Bit-Vex Warning: Risks and Red Flags

The world of online trading and cryptocurrency attracts thousands of hopeful investors — drawn by promises of fast gains, easy sign-ups, and slick user interfaces. But not all that glitters online is gold. Platforms that tout big returns and effortless investing can, in some cases, hide serious risks. Bit-Vex.com is raising red flags for many industry watchers and users alike. In this review, we examine the evidence, highlight warning signs, and explain why Bit-Vex may pose a high risk. This is an objective, inclusive analysis to help readers make informed decisions.

What is Bit-Vex?

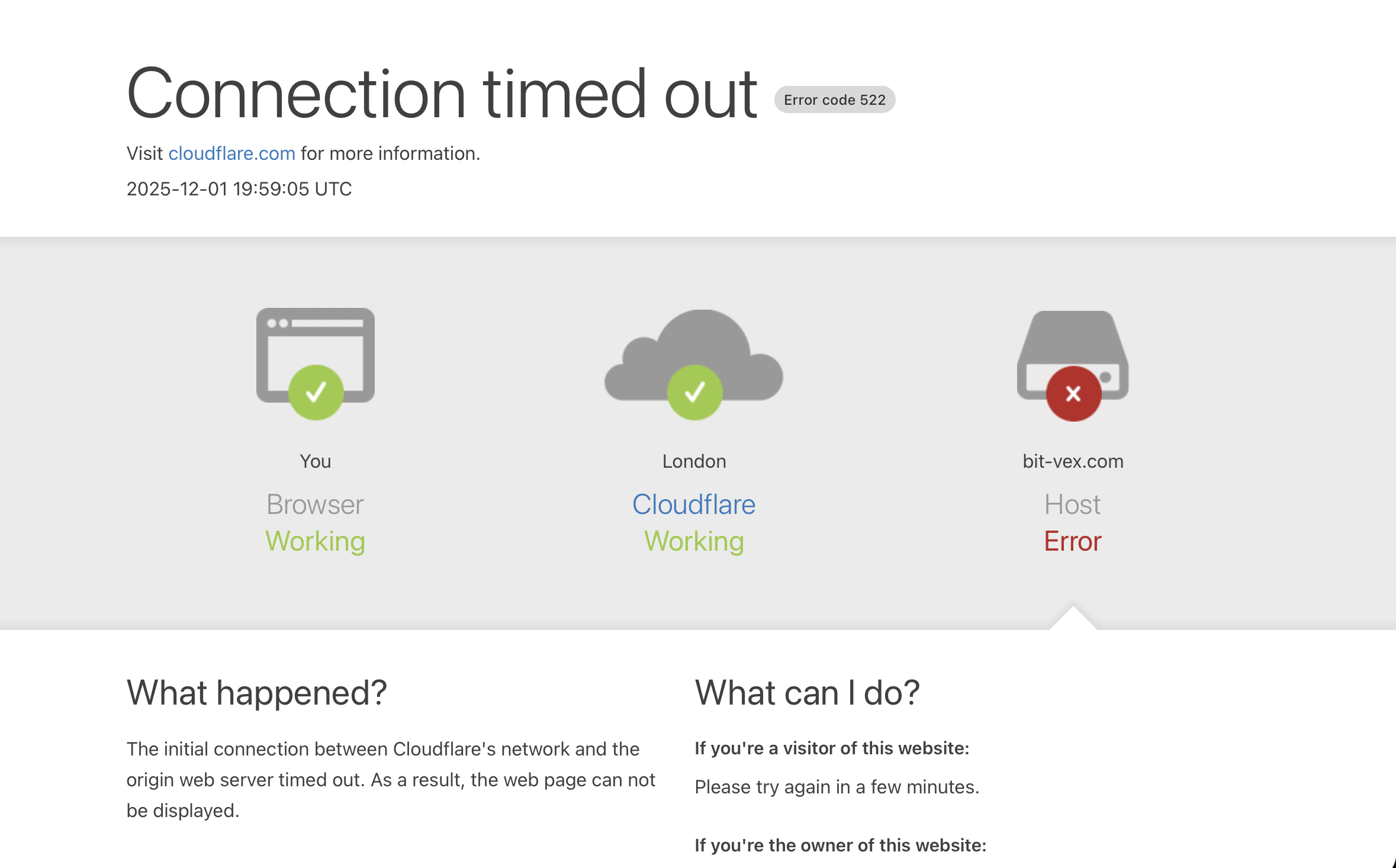

Bit-Vex markets itself as an online trading and crypto-asset platform. On the surface, it offers features commonly associated with legitimate brokers: trading dashboards, promises of profit, and user-friendly interfaces. For many visitors, the polished design and aggressive marketing can give the impression of a professional, trustworthy service.

