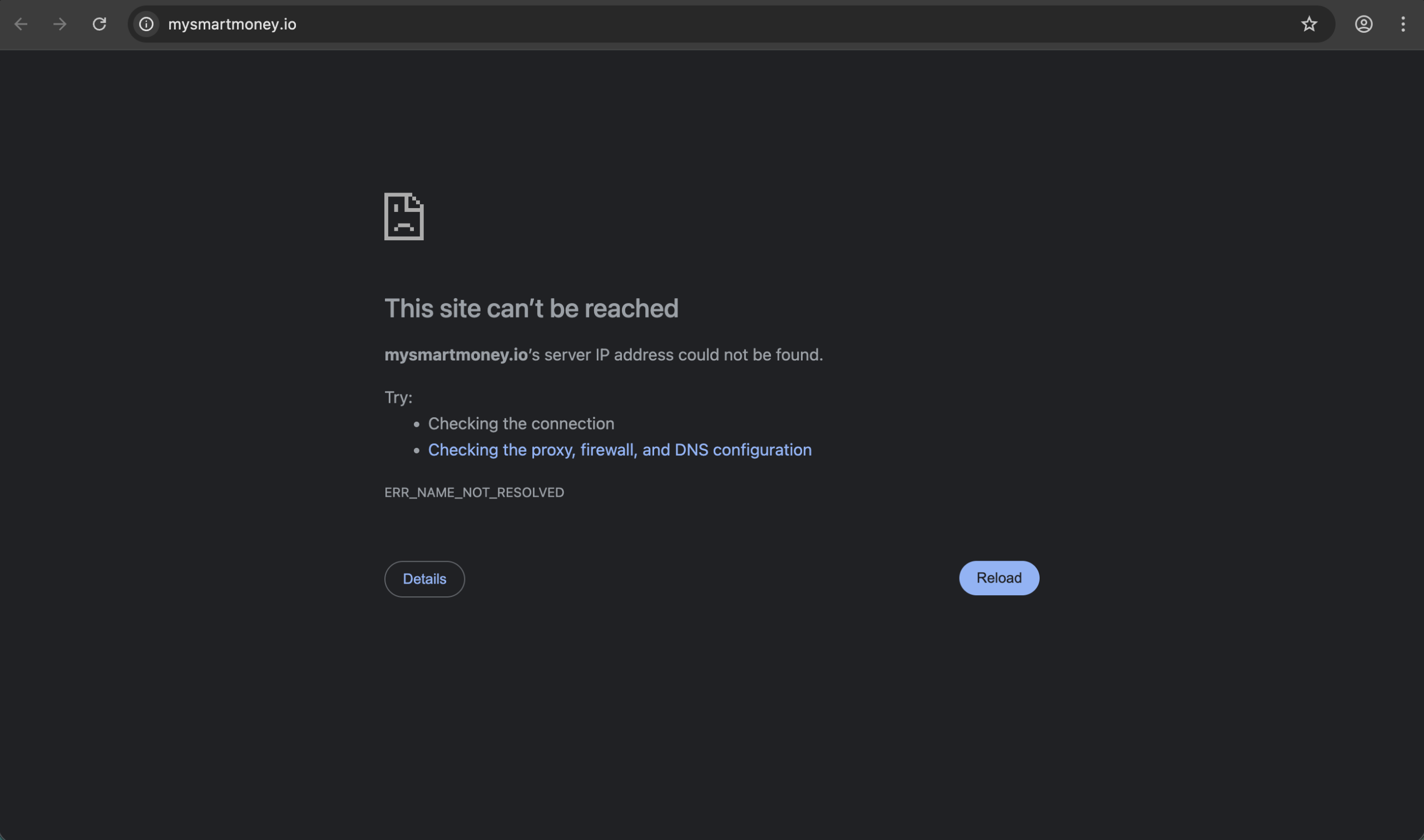

MySmartMoney.io Review Before You Invest

In the rapidly expanding world of online financial services and automated trading systems, it’s crucial to distinguish between legitimate platforms and those that could cost you time, money, and personal information. One platform that has recently attracted attention — not for its quality, but for how questionable it appears — is MySmartMoney.io. In this review, we’ll break down what this platform claims to offer, the issues uncovered by independent analysts, and why you should approach it with extreme caution.

What Is MySmartMoney.io Supposed to Do?

MySmartMoney.io presents itself as a modern financial service offering hands-free copy trading — a system where users supposedly let automated tools or professional strategies trade on their behalf. The marketing materials highlight features like performance-based fees (only charging when users profit), a large client base, and impressive success rates. While these claims might sound appealing, an investigation into the platform reveals far more concerning facts.

