Goldeight.co.uk Full Investment Review

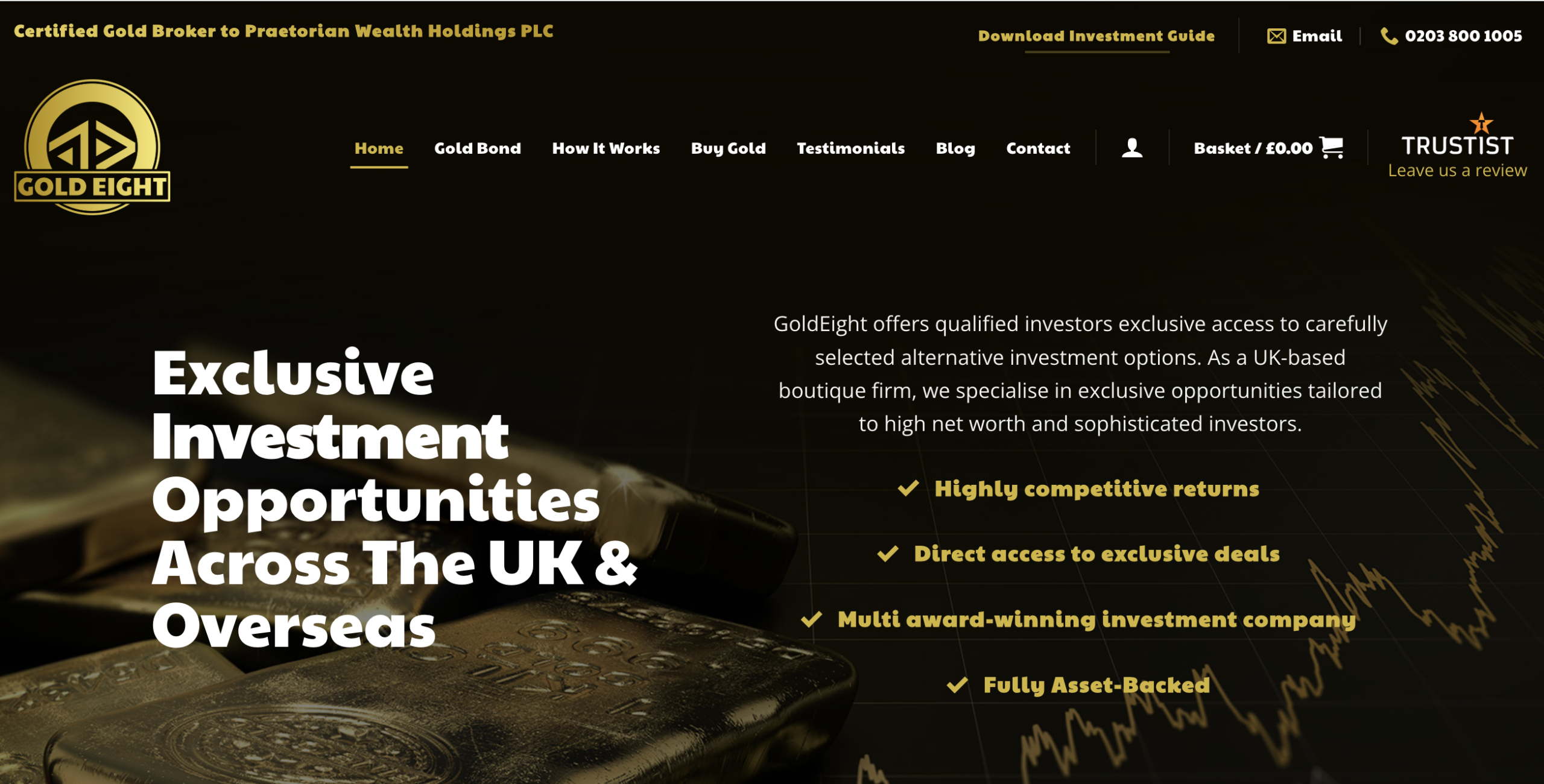

When evaluating online financial and investment platforms, a crucial part of due diligence is verifying whether a company is properly authorised and transparent about how it operates. Goldeight.co.uk, marketed under the name GoldEight Ltd, presents itself as a provider of gold‑based investments and related financial services. While the company projects a professional image on its website, independent regulatory warnings and important disclosures raise serious concerns about its legitimacy and safety.

