Ponzicoin Explained – How This Crypto Scam Tricked Thousands

The world of cryptocurrency has always attracted innovators, investors, and unfortunately, opportunists who exploit newcomers through cleverly designed scams. Among the many suspicious projects that have emerged, Ponzicoin stands out as an example of how digital assets can be misused to create an illusion of profit while hiding a dangerous structure beneath. Despite its playful name, Ponzicoin has misled countless individuals who believed they were part of a unique opportunity. In this review, we explore how Ponzicoin operates, the red flags surrounding it, and the mistakes many victims never saw coming.

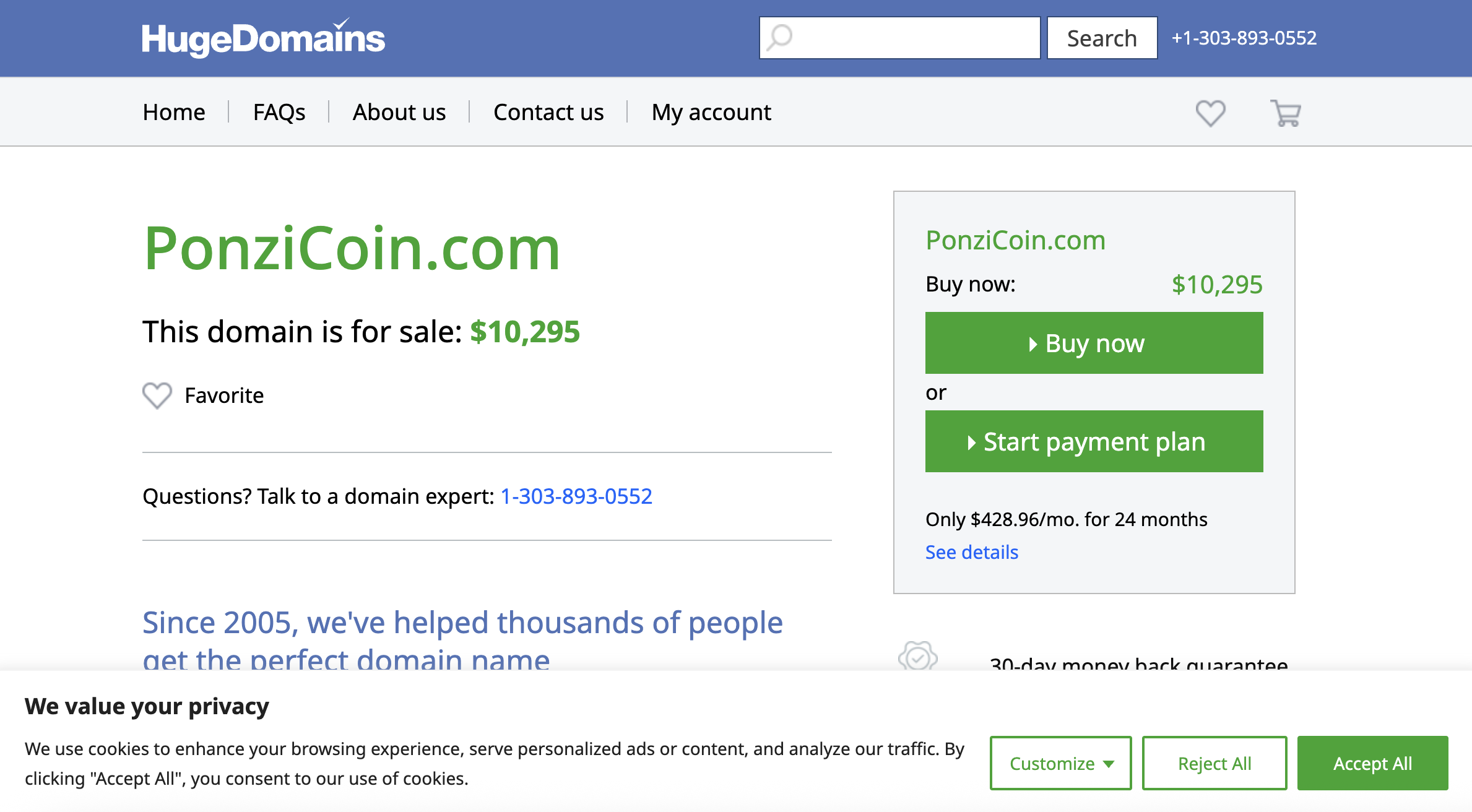

What Is Ponzicoin?

At first glance, Ponzicoin presents itself as a cryptocurrency project built on humor and simplicity. Its name openly references the infamous “Ponzi scheme” which should naturally raise concerns. Nevertheless, many users ignored this warning and joined the platform out of curiosity or the hope of easy returns. The project uses vague promises, unreliable mechanisms, and unrealistic return rates to entice individuals who may not understand the underlying risks.

