FXNovaCapital.com: User Considerations

Financial trading platforms that promise easy access to forex, crypto, and CFD markets can seem attractive — especially for beginners looking to diversify their investments. FXNovaCapital.com markets itself as an online broker with modern tools, fast execution, and broad market access. But a closer inspection of both independent analyses and user feedback paints a very different picture from the polished claims on the site.

After reviewing available data from multiple reputation checkers and user feedback platforms, it’s clear that FXNovaCapital.com raises serious credibility concerns. This review explores why many investors should be extremely careful before considering engagement with this platform.

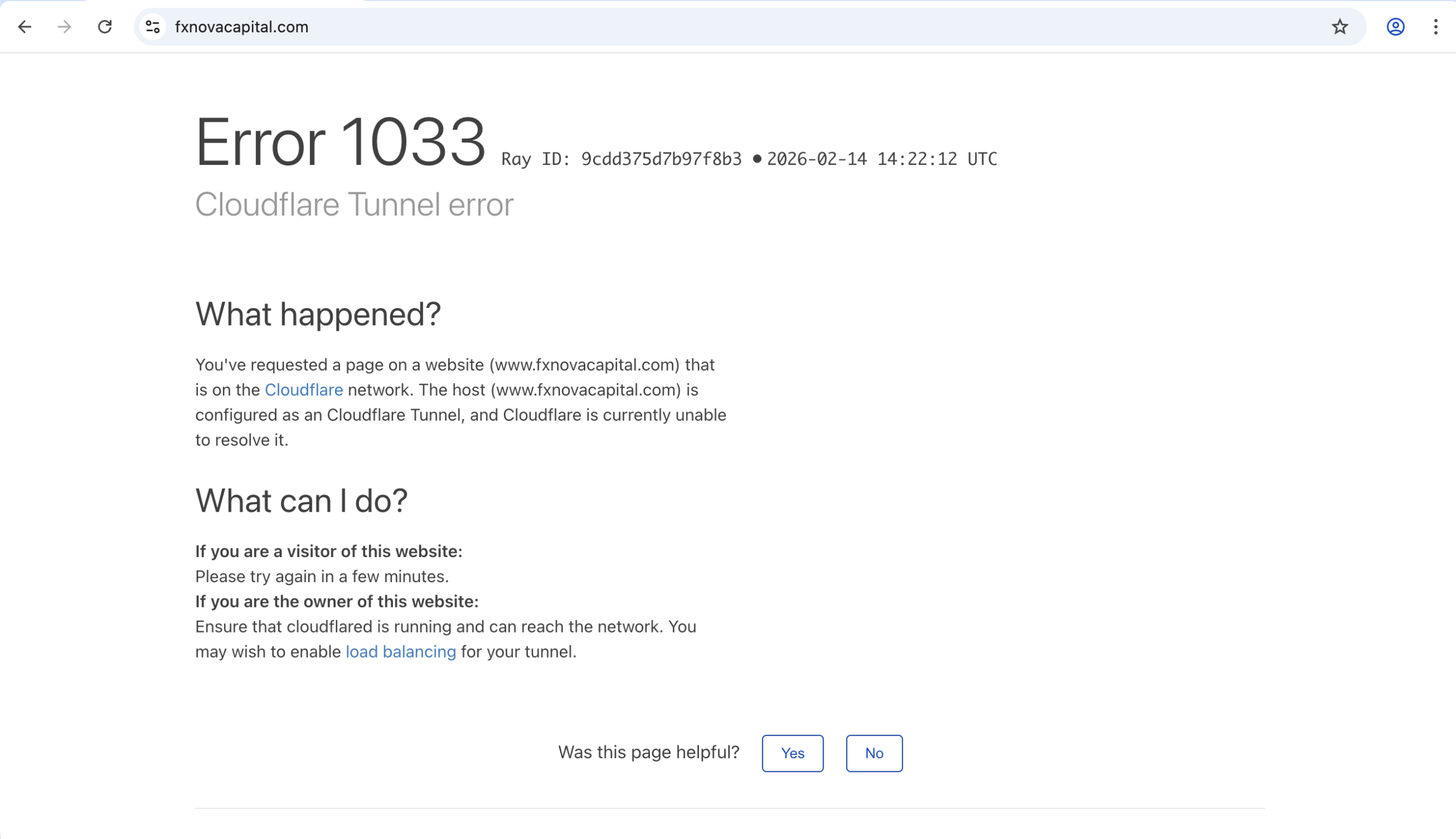

1. Very Low Trust and Suspension Indicators

Automated reputation services give FXNovaCapital.com an alarmingly low trust score. According to independent web trust tools, the domain has a trust score of 0 out of 100, signaling it may be unsafe or very untrustworthy. Characteristics contributing to this low score include the domain’s recent creation (in late 2025), hidden registration information, and association with online financial services that are high risk by design.

Additionally, some security audits report that parts of the site have shown server errors and potential technical issues, which can sometimes indicate instability in the platform’s operations.

2. Lack of Regulation or Licenses

A fundamental requirement for any legitimate financial broker is clear regulatory oversight. Trusted brokers must be registered with and supervised by recognized financial authorities such as the UK’s Financial Conduct Authority (FCA), the US’s Securities and Exchange Commission (SEC), Australia’s ASIC, or similar bodies.

Recovered analyses note that FXNovaCapital does not disclose any valid registration or licensing with these authorities. It does not appear on official regulator registers, and no verifiable regulatory documentation is available on the website. This absence means there is no legal supervisory body overseeing its operations, leaving users without important investor protections.

3. Customer Complaints and Mixed Reviews

User‑generated reviews on review platforms reveal a highly mixed set of experiences with this broker. Across dozens of recent reviews:

-

Many users report difficulty accessing funds or profits once deposited. Some said their funds were “locked” with no clear explanation or timeline for release.

-

A significant share of reviews describe unresponsive or non‑existent customer support — particularly when issues arise.

-

Several reviewers have alleged that credit or account actions were taken without clear consent, which is a serious concern for account integrity and financial security.

These negative experiences make up a large portion of user feedback, and when taken together they point to systemic issues rather than isolated incidents.