However — as multiple reviews, watchdog reports, and regulatory alerts suggest — Bit-Vex fails to meet many of the core standards one should expect from a legitimate financial or crypto broker. The structure, behaviour, and public track record of Bit-Vex resemble those of platforms classified as fraudulent.

🚩 Major Red Flags: Why Bit-Vex.com Raises Strong Warnings

1. Lack of Proper Regulation and Oversight

A foundational test for any legitimate broker or crypto platform is whether it operates under recognized regulation. Regulated platforms are bound by rules that help protect clients — from fund security to transparent practices. Investing.com+2Dukascopy+2

By contrast, Bit-Vex is widely reported as unregulated, lacking any credible registration with financial authorities. Many analysts and review platforms explicitly state that this alone is “a major red flag.” Personal Reviews+1

Operating without regulatory oversight means there’s little guarantee that funds are held securely — or that users have any legal protection if things go wrong. EBC Financial Group+1

2. Hidden or Untrustworthy Company Information

Legitimate brokers typically offer transparent information: registered address, real contact information, disclosures of ownership or management, and easily verifiable credentials. International Adviser+1

Bit-Vex, however, reportedly fails this test. Reviews note a lack of verifiable company address, disconnected contact numbers, and no credible public corporate structure. ScamGuard™+1

When a platform hides basic corporate information, it’s a strong indicator that accountability is unlikely — exactly what fraudsters rely on to avoid detection.

3. Very Recent Launch, Poor Reputation, and Fake Reviews

Part of assessing a broker’s legitimacy is checking how long it has existed, what its track record is, and how real users rate it. According to one independent review website, Bit-Vex was flagged as suspicious shortly after launch: reportedly labeled fraudulent just 65 days into operation. ScamGuard™

Moreover, reviews are extremely sparse: few real user testimonials, little presence on social media — and many of the “positive” reviews are considered suspicious or fabricated. ScamGuard™+1

These factors erode any trust that a newcomer might place in the platform based simply on its marketing presence.

4. Unrealistic Promises and Guaranteed Returns

A classic hallmark of scam investment or trading platforms is the promise of big returns with little risk. This rarely reflects reality, especially in volatile markets like crypto or forex. Investopedia+2jmw.co.uk+2

Bit-Vex has been accused of using exactly that tactic — advertising high returns on deposits, guaranteeing profits, or promoting “get-rich-quick” opportunities that defy typical market behavior. Personal Reviews+1

When a platform promises guaranteed or unusually high returns, that’s a strong signal to approach with extreme caution.

5. Reported Withdrawal Issues and Unresponsive Support

One of the most common complaints against platforms like Bit-Vex involves withdrawals — especially difficulties when users try to cash out. Reports suggest that once deposits are made and “profits” are shown, withdrawal requests are met with delays, unexplained obstacles, or even refusal, and support becomes unresponsive. Personal Reviews+2ScamGuard™+2

This pattern — lure with profits, block exit when cashing out — is a commonly documented modus operandi of fraudulent brokers. EBC Financial Group+2BrokerChooser+2

6. High-Pressure Marketing, Aggressive Outreach & Manipulative Tactics

Fraudulent platforms frequently rely on psychological pressure: urging people to deposit more, promising “limited-time offers,” or using aggressive outreach via cold calls, social media messages, or spam emails. primexbt.com+2BrokerChooser+2

Bit-Vex reportedly uses some of these tactics, offering bonuses, pushing automated trading tools, or encouraging rapid deposits — all signs consistent with scam-style operations. Personal Reviews+1

7. Use of Fake Endorsements, Deepfakes, or Misleading Claims

In one of the more disturbing tactics attributed to Bit-Vex in the past, scammers have used deep-fake videos of celebrity-figures promoting the platform — falsely implying that well-known personalities back Bit-Vex. heimdalsecurity.com+1

Such deceptive marketing aims to exploit trust and familiarity. It’s a cunning method to lure unsuspecting investors who may recognize a familiar face or name.

How Bit-Vex Mirrors Common Scam Patterns

Putting the above points together, Bit-Vex aligns closely with many typical markers of fraudulent or high-risk platforms:

-

Unregulated, no oversight

-

Hidden company and contact information

-

New domain / short operational history

-

Sparse or suspicious reviews and lack of social proof

-

Promises of guaranteed or unrealistic profits

-

Withdrawal issues and unresponsive support

-

High-pressure marketing and aggressive sales tactics

-

Use of fake endorsements or manipulated media

These patterns are widely cited by regulators, consumer-protection bodies, and cybersecurity experts as indicators of scam brokers — especially in forex, CFD, or crypto domains. Dukascopy+2Investing.com+2

For many analysts, ticking multiple of these boxes almost always signals a high probability of fraud or loss — not legitimate trading.