FCA Regulation Warning — A Critical Red Flag

The most authoritative and concerning information about GoldEight comes from the Financial Conduct Authority (FCA) in the United Kingdom, which has publicly named GoldEight Ltd on its Warning List. According to the FCA, this firm may be providing or promoting financial services or products without permission, meaning it is not authorised to carry out regulated financial activities in the UK.

This is a significant issue: authorised financial firms must meet stringent criteria around capital adequacy, client fund protection, transparent disclosures, and regulatory compliance. Because GoldEight is not authorised by the FCA, clients do not have recourse to the Financial Ombudsman Service or compensation schemes such as the Financial Services Compensation Scheme (FSCS) if problems arise — including loss of funds.

Marketing Claims vs. Lack of Oversight

The Goldeight.co.uk website promotes investment opportunities that include fixed‑return gold loan notes, escrow procedures, and partnerships with purported third‑party entities like law firms and refineries. These descriptions are crafted in professional language, showcasing steps of a supposedly robust investment process.

However, the site also includes a legal disclaimer in small text acknowledging that its content has not been approved by an authorised person under UK financial law, and that acting on the information could expose you to the risk of losing all of your invested assets.

This wording is important because it signals that — despite the positive framing — the website is effectively not compliant with UK financial promotion rules and is potentially targeting only certain classes of professionals or high‑net‑worth individuals. Such disclaimers appear frequently on sites that lack full regulatory oversight and wish to limit their legal liability.

Company Registration vs. Operational Reality

According to public company information, Goldeight Ltd is a registered private limited company in England and Wales with a long history in business records. However, company registration status does not equate to regulatory approval to provide financial investments or advisory services.

Many legitimate businesses may be registered companies in the UK, but without carrying FCA authorisation for investment activities, there are no enforced rules for them to follow with respect to financial conduct or investor protection. In other words: being a registered company tells you it exists legally, but it does not confirm that it can lawfully operate as an investment provider.

Absence of Independent User Feedback

Unlike established bullion brokers or investment firms that have extensive independent reviews and verifiable client testimonials across platforms like Trustpilot or Sitejabber, there is very limited independent customer feedback related to Goldeight.co.uk.

The testimonials on the company’s own site are overwhelmingly positive, but reviews hosted directly on a business’s website are not a reliable gauge of independent customer experience. Verified third‑party reviews can provide important context about fulfillment, customer support, and actual outcomes experienced by users — something that is largely missing here.

Without this context, it’s difficult to assess whether client experiences are consistent with what’s portrayed by the company, or if they may reflect issues such as delays, disputes, or unmet expectations.

Marketing Disclaimers and High‑Threshold Requirements

Goldeight.co.uk’s public page includes dense legal language specifying that its investment offerings are available only to certain categories of investors — such as investment professionals or high‑net‑worth individuals — under Money‑Promotions regulations in the UK.

This kind of restriction is commonly used by platforms that would otherwise require full regulatory disclosure if marketing to the general public. While targeting experienced and wealthy individuals might be a legitimate business model, it also reduces the level of transparency and safety available to ordinary retail investors and may indicate that the platform is avoiding full consumer protections.

Weighing the Evidence

summarising the concerns about Goldeight.co.uk:

-

❗ Not authorised by the FCA to provide financial services, as confirmed by official warning lists.

-

⚠️ Website legal disclaimers acknowledge that information is not approved by an authorised person and can carry significant risk.

-

📌 Company registration alone does not represent regulatory approval to offer investment products.

-

🛑 Independent user feedback is limited beyond the company’s own testimonials.

These factors taken together demonstrate that Goldeight.co.uk is not operating with the level of regulatory oversight and transparency expected from a legitimate investment service in the UK.

Final Takeaway

Despite polished marketing and professional‑sounding descriptions of gold investment products, Goldeight.co.uk’s lack of FCA authorisation, legal disclaimers, and limited independent user verification create a high level of uncertaintyaround its operations. The absence of comprehensive regulation means investors have little to no formal protections if something goes wrong.

If you are exploring opportunities in physical commodity investment or financial markets, it’s essential to prioritise firms that are clearly authorised and regulated by recognised authorities — offering full transparency, investor safeguards, and accountability.

Considering the evidence, potential users should be cautious, conduct much deeper due diligence, and be fully aware of the financial risks involved before engaging with this platform.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to goldeight.co.uk, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as goldeight.co.uk continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.