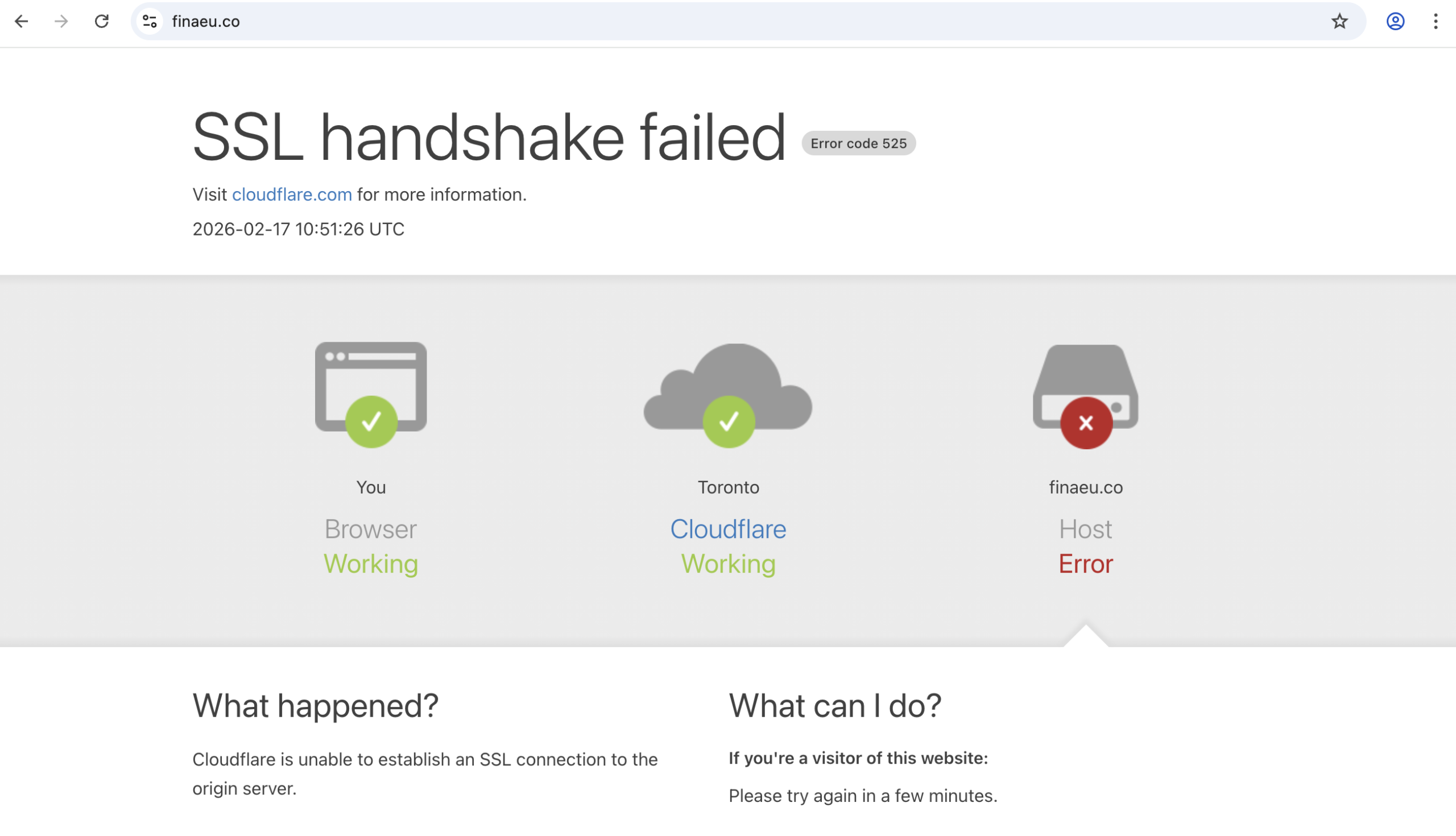

FINAEU.co Company Overview

The expansion of online investment and trading platforms has made it crucial for investors to differentiate between legitimate brokers and platforms that may lack transparency or accountability. FINAEU.co positions itself as a professional financial service provider, offering trading solutions, account management, and promises of profitable investment opportunities. While the website presents itself as modern and reliable, a deeper review reveals multiple areas that raise concern.

