NorthDirect.com Independent Analysis

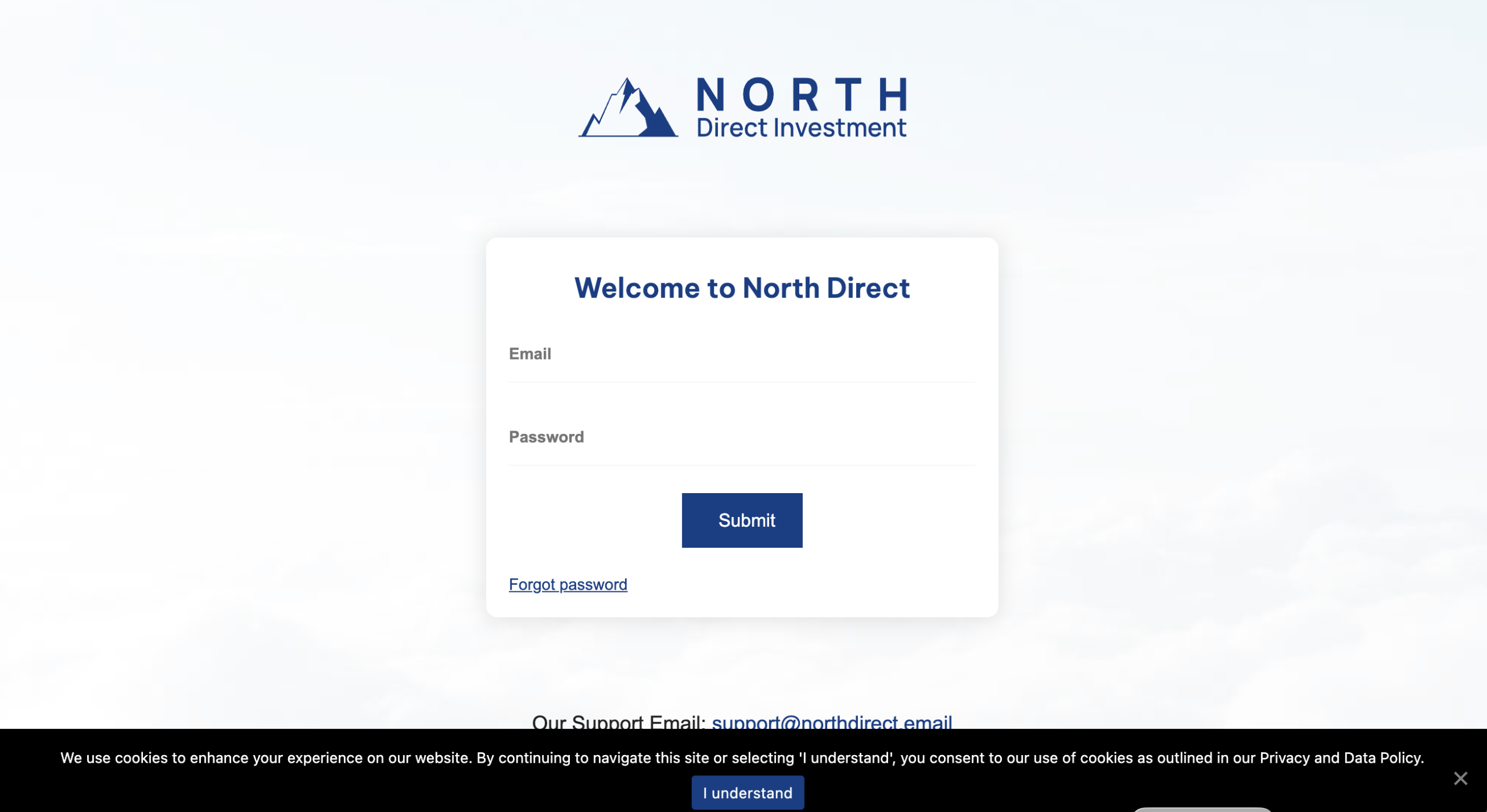

In the landscape of online investment platforms and financial tools, not all sites are created equal. One site that has been drawing attention online is NorthDirect.com, which markets itself as a financial service provider offering investment opportunities and portfolio services. While the platform presents an aura of professionalism, a deeper analysis reveals several important concerns that every potential user should understand before engaging with the service.

This review takes a closer look at NorthDirect.com’s claims, credibility signals, user experiences, and structural indicators to give you an informed perspective.

