LibertyMarkets Detailed Assessment

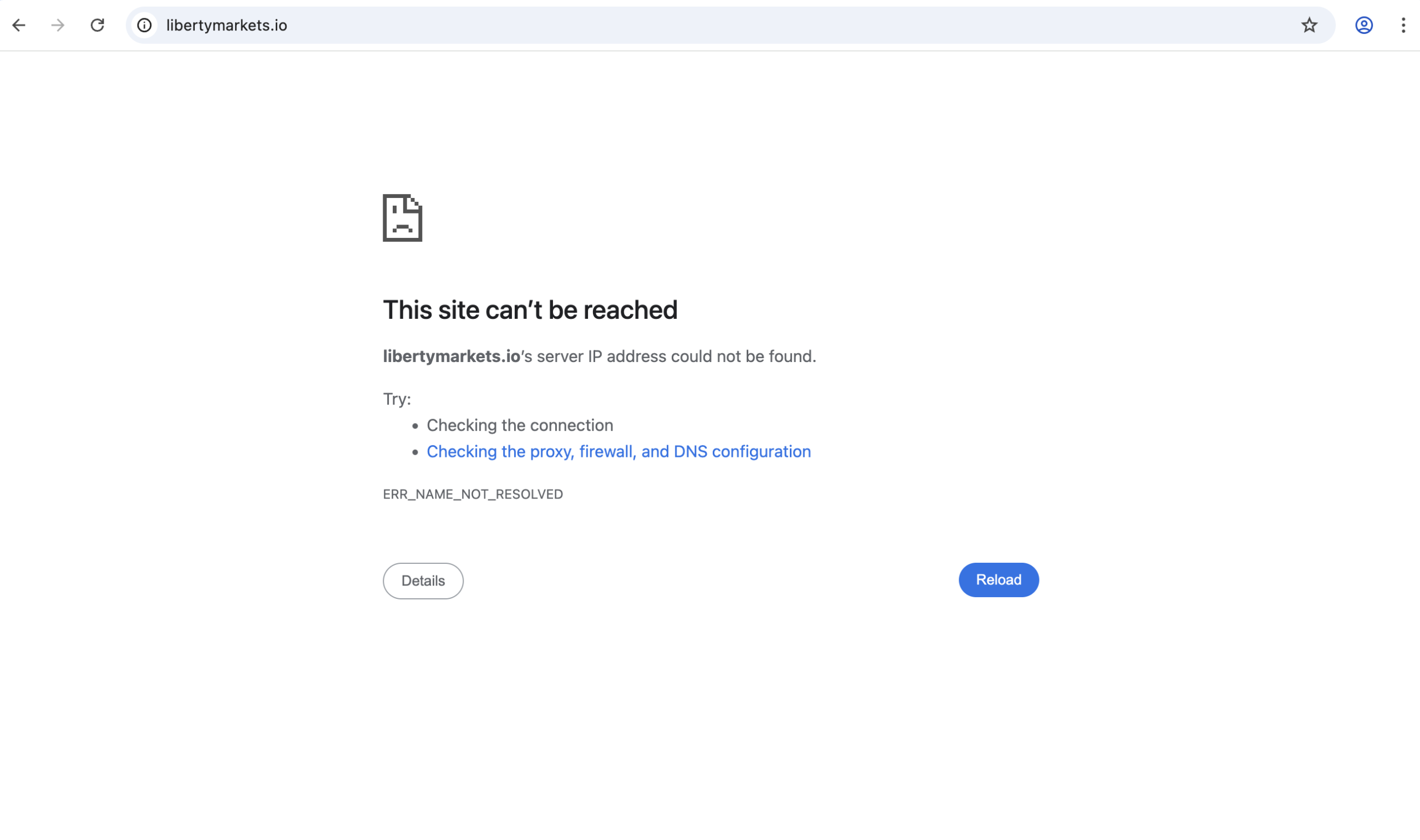

Online trading and cryptocurrency platforms have become increasingly popular, attracting investors with promises of fast gains, advanced tools, and global accessibility. However, not all platforms that look professional on the surface are legitimate or trustworthy. One such platform drawing scrutiny is libertymarkets.io. While it markets itself as a multi‑asset exchange offering crypto and precious metal trading, independent credibility checks reveal a concerning picture that suggests it should be approached with extreme caution — if at all.

