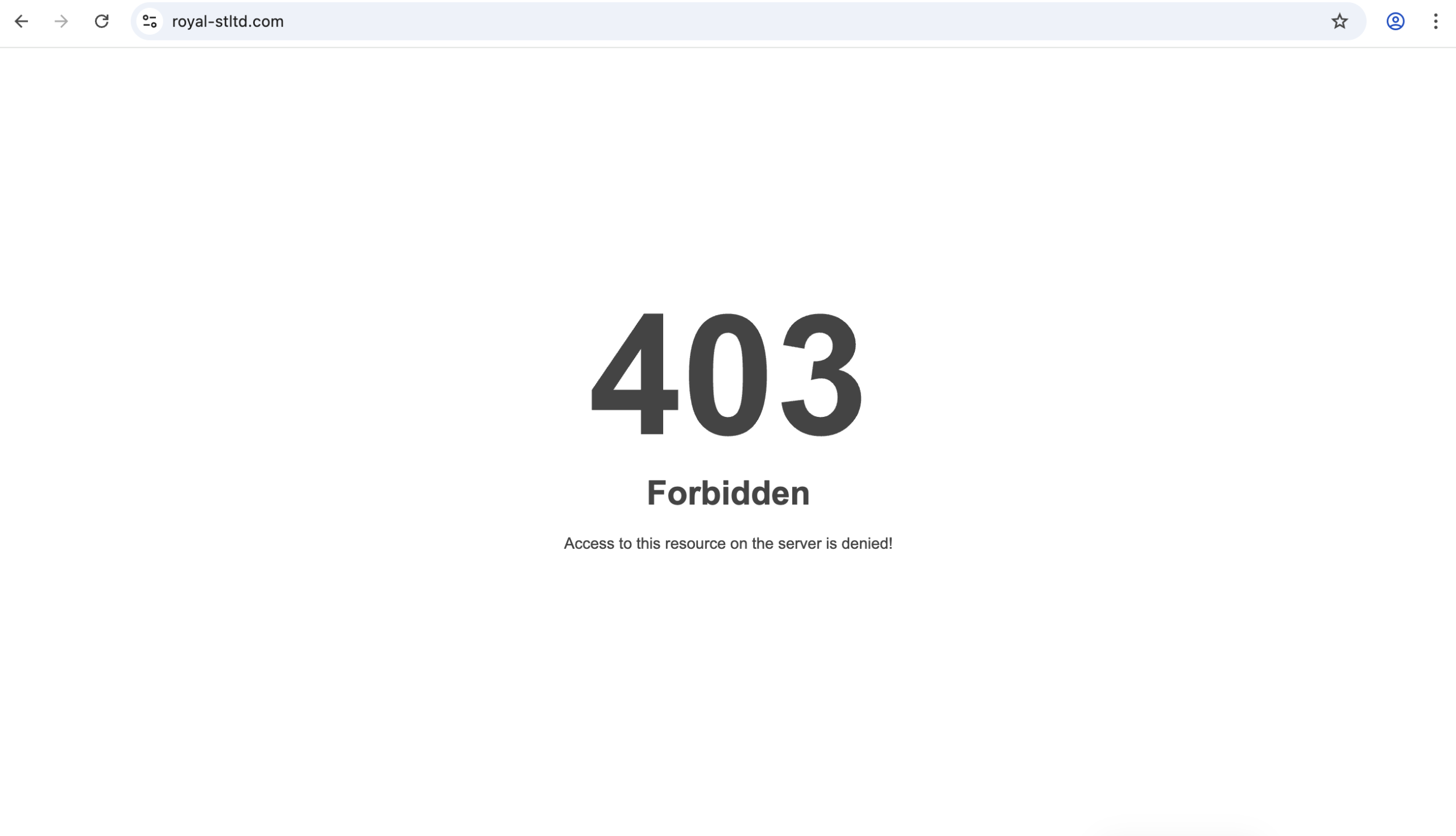

Royal-StLtd.com 7 Trust Concerns

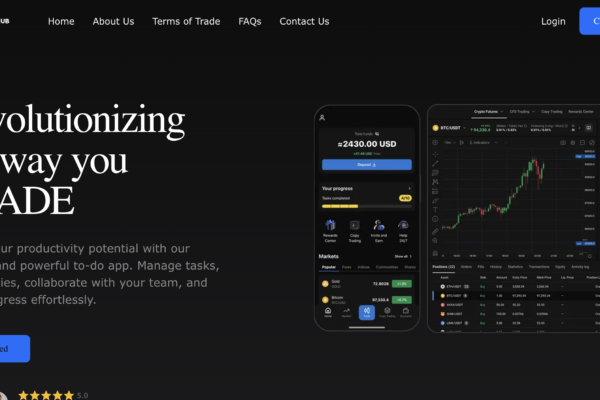

In an era where online financial services attract users with promises of fast profits and simplified trading, it has become critical to evaluate platforms beyond their marketing. Royal‑StLtd.com (Royal-StLtd) is one such website that promotes itself as a full‑service trading and investment broker. On the surface, the platform uses polished language and modern design elements to convey professionalism. But when one examines the structural, operational, and transparency indicators that define trustworthy financial services, several concerning signs emerge.

