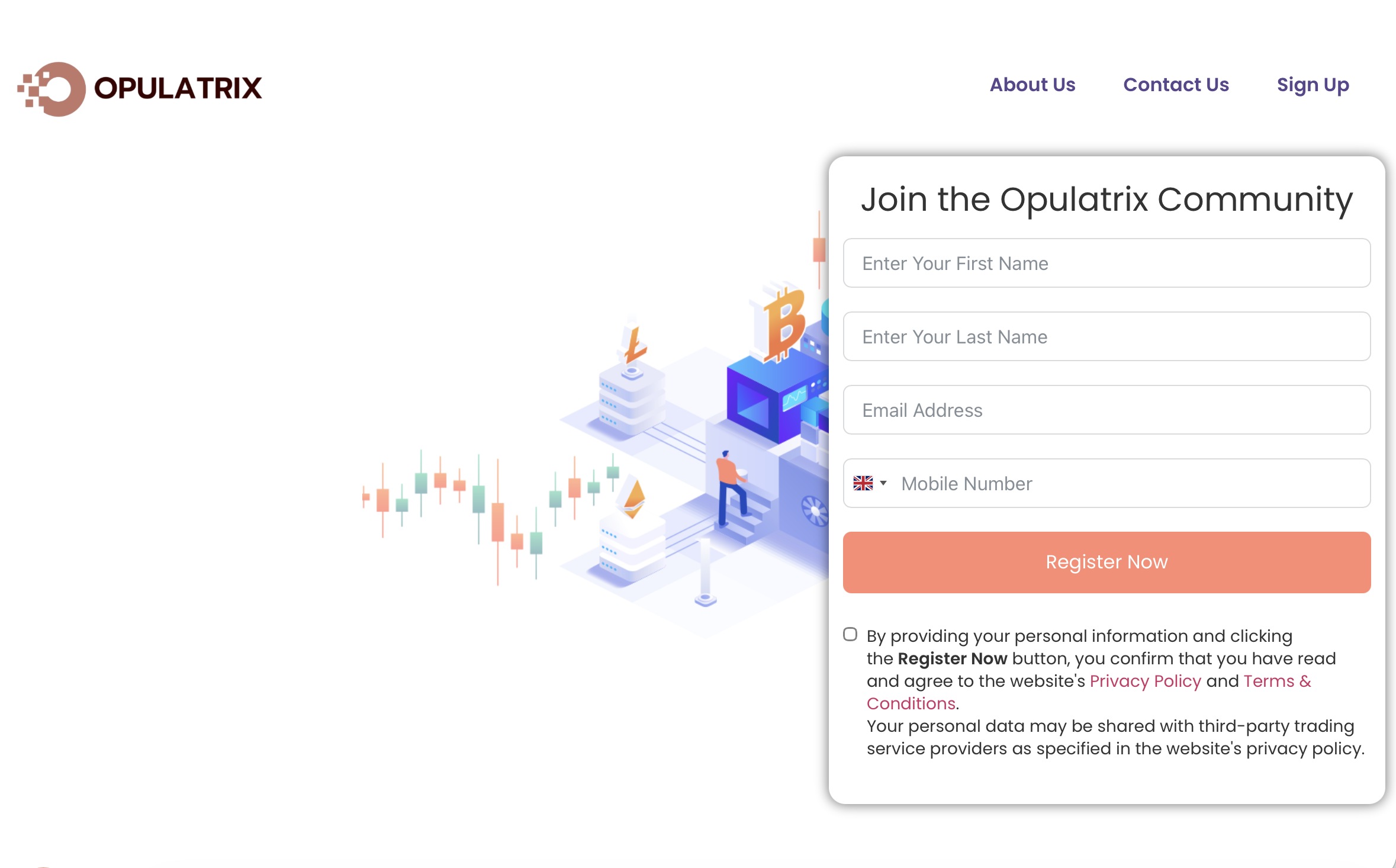

Opulatrix.co.uk Review: What You Should Know

Introduction

Opulatrix presents itself as an online investment/trading platform, offering services such as forex, commodities, crypto or other high-yield asset trading. On the surface, it may look polished and modern — with promises of profit, easy access, and attractive returns. But when you peer beneath the façade, Opulatrix exhibits many of the hallmarks common to risky or outright scam platforms.

