Bitgerms.com Honest Review

In the crowded world of online cryptocurrency services and investment platforms, it’s crucial to distinguish between credible firms and those that exhibit characteristics commonly associated with fraudulent or untrustworthy operations. Bitgerms.com is one such website that, based on multiple independent assessments, raises serious questions about its legitimacy and trustworthiness.

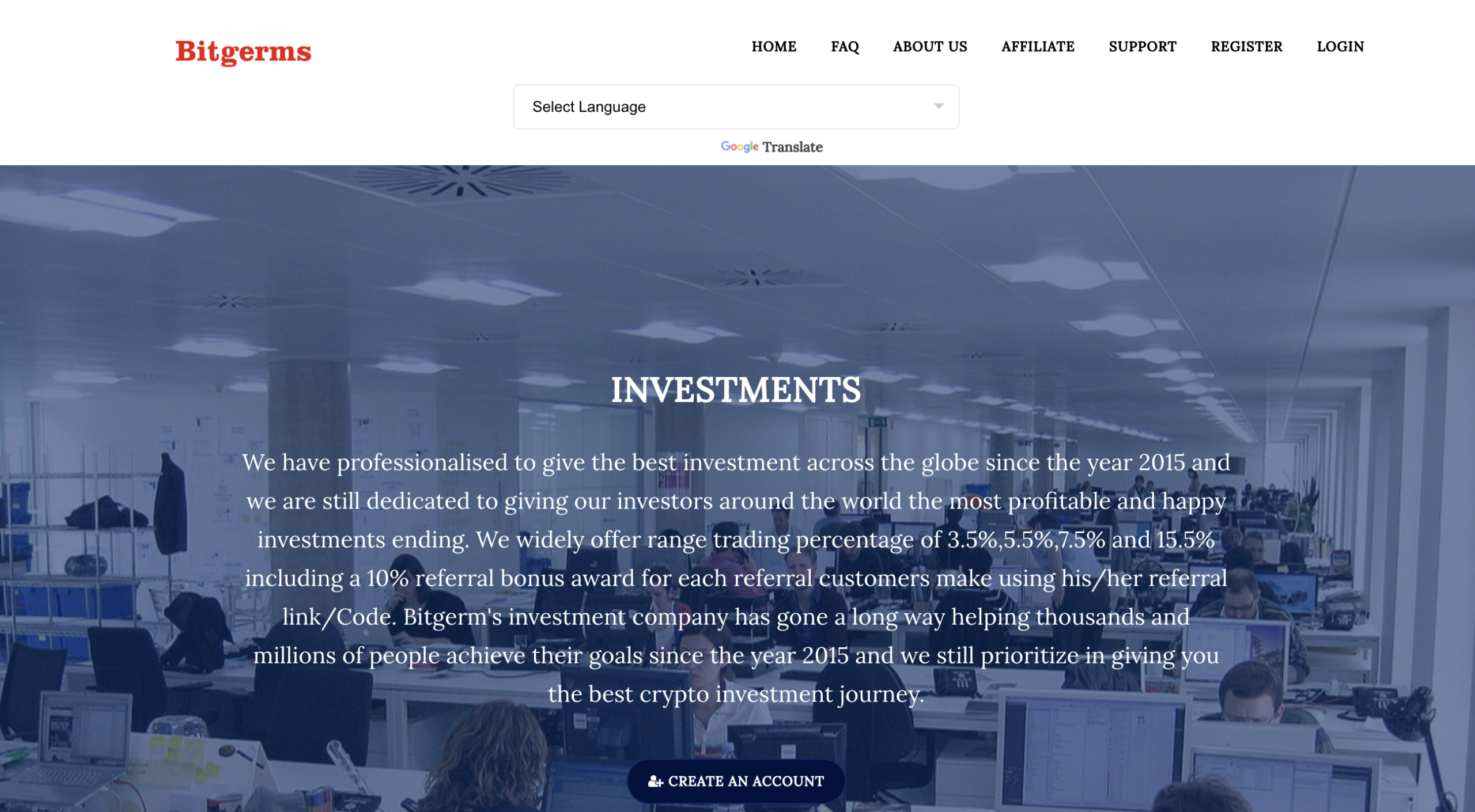

What Bitgerms.com Claims to Be

On the surface, Bitgerms.com presents itself as a high-end financial services provider offering sophisticated investment products, global asset management, and what it describes as “fully regulated” operations with insured funds. According to its own marketing, the company has offices and employees worldwide, and claims to protect investor capital while delivering lucrative opportunities.

