SmartReserveHoldings Investment Review

In the ever-expanding world of online financial platforms, traders and investors constantly seek tools that promise access to global markets, cutting-edge analytics, or sophisticated technologies like artificial intelligence (AI). One platform that has recently drawn attention is smartreserveholdings.com, operating under the name Smart Reserve Holdings. On the surface, this site presents itself as a comprehensive trading venue covering stocks, forex, cryptocurrencies, commodities, indices, bonds, mutual funds, and similar instruments.

However, beneath that polished presentation lies a combination of issues serious enough to justify deep skepticism from prospective users. Based on regulatory alerts, domain analysis, and user accounts, Smart Reserve Holdings exhibits multiple problematic traits that undermine confidence and suggest it’s a platform most investors should avoid.

Operating Status and Regulatory Standing

One of the most crucial aspects of evaluating any investment or trading platform is confirming its regulatory status. In Canada, for example, firms offering trading or investment services must be registered with provincial securities authorities to operate legally — which ensures they must follow strict consumer protection standards.

According to an investor alert issued by the Financial and Consumer Affairs Authority of Saskatchewan (FCAA), Smart Reserve Holdings is not registered to trade or sell securities, derivatives, or related financial products in Saskatchewan or other Canadian jurisdictions. This applies to the platform’s activities under the URL smartreserveholdings.com.

Being unregistered means that users who send money or invest through the platform do not enjoy the protections afforded by securities laws in Canada. In legitimate markets, registration is a basic compliance requirement. Its absence here is a strong indication that the business model does not meet standard regulatory norms.

Website Trust and Technical Factors

Independent analysis tools that assess overall website trustworthiness assign smartreserveholdings.com a low to questionable trust score. One reputation platform gave the site a trust rating below average, tagging it as “questionable” and “controversial” in part because it is newly created and shows potential links to suspicious behavior such as spam or phishing vectors.

A site’s age matters in this context; smartreserveholdings.com was registered in March 2025, which makes it very new compared to long-standing platforms. Newly registered financial websites with few verifiable third-party endorsements or established metrics are inherently riskier, especially when they solicit financial activity.

Additionally, much of the ownership and contact information for the platform is hidden behind privacy redaction. Legitimate investment firms usually provide clear corporate details, physical addresses, and transparent leadership structures. The absence of such transparency complicates verification and raises concerns about accountability.

Claims vs. Verifiable Reality

Smart Reserve Holdings markets itself as offering advanced tools — including AI-powered trading technology — and broad market access. However, aside from promotional content, independent confirmations of these claims are lacking.

The broader digital footprint of the platform is thin. There are few verifiable mentions or credible third-party reviews outside automated reputation scanners and user discussions, and some of the only substantial regulatory context comes from warnings, not endorsements. This makes it difficult to confirm that the platform actually delivers the services it advertises.

In addition, in some user community discussions, individuals reported experiences of aggressive contact tactics from assigned “brokers,” pressure to make additional deposits, and difficulty retrieving funds — patterns that resemble typical operational models of dubious trading services.

User Experience Patterns in Independent Discussions

While many detailed complaints about online services should be verified individually, there are recurring themes in independent public forums about Smart Reserve Holdings or entities linked to similar platforms:

-

Reports of accounts being assigned persistent contact persons urging further deposits.

-

Screens that show fabricated growth or returns to build trust early on.

-

Difficulty withdrawing funds without paying “additional fees” or charges.

-

Non-responsive customer service once deposits have been made.

Even though these accounts don’t represent a scientific sample, the consistency of these claims across multiple community posts adds to the concerns around the platform’s operational integrity.

