Agileswap.io: Hidden Red Flags

Introduction

The growth of decentralized finance (DeFi) and online trading platforms has created new opportunities for investors to access digital assets, yield opportunities, and trading services. However, not all platforms operate under clear regulatory standards, and many prioritize marketing over transparency.

Agileswap.io is one such site that has drawn attention. Marketed as an intuitive trading and investment service, Agileswap.io promises users attractive returns and modern trading tools. But before risking funds on any platform, investors must evaluate whether the service is credible, transparent, and built with investor protections in mind.

This review explores Agileswap.io’s platform, features, operational transparency, potential concerns, and what prospective users should consider before engaging.

What Agileswap.io Advertises

Agileswap.io presents itself as a comprehensive trading and investment platform. Its offerings reportedly include:

-

Access to cryptocurrency and digital asset trading

-

Investment plans with return projections

-

User dashboard with portfolio tracking

-

“Expert guidance” for trading strategies

These features are designed to appeal to both beginners and experienced traders seeking efficient online market access.

However, polished marketing content should never overshadow critical evaluation of the platform’s structure, oversight, and track record.

Regulatory and Licensing Transparency

One of the first questions any investor should ask is: Is the platform regulated?

Trusted trading platforms are licensed by established financial authorities or compliant with recognized regulatory frameworks. This protects investors by ensuring:

-

Segregation of client funds

-

Financial audits and reporting standards

-

Dispute resolution procedures

-

Enforced compliance and security

In the case of Agileswap.io, there is limited public information confirming regulatory registration, licensing, or oversight by established financial authorities. When a platform does not clearly disclose licensing details, it becomes difficult to assess its compliance, accountability, and investor protections.

Investors should always verify a platform’s regulatory status independently through official regulatory databases before depositing funds.

Promotional Claims and Return Expectations

Agileswap.io reportedly showcases potential earnings and “investment returns” on its homepage or promotional materials. While smart investing has the potential to yield gains, it’s important to remember:

-

No legitimate trading platform guarantees profits.

-

Financial markets – especially crypto markets – are volatile.

-

Returns depend on market conditions, strategy, and risk management.

Platforms that place disproportionate emphasis on returns without equal focus on risk may encourage unrealistic expectations. A responsible investment service will clearly disclose both potential benefits and inherent market risks.

Deposit Requirements and Account Setup

To begin trading or investing with Agileswap.io, users are typically required to:

-

Create an account

-

Verify identity (KYC requirements may vary)

-

Fund the account with a deposit

Some sites also feature tiered plan options, where higher levels require larger deposits and promise heightened access or returns.

Before funding an account, users should carefully review:

-

Minimum deposit amounts

-

Terms tied to deposit bonuses (if any)

-

Withdrawal eligibility requirements

Lack of clarity in these areas should be considered a warning sign.

Withdrawal Procedures and Concerns

A major test of any platform’s trustworthiness is its withdrawal process. Clear and reasonable withdrawal policies indicate operational transparency.

Important questions to ask include:

-

How long do withdrawals take to process?

-

Are there any hidden fees?

-

Are there verification requirements that block withdrawals?

-

Are there reports of delays or rejections?

Uncertainty in any of these areas—especially after funds are deposited—can be a red flag. Investors should always confirm withdrawal procedures before depositing funds.

Customer Support and Communication

Reliable platforms provide timely, transparent support via:

-

Live chat

-

Phone support

-

Clear email responses

Quality communication includes straightforward answers about:

-

Account verification

-

Deposits and withdrawals

-

Platform features

-

Policy clarifications

If customer support becomes difficult to reach once funds are deposited, or if responses avoid specific questions, this is a concern.

Website and Operational Transparency

Transparency is a cornerstone of trustworthy financial services. Legitimate platforms disclose:

-

Legal entity and company registration

-

Physical office address

-

Team credentials

-

Corporate history

With Agileswap.io, publicly available information about ownership, location, and leadership is limited. When corporate details are vague or absent, investors find it harder to verify the authenticity of the platform.

