methtradehub.com Trust Concerns

Online trading and investment platforms continue to grow rapidly, with hundreds of services offering access to financial markets. Amid this expansion, some platforms lean heavily on polished marketing rather than transparent, verifiable operations. methtradehub.com is one such platform that presents itself as a modern online broker, promising access to various financial instruments and profitable opportunities. However, a closer look at how the platform operates, the clarity of its disclosures, and user feedback reveals several areas of concern that investors should understand before engaging.

This review explores methtradehub.com’s structure, transparency, regulatory profile, and user experiences to help you make a more informed judgment about the platform’s credibility.

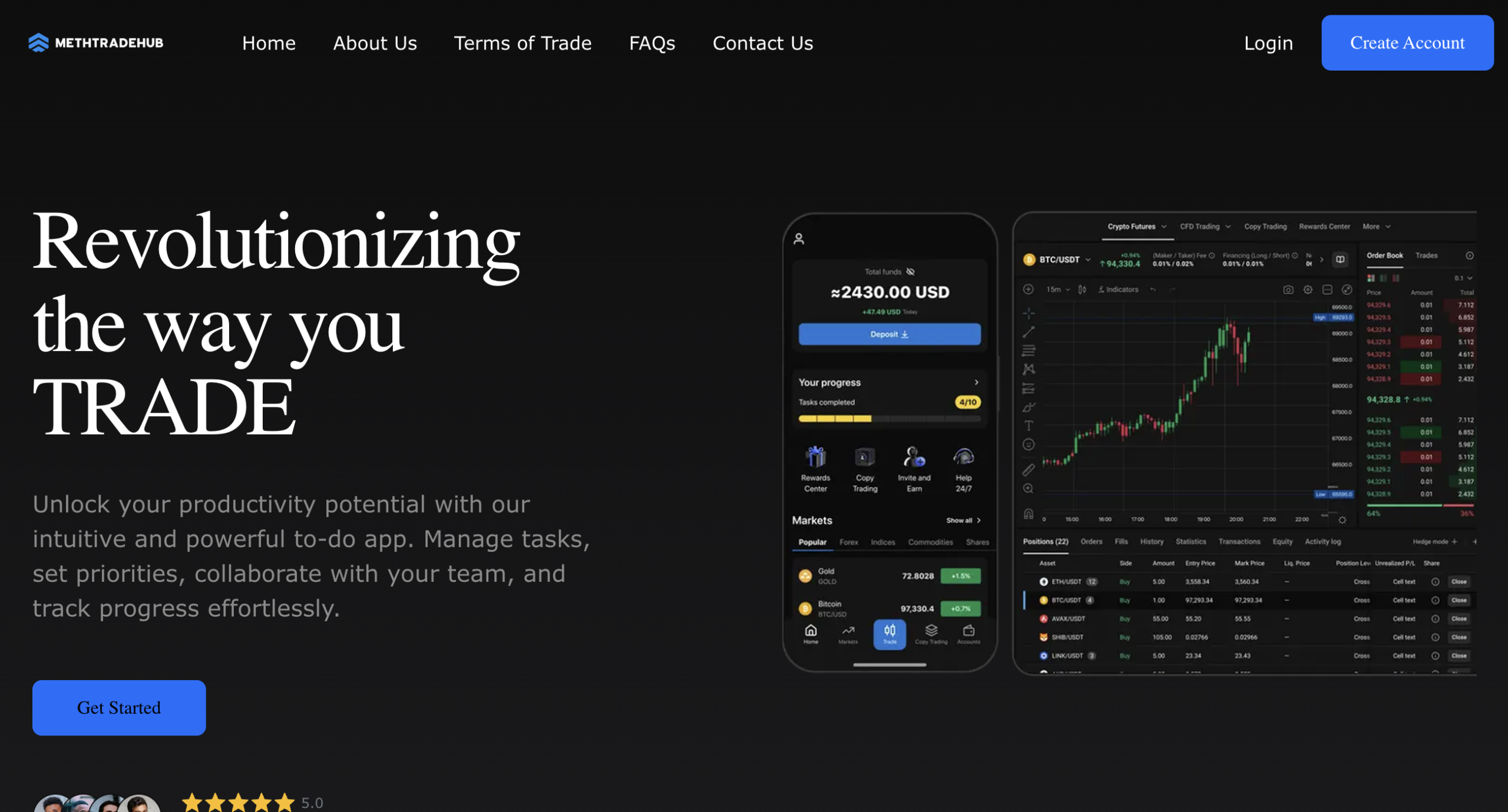

1. Professional Design, Unverified Substance

At first glance, methtradehub.com has a visually polished interface with bold claims about “intuitive trading,” “fast execution,” and “expert support.” These kinds of phrases are meant to appeal to both novice and experienced traders, suggesting that users can easily access global markets and maximize returns.

