PayCoin Review – What You Need to Know Before Getting Involve

The cryptocurrency space is full of innovation, yet it also attracts countless questionable projects that take advantage of inexperienced investors. PayCoin is one of those names that repeatedly resurfaces in discussions about controversial or deceptive crypto schemes. Although it has appeared in different forms over the years, many users continue to associate it with misleading promises, unstable platforms, and suspicious financial practices. This review explores PayCoin in detail, and it explains why investors should be cautious when dealing with anything related to the project.

Understanding What PayCoin Claims to Be

PayCoin originally entered the crypto landscape as a digital currency promising convenience, fast transactions, and high potential returns. It was presented as a modern alternative to established cryptocurrencies, and it attempted to attract users by offering unusually high incentives. However, as time passed, several red flags began to emerge. These warning signs quickly overshadowed the initial hype, and investors started questioning the project’s authenticity.

While some crypto tokens fail due to poor management or lack of adoption, PayCoin’s issues stem from deeper structural problems. Many of its promises appeared unrealistic from the beginning, and its operations raised doubts among analysts and users alike. As a result, PayCoin gathered a reputation that still follows it today, despite attempts to rebrand or reposition itself.

Unrealistic Claims and High-Risk Promises

One of the most concerning elements of PayCoin is how aggressively it markets itself to new investors. The project often highlights the possibility of quick financial gains, yet it provides little evidence to support these claims. When a crypto platform focuses more on hype than on transparent technology or business models, investors should proceed with extreme caution.

For example, PayCoin once promoted the idea that its value would remain stable due to a special reserve mechanism. In theory, this setup was meant to prevent major price crashes. In reality, such a system requires massive financial backing and constant liquidity — neither of which PayCoin demonstrated. As more users recognized the inconsistency between the promises and the actual market behavior, trust began to deteriorate rapidly.

Moreover, bonus offers, referral rewards, and guaranteed returns also contributed to investor skepticism. Since legitimate cryptocurrencies cannot promise fixed profits, these kinds of claims often signal hidden risks or manipulative strategies. Because PayCoin repeatedly pushed these incentives, it eventually positioned itself as a project that prioritized marketing over real innovation.

Lack of Transparency in Operations

Another major issue surrounding PayCoin is the lack of clear information about the people behind the project. Transparency is essential in the crypto industry, especially when a platform handles investor funds. However, PayCoin’s leadership, operational structure, and financial management were frequently ambiguous. As a result, potential investors could not verify who controlled the token or how it was being managed.

Furthermore, the platform rarely provided verifiable technical documentation. Because of that, users were left guessing whether the token had genuine utility or if it relied solely on speculative trading. Although some projects evolve and improve over time, PayCoin did not make significant progress in addressing these concerns. Instead, it allowed uncertainty to surround nearly every part of its operations.

This pattern of behavior is especially concerning, since many scam-prone projects avoid transparency to conceal misconduct or instability. Even though not every opaque project is fraudulent, the lack of clarity makes it far easier for deceptive practices to occur. Consequently, many crypto communities now consider transparency a fundamental requirement, one that PayCoin has consistently failed to meet.