This review examines FINAEU.co’s claims, corporate transparency, regulatory stance, user feedback, and operational practices to provide investors with an informed perspective.

1. Marketing Presentation vs Reality

FINAEU.co uses a visually appealing website, persuasive language, and bold statements about trading efficiency and profit potential. It highlights features such as “instant account setup,” “advanced analytics,” and “expert portfolio management” designed to attract both new and experienced investors.

However, a professional design and marketing copy are not proof of legitimacy. Reliable platforms are characterized by transparent corporate structures, clear regulatory compliance, and verifiable user experiences. FINAEU.co’s presentation may impress at first glance, but it does not provide evidence to support its promises.

2. Lack of Corporate Transparency

One of the most important aspects of assessing a financial platform’s trustworthiness is knowing its corporate identity. Legitimate brokers disclose their legal entity, registered office, and key executives. This allows users to verify accountability and authenticity.

FINAEU.co does not provide verifiable corporate information. There is no public record of registration, no executive team information, and no clearly identifiable office address. Without this transparency, investors cannot confirm who is responsible for operations or how funds are managed, which is a significant red flag.

3. Regulatory Oversight Concerns

Regulatory compliance is a critical indicator of a trustworthy broker. Recognized authorities, such as the UK Financial Conduct Authority (FCA), U.S. Securities and Exchange Commission (SEC), and Australian ASIC, monitor brokers, enforce regulations, and ensure client protections.

FINAEU.co does not display any valid regulatory licenses or oversight from recognized authorities. The lack of regulation means there is no guarantee of fund security, fair trading practices, or accountability in disputes. This absence of regulatory compliance is a serious concern for potential users.

4. User Feedback and Complaints

User experiences often reveal the operational realities behind a platform’s marketing. Reports related to FINAEU.co indicate several recurring issues:

-

Withdrawal Problems: Users report delays or blocks when attempting to withdraw funds, sometimes without explanation.

-

Customer Support Issues: Many users describe non-responsive or evasive support when addressing account or transaction concerns.

-

Unclear Fees and Terms: Investors often find the fee structures ambiguous and the terms of service difficult to understand.

The recurrence of these complaints across multiple users suggests that these are systemic problems rather than isolated incidents.

5. Opaque Terms and Conditions

Reliable financial platforms make their terms and fees clear and easily accessible. FINAEU.co’s policies, however, are buried in fine print or written ambiguously, making it difficult for users to fully understand the rules governing deposits, withdrawals, or account management. This lack of clarity increases the potential for unexpected restrictions or charges.

6. Marketing Practices and Pressure Tactics

Some users report receiving persistent outreach from FINAEU.co representatives encouraging additional deposits or participation in “premium” opportunities. While proactive communication is common in financial services, high-pressure tactics are not typical of reputable brokers. Legitimate platforms allow investors to make decisions at their own pace without coercion.

7. Lack of Independent Verification

Third-party audits or independent verification of operations are often used by legitimate brokers to demonstrate credibility and accountability. FINAEU.co does not provide any evidence of external audits or third-party verification, leaving investors without an independent means of confirming the platform’s practices or solvency.

The absence of independent verification adds another layer of uncertainty and risk for potential users.

Conclusion — Why Caution Is Warranted

FINAEU.co presents itself as a professional trading and investment platform, but multiple factors raise concerns:

-

Lack of transparent corporate information

-

No regulatory licensing or oversight

-

Recurrent user complaints about withdrawals and support responsiveness

-

Ambiguous fee structures and hidden conditions

-

High-pressure marketing tactics

-

Absence of independent audits or third-party verification

These combined issues indicate that investors should exercise extreme caution. Choosing a platform without regulatory oversight, verifiable corporate identity, and transparent operational practices significantly increases financial risk.

For investors seeking online trading or investment platforms, it is essential to prioritize services that demonstrate clear regulation, transparent corporate structure, and consistent, verifiable user feedback. FINAEU.co currently does not meet these standards, suggesting that cautious evaluation is crucial before considering engagement.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to FINAEU.co, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as FINAEU.co continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.