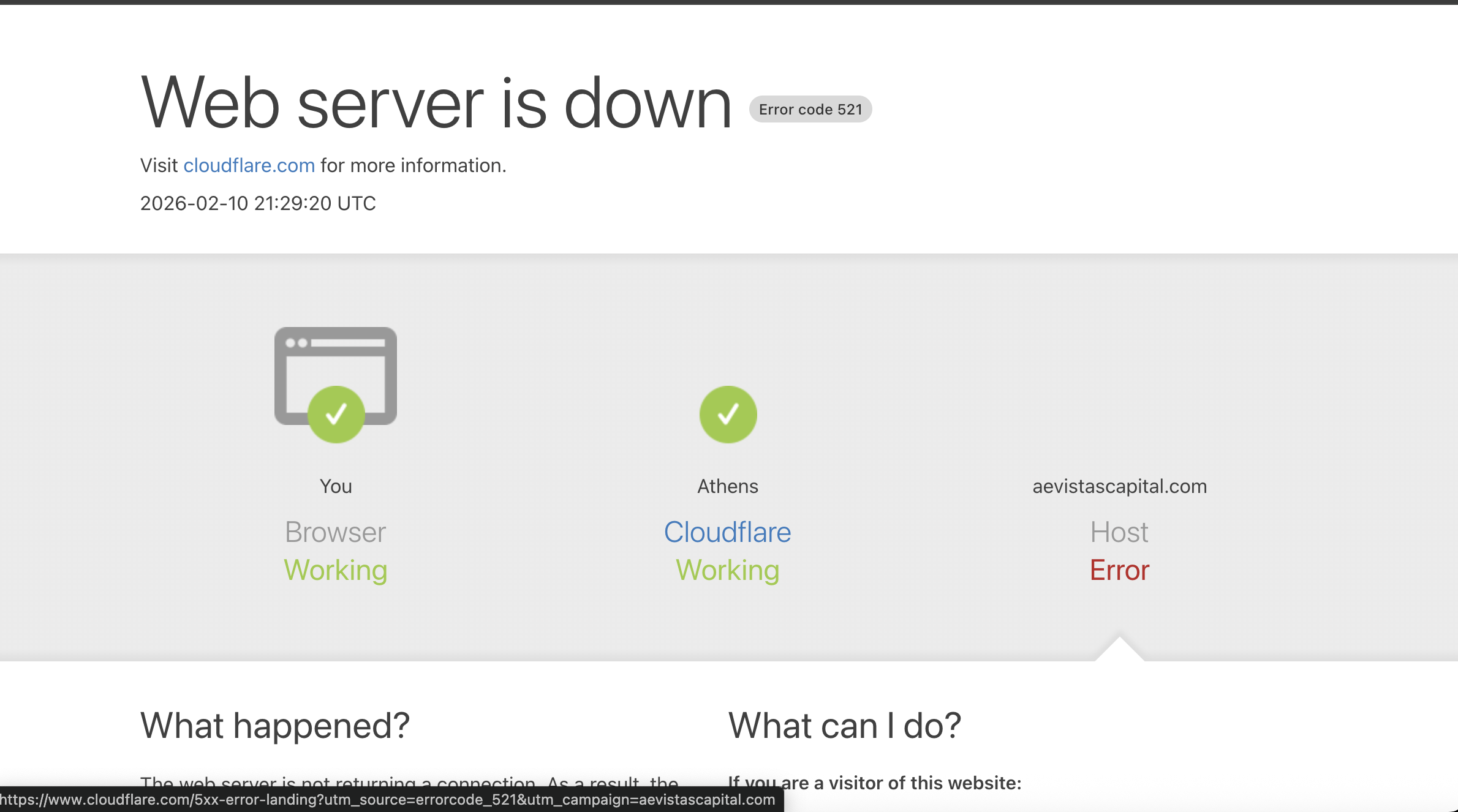

AevistasCapital.com Investment Risks

In the vast and rapidly evolving world of cryptocurrency and digital finance, new investment platforms appear almost daily. While some are credible and transparent, others raise questions due to their structure, claims, or lack of verifiable information. AevistasCapital.com is one such platform that has attracted attention — and significant concern — from investors seeking clarity and safety.

This review takes a careful look at what AevistasCapital.com claims to offer, how it operates, the potential risks involved, and key factors anyone considering this platform should understand before making any decisions.

Understanding AevistasCapital.com: What Is It Supposed to Be?

AevistasCapital.com markets itself as an online investment platform, offering users the opportunity to grow their digital assets — most commonly cryptocurrencies — through a set of structured investment plans. The site suggests that users can earn returns by depositing funds, which are then supposedly managed by the platform’s financial mechanisms.

On the surface, this type of service appeals to people interested in passive income or automated investment strategies in the crypto ecosystem. However, cryptocurrency markets are complex, volatile, and fundamentally unpredictable. Genuine platforms in this space tend to emphasize education, risk disclosure, and market-driven performance, not guaranteed returns.

What the Platform Promises

One of the first things many users notice on AevistasCapital.com is its list of investment plans. These packages usually:

-

Require an upfront deposit in cryptocurrency

-

Promise regular profit payouts

-

Include different “tiers” or levels of returns based on the amount invested

The exact numbers offered by these plans vary, but the essential pattern is familiar: fixed or high percentage returns over a defined period.

In real financial markets — especially in crypto — returns are rarely fixed or guaranteed. Prices fluctuate constantly, and the value of digital assets can swing dramatically within minutes. Any platform that presents profits as predictable and consistent should be scrutinized carefully.

Transparency: What’s Missing?

