Payincome.io Review – Exposing Red Flags Behind the Platform

The online investment space has grown rapidly, and with that growth comes a flood of questionable platforms promising unrealistic profits. One such platform is Payincome.io, a site that markets itself as a high-return opportunity for anyone looking to grow their money quickly. Although its marketing language may seem convincing, a closer look suggests that the risks far outweigh the potential rewards. This review carefully examines Payincome.io, highlighting the major concerns, user complaints, operational issues, and red flags that point toward a highly suspicious platform.

Introduction to Payincome.io

Payincome.io presents itself as a simple and profitable investment platform, offering returns that appear effortless. At first glance, the homepage is filled with phrases like “instant income,” “guaranteed profits,” and “zero risk.” Additionally, the website claims to use advanced trading strategies and automated tools capable of generating consistent gains for users. However, as soon as you begin analyzing the platform’s structure, many inconsistencies become apparent. These inconsistencies quickly raise doubts about the legitimacy of Payincome.io.

For instance, the website provides little information about the company’s location, leadership team, or regulatory standing. Instead, the language used feels generic and manufactured, which is often a warning sign of a platform that is more focused on attracting deposits than providing genuine services.

Unrealistic Profit Claims

One of the most concerning aspects of Payincome.io is its bold and unrealistic profit promises. The platform advertises daily returns that are far above what legitimate trading or investment services can offer. Although high profits can be appealing, consistently guaranteeing them is simply unrealistic.

Moreover, reputable financial firms openly acknowledge the risks involved in investing. Payincome.io, however, fails to address risk in any meaningful way. Instead, it repeatedly emphasizes “guaranteed earnings,” which is a signature tactic used to lure inexperienced investors. Because legitimate investment platforms never guarantee fixed profits, this alone should prompt users to proceed with extreme caution.

Lack of Company Transparency

As you dig deeper into the platform, another major issue becomes clear: a complete lack of transparency. The company behind Payincome.io provides no verifiable details about its owners, founders, or corporate headquarters. Additionally, the website does not offer any business registration information or regulatory licenses.

This matters significantly because online investment platforms must comply with financial regulations to operate legally. When a platform cannot provide proof of licensing or oversight, it means there is no accountability. Consequently, investors have no protection if something goes wrong.

Furthermore, the platform uses stock photos to represent its “team,” which strongly suggests that the individuals shown are not real employees. When combined with vague descriptions and fabricated credentials, this further undermines the site’s credibility.

Suspicious Payment and Withdrawal System

Although Payincome.io encourages users to deposit money quickly, withdrawing funds appears to be a completely different experience. Many users have reported that as soon as they request a payout, unexpected fees, account freezes, or verification delays occur. These obstacles are deliberately designed to discourage withdrawals and pressure users into depositing even more.

For example, some investors claim that the platform requests additional deposits before releasing their earnings. Others mention that support representatives stop responding as soon as withdrawal questions arise. While many platforms process transactions within a reasonable timeframe, Payincome.io’s pattern of delays and excuses suggests that the system is structured to retain user funds rather than return them.

Because legitimate platforms operate on clear and predictable processes, these kinds of inconsistencies are a major red flag.

Generic and Recycled Website Design

Another indicator of suspicious activity is the website design itself. Although it appears visually appealing at first, many portions of the site contain generic and repetitive content. Even worse, sections of the text appear to be copied from other unreliable investment sites.

This copy-and-paste style is common among platforms that operate briefly, collect deposits, and then disappear. Instead of providing genuinely useful information, they rely on templates designed to look professional without offering any substance. Furthermore, the website’s terms and conditions are vague, poorly written, and lack clear legal details, which is often a deliberate choice to reduce liability.

Fake Reviews and Social Proof

To make the platform appear more trustworthy, Payincome.io includes numerous fake testimonials across its pages. These “reviews” often contain identical writing styles, exaggerated claims, and stock photos. Additionally, most of the testimonials avoid mentioning specific details about the platform’s operations or features. This is a common strategy used by deceptive services to build artificial trust.

Meanwhile, independent discussions and user feedback found outside the platform paint a very different picture. Many individuals mention lost funds, stalled withdrawals, and poor communication from the support team. When outside reviews consistently contradict the testimonials on the website, it becomes clear that the platform’s social proof cannot be trusted.

High-Pressure Sales Tactics

Payincome.io also relies heavily on high-pressure tactics to convince users to deposit funds. For example, the website frequently mentions limited-time offers or “bonus opportunities” that disappear after a short period. Although these countdowns appear urgent, they often reset automatically, revealing that the pressure is manufactured.

Additionally, some users report receiving direct messages from platform representatives encouraging them to upgrade their accounts or increase their investment. These representatives often use emotional persuasion, promising users that “bigger deposits lead to bigger earnings.” This type of behavior is typical of platforms designed to extract as much money as possible before shutting down.

No Evidence of Real Trading Activity

Although Payincome.io claims to use advanced trading algorithms, there is no evidence of actual trading taking place. The platform fails to show live trade records, financial audits, third-party verification, or any proof that trades are executed on real markets.

