Finquickly.com Is It Legitimate?

In recent months, finquickly.com has appeared on the radar of many online investors and reviewers. At first glance, the website presents itself as a financial services provider that helps users trade or invest — often with an emphasis on digital assets or rapid returns. But beneath the surface, numerous factors raise alarm bells that suggest potential trouble for anyone considering putting money into this platform.

This review breaks down what finquickly.com claims to be, what independent assessments and real user feedback indicate, and why it’s critical to approach this platform with extreme caution.

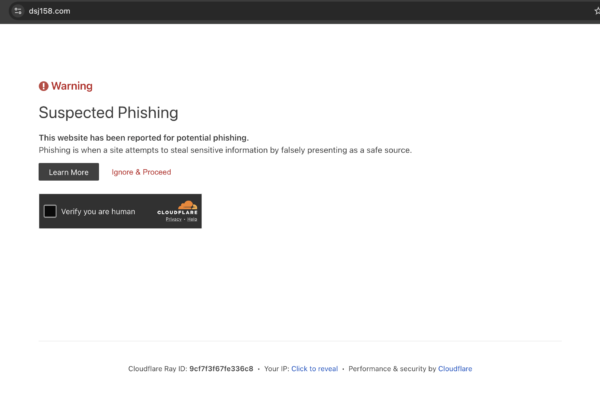

Lack of Verified Regulatory Oversight

One of the most important indicators of legitimacy for any financial or investment site is whether it is registered and regulated by a recognized authority. Platforms that deal with trading, investment, or asset management should typically be regulated by institutions such as the Financial Conduct Authority (FCA) in the UK, SEC in the USA, ASIC in Australia, or similar bodies.

There is no verifiable evidence that finquickly.com holds a real licence from any major financial regulator. Searches of official regulatory databases do not list the platform as a registered entity, and the website itself does not disclose credible licensing information. This absence of clear regulatory status means there is no independent oversight ensuring fair practices, transparency, or protection of client funds — a fundamental indicator used to differentiate legitimate firms from unreliable operations.

Anonymous Ownership and Hidden Domain Data

Another major concern is the lack of transparent company information. Independent site analyses show that the finquickly.com domain was created relatively recently and has its WHOIS ownership details hidden using privacy services. This means basic information — such as the true owner, physical address, and corporate structure — is not publicly verifiable.

Legitimate financial service providers usually disclose clear ownership and contact information, often including audited corporate reports and regulatory filings. When such essential details are obscured, it becomes significantly harder for users to assess the reliability or accountability of a platform.

Conflicting User Reviews and Questionable Reputation

Looking at user feedback reveals mixed and conflicting reports about the platform’s operations. On some review aggregators, finquickly.com shows high star ratings, with some “verified” reviews claiming quick processing and positive experiences. However, these positive reviews are likely unverified and possibly manipulated or fabricated — an issue common with platforms trying to artificially boost their online reputation.

On more open and widely used review platforms, the picture looks substantially different. A large proportion of user feedback reflects severe problems with delayed withdrawals, unclear processes, and unreliable support. Some reviewers report long withdrawal delays and lack of reliability when attempting to access their funds.

This wide discrepancy between overly positive reviews on some sites and negative experiences reported elsewhere is a characteristic often seen in fraudulent or untrusted services, where positive reviews are created or manipulated to counterbalance real user complaints.

Typical Problem Patterns in Reported Interactions

Independent analyses of similar platforms — like those documented in user investigations and community discussions — show several recurring issues that often arise with sites operating without credible oversight. These include:

-

Withdrawal Difficulties: Users have encountered excessive delays or excuses when attempting to withdraw funds, with the platform imposing unexpected barriers.

-

Pressure to Increase Funds: Reviewers frequently describe scenarios where they were encouraged to deposit larger sums or “upgrade accounts” to access full features — a tactic that can trap users into committing more capital.

-

High-Pressure Sales Tactics: There are reports of aggressive outreach to prospective investors through messages, cold calls, or social media outreach, often paired with promises that sound too good to be true.

These problem patterns are similar to those documented with other unverified financial websites that lack oversight and regulatory accountability.

Website Characteristics Raise Suspicion

Beyond user feedback, the structure and presentation of the finquickly.com website also raise concerns:

-

The site lacks detailed legal documentation such as audited financial statements or verifiable corporate disclosures.

-

There are few — if any — verifiable institutional references that link the site to established financial entities.

-

Domain registration being recent and masked suggests that the platform could be transient rather than built for long-term operation.

Such characteristics are typical of online operations that prioritise quick user acquisition rather than sustainable, transparent financial services.

Why Caution Is Essential

Given the combination of hidden ownership, lack of regulation, conflicting user feedback, and suspicious practices, the risks associated with interacting with finquickly.com are significant. Without clear oversight from trusted financial regulators, users have no guarantee of protection or recourse if funds are mishandled, withheld, or lost.

It’s also important to recognise that some of the positive reviews circulating online may not reflect real user experiences and could be used to lure more unsuspecting users into depositing funds.

Final Thoughts: A Strong Recommendation to Avoid Engagement

While the internet is full of investment platforms and financial services claiming innovation or excellent returns, prudence is critical. finquickly.com lacks transparency, verified regulatory status, and consistent user trust metrics, all of which are foundational to legitimate financial services.

For anyone considering depositing money with finquickly.com, the safest course is to steer clear entirely and focus only on platforms that are transparent, registered with recognised regulators, and widely trusted by independent communities.

Your funds and financial wellbeing should always be protected by clear oversight and accountability — and at this time, finquickly.com does not demonstrate the attributes necessary to meet that standard.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to finquickly.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as finquickly.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.