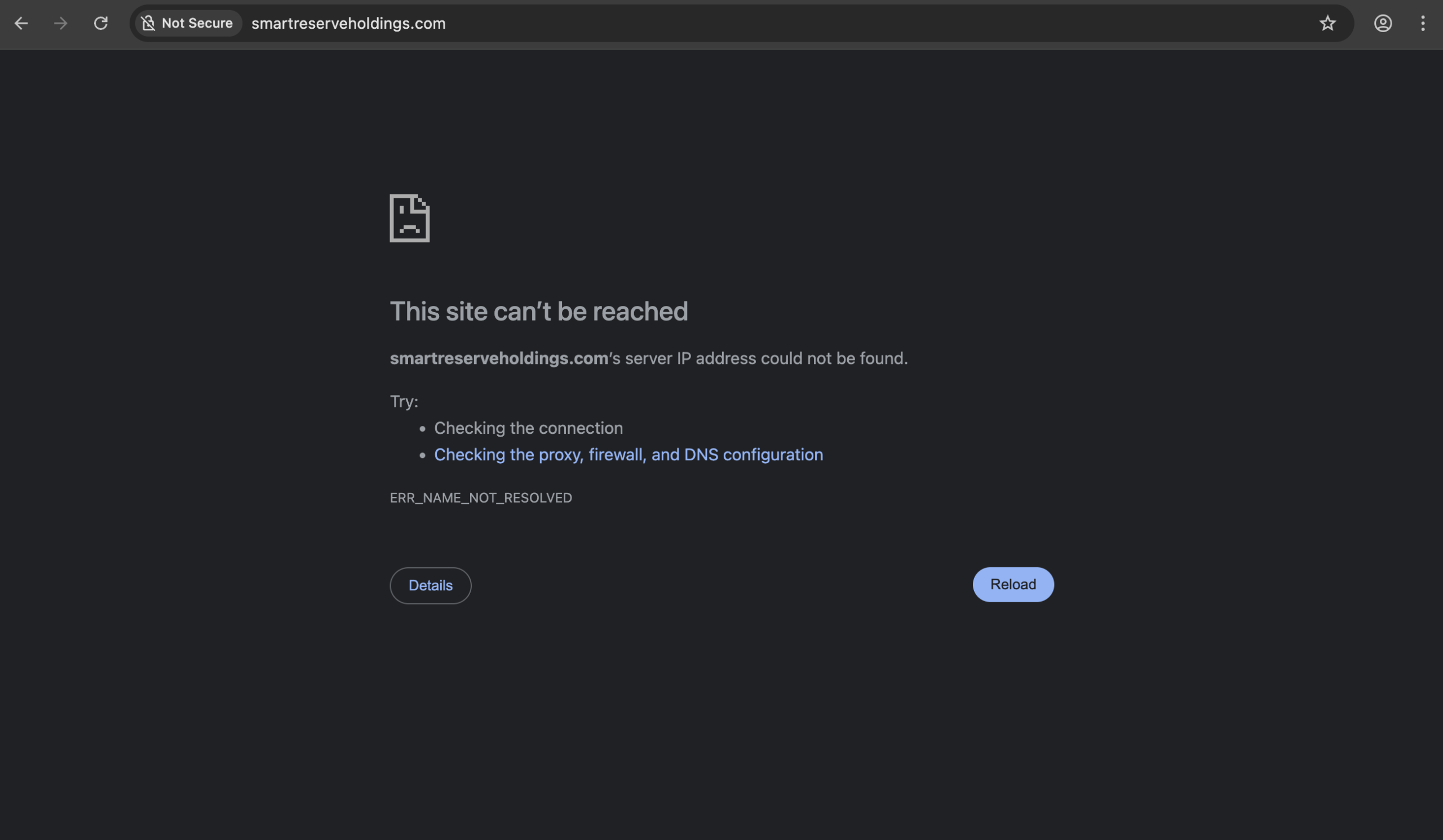

The Shutdown and Public Alerts

More recently, community discussions and investor reports indicate that the website has been shut down entirely, and the government-issued alert remains the primary publicly documented action against the entity. This indicates that regulatory agencies have taken formal notice of the platform’s activities, and that the warning was based on official review rather than speculation.

This context — combined with the lack of registration and the absence of credible oversight — means that individuals who engage with such platforms risk their capital without the possibility of legal recourse if problems arise.

Final Evaluation

Smartreserveholdings.com checks many of the boxes that financial professionals and experienced traders mark as red flags:

-

No registration with recognized securities regulators in jurisdictions where it solicits clients.

-

Low trust and reputation scores from independent web safety analyzers.

-

A recently registered domain with opaque ownership details.

-

Reports of problematic user interactions and unclear withdrawal outcomes.

Taken together, these factors suggest that smartreserveholdings.com does not meet the standards expected of a safe, compliant, and transparent financial services platform. For anyone considering using it for investment, trading, or financial services, the evidence strongly points to exercising extreme caution and avoiding engagement.

Before entrusting any platform with your money, always verify its regulatory status with local financial authorities and seek out multiple independent reviews from reputable sources.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to smartreserveholdings.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as smartreserveholdings.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.