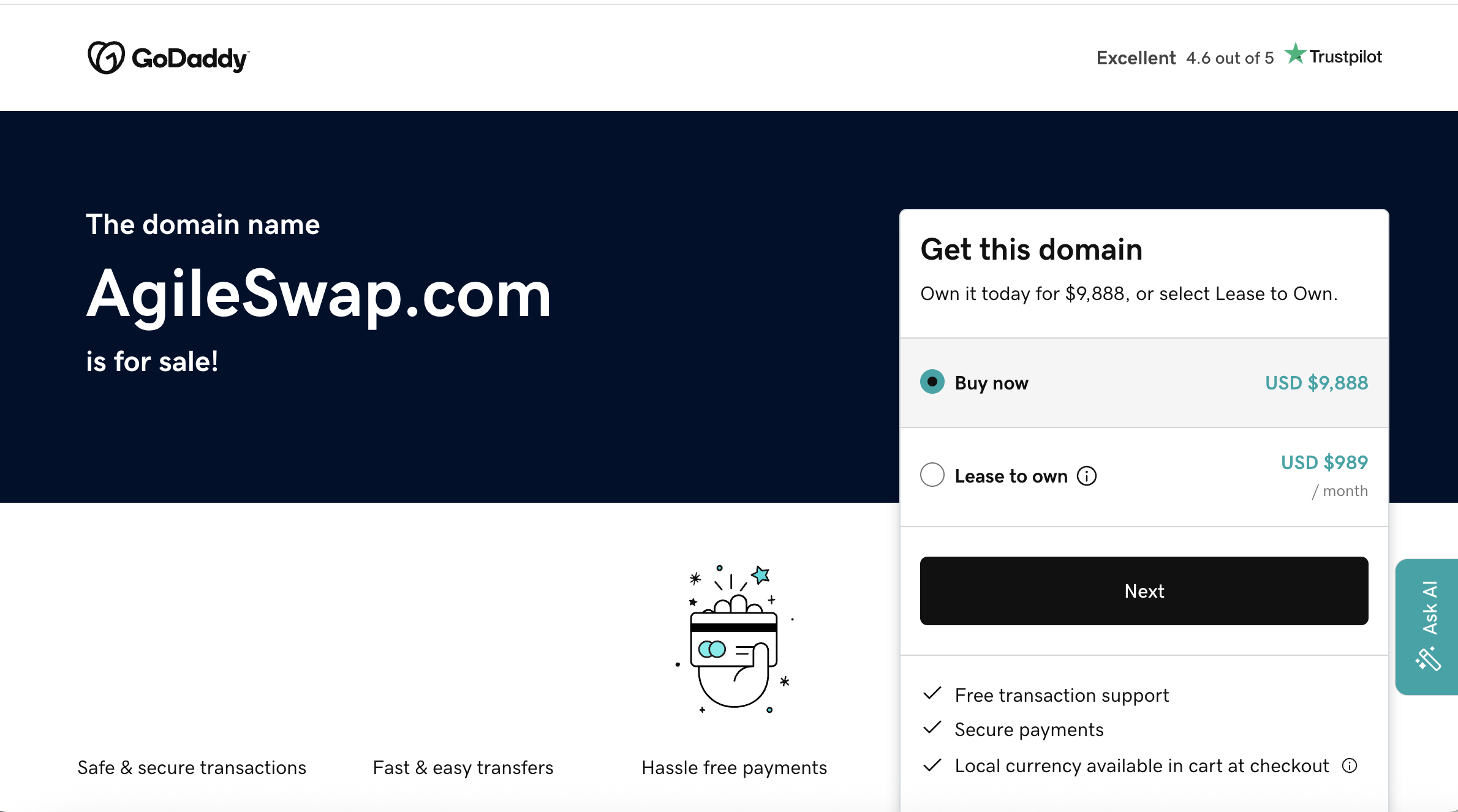

Additionally, recently created domains or sites without verifiable operational history should be approached with caution.

Comparison With Established Platforms

Comparing Agileswap.io with widely recognized exchanges and brokers can help clarify differences:

|

Feature |

Established Exchange |

Agileswap.io |

|---|---|---|

|

Regulated oversight |

✅ |

❓ |

|

Transparent corporate details |

✅ |

⚠️ |

|

Clear fee & withdrawal policies |

✅ |

⚠️ |

|

Publicly verifiable trading execution |

✅ |

⚠️ |

|

Accessible customer support |

✅ |

⚠️ |

-

While many reputable platforms prioritize compliance and transparency, ambiguous platforms often have gaps in these critical areas.

Key Warning Signs to Consider

Potential red flags that deserve careful consideration include:

-

Lack of verifiable licensing and regulation

-

Promotional emphasis on high returns without risk context

-

Opaque withdrawal procedures

-

Minimal corporate transparency

-

Inconsistent support responses

Any one of these signs warrants caution; together, they elevate the risk profile.

Importance of Independent Research

Before committing any funds:

-

Verify whether the platform is regulated through recognized agencies.

-

Search for independent user reviews on trusted sites.

-

Review all terms and conditions—especially those tied to withdrawals.

-

Confirm whether the trading activity reflects real market execution.

-

Seek educational material to understand market risks.

Sound research empowers you to make decisions grounded in facts—not just marketing claims.

Final Observations

Agileswap.io positions itself as a trading and investment service with modern tools and potential opportunities. However, the lack of easily verifiable licensing, limited corporate transparency, and withdrawal clarity make it essential for investors to conduct careful due diligence.

Online trading and DeFi are legitimate parts of the financial landscape—but they require informed participants and trustworthy platforms.

-

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to agileswap.io, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as agileswap.io continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.