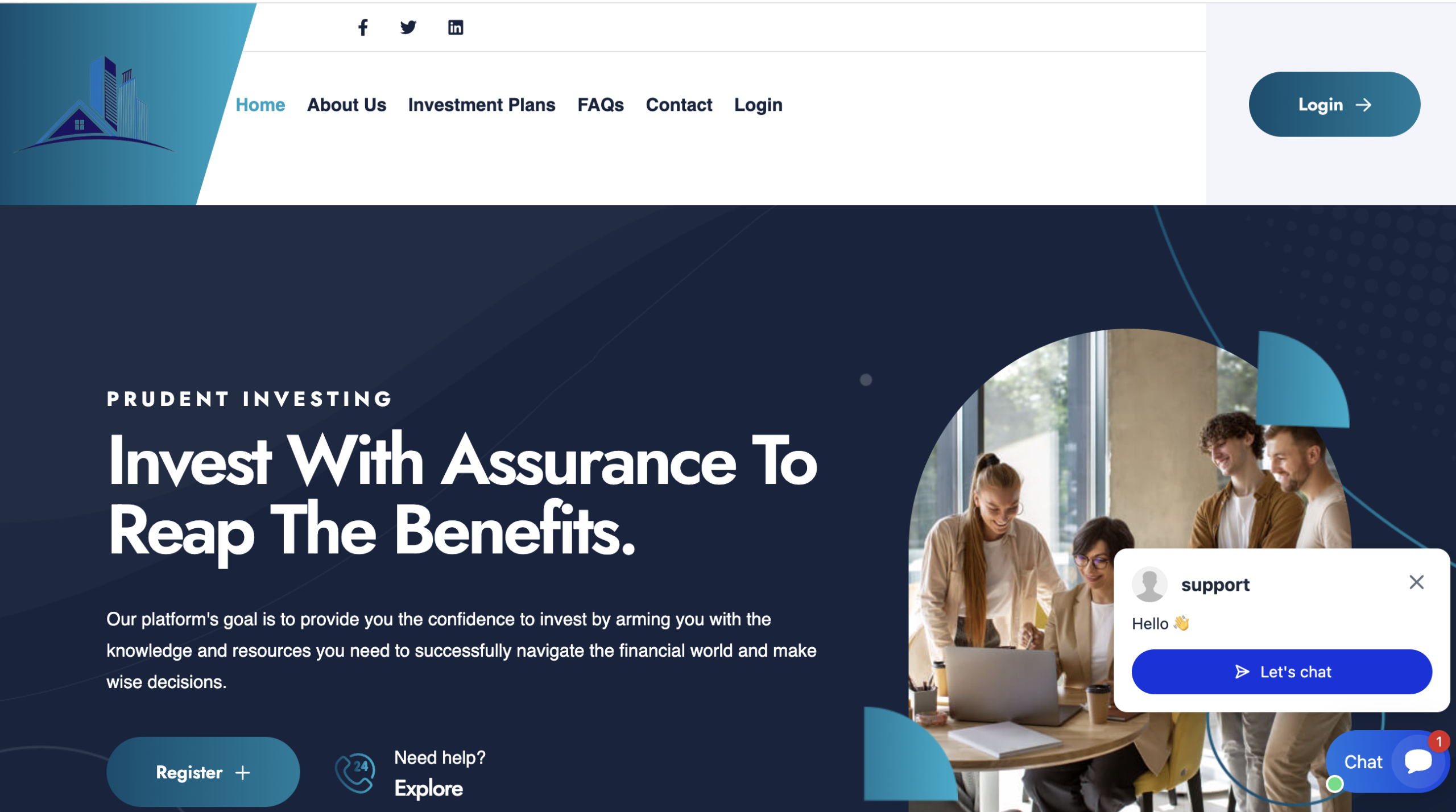

ApexTrusts Review Investors Beware!

In the crowded and often opaque world of online investment platforms, ApexTrusts.ltd has emerged on social media feeds, investment groups, and unsolicited ads promising fast growth, high returns, and seemingly professional financial services. At first glance, such pitches can seem compelling — especially to new or inexperienced investors keen to grow capital in crypto or other markets. But a deeper look at this platform reveals disturbing patterns and warning signs that should make potential users think twice before engaging. This review dissects the issues with ApexTrusts.ltd, explains why many experts and users view it skeptically, and ultimately advises staying well clear of this platform.

Minimal Transparency and Absence of Regulation

One of the most fundamental requirements for any legitimate financial services provider is clear regulatory oversight. Established brokers or investment platforms operate under the supervision of recognized regulators — for example, the Australian Securities and Investments Commission (ASIC), the U.K. Financial Conduct Authority, or the U.S.Securities and Exchange Commission. These bodies ensure that firms adhere to standards that protect investor funds and enforce accountability.