It’s worth noting that there are several positive reviews claiming smooth withdrawals, low fees, and a user‑friendly interface, but these are overshadowed by multiple complaints about blocked funds and bad customer service.

4. Minimal Transparency and Corporate Details

The corporate information provided by FXNovaCapital.com is minimal and unverifiable. While the site lists an address in Vancouver, Canada and a phone number, there is no publicly verifiable company registration number, detailed leadership team, or operational history. Independent assessments specifically highlight the lack of any meaningful business background or proof of legitimate operational structure.

This is critical: legitimate brokers disclose who owns and manages the company, where they are legally incorporated, and under what regulatory framework they operate. FXNovaCapital.com does none of these.

5. Potential Fake or Inflated Reviews

Some expert assessments of this platform have noted that positive reviews often come across as overly generic, lacking concrete detail about actual trading experiences, fees, or customer processes — a common feature of paid or fake testimonials. In some cases, the comments flow in similar style and tone, which suggests they might not be genuine user experiences but rather curated content designed to build superficial trust.

6. Hidden Costs and Unclear Terms

Independent analysts also emphasize that the platform does not provide clear, easily accessible information about its fee structure, commissions, spreads, or withdrawal policies. When financial terms are not transparently listed, users can incur unexpected costs or face barriers when attempting to withdraw funds.

Combined with customer complaints about blocked funds, this lack of clarity is a significant cause for concern.

Conclusion: Exercise Strong Caution with FXNovaCapital.com

Taken together, the evidence suggests that FXNovaCapital.com does not meet basic standards of transparency, regulation, or user protection expected of a credible online broker:

-

Trust score analyses rate the site extremely low.

-

There is no verifiable regulatory oversight.

-

User reviews are mixed with many reports of problems accessing funds.

-

Corporate details and operational history are minimal or absent.

-

Positive reviews may be superficial or inflated.

For anyone considering this platform for trading or investment, it is important to be extremely prudent. Without regulatory oversight or trustworthy verification, your money and personal information are exposed to unnecessary risk. Verified, regulated brokers provide investor protections and legal recourse that FXNovaCapital.com currently does not offer — making safer alternatives a vastly better choice for your financial activity.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to alphabullmarkets.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as alphabullmarkets.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.