Why Platforms Like Bit-Vex Keep Preying on People — And How They Exploit Hope and Trust

Even though the warning signs are many, scam platforms remain dangerous — and effective — for several reasons:

-

Professional appearance: A well-designed website, slick marketing materials, and a “modern” user interface can create an illusion of credibility — especially for less experienced investors.

-

Emotional triggers: Fear of missing out (FOMO), desire for quick profits, dreams of financial security — these emotions make people more vulnerable to persuasive messages.

-

Lack of regulatory knowledge: Many prospective investors don’t know how to verify licenses or check a broker’s regulatory status, making them susceptible to deception.

-

Social proof exploit: Fake reviews, fake testimonials, and deep-faked celebrity endorsements create an echo chamber of supposed trust.

-

Ease of deposit, difficulty of withdrawal: Collecting funds is easy (often via crypto or wire transfer), but retrieving them becomes nearly impossible — giving scammers time to vanish.

These dynamics make scam platforms like Bit-Vex appealing to a broad audience — while almost guaranteeing harm to those who deposit.

Key Lessons for Anyone Considering an Online Trading Platform

From the analysis of Bit-Vex and similar cases, a few core lessons stand out. These can act as a checklist for anyone evaluating a broker or trading platform — whether crypto, forex, or CFDs:

-

Verify regulation and licensing rigorously. Never trust a platform unless you can confirm its registration with a reputable regulatory body. Investing.com+1

-

Demand transparency about company details. Real brokers provide verifiable contact info, corporate registration, and physical addresses. Hidden ownership is a major red flag. International Adviser+1

-

Be skeptical of big promises and guarantees. No legitimate investment — especially in volatile markets — can guarantee profits without risk. jmw.co.uk+2Investopedia+2

-

Test withdrawals before trusting with large funds. If withdrawals are difficult, delayed or denied — that’s a clear sign of serious risk. Avatrade+1

-

Avoid pressure tactics and unsolicited offers. Cold-calls, “special offers,” or urgent deposit requests are common scam strategies. primexbt.com+1

-

Check online reputation — beyond the platform’s own website. Look for independent reviews, complaints, regulatory warnings, or watchdog reports. Genuine platforms have transparency and verifiable history. Personal Reviews+2BrokerChooser+2

-

Treat celebrity endorsements and influencer claims with extreme caution. Scammers increasingly rely on manipulated media and deep-fakes to create false legitimacy. heimdalsecurity.com+2BleepingComputer+2

Applying these checks consistently can save individuals from falling victim to suspicious platforms — especially those that promise easy gains with little transparency.

Broader Warning: Why Crypto & Forex Markets Are Attractive to Scammers — And What That Means for Investors

Markets like forex, CFDs, and cryptocurrencies inherently carry risk — volatility, leverage, rapid price changes, and technical complexity. This environment makes them fertile ground for manipulative schemes. Many fraudulent platforms take advantage of:

-

Global reach and cross-border anonymity — making enforcement difficult.

-

Technical complexity and lack of investor knowledge — giving scammers cover behind jargon and fake “algorithms.”

-

Ease of anonymous payment methods (e.g. crypto wallets, wire transfers) — making it hard to trace funds once they vanish. GetSmarterAboutMoney.ca+1

-

Limited regulation in some jurisdictions — or outright lack of oversight for many crypto platforms.CFTC+2FCA+2

This systemic vulnerability means that every time you see a “new opportunity” online — with promises of high returns and low transparency — you should treat it with healthy skepticism. The burden of proof lies with the platform to show credible regulation, clear company information, transparent execution, and verifiable histories.

Final Verdict: Bit-Vex.com — High Risk, Very Suspicious, Likely Fraudulent

Based on the publicly available evidence, user reports, expert analyses, and common-sense evaluation against known scam patterns — Bit-Vex.com appears to match many of the features typical of a scam broker or crypto fraud operation. Its lack of regulation, opaque structure, history of negative or missing reviews, withdrawal complaints, and use of aggressive marketing and deceptive promotions all point strongly toward high risk.

For anyone researching Bit-Vex or similar platforms, the safest assumption should be skepticism. If even one of the major red flags — lack of regulation, refusal to provide verifiable company data, unrealistic guarantees — exists, the risk to your capital is significant.

For these reasons, Bit-Vex should be treated not as a legitimate broker, but as a warning example: a cautionary tale about how easily polished marketing hides dangerous operations.

Report bit-vex.com And Recover Your Funds

If you have lost money to bit-vex.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like bit-vex.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.