Cash-Interest.com User Guide

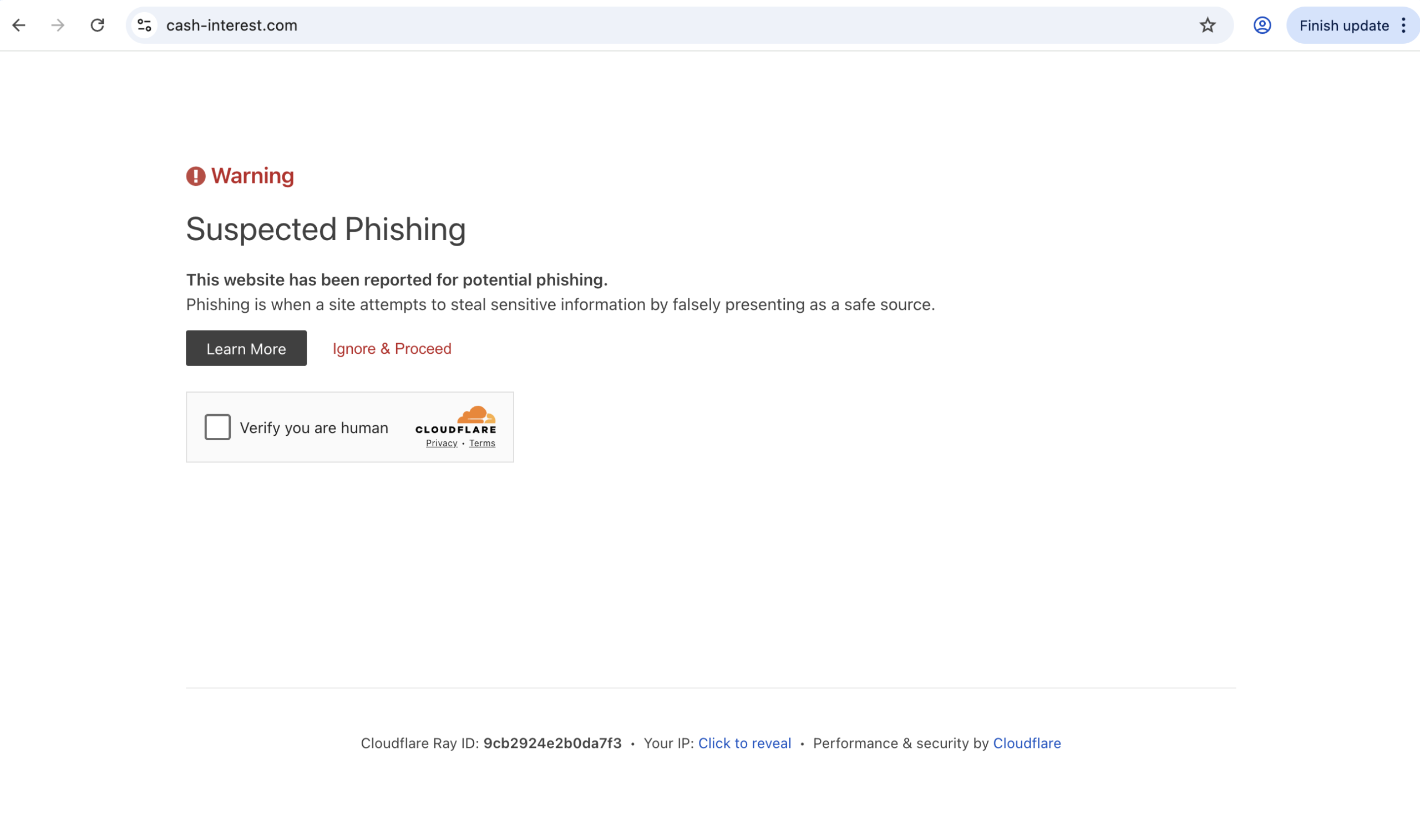

When evaluating online financial platforms, especially those that offer cash‑related services, transparency and credibility are critical. One site that has raised eyebrows among some users is cash‑interest.com. While the domain name may sound legitimate and straightforward — suggesting a focus on interest‑related cash services — the reality is more ambiguous, with several concerning indicators that potential users should be aware of before engaging with the platform.