In the case of ApexTrusts.ltd, there are no indications that the platform is licensed or regulated by any reputable financial authority. Review summaries flag that ApexTrusts.ltd “operates without the necessary licensing or oversight” and does not disclose any verifiable regulatory credentials, company registration details, or legal entity information that users can independently check. This absence of regulatory transparency should immediately raise warning flags because it means there is no formal entity responsible for safeguarding user funds or resolving disputes responsibly.

Withdrawal Problems and Lock-in Tactics

Numerous accounts from individuals attempting to use the service describe persistent issues with fund withdrawals. According to user reports, the difficulties often start soon after an initial deposit is made. Attempts to withdraw earned capital or even the initial investment reportedly lead to delays, repeated requests for additional information, or opaque conditions that were never clearly communicated upfront.

Some investor observations describe “endless delays” and “account freezes without explanation” when trying to access their money — a tactic commonly associated with scam operations. These experiences align with classic scam mechanics: lock up funds, shift responsibility to the investor, and create as many procedural hurdles as possible under the guise of risk control or compliance.

Questionable Customer Support

A legitimate financial platform invests heavily in robust, responsive customer support because real clients need timely assistance with technical issues, account management, compliance queries, and market questions. In contrast, users of ApexTrusts.ltd report a lack of effective customer support — from slow or non-existent responses to support requests to representatives who offer vague explanations and avoid addressing core transactional concerns.

Consistent complaints about non-responsive or unhelpful support personnel highlight an operational weakness that goes beyond poor service: it reflects an absence of genuine accountability. A platform that cannot (or will not) help users resolve withdrawal problems or financial disputes is a platform you cannot rely on.

Aggressive Upselling and Psychological Pressure

A strategy often used by fraudulent investment platforms is psychological manipulation — deploying aggressive upsell tactics and fear-of-missing-out (FOMO) language to keep investors engaged and continually depositing more funds. ApexTrusts.ltd reportedly engages in this behavior, pushing users toward additional investment products or suggesting that greater returns are only possible after further deposits.

This kind of marketing is not typical of reputable financial institutions, which should be focused on transparent investment strategies and risk disclosures. Instead, persistent pressure to keep adding capital is characteristic of platforms with incentives tied solely to inflating depositor balances without regard for investor welfare.

Third-Party Indicators Suggest High Risk

Independent online reputation tools offer another layer of scrutiny. While ScamAdviser and similar services don’t definitively label apextrusts.ltd as a confirmed scam, they often show weak trust scores and limited credibility signals — especially for newly registered or low-visibility domains such as this one. These tools evaluate domain age, traffic volume, server reputation, and the presence of negative markers such as phishing reports or spam associations. While not definitive on their own, these indicators add weight to concerns when combined with other warning signs.

Additionally, broader analysis of similarly named platforms (e.g., apextrustltd.com, apextrustfunds.com) from other reputation checkers reveals extremely low trust scores and classification as unsafe or high-risk in aggregated threat databases. This pattern across several domain variants suggests common tactics used by fraudulent operations — rebranding quickly or operating multiple related sites with similar names to confuse potential victims.

Why That Matters

Investment scams succeed because they mimic the outward appearance of legitimate services while exploiting gaps in regulation, transparency, and verifiable credentials. The absence of a clear legal entity, regulatory license, robust customer support, and documented financial safeguards means that investors have virtually no protection if things go wrong. This is why financial regulators around the world — including ASIC and similar authorities — publish investor alert lists and urge consumers to verify licensing before engaging with online investment services.

Final Verdict: Steer Clear

Based on available evidence — including persistent user complaints about withdrawals, lack of regulatory oversight, negative third-party assessments, and questionable customer support — ApexTrusts.ltd presents a high level of risk and should be avoided. Platforms that do not disclose verifiable credentials and that use aggressive upsell and locking tactics with investor funds operate outside the standards of legitimate financial services.

If you are exploring online investment or trading platforms, prioritise those with:

-

Recognized regulatory licenses (e.g., ASIC, FCA, SEC)

-

Transparent company information and physical headquarters

-

Clear customer support channels

-

Audit-ready financial disclosures

-

A documented history of client fund safety

These are markers of a platform that takes investor protection seriously. ApexTrusts.ltd does not currently demonstrate these attributes — a fact that makes it a poor choice for anyone looking to safeguard their money and build sustainable long-term investment returns.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to apextrusts.ltd, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as apextrusts.ltd continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.