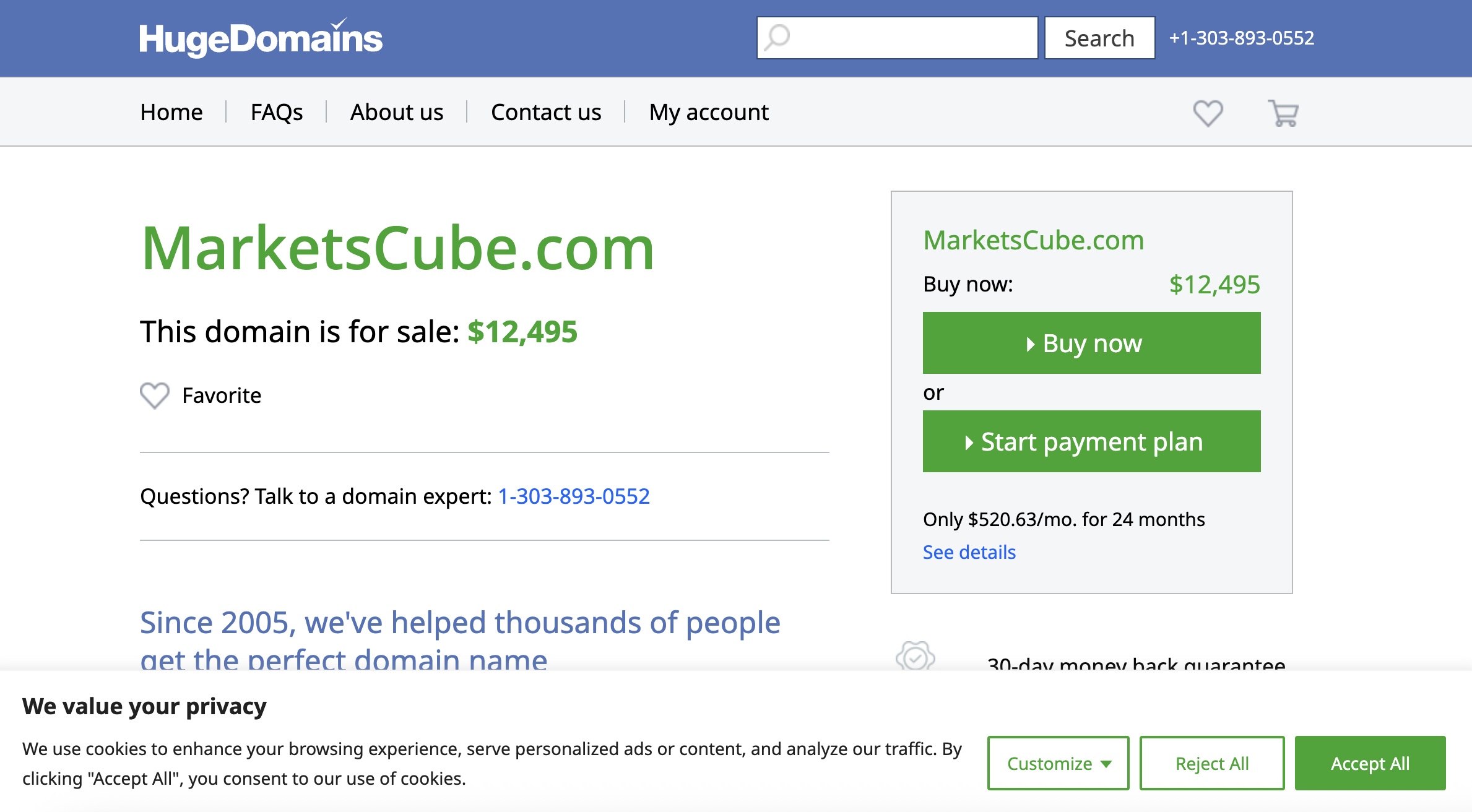

Is Marketscube.com a Scam? Full Investigation and Honest Review

Online trading platforms continue to grow rapidly, which unfortunately attracts dishonest operators looking to exploit investors. Marketscube.com is one such platform that has triggered widespread concern due to its questionable practices, lack of transparency, and unregulated operations. This comprehensive review examines the platform’s setup, promises, user experience, risks, and the red flags that every potential investor should know before engaging with it.

Introduction to Marketscube.com

Marketscube.com presents itself as an advanced forex and cryptocurrency trading platform offering innovative tools, expert strategies, and guaranteed trading success. At first glance, the website appears professional, featuring promotional statements about profitability and sophisticated market analysis. The platform markets itself as beginner-friendly and claims to employ skilled analysts who help users earn consistent returns.

However, upon closer inspection, several aspects of Marketscube.com raise doubts about the platform’s legitimacy. The bold claims of high returns, the lack of identifiable team members, and the unclear operational framework suggest that investors should approach the platform with extreme caution.

Lack of Proper Regulation

One of the most critical issues with Marketscube.com is its absence of regulatory oversight. Reputable trading platforms operate under the supervision of recognized financial authorities to protect traders and ensure adherence to industry standards. Marketscube.com, however, does not clearly disclose any valid licenses or regulation details.

A legitimate brokerage typically provides:

-

Licensing numbers

-

Verification details

-

Regulatory body information

-

Compliance documentation

Marketscube.com fails to provide any of these. This alone is a major red flag, as unregulated platforms frequently engage in deceptive behavior, misuse client funds, and operate without accountability.