One of the most important elements in evaluating an investment platform is transparency. Legitimate financial services typically disclose:

-

Who runs the company

-

Where the business is registered

-

How investment strategies are implemented

-

Details about risk management

AevistasCapital.com, however, provides limited to no detailed information in these areas. The platform does not clearly identify its leadership team, corporate registration, operational jurisdiction, or the specific mechanisms by which it intends to generate profits for users.

This absence of transparency makes it difficult — if not impossible — for potential users to verify the legitimacy of the service or understand how their funds might be managed.

How Real Investment Platforms Operate vs. AevistasCapital.com

To appreciate the concerns surrounding AevistasCapital.com, it helps to briefly contrast it with how legitimate crypto investment and financial platforms typically function.

Legitimate Platforms:

-

Offer clear documentation about their team and business model

-

Explain how profits are generated, often tying them to real market activities

-

Include comprehensive risk disclosures

-

Provide transparent terms of service and legal compliance information

AevistasCapital.com:

-

Lacks verifiable business information

-

Offers promises of profit without a clear underlying method

-

Minimizes discussion of risk

-

Does not disclose how assets are managed or what strategies are used

This difference is not minor — it speaks directly to the reliability and accountability of the service.

Red Flags: What Raises Concern?

Several aspects of AevistasCapital.com stand out as potential red flags for prospective users:

1. Guaranteed or High Returns

Cryptocurrency markets are volatile. Platforms that guarantee profits or advertise high fixed returns should be treated with caution, as they depart from how real markets behave.

2. Lack of Verified Leadership

Reputable investment platforms are transparent about who runs them. The absence of identifiable leadership can signal a lack of accountability.

3. Unclear Business Model

Users should always be able to understand where profits come from. If a platform doesn’t explain how it intends to generate returns, its claims are difficult to trust.

4. Minimal Risk Information

Responsible financial services emphasize risks alongside opportunities. AevistasCapital.com’s lack of clear risk discussion is concerning.

5. No Detailed Terms or Legal Disclosure

Investment platforms should include extensive terms of use and legal information. Without this, it is unclear how disputes or operational issues would be handled.

Is There Evidence of Real Activity?

One way to judge a platform’s legitimacy is to look for signs of real operational activity. This can include:

-

Client testimonials with verifiable history

-

Public financial reports or audits

-

Community engagement on independent forums

-

Mentions in reputable crypto media outlets

In the case of AevistasCapital.com, there is limited verifiable evidence of any of these indicators. The platform’s public footprint is minimal, and there is little to no independent coverage or documented audit of its operations. This absence of real operational signals naturally leads to questions about the platform’s credibility.

The Bigger Picture: High-Risk Crypto Platforms

AevistasCapital.com fits a pattern seen in a category of high-risk online crypto platforms. While not every such platform is inherently fraudulent, they share several structural concerns:

-

Promises of fixed returns in a volatile market

-

Lack of detailed operational transparency

-

Anonymous or unverifiable leadership

-

Heavy focus on attracting deposits rather than educating investors

Platforms with these features often prioritize rapid growth over sustainable financial practices. For investors, this creates a situation where caution — and thorough independent research — becomes essential.

What Investors Should Consider Before Engaging

If someone is considering investing with AevistasCapital.com or similar platforms, here are some important points to think about:

Understand the Risk

Cryptocurrency is volatile. No platform can guarantee fixed returns without assuming unreasonable risk or engaging in unsustainable models.

Seek Transparency

Before depositing funds, users should be able to answer basic questions about how and where their money will be handled.

Look for Verifiable Proof

Real investment platforms typically have a long track record, independent audits, and a visible presence within the crypto community.

Avoid Emotional Decisions

The promise of high returns can be tempting, but sound investment decisions are based on facts, not promises.

AevistasCapital.com Compared to Established Platforms

Established crypto investment platforms tend to share features that promote confidence and accountability:

-

Regulatory compliance: Clear information on where the platform operates and under what legal framework.

-

Open leadership: Team members and executives are publicly known and verifiable.

-

Transparent methodology: Users can see exactly how funds are allocated and how profits are calculated.

-

Community trust: Discussions in respected forums often include balanced assessments from experienced users.

AevistasCapital.com currently lacks clear evidence in all of these areas, making direct comparison with legitimate platforms difficult.

Community Signals and Public Discussion

Experienced crypto investors often consult community forums, social platforms, and independent reviews before trusting a new service. While discussions about AevistasCapital.com do exist in some corners of the internet, they tend to focus on concern rather than endorsement.

In general, platforms that lack active, positive discussion among knowledgeable users are viewed with caution. Communities often act as early warning systems; silence or skepticism can be just as telling as outright criticism.

Final Assessment: Proceed with Extreme Caution

After examining how AevistasCapital.com presents itself and comparing it with how established investment services operate, the platform raises serious questions that investors should not ignore.

The key issues include:

-

Unrealistic profit expectations for a market known for unpredictability

-

Lack of transparency in leadership and operations

-

No clear explanation of how profits are generated

-

Minimal publicly verifiable evidence of real activity

-

Insufficient risk disclosure

Taken together, these factors paint the picture of a platform that demands extreme caution. While not every new or unconventional service is fraudulent, anywhere there is ambiguity about how money is managed, investors should be skeptical and well informed before proceeding.

Closing Thoughts

The appeal of fast profits and automated income is understandable, especially for those new to crypto investing. However, the complexities of digital asset markets mean there are no shortcuts to guaranteed gains. Platforms that make bold promises without clear evidence or accountability should be approached with a high degree of skepticism.

For anyone exploring new investment opportunities, due diligence, education, and prudence are the best tools for protecting your assets and making informed decisions in a deeply uncertain market.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to aevistascapital.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as aevistascapital.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.