This review explores what is known about cash‑interest.com, examines how people have experienced it, and explains why many observers urge caution.

1. Limited Public Feedback and No Verified Presence

A common first step in vetting any online business is to look for independent user feedback or verified activity from the platform. For well‑established companies, you’ll typically find multiple user testimonials, verified third‑party reviews, or broader community discussion about their services.

In the case of cash‑interest.com, there is only a single review visible on a popular review platform, and it shows a low overall score and a negative experience from the reviewer. That sole review includes a personal account of a negative outcome involving the site’s services, which sets off alarm bells for newcomers considering using it.

This lack of a meaningful body of feedback — especially for a site that appears to offer financial services — is concerning because legitimate financial platforms typically generate extensive user interaction and commentary over time.

2. Unclear Business Model and Value Proposition

One of the core challenges with cash‑interest.com is that it’s not easy to determine what its core services are or how they work. Legitimate financial platforms clearly outline:

-

What services they offer (loans, savings, investment products, etc.)

-

How their pricing and terms are structured

-

How users access those services

-

What protections or regulatory frameworks apply

In contrast, cash‑interest.com’s public presence lacks these essential details. Without clarity on the underlying business model, it’s hard for users to understand what they’re signing up for or how funds are handled. This ambiguity makes it difficult to assess whether the platform is operating with legitimate financial products or merely using generic branding to attract attention.

3. Negative User Experience Reported

The one available review linked to cash‑interest.com warns that the reviewer felt mistreated and experienced loss after using the platform. Although a single review does not automatically confirm systemic problems, the presence of an extremely negative first‑hand account should not be discounted, especially when such accounts correlate with a lack of positive feedback from other users.

With financial services, even one reported case of loss due to unclear terms or poor service delivery is a significant signal that potential users should scrutinize the platform carefully.

4. No Clear Regulatory or Licensing Information

For online platforms that deal with financial products, investment, lending, or interest‑bearing accounts, transparent regulatory compliance is crucial. Regulated entities typically publish clear licensing details and are subject to oversight by financial authorities. These regulatory details help protect consumers and provide recourse if issues arise.

There is no widely visible regulatory documentation or authoritative licensing information publicly associated with cash‑interest.com. In most jurisdictions, this is a basic expectation for a platform purporting to deal with financial services. The absence of such information makes it difficult to confirm whether cash‑interest.com is running within the bounds of legitimate financial activity.

5. Domain and Digital Footprint

A quick look at cash‑interest.com’s digital footprint shows minimal visibility and no extensive presence in trusted review hubs. Established financial platforms often accumulate user engagement, news mentions, and community discussion over time. The absence of such historical visibility suggests that the platform may either be very new or not broadly trusted enough to attract extended discussion.

In many cases, domains with low visibility and little public interaction can be tied to speculative websites that use generic financial terminology to attract clicks but without a solid operational base behind them.

6. Implications for New Users

Before considering engagement with cash‑interest.com — whether through signing up, entering financial information, or depositing funds — there are several key questions a prudent person should ask:

-

What exactly does the platform offer? Is the service a savings product, a loan service, or something else? If the answer remains unclear, that’s a major concern.

-

Is there regulation or oversight? Verifiable financial services need to be backed by clear compliance with financial authorities.

-

Where are user experiences? The lack of broad and credible feedback makes it hard to judge whether the service delivers what it promises.

-

Are terms transparent? Without transparent terms of service, fee structures, and account guarantees, users are left guessing.

These questions highlight the core issue: without clear and verifiable information, any financial engagement involves unknowns that can lead to poor outcomes.

Conclusion

Examining cash‑interest.com reveals several indicators that caution is warranted. The platform has minimal publicly visible reviews, with the only documented feedback showing a negative user experience. There’s a notable absence of clear regulatory status, no obvious detailed service description, and no broad user discussion to support confidence in its operation.

Together, these factors suggest that cash‑interest.com may not be a dependable choice for individuals seeking reliable financial services. For anyone exploring online financial platforms, the safest course is to choose providers with well‑established reputations, clear regulatory compliance, and extensive positive user engagement.

Because of the lack of transparency and limited trustworthy evidence about how cash‑interest.com operates, many reviewers advise potential users to proceed with caution and consider alternatives with stronger track records.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to cash-interest.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as cash-interest.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.