These claims are designed to instill confidence and convey legitimacy — but as with many such websites, a deeper look shows a very different reality.

Lack of Transparency and Hidden Ownership

One of the most fundamental checks you can do when evaluating a financial website is to identify who operates it. Bitgerms.com fails this test entirely:

-

The WHOIS registration data shows the domain owner’s identity is hidden, providing no verifiable corporate name, address, or accountable leadership.

-

Legitimate investment platforms typically disclose regulated entities, board members, official registrations, and verifiable contact details — none of which are available for Bitgerms. This lack of transparency makes independent verification impossible.

This kind of anonymity is common among dubious platforms because it makes it harder for consumers and authorities to trace responsibility for funds or operations.

Poor Trust and Reputation Scores

Independent reputation checkers and automated security tools consistently evaluate Bitgerms.com poorly:

-

Scamadviser assigns the site an extremely low trust score, indicating a high potential for fraudulent behavior or at least significant uncertainty about the site’s safety.

-

Gridinsoft security scoring — another independent assessment — rates the site as highly suspicious with a trust score near the bottom of the scale (1/100), highlighting multiple risk indicators including blacklisting by security providers and limited site credibility.

When two separate automated systems both judge a website as suspicious or low-trust, that pattern is a clear warning sign that something is not right.

Security and Hosting Concerns

Some visitors might think that an SSL certificate (the “secure padlock” in the browser URL bar) is a sign that a site is safe — but in reality, encryption only protects data in transit and does not prove legitimacy. Scams and phishing sites also use SSL certificates to make themselves appear secure.

Additional technical concerns include:

-

The site is hosted on shared servers alongside other low-trust websites. Data-sensitive services hosted in such environments are more vulnerable to compromise.

-

The website has limited real traffic and engagement, meaning it lacks the footprint expected of a reputable global financial service.

Unverified Regulation Claims

Bitgerms.com’s own content asserts that the platform is regulated and that investor funds are “protected by insurance,” but no independent regulatory body is referenced, and no verifiable licence identifiers are provided on authoritative registries.

In contrast, established financial regulators (such as the UK’s Financial Conduct Authority or similar bodies in Europe) maintain public registers of authorised firms — and platforms without registration on those lists should not be assumed to be compliant or safe.

Why Investors Should Be Wary

Based on the combination of hidden ownership, poor external trust scores, suspicious technical indicators, and unverified regulatory claims, Bitgerms.com exhibits many traits commonly associated with untrustworthy or potentially deceptive investment websites.

Here’s a summary of the key concerns:

-

No public, verifiable corporate identity

-

Low trust and security scores from independent tools

-

Blacklisted or flagged by security services

-

Claims of regulation without supporting evidence

-

Limited traffic and site footprint that does not match purported global prominence

Together, these point to a pattern where caution is strongly advised.

Final Verdict

Bitgerms.com markets itself as a global investment authority, but multiple red flags suggest that the site lacks the transparency, legitimacy, and independent oversight that responsible investors should demand. Independent reputation systems judge the platform as untrustworthy, technical analyses reveal security flags, and there’s no reliable proof of regulatory compliance.

Given these issues, potential investors are urged to approach Bitgerms.com with extreme caution and consider established, regulated alternatives that provide clear documentation, transparent ownership, and independent audit trails.

If you’re researching crypto or online investment services, always check official regulatory registers, seek independent reviews, and verify that a platform’s claims are backed by verifiable credentials before engaging with it.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to bitgerms.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as bitgerms.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.