Anonymous Company Structure

Transparency is essential in the financial industry, yet Marketscube.com does not reveal much about the company behind the platform. There is no clear information about:

-

The owners or founders

-

The company’s physical office location

-

The management team

-

Verifiable corporate registration

A platform that handles client investments but hides its identity is inherently suspicious. Investors have no way to verify who controls their funds or what legal protections exist in case of disputes.

The anonymity surrounding the platform’s operators raises serious concerns about credibility and reflects common tactics used by fraudulent online brokers.

Unrealistic Profit Promises

Marketscube.com frequently promotes unrealistic earning potentials, suggesting that investors can generate substantial profits with minimal risk. Such promises often target inexperienced traders who may not understand the risks associated with forex or cryptocurrency markets.

Statements implying “guaranteed returns,” “consistent daily profits,” or “low-risk high-reward trading strategies” are hallmarks of deceptive platforms. No legitimate broker can truthfully guarantee profits because the financial markets are inherently volatile.

This type of aggressive marketing is designed to lure investors with the false belief that success is assured, which is a classic indicator of a fraudulent operation.

Unclear Account Types and Hidden Fees

While the platform lists various account types, the descriptions are often vague, lacking clear explanations of:

-

Trading conditions

-

Spread details

-

Commission structures

-

Leverage options

-

Withdrawal limitations

Users have reported hidden fees that were not disclosed upfront, such as unexplained deductions, withdrawals being held pending “extra verification,” and unexpected charges for inactivity or account upgrades.

Legitimate platforms ensure that financial details are fully transparent. However, Marketscube.com uses confusing terminology and non-specific account requirements, which can trap investors into paying more than expected.

Manipulated Trading Environment

Another concerning pattern associated with Marketscube.com is the allegation that the platform may manipulate trading data. A number of users have claimed that:

-

Trades appear delayed during high-momentum market periods

-

Profit calculations seem inconsistent

-

Market data does not align with publicly available information

-

Positions close unexpectedly without trader authorization

While these claims are difficult to verify externally, they align with common practices observed in unregulated and fraudulent trading sites where the platform has full control over the trading environment.

When a broker controls the platform and is not regulated, it can manipulate outcomes to prevent users from profiting, making the trading experience fundamentally unfair.

Complicated and Suspicious Withdrawal Process

One of the biggest concerns surrounding Marketscube.com is the difficulty users report when attempting to withdraw their funds. Although the platform promises fast and easy withdrawals, real-world experiences tell a different story.

Several users describe:

-

Long delays in withdrawal approval

-

Requests for unnecessary documents

-

Sudden requirement for additional fees before release of funds

-

Complete non-response from support after withdrawal attempts

Some users are even told that they must upgrade their accounts or deposit more money to unlock withdrawals—another common tactic used to extract additional funds from victims.

A transparent, trustworthy broker ensures smooth and timely transactions. Difficulty in withdrawing funds is a major warning sign that the platform may not intend to return investor money.

Deceptive Sales Tactics and Pressure to Deposit More

Many users report that Marketscube.com employs aggressive marketing and high-pressure sales techniques. These include:

-

Frequent phone calls from “account managers”

-

Persuasion to make higher deposits

-

Emotional manipulation

-

Claims that bigger deposits unlock higher profits

-

Urgency tactics such as “limited offers” or “special bonuses”

These tactics aim to push investors into making rushed decisions without time to evaluate risks. High-pressure deposit strategies are often used by unregulated brokers that prioritize obtaining money over providing legitimate services.

In contrast, genuine platforms focus on user education, service quality, and transparent communication.

Poor Customer Support and Unresponsive Communication

Customer support is an essential aspect of any online trading platform. Marketscube.com, however, has several concerning patterns related to its support system:

-

Slow response times

-

Generic replies that do not address specific questions

-

Support tickets that go unanswered

-

Phone lines that suddenly become unreachable

-

Chat systems that appear active but do not respond

Once a user expresses concerns or attempts to withdraw money, communication often becomes sparse or stops entirely. This behavior further suggests that the platform prioritizes deposit collection rather than authentic customer service.

No Educational Resources or Training Materials

Legitimate trading companies offer educational materials to empower users—such as webinars, tutorials, demo accounts, or market analysis tools. Marketscube.com, however, provides minimal or superficial educational content.

Most of the information on the site is promotional and vague, focusing on marketing rather than training. The lack of genuine educational support indicates that the platform is not invested in helping users become informed traders.

User Complaints and Negative Experiences

A large number of user testimonials describe similar issues:

-

Difficulty withdrawing funds

-

Pressure to deposit more

-

Lack of transparent information

-

Poor communication

-

Suspicious trading results

-

Account managers becoming hostile or unresponsive

These recurring patterns paint a concerning picture of a platform that may be engaging in unethical practices. When user experiences consistently point to a lack of trustworthiness, it is wise to consider them seriously.

Final Verdict: Is Marketscube.com a Scam?

Based on the findings in this review, Marketscube.com displays numerous red flags associated with fraudulent trading platforms. These include:

-

No verifiable regulation

-

Anonymous ownership

-

Unrealistic profit claims

-

Lack of transparency

-

Complex, delayed withdrawals

-

High-pressure sales tactics

-

Poor customer support

-

Negative user experiences

All these factors combined suggest that Marketscube.com operates in a highly suspicious manner and poses a significant risk to anyone considering investing through the platform.

Investors are strongly advised to be cautious with platforms that do not operate transparently or ethically. Choosing regulated, reputable brokers is always the safest approach when participating in online trading.

Report. Marketscube.com And Recover Your Funds

-

If you have lost money to marketscube.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like marketscube.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.