This review outlines critical red flags, suspicious structures, and typical scam-style behaviors associated with Opulatrix. Whether you are an experienced investor or new to online trading, the objective is to provide clear, accessible information so you — and your readers — can recognise potential threats and avoid harmful financial exposures.

What Opulatrix Claims to Offer

Based on its marketing and advertised services, Opulatrix appears to promise:

-

Access to trading in assets like forex, commodities, crypto or other “high-reward” markets

-

Simplified account setup and user-friendly trading interface

-

Promises of high returns and quick profits

-

Ease of deposit and potential for rapid growth

For many people seeking financial growth or an extra income stream, such offers may seem appealing — especially if they lack deep experience or if the platform seems polished. But legitimate investing always involves risk, transparency, and regulation. When those fundamentals are missing or unclear, risk dramatically increases.

Major Red Flags & Risk Indicators

After analysing common fraud-prevention criteria and reported observations, the following are the major warning signs with Opulatrix.

1. No Reliable Proof of Regulation or Licensing

A foundational element of any legitimate investment platform is registration or regulation by a recognised regulatory authority. Regulated firms are subject to oversight, compliance, accountability, and certain safeguards for clients. FCA+2expertsforexpats.com+2

Opulatrix — like many high-risk platforms — does not provide verifiable regulatory credentials or licensing information. This lack of oversight means there’s no formal protection or transparency about how the platform operates or handles your funds.

2. Unclear, Incomplete or Hidden Company Information

Trustworthy financial services openly share their corporate identity — including registered address, company name, leadership, and contact details. Transparent documentation is critical. Investopedia+2expertsforexpats.com+2

With Opulatrix, publicly available information about its ownership or physical address is vague or missing. This opacity makes it nearly impossible for an independent investor to verify who runs the platform or where the funds go.

3. Promises of High, Guaranteed Returns with Low Risk

One of the most common tactics used by scam platforms is offering high returns, often described as “guaranteed,” with little or no risk. Real investing — whether forex, commodities, crypto, or stocks — always carries risk, volatility, and uncertainty. competition-bureau.canada.ca+2Consumer Advice+2

If Opulatrix markets itself with assurances of steady profits, quick riches, or minimal downside, that alone is a strong red flag.

4. Pressure or Urgency to Invest Quickly

Scam platforms frequently use urgency and pressure tactics. They might push potential investors to deposit quickly, claim limited availability, or promise that “everyone else is investing.” These sales‐pressure techniques aim to reduce the time people take to think, research, or seek independent advice. GetSmarterAboutMoney.ca+2Action Fraud Claims Advice+2

If Opulatrix uses similar pressure-laden language or marketing — encouraging rapid deposit decisions — that’s a serious warning sign.

5. Glossy Website Design, But Substance Lacking

Many fraudulent investment schemes rely on slick, professional-looking websites, dashboards, and fancy graphics to create an illusion of legitimacy. But good design is cosmetic; it doesn’t replace transparency, regulation, or real operational history. International Adviser+2netcraft.com+2

Although Opulatrix might appear modern and polished, that aesthetic alone means nothing if critical structural and regulatory elements are missing.

6. High-Risk Nature of the Offered Services

The types of investments that Opulatrix promotes — such as forex, crypto, commodities, or high-yield schemes — inherently carry elevated risk. Regulators and financial-fraud watchdogs consistently warn that platforms offering high-reward, high-risk investments must be approached carefully. ScamAdviser+2Investopedia+2

When high-risk services are combined with unclear licensing and opaque company information, the danger becomes significantly greater.

Typical Scam Structure: How Platforms Like Opulatrix Often Work

Based on patterns documented by regulatory advisories and fraud investigators, many platforms similar to Opulatrix follow a familiar scams structure:

-

Attraction & Marketing — They advertise easy money, quick gains, and sometimes “exclusive” opportunities to lure interest.

-

Low Barrier to Entry — Account signup is simple, deposit methods are easy, and initial deposits may seem small.

-

Initial Simulated Returns — Early or small deposits may yield apparent profits (often not based on real trades) to build trust and encourage more investment.

-

Aggressive Upselling or Pressure — Users are encouraged to deposit more funds or “unlock” higher returns by upgrading accounts or investing more.

-

Lack of Transparency & No Independent Verification — Ownership, regulatory status, and fund handling remain hidden.