Extremely Low Trust Scores From Independent Sources

One of the most important things you can do before interacting with any online financial service is to check its trustworthiness using reliable evaluators. When MySmartMoney.io was analyzed by Scam Detector, it received a very low trust score — far below what would be expected for a legitimate financial site. This score reflects a high probability of suspicious and risky behavior.

Another widely used site that checks web platforms for safety — ScamAdviser — assigned MySmartMoney.io a very low trust score as well, describing the site as “very likely unsafe.” Factors contributing to this include hidden ownership details and the domain’s recent registration date.

These kinds of low trust scores are important red flags and should always prompt deeper scrutiny.

Lack of Transparency and Hidden Ownership

A legitimate financial platform should clearly disclose:

-

Who owns and operates it

-

Where it’s legally registered

-

How it’s regulated

MySmartMoney.io fails on all counts. Ownership information in domain records is masked through privacy services, meaning there’s no clear indication of who is actually behind the platform. There’s no publicly verifiable informationabout its leadership, headquarters, or regulatory compliance — essential elements for any trustworthy financial service.

This lack of transparency makes it virtually impossible for users to assess the platform’s credibility or pursue legal accountability if issues arise.

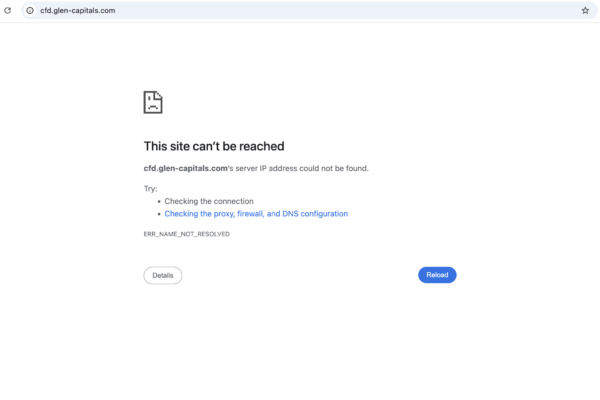

Young Domain Age Signals Instability

Another factor experts look at when evaluating websites is domain age. MySmartMoney.io was registered very recently, with records showing it was created in late 2025. New websites aren’t always problematic, but many fraudulent platforms use newly registered domains specifically so they can launch aggressively, collect user funds, and then vanish. Older, established platforms typically have a track record that can be reviewed and verified over time.

A very short operating history combined with little online presence only adds to the risk profile.

Hidden Risks in Claimed “Performance” Metrics

The promotional content on MySmartMoney.io boasts things like thousands of clients, millions in trades, and high success rates. What’s missing is any verifiable audit, third-party performance data, or transparent evidence backing those claims. Without independent verification, such metrics are nothing more than marketing slogans.

Platforms that genuinely manage trading or investment activity usually provide audited performance reports or are registered with financial authorities — neither of which is present here.

High-Risk Financial Service Overlay

While some financial services are inherently risky, legitimate ones clearly communicate the risks and regulatory status to users. ScamAdviser notes that MySmartMoney.io appears to be associated with high-risk financial services, including crypto trading, which scammers frequently use to obfuscate transactions and make recovery difficult.

Unregulated crypto-based services are especially susceptible to misuse, and many fraudulent operators choose this route precisely because it makes tracing funds harder.

Warning Signs in Online Behavior Patterns

Although there’s limited direct user feedback specific to MySmartMoney.io, patterns identified by these analytical tools — such as hidden owner identity, young domain age, and association with high-risk financial activity — mirror common traits seen in many fraudulent platforms. These are the kinds of indicators that scam investigators typically highlight long before widespread user complaints emerge.

Important Precautions Before Interacting with Sites Like This

If you’re considering any online financial or trading platform, here are some practical steps before you engage:

-

Verify whether the platform is registered with recognized financial regulators.

-

Search for independent performance reports and audited trading histories.

-

Check ownership details in WHOIS records and see if they are publicly transparent.

-

Look for user discussions and complaints from credible review sources.

-

Avoid platforms with obfuscated or hidden contact information.

Conclusion: Avoid MySmartMoney.io

Based on independent trust evaluations and structural concerns, MySmartMoney.io exhibits multiple warning characteristics that are commonly associated with unreliable or fraudulent financial platform setups. The low trust scores, lack of transparency, young domain age, and high-risk positioning together create a compelling case for caution.

No serious financial service hides its operators, avoids regulatory disclosure, or relies on unverifiable performance claims. For these reasons, it’s advisable to steer clear of MySmartMoney.io and avoid depositing funds or providing sensitive personal information.

Your financial safety should always come first — and platforms that fail to demonstrate legitimacy are simply not worth the risk.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to mysmartmoney.io, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as mysmartmoney.io continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.