While some crypto projects try to hide their true intentions, Ponzicoin takes a different approach by masking its structure behind playful branding. This strategy often lowers people’s defenses because they believe the developers are being transparent. However, transparency is meaningless if the structure itself is built on deception. As a result, many individuals discovered too late that the project collects funds without offering a genuine product or long-term plan.

How Ponzicoin Attracts Its Victims

A major part of Ponzicoin’s strategy is convincing investors that the platform’s simplicity is a sign of innovation. In addition, the project uses marketing tactics that make people feel like early participants in something revolutionary. This sense of exclusivity often pushes people to invest more quickly, especially when combined with promises of growth.

Moreover, Ponzicoin frequently emphasizes community involvement. It encourages users to spread the word and invite others, which is a classic indicator of a pyramid-style setup. Since returns supposedly increase as more individuals join, early participants feel motivated to recruit friends and colleagues. As a result, the project gains rapid traction without offering genuine value. Eventually, this structure becomes unsustainable as new investors stop joining.

Even though the platform’s name clearly signals its nature, individuals who lack investment experience often overlook such clues. The desire for quick income can overshadow rational thinking, especially when the project frames itself as harmless or humorous.

Red Flags Surrounding Ponzicoin

Identifying warning signs is essential in understanding why Ponzicoin is considered a scam. Here are the most significant concerns that stand out during an evaluation of the platform:

1. No Legitimate Use Case

Most authentic cryptocurrencies solve specific real-world problems or introduce technological advancements. In contrast, Ponzicoin offers nothing more than participation in a cycle of investment. The only way for early adopters to benefit is through funds contributed by newcomers. Since the project does not produce revenue or value, it cannot sustain long-term operations.

2. Highly Unrealistic Promises

Promises of fast or guaranteed returns are common in fraudulent schemes. Ponzicoin markets itself as a project where value increases simply because more people join. While this might seem appealing at first, such a setup is inherently flawed. Eventually, the flow of new participants slows down, causing the entire structure to collapse.

3. Anonymous Developers

Authentic cryptocurrency projects usually provide transparent information about the team behind them. Ponzicoin does not offer clear details about its founders, making accountability impossible. When developers hide their identities, it is often because they intend to disappear once funds are collected.

4. No Regulatory Oversight

The platform operates without proper registration or oversight from financial authorities. While many crypto projects are decentralized and independent, having no regulatory framework whatsoever increases the likelihood of misconduct.

5. Heavy Dependence on Recruitment

Any platform that encourages users to bring in more investors should automatically raise suspicion. This form of growth mirrors traditional Ponzi schemes, which rely on constant inflows to maintain the illusion of profit.

Why People Still Fall for Ponzicoin

Despite its obvious red flags, many individuals still invest in Ponzicoin. Human psychology plays a significant role in this behavior. Whenever a scheme highlights rapid growth or early success stories, potential investors feel a fear of missing out. This emotional response often leads them to ignore signals that would normally cause concern.

Additionally, the crypto industry itself is filled with legitimate projects that have grown rapidly in the past. Because of this, many people believe that any project with hype or momentum might be the next breakthrough. Scammers understand this and craft their strategies to imitate the success patterns of real projects.

Furthermore, Ponzicoin’s humorous branding makes it seem harmless. By giving the appearance of a joke, the platform distances itself from suspicion. However, scams do not always rely on fear or secrecy. Sometimes they hide behind humor, which can be even more effective.

What Happens to Investors Eventually

Almost all Ponzi-style structures follow the same pattern. At first, users appear to make profit as long as new participants join. Early investors may even receive small returns, which further strengthens their trust in the platform. Nevertheless, the illusion fades once growth slows down.

When fewer individuals enter the system, payouts stop, communication disappears, and the platform becomes inactive. Investors then realize they have no way to recover their funds. The lack of developer transparency and regulatory oversight makes it nearly impossible to track down those responsible.

Ponzicoin eventually collapses under its own weight because it lacks sustainability. In the end, only those who joined early and exited quickly gain anything, while the majority suffer losses.

How to Identify Similar Crypto Schemes

To avoid falling for schemes like Ponzicoin, it is helpful to recognize the traits they share. You should look for the following indicators when evaluating new digital investment opportunities:

-

Promises of guaranteed or very high returns

-

Pressure to invest quickly

-

Limited or anonymous developer information

-

Lack of a clear product or service

-

Recruitment-focused growth models

-

No independent audits or oversight

By keeping these factors in mind, individuals can protect themselves from losing money to deceptive platforms.

Conclusion

Ponzicoin presents itself as a lighthearted crypto project, yet its structure and behavior align closely with traditional Ponzi schemes. Although its branding may appear humorous, the financial impact on investors is very real. Through unrealistic promises, anonymous developers, and a structure based entirely on new participant funds, the platform demonstrates all the characteristics of a scam.

For anyone exploring the crypto market, taking time to research and verify legitimacy is essential. Awareness of schemes like Ponzicoin helps protect individuals from falling into similar traps in the future.

Report. Ponzicoin And Recover Your Funds

-

If you have lost money to ponzicoin, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like ponzicoin continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.