RoboBrokerLtd.com Platform Overview

In the crowded world of online trading services, RoboBrokerLtd.com markets itself with polished branding and claims of advanced technology, offering access to global markets and supposedly “AI‑enhanced” trading results. But behind the sleek interface and buzzwords lies strong evidence that this platform may not be a trustworthy choice for investors. Across multiple reputation scans and thousands of user reviews, significant issues emerge that suggest caution is well‑advised before considering any financial engagement with the site.

This review examines key concerns around RoboBrokerLtd.com, highlighting the most relevant warning signs and user experiences that have surfaced online.

1. Extremely Low Trust Scores from Independent Scanners

Multiple independent website reputation tools assign robobrokerltd.com an exceptionally low trust score, indicating potential safety and legitimacy issues:

-

One analytical platform rates the site’s trust score at approximately 5.7 out of 100, classifying it as suspicious, young, and untrustworthy based on over 50 risk factors including phishing indicators, spam potential, and domain history.

-

Another reputation checker gives the domain an overall trust rating of 0 out of 100, with a warning that the site has been reported as possibly harmful and is associated with predominantly negative feedback.

Such extremely low scores from reputable risk detection engines are far outside the range expected for legitimate financial services platforms and suggest widespread concerns about the domain’s operations and online footprint.

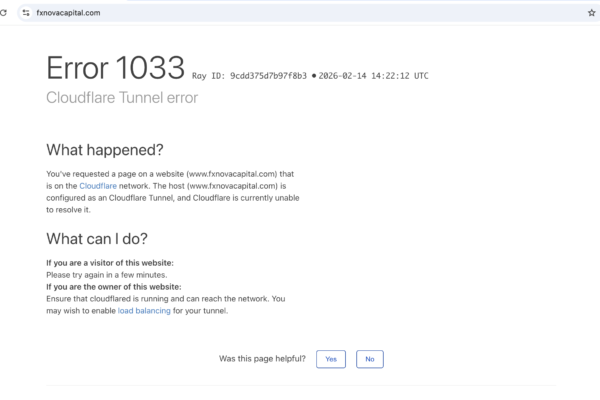

2. Young Domain with Limited Established History

The website was registered only in April 2025, making it a very new player in the online trading space. Short domain age is not by itself disqualifying, but combined with other indicators — such as hidden registration details and a lack of long‑term presence — it raises legitimate questions about the platform’s maturity and credibility.

Legitimate brokers generally have years of operational history, verifiable customer testimonials on independent forums, and regulatory transparency. RoboBrokerLtd.com’s short online lifespan means it lacks this historical performance record, which makes evaluation difficult and trust harder to establish.

3. Predominantly Negative User Feedback

User reviews are a crucial gauge of how a platform performs in practice, and RoboBrokerLtd.com has attracted a large number of critical experiences, especially on third‑party review sites:

-

On one popular global review site, the platform holds a very low average rating with the majority of reviewers giving 1 star and sharing negative experiences related to lost funds and bad practices.

-

Many reviewers explicitly warn others not to invest through the platform, citing broken promises, difficulty withdrawing funds, and aggressive promotional tactics.

-

Although a minority of positive reviews exist on some sites, the significant volume of negative accounts outweighs them and suggests systemic issues rather than isolated dissatisfaction.

These patterns of feedback — including consistent complaints about lost money and withdrawal problems — are red flags for anyone considering a trading service.

4. Lack of Clear Regulatory Credentials

A fundamental mark of legitimacy for any online broker is registration or oversight by a recognized financial authority. In RoboBrokerLtd.com’s case, there is no verifiable evidence of regulation by reputable agencies such as the UK’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or similar organizations.

The absence of regulatory licensing means that users have no official safeguards if funds are mishandled, misrepresented, or otherwise compromised. Trusted brokers must post licensing information, regulatory numbers, and compliance disclosures publicly — something RoboBrokerLtd.com notably does not do.

5. Reported Withdrawal Issues and Fake Trading Figures

Investigations and user reports align in identifying specific problematic behaviors associated with the platform:

-

Some independent analyses describe the site as displaying fabricated profit figures on trading dashboards, creating a misleading illusion of fast gains.

-

User accounts and third‑party reports indicate that customers attempting to withdraw funds may face delays, new fee demands, or blocking of access entirely — a common pattern among fraudulent trading operations.

These tactics — showing inflated results to bait investors and then placing barriers on withdrawals — are classic elements seen in deceptive investment platforms.

6. Hidden Ownership and Transparency Issues

Legitimate trading platforms provide clear company details, including registered office addresses, leadership names, and public business credentials. RoboBrokerLtd.com, however, conceals its ownership in domain privacy records and lacks transparent corporate information.

Platforms with hidden or unverified ownership make it difficult for users to assess who is handling their funds and under what legal framework, further eroding confidence.

Conclusion: Significant Concerns with RoboBrokerLtd.com

When independent trust scores, real user feedback, and transparency issues are all taken into account, RoboBrokerLtd.comshows multiple concerning patterns far removed from what accredited financial brokers normally exhibit:

-

Very low independent trust scores indicating potential safety issues.

-

Predominantly negative user experiences pointing to lost funds and poor service.

-

No verifiable regulatory oversight or licensing.

-

Reports of inflated profit displays and withdrawal obstacles.

-

Opaque ownership and limited corporate transparency.

Given this combination of red flags, it is prudent for potential users to exercise extreme caution and strongly reconsider any financial engagement with RoboBrokerLtd.com. Investors are generally better served by well‑regulated platforms with transparent histories, robust oversight, and independent positive reviews rather than unverified services that raise questions on so many fronts.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to robobrokerltd.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as robobrokerltd.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.