However, a visually appealing design does not equate to a trustworthy operation. In financial services, real credibility is anchored in verifiable facts: clear corporate identity, public regulatory transparency, documented trading mechanisms, and user‑centric policies. Unfortunately, methtradehub.com lacks several of these essential components.

2. Lack of Clear Corporate Identity

One of the first steps in evaluating any financial platform should be verifying who is behind it. Reputable brokers disclose:

-

The full legal company name and registration number

-

A verifiable physical address

-

Names of key executives or directors

-

Links to official regulatory records

methtradehub.com does not provide clear, verifiable corporate information. There are no obvious links to business registry entries, no identifiable leadership team, and no physical address that can be confirmed independently. When a platform operating in financial markets omits these basics, it raises concerns about accountability. Investors have no reliable way to verify that the service is legally registered or that anyone is responsible for its operations.

3. Regulatory Credentials Are Absent

Regulation is a cornerstone of investor protection. Recognized financial authorities—such as:

-

the UK Financial Conduct Authority (FCA)

-

the U.S. Securities and Exchange Commission (SEC)

-

Australia’s ASIC

—set standards for brokers, enforce compliance, and offer recourse in disputes. Regulated brokers must publicly disclose their licenses, their regulatory status, and how they handle client funds.

methtradehub.com does not display any valid regulatory information from credible authorities. There are no license numbers, no regulatory seals, and no references to external oversight. This absence means investors have no assurance that funds are handled responsibly, that fair trading practices are enforced, or that legal protections exist in the event of a dispute. A lack of regulatory transparency is one of the strongest warning signs a financial platform can exhibit.

4. Patterns in User Feedback

User reports often reveal operational issues that marketing materials gloss over. In the case of methtradehub.com, independent user feedback—shared across forums, comment threads, and review sites—shows recurring problems:

-

Withdrawal Barriers: Multiple users report significant delays or outright refusal of withdrawal requests after initial deposits are made.

-

Poor Customer Support: Many users describe attempts to reach support that are ignored, delayed, or met with vague, non‑helpful responses.

-

Unclear Fee Information: Investors have noted that fee structures and trading terms are not explained clearly before investing, leading to confusion and unexpected charges.

When similar complaints appear repeatedly across different users and platforms, it points to systemic issues rather than isolated incidents.

5. Opaque Terms and Conditions

A transparent financial platform provides clear, easily accessible terms and conditions covering fees, withdrawal processes, account management, and dispute procedures. On methtradehub.com, these key details are buried in dense language and hard‑to‑find sections with wording that is vague or overly complex. This lack of clarity makes it difficult for users to understand:

-

How and when they can withdraw funds

-

What fees they may incur

-

What rights they have if issues arise

-

How disputes are handled

Platforms that obscure these details increase the risk of misunderstandings and disputes, which can result in financial loss or blocked access to funds.

6. Pressure‑Style Outreach Tactics

Some users report receiving repeated follow‑ups from methtradehub.com representatives after initial contact. These messages often encourage larger deposits or participation in “high‑yield opportunities” without adequately explaining the risks involved.

While outreach is a normal part of customer service, persistent pressure to invest more money is not typical of reputable brokers. Responsible platforms focus on providing clear information and supporting users in making informed decisions, not on pushing additional transactions.

7. Lack of External Verification or Independent Audit

Legitimate brokers often undergo independent audits or publish third‑party verification of their practices to demonstrate operational integrity. In contrast, methtradehub.com offers no evidence of external verification or third‑party auditing. Without objective confirmation of its practices, investors have no reliable basis to assess the platform’s stability or ethical standards.

Conclusion — Why Caution Is Essential

methtradehub.com presents itself as an attractive option for online trading and investment, but several serious issues indicate that investors should proceed with caution:

-

Absence of verifiable corporate identity

-

No recognized regulatory licensing or oversight

-

Recurrent complaints about withdrawals and support challenges

-

Opaque terms and confusing fee disclosures

-

High‑pressure marketing outreach

-

Lack of independent verification or audit

These factors suggest that the platform does not meet accepted standards of transparency or investor protection. In the absence of regulatory accountability and clear operational disclosures, users face increased risk of financial loss, confusion, or blocked access to funds.

Investors considering online trading platforms should prioritise those with clear regulatory compliance, publicly verifiable corporate information, transparent terms, and a history of responsive customer support. Without these elements, the risk associated with engagement increases substantially.

Ultimately, careful evaluation and cautious skepticism are essential when dealing with online financial services. methtradehub.com currently lacks the core indicators of a trustworthy platform, and that is why potential users should be especially attentive before considering any form of engagement.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to methtradehub.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as methtradehub.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.