This review provides a comprehensive analysis of Royal-StLtd claims, regulatory standing, user experiences, and structural integrity, with a view to helping investors make a more informed judgment.

1. Marketing Versus Substance

Royal-StLtd presents itself with language typical of many online trading platforms: efficient execution, diverse asset classes, and tools designed for both novices and experienced traders. The site appeals to users through sleek visuals and bold claims about potential returns.

However, marketing language alone does not verify competence or legitimacy. For platforms involved in financial trading, verifiable credentials, clear risk disclosures, and regulatory compliance are far more important indicators than promotional copy. Unfortunately, Royal-StLtd does not consistently demonstrate these fundamentals.

2. Corporate Identity and Transparency Issues

A reliable financial services provider clearly discloses its legal entity, physical offices, leadership team, and business registration details. This information allows users to verify formal legitimacy and pursue accountability if needed.

Royal-StLtd lacks detailed, verifiable corporate information. The website does not provide clear disclosure of its registered business name in official records, does not list executives by name, and gives no verifiable company address linked to public registries. This lack of transparency makes it impossible for users to confirm who is actually behind the platform, a serious shortcoming for any service handling financial assets.

Without a clear corporate identity, investors are essentially placing trust in an anonymous entity—a situation that is antithetical to responsible investing.

3. Regulatory Oversight and Compliance

A key benchmark for financial brokers is whether they are governed by recognised regulatory authorities. Bodies such as the UK Financial Conduct Authority (FCA), U.S. Securities and Exchange Commission (SEC), and Australia’s ASIC enforce compliance standards that protect users, safeguard client funds, and provide mechanisms for dispute resolution.

Royal-StLtd does not provide valid regulatory licence information. There are no credible disclosures of regulatory oversight by any major financial authority. Without such licensing, nothing prevents the platform from operating without investor protections or audits. This regulatory gap places clients at risk and makes it very difficult to enforce any form of accountability.

4. User Experience Reports

While marketing materials on the site are polished, the real test of a platform’s value comes from the experiences of its users. Reports circulating in online forums and review communities bring several consistent themes:

-

Problems withdrawing funds: Multiple users state they had difficulty retrieving their deposits or profits. Some report delays that stretched for weeks without a satisfactory resolution.

-

Support responsiveness issues: A common complaint is that customer support either responds slowly or provides vague, non‑specific answers when users request assistance with account issues.

-

Unclear fee structures: Users describing their experience note that fees and charges were not properly explained up front, leading to confusion.

Those patterns—withdrawal obstacles, poor communication, and ambiguous terms—are significant because they recur across independent user accounts rather than being isolated complaints.

5. Opacity in Terms and Conditions

Financial platforms should make their terms and conditions, including fees, withdrawal policies, and dispute resolution procedures, easily accessible and understandable. Royal-StLtd terms are buried in dense fine print with minimal transparency. Critical information—such as how and when withdrawals are processed—is not clearly specified in user‑friendly language, which can lead to confusion or frustration when users try to exercise their rights.

When a platform obscures essential contractual information or makes it difficult to locate, it raises questions about how much users truly understand before they deposit funds.

6. Marketing Approaches and Pressure Tactics

Another element worth evaluating is the nature of client outreach. Some users report that representatives from Royal-StLtd have engaged in persistent contact to encourage additional deposits. They describe a sense of pressure rather than support.

Aggressive follow‑ups and incentive‑based messaging can be common in high‑pressure sales environments, but they should not define the communication style of a reputable broker. Responsible platforms provide clear information and allow users to make decisions without ongoing solicitation.

7. Absence of Independent Verification

Established financial services often undergo independent audits or provide third‑party validation of financial practices and results. Such verification helps establish credibility and gives users a basis for trust beyond promotional material.

Royal-StLtd has not published any evidence of audit outcomes or external assessments from recognised third‑party entities. The absence of such verification leaves users with no independent confirmation of the platform’s integrity or stability.

Conclusion — Why Reminder Caution Is Important

While Royal-StLtd uses polished design and confident language to present itself as a legitimate financial broker, deeper examination reveals critical concerns:

-

Lack of clear corporate identity or ownership transparency

-

No evidence of regulatory licensing or oversight

-

Recurring reports of withdrawal barriers and poor communication

-

Opaque terms and fee structures

-

Aggressive communication tactics

-

Absence of independent verification or audit history

These factors together suggest that investors should exercise caution before engaging with this platform. Trading and investment services carry inherent risk—but that risk must be managed within a framework of transparency, regulation, and accountability. Royal-StLtd currently falls short of these essential standards.

For anyone considering using an online broker, it is crucial to prioritise platforms with verifiable regulatory compliance, clear operational terms, and a track record of transparent user interactions. When those criteria are missing, as is the case here, the potential downside risk increases significantly.

Choosing where to entrust your capital is a decision that should be grounded in transparency and security—not just persuasive marketing messages on a website.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to Royal-StLtd, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as Royal-StLtd continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.