-

Complicated or Blocked Withdrawals — When investors seek to withdraw their funds, they may be met with delays, sudden fees, unverifiable hurdles, or outright refusal (a recurring pattern in many scam reports). Investopedia+2FCA+2

-

Eventual Disappearance or Collapse — At some point, the platform may shut down, change domain names, or become unresponsive — leaving investors unable to access their funds.

This structure is similar to what regulators classify as fraudulent schemes, including “high-yield investment programs (HYIPs)” or unregulated trading operations masquerading as legitimate brokers. Wikipedia+2Wikipedia+2

Why Opulatrix Presents Particular Danger — Not Just to Novices

While many people associate scams with naive, inexperienced investors, the truth is more complex. Even experienced or savvy investors can fall prey — especially when platforms use polished marketing, complex financial jargon, or promises of cutting-edge trading tools.

Here’s why Opulatrix is particularly risky:

-

No regulatory safety net — Without oversight, there’s no guarantee your funds are protected or handled ethically.

-

Opaque corporate structure — If you can’t verify who runs the company, you can’t hold anyone accountable.

-

High-risk products with unclear risk disclosure — Assets like crypto or forex are volatile; hiding the risk or overstating returns misleads investors.

-

Psychological leverage & social engineering — Pressure, urgency, and fear of missing out can override rational assessment and due diligence.

-

Possibility of total loss — Given all the red flags, there’s a real chance deposits may just vanish — or become nearly impossible to retrieve.

Scams exploit human hope, trust, and desire for quick financial improvement. Opulatrix seems designed to leverage exactly those vulnerabilities.

Broader Context — Why Platforms Like Opulatrix Keep Appearing

The rise of internet-based investing and digital assets has lowered entry barriers significantly. This creates fertile ground for scammers who can cheaply build professionally designed websites, set up trendy dashboards, and aggressively market to a global audience. netcraft.com+2McAfee+2

Economic uncertainty, social media influence, and fascination with “get-rich-quick” schemes further fuel demand — making people more vulnerable to promises of high returns and minimal effort. Scammers exploit these dynamics by blending design sophistication with misleading claims.

Because of this, fraudulent platforms have evolved to become more convincing, more persuasive, and harder to distinguish from legitimate services. That’s why awareness, education, and due diligence are vital for anyone considering online investing.

Key Takeaways — What You Should Always Do Before Investing

| ✅ What to Do / Check | ⚠️ Why It Matters / Risk If You Don’t |

|---|---|

| Verify regulation or licensing | Unregulated platforms offer no legal protection or oversight |

| Check corporate identity, address, ownership info | You must know who you’re dealing with — opaque structures hide fraud risk |

| Be sceptical of “guaranteed profits” or “risk-free” returns | Real investments always carry risk; guarantees are a common scam tactic |

| Avoid pressure-based or time-limited investment pitches | Urgency undermines thoughtful decision-making and due diligence |

| Demand transparent withdrawal and fund handling policies | Without clarity, funds may become inaccessible or misused |

| Treat polished design, testimonials, and marketing claims as cosmetic | Appearance alone doesn’t prove legitimacy — substance matters |

| Understand risk and volatility of high-yield products (crypto/forex) | High-reward markets can lead to high losses, especially if unmanaged |

If any of these checks fail or feel suspicious, it’s usually better to step away — even if the offer seems tempting.

Final Verdict: Opulatrix Is Highly Risky — Approach with Extreme Caution

Based on the evidence and structural analysis, Opulatrix fails to meet fundamental standards of a legitimate investment or trading platform. Its lack of regulation, absence of transparent company information, high-risk marketing promises, and alignment with common scam-structure patterns place it firmly in the “high-risk / likely fraudulent” category.

Whether you are an experienced investor or new to the world of finance, Opulatrix does not meet the criteria for a responsible, trustworthy investment service. Its risks far outweigh any potential benefit — and betting on such a platform is more like gambling than investing.

If you are seeking genuine, reliable investment opportunities, prioritise transparency, regulation, solid track records, and reputable reviews — not flashy websites and high-risk promises.

Stay informed, stay cautious, and treat any offer that seems “too good to be true” as a serious warning sign.

Report Opulatrix And Recover Your Funds

If you have lost money to Opulatrix, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Opulatrix continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.