Complaints From Users

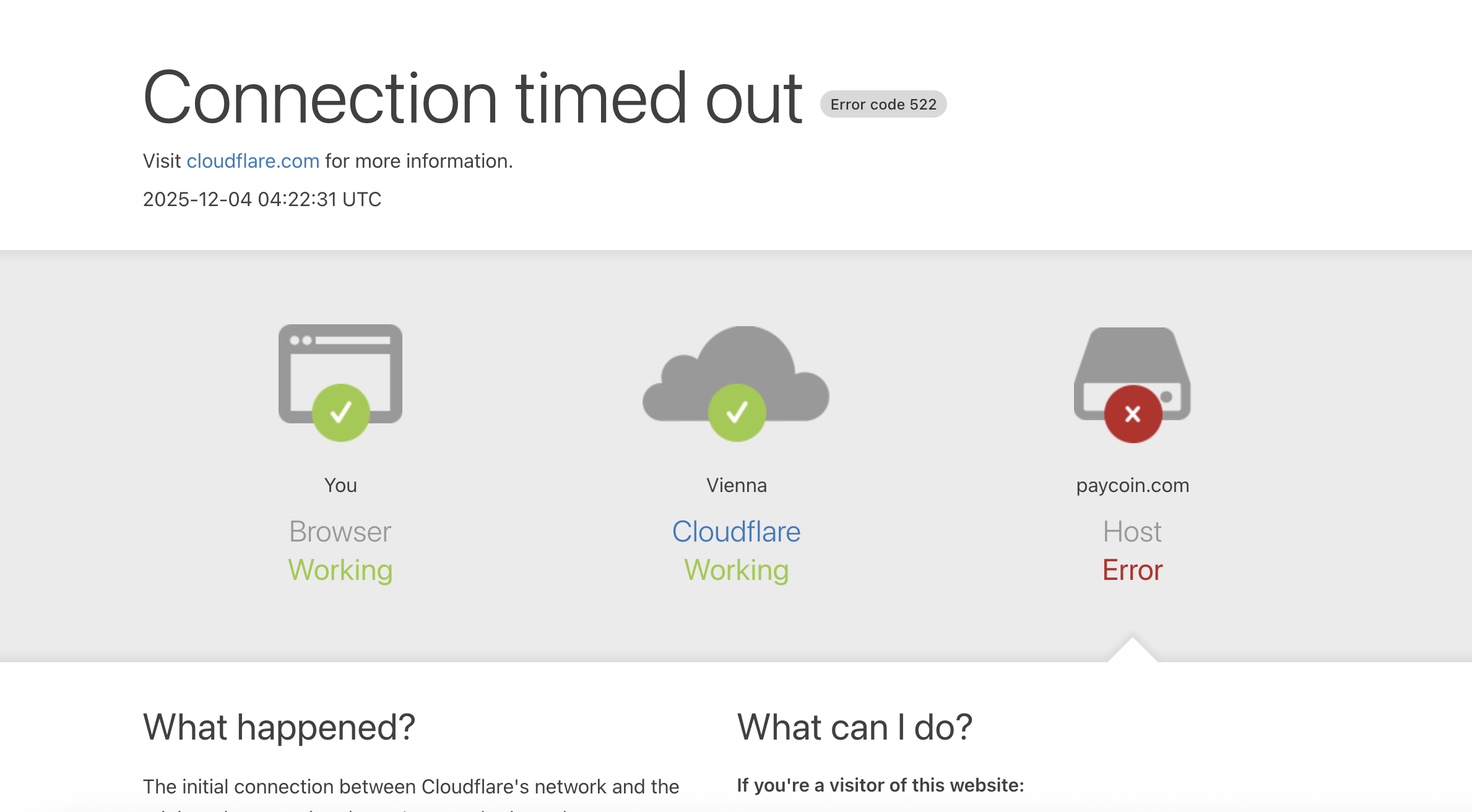

In addition to unclear operations, PayCoin has also accumulated numerous complaints from users across various platforms. These grievances typically revolve around issues such as withdrawal delays, unexpected fees, or sudden account restrictions. Since legitimate platforms usually maintain reliable support systems, the consistent appearance of these problems raises serious doubts.

Users have also reported price manipulation, unstable returns, and misleading marketing messages. Whenever a project repeatedly disappoints investors, it becomes difficult for it to regain trust. Because PayCoin did not address these concerns effectively, frustration continued to grow. Eventually, the negative feedback became a defining part of its reputation.

Another common issue involves misleading information about how PayCoin could supposedly generate returns. Some users claimed they were encouraged to believe the token would rise significantly in value, yet no supporting evidence was provided. As these unrealistic expectations failed to materialize, investors felt deceived, further damaging the token’s credibility.

A History of Controversy

Unlike many small crypto projects that quietly fade from the market, PayCoin has remained in the spotlight due to repeated controversy. Over time, its name became associated with questionable business practices, failed commitments, and inconsistent performance. Although the project attempted to reinvent itself at different points, the controversies never fully disappeared.

This history matters because investors typically evaluate crypto projects based on long-term trust. When a coin is connected to repeated issues, even new versions or rebranding attempts struggle to escape the past. Therefore, PayCoin’s legacy continues to influence how the market views it today.

Additionally, some of the individuals linked to earlier PayCoin iterations have also been connected to other problematic ventures. Although this alone does not prove wrongdoing, it reinforces concerns about the project’s reliability. As a result, investors generally choose to avoid platforms with inconsistent leadership or questionable past behavior.

Marketing Tactics That Target New Investors

Scam-prone crypto projects often target inexperienced traders, and PayCoin has used similar tactics. Its website and promotional content have frequently emphasized potential profits while downplaying risks. By presenting an overly optimistic image, the project attracts individuals who may not thoroughly research it before committing funds.

Furthermore, referral programs, community hype, and promises of future growth contribute to the illusion of legitimacy. When combined with vague or exaggerated claims, these strategies create an environment where new users may feel pressured into joining quickly. Because time pressure is a common technique in financial scams, this pattern adds to investor concerns.

In a legitimate cryptocurrency project, growth occurs through solid fundamentals. However, PayCoin often relied on emotional persuasion rather than technical innovation. This approach not only misleads users but also makes long-term sustainability unlikely.

Technical Limitations and Lack of Innovation

Beyond the marketing claims and controversies, PayCoin suffers from deeper technical issues. Successful crypto projects typically provide clear documentation, active developer communities, and reliable updates. PayCoin, however, has offered little evidence of continuous development or meaningful improvements.

Since technology evolves rapidly, stagnant platforms inevitably fall behind. Additionally, PayCoin’s failure to clearly explain its underlying blockchain or tokenomics raises further concerns. Investors need to understand how a token functions before committing funds, yet PayCoin’s documentation has consistently been incomplete.

Another problem involves security. Without transparent auditing, it is difficult to verify whether the project is safe from vulnerabilities. In the crypto space, platforms that lack verified security protocols often expose users to unnecessary risks. PayCoin’s lack of technical clarity therefore adds yet another reason for investors to remain skeptical.

Red Flags Investors Should Look Out For

While reviewing PayCoin, several red flags stand out:

-

Unrealistic promises of guaranteed or unusually high returns

-

Lack of transparency about founders and operations

-

Numerous user complaints regarding withdrawals or support

-

Weak or unclear technical documentation

-

Aggressive marketing tactics that target new investors

-

Repeated controversies surrounding earlier versions of the project

When multiple warning signs appear together, investors should be extremely cautious. Although the crypto market always carries risk, certain projects exhibit patterns that significantly increase the possibility of deceptive behavior.

Conclusion: Why PayCoin Remains a Risky Project

After examining PayCoin from multiple angles, it becomes clear why the project has developed such a negative reputation. Its unrealistic promises, history of controversy, lack of transparency, and persistent user complaints all contribute to the conclusion that PayCoin is not a trustworthy investment.

In addition, the absence of meaningful development or documentation makes it difficult to view the project as anything more than a high-risk undertaking. While some crypto projects recover from early issues, PayCoin has shown little improvement over time. Because of this, investors are better off focusing on platforms with verifiable information, transparent teams, and strong long-term potential.

Report. PayCoin And Recover Your Funds

-

If you have lost money to payCoin, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like payCoin continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.