Below, we break down key issues tied to libertymarkets.io and explain why users would be well‑advised to reconsider engaging with this platform.

1. Very Low Trust Score From Independent Evaluators

One of the most significant concerns about libertymarkets.io is its extremely low trust score assigned by an independent fraud‑detection evaluator. According to one in‑depth analysis, the platform scored just 16.4 out of 100, with tags like “Controversial,” “High‑Risk,” and “Unsafe.” These types of scores are aggregated based on technical, contextual, and domain‑history indicators that together form an overall credibility assessment.

A score this low signals that the platform fails to meet minimum credibility thresholds used by reputable services and that there are multiple concerns about its operations.

2. Extremely Recent Domain With No Track Record

Libertymarkets.io was registered on January 2, 2026 — only a matter of weeks ago at the time of this review. Such a new domain means there’s no long‑term operational history to evaluate. Established trading and investment services usually have years of verifiable presence, user feedback, and regulatory records. A newly created domain with minimal traceable activities makes it very difficult to confirm authenticity or performance history.

3. Ownership Details Are Hidden

The platform’s WHOIS data is protected by privacy services, meaning no actual owner information is visible — including business registration, physical address, or executive profiles.

In the financial sector, transparency is critical. Legitimate services disclose their corporate entity, leadership team, and often provide proof of external audits or regulatory licenses. When ownership is concealed, it raises questions about accountability and legitimacy.

4. Conflicting Reputation Assessments Offer No Assurance

Some automated security tools provide a more positive picture, rating libertymarkets.io with a moderate trust score (e.g., 60/100) based on basic safety checks like SSL certificates and absence of malware warnings.

However, this doesn’t address deeper issues like business legitimacy, regulatory compliance, or trustworthiness in financial operations. A valid SSL and basic server setup can exist on sites that are technically safe to browse yet still unreliable as trading platforms.

5. Red Flags Beyond Technical Checks

Independent evaluators also point out several risk and suspicion indicators tied to the platform’s presence:

-

Newly registered domain with no historical footprint in trading markets.

-

Privacy‑protected ownership, hiding business details.

-

Platform claims of broad services with no verifiable user data supporting them.

These types of signals are consistent with what analysts see in many unverified or high‑risk financial websites.

6. No Verifiable Regulator or Licensing Information

A legitimate trading or exchange service that deals with crypto and traditional assets should be registered with relevant financial authorities in established markets — for example ASIC (Australia), FCA (UK), or equivalent regulators. There is no available evidence that libertymarkets.io is licensed or regulated by any major financial authority. This absence of oversight means no formal protections or accountability mechanisms are in place for users who interact with the platform.

7. Lack of Independent User Feedback

As of the current evaluations, there is no significant independent user feedback or reputable third‑party reviewsavailable for libertymarkets.io. Legitimate platforms often have discussions on financial forums, community feedback on social media, and trailable customer experiences. The lack of verifiable user reports makes it impossible to confirm whether the platform actually performs as advertised. It also means there’s no public evidence that real customers have had successful trading experiences or withdrawals.

Conclusion: Clear Signs to Exercise Extreme Caution

Taken together, the available data paints a picture of a platform with serious transparency and credibility issues:

-

Extremely low trust score from independent analysis.

-

Newly registered domain with no track record.

-

Hidden ownership information.

-

Absence of verifiable regulation.

-

No credible user feedback from independent sources.

This combination of factors strongly suggests that libertymarkets.io does not meet the basic standards users should expect from a trustworthy trading or financial platform. While the site may appear visually polished, surface design does not guarantee legitimacy or safety, especially when deeper credibility signals are lacking.

For anyone considering online trading or investing, the safest approach is to avoid platforms with opaque operations and to choose services that are regulated, well‑established, and backed by documented user experiences and clear corporate identity.

Proceed with extreme caution and prioritise platforms with proven credibility — your financial security deserves no less.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to libertymarkets.io, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as libertymarkets.io continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.