How NorthDirect.com Markets Itself

NorthDirect.com’s website positions the platform as an accessible gateway to financial markets, promising:

-

Financial growth opportunities

-

Market insights and strategy tools

-

Easy account opening and fast onboarding

The site’s homepage uses stock imagery of global markets and optimistic language about investing success. However, marketing design and promotional content do not equal legitimacy — especially in the financial services sector.

Absence of Verified Regulatory Status

One of the most critical aspects of any financial services platform is its regulatory authorization. Legitimate brokers and investment firms are normally registered with recognized authorities such as:

-

The UK’s Financial Conduct Authority (FCA)

-

The U.S. Securities and Exchange Commission (SEC)

-

The Australian Securities and Investments Commission (ASIC)

-

The European Securities and Markets Authority (ESMA)

In the case of NorthDirect.com, there is no clear evidence that the company is listed on any major regulatory register as an authorised investment services provider. A legitimate listing would typically include:

-

A registration/license number

-

Publicly accessible regulator documentation

-

Clear disclaimers linking the platform to an official regulator

When such verification is absent or cannot be independently confirmed, users are left without the protections afforded by regulated entities, such as dispute resolution mechanisms, capital safeguards, and mandatory disclosure standards.

Lack of Transparent Corporate Information

Another issue is that NorthDirect.com’s website does not offer clear and verifiable corporate details. Key information that credible financial services platforms typically disclose includes:

-

Full legal company name

-

Physical address with verifiable details

-

Leadership team profiles

-

Corporate registration numbers

On NorthDirect.com, these pieces of information are either missing, vague, or cannot be matched to publicly available corporate records. This makes it difficult for users to determine who operates the service and under what legal framework.

A lack of transparency about ownership and corporate identity is a structural concern that users should take seriously.

User Experience and Service Claims

NorthDirect.com advertises features such as market analytics, tailored investment options, and access to supposedly advanced financial tools. However:

-

There is limited independent verification of these claims from credible third-party sources.

-

The platform does not provide easily accessible documentation of its methodologies or investment strategies.

-

No audited performance results are published that could allow users to evaluate claims of returns.

This absence of verifiable operational detail leaves users with promotional language rather than substantiated information.

Withdrawal and Customer Support Issues

A common metric for evaluating an online financial platform’s credibility is how smoothly funds can be deposited and withdrawn and how responsive support is when issues arise.

Although NorthDirect.com does not have a large volume of publicly available reviews on well-known review platforms, a number of user comments across independent forums and comment sections suggest:

-

Delays or difficulty with account withdrawals

-

Confusing or conflicting responses from customer support

-

Vague explanations for account or transaction restrictions

These types of reports, especially when repeated across multiple independent discussions, are important to weigh when considering a new financial service platform.

Website Security and Technical Indicators

NorthDirect.com does use standard website security protocols such as HTTPS to encrypt data transmitted between your browser and the site. While this is good practice, HTTPS encryption alone does not guarantee that a platform is legitimate or financially sound — it simply protects data in transit.

Other technical indicators, such as the website’s age, hosting history, WHOIS domain transparency, and its digital footprint outside of its own site, raise additional flags. For example:

-

Domain registration details may be private or obscured

-

Website age could be very recent, which may not reflect an established track record

-

Limited historical presence on archives or finance community sites

These factors contribute to a lower confidence assessment in terms of reputation and reliability.

Marketing Language That Encourages Fast Decisions

NorthDirect.com’s promotional content includes phrases designed to inspire urgency and confidence in quick decision-making, such as:

-

“Start earning today”

-

“Unlock wealth-building potential”

-

“Join a growing financial community”

While inspirational language is common in many industries, in financial services it should always be accompanied by full disclosure of potential outcomes, market risks, and operational terms. In this case, the emphasis on results without transparent backing may be misleading to users who are not experienced in evaluating marketing versus substance.

Why All This Matters

When choosing a platform to handle financial activity, especially investment or trading accounts, users benefit from:

-

Regulatory oversight, which provides consumer protections

-

Transparent corporate identity, which allows accountability

-

Documented operational methodologies, which demonstrate legitimacy

-

Independent user feedback, which validates actual user experience

Without these foundational elements, users are assuming significant uncertainty.

Final Thoughts

NorthDirect.com presents a polished interface and aspirational messaging, but lacks the structural transparency and verifiable credentials that experienced users should expect from financial service platforms. The absence of a clear regulatory presence, limited corporate information, and recurring user concerns about support and fund access make this site one that potential users should approach with caution.

Before engaging with any platform that deals with financial instruments or investment services, always:

-

Check official regulatory registers

-

Seek third-party verified reviews

-

Confirm corporate identity through public records

Being thorough upfront can help protect your assets and provide peace of mind.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to northdirect.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as northdirect.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.