Because of this lack of transparency, it becomes difficult to believe that the platform generates profits through legitimate financial activities. Instead, its model resembles that of a high-yield investment scam, which relies on new deposits rather than real trading.

Poor Customer Support

While the platform promotes responsive customer support, user experiences tell another story. Many individuals state that support representatives are quick to respond before a deposit is made but almost completely absent afterward. As a result, users often feel abandoned as soon as they request withdrawals or ask challenging questions.

Poor communication is one of the most common warning signs of an unreliable platform, and Payincome.io clearly fits this pattern.

Final Thoughts on Payincome.io

After reviewing Payincome.io in detail, the conclusion is clear: the platform displays nearly every red flag associated with high-risk online investment scams. From unrealistic profit guarantees and a lack of transparency to withdrawal difficulties and fake testimonials, the evidence strongly suggests that users should approach this platform with extreme caution.

Although the site attempts to appear legitimate, its structure and behaviors reveal a business model that prioritizes collecting deposits over offering genuine financial services. Therefore, anyone considering an online investment platform should thoroughly research it, compare it to regulated alternatives, and always prioritize safety.

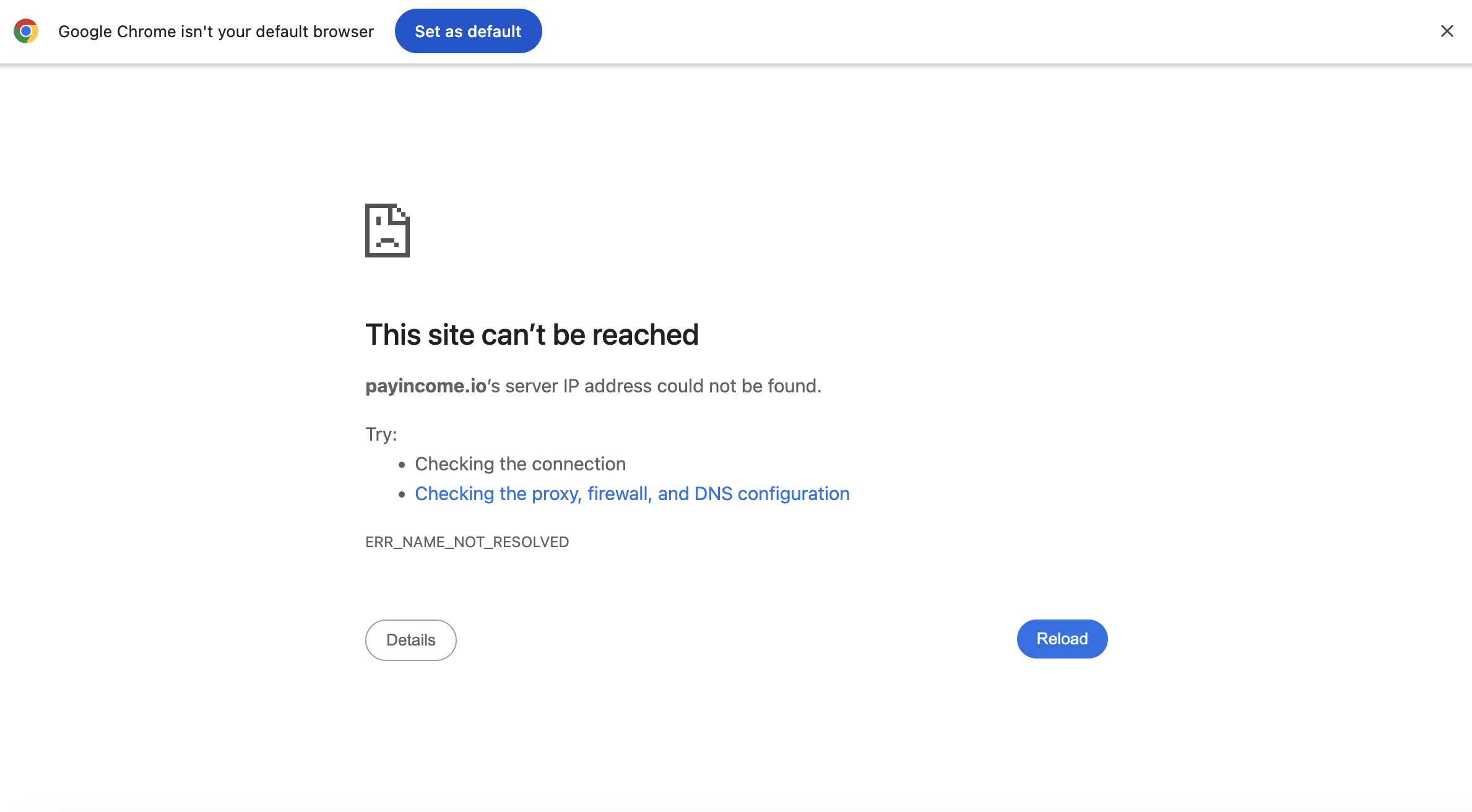

Report. Payincome.io And Recover Your Funds

-

If you have lost money to payincome.io, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like payincome.io continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.