Wefunder.com Scam Signs Every User Should Know

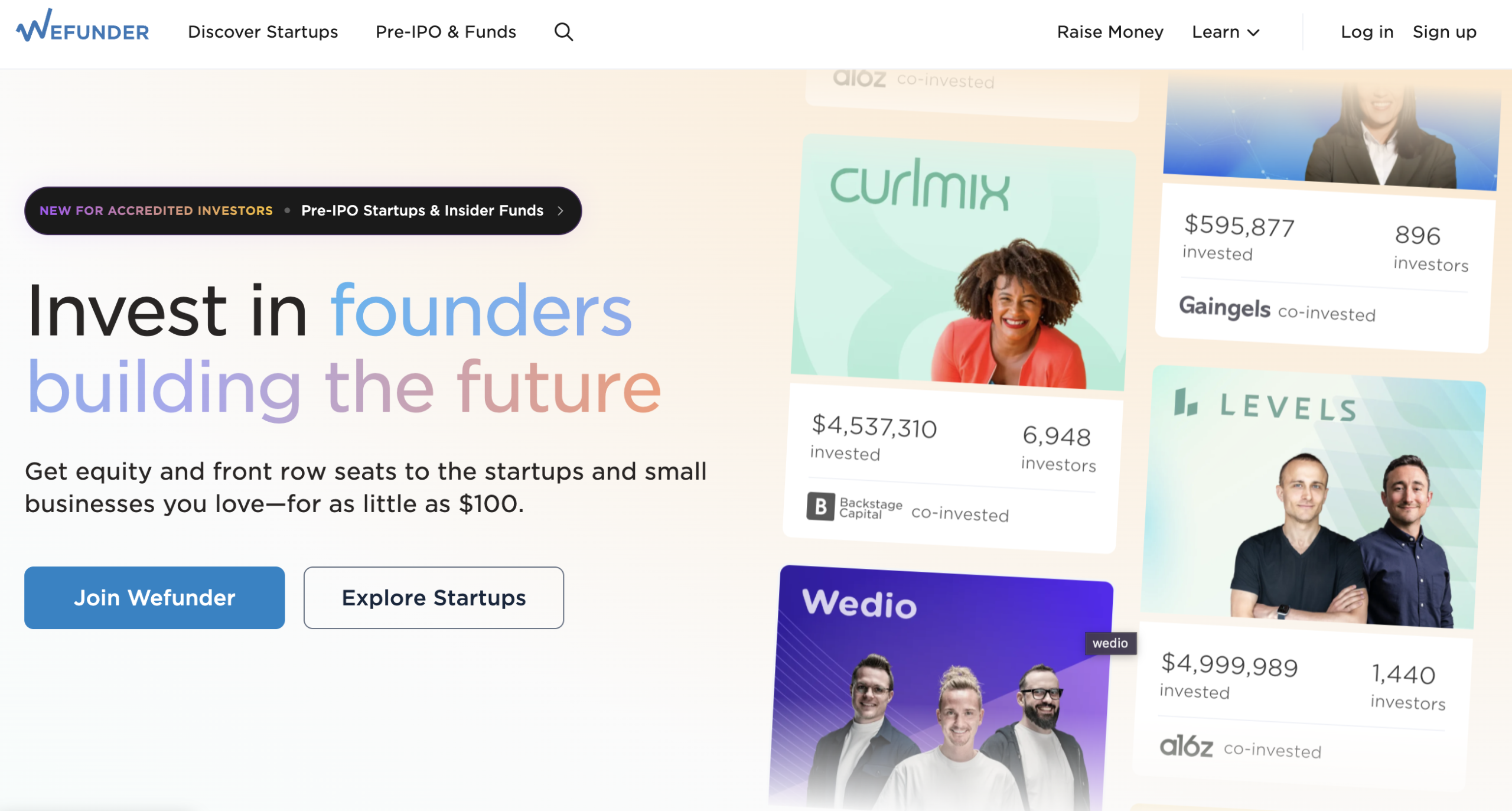

Wefunder markets itself as a gateway for everyday people to invest in early-stage startups. For as little as $100, Wefunder allows potential investors to buy shares or debt in private companies that are raising funds. Bankrate+2Wefunder+2

On the surface, this sounds like a democratization of startup investing — no longer limited to wealthy or “accredited” investors. But when you dig deeper, the model reveals major red flags and serious risks that make Wefunder a problematic choice for many.

Why Wefunder’s model is inherently risky — the “scam potential”

• Startups are extremely high-risk

Wefunder deals primarily in early-stage companies. As with all startups, most fail — meaning your investment can vanish. Wefunder itself warns that “every investment listed … is riskier than a public company,” and “it is entirely possible that you could lose every dollar you invest.” help.wefunder.com+2CrowdSpace+2

When you back a startup on Wefunder, you are essentially betting on what’s often an unproven idea, team, or business model — a gamble many investors are unprepared for.

• Limited liquidity and uncertain returns

Even if a startup “succeeds,” there is no guarantee you will see a return any time soon — or at all. Many of the companies raising funds on Wefunder are not publicly listed, meaning there is no easy market to sell your shares. Past reviews note there is “no track record of startups on the platform making investors money.” Boring Business Nerd+2Merchant Maverick+2

This lack of liquidity turns any small initial investment into a long-term lottery ticket — and that lottery is more likely to lose than win.

• High fees and potential misalignment of incentives

Wefunder charges transaction fees: for instance, a platform fee on investments. NerdWallet+1 This structure may create misaligned incentives: the platform benefits from volume, regardless of whether the underlying startups perform well. When payments go through before returns — you pay whether the venture succeeds or fails.

Moreover, some fundraising efforts on Wefunder reportedly require startups to raise a significant amount from their own network before public investors can join. That can force founders to lean heavily on friends and family — sometimes with limited transparency — increasing the risk that the business is under-capitalized or dependent on goodwill rather than sound fundamentals. Merchant Maverick+2Crowdinform+2

• Lack of reliable data or proven success

Because most companies on Wefunder are private, there is often sparse public data about their performance, balance sheets, or realistic prospects. Many Wefunder profiles reportedly “obscure financial information” or require digging through dense legal documents to understand the true value and risk. Boring Business Nerd+2Crowdinform+2

When you invest, you’re often trusting a narrative rather than concrete, verified business metrics. That increases the chance of being misled or overestimating potential.

Real-World Feedback: Investors Are Wary

Among users and industry commentators, there is significant skepticism. On Reddit’s equity-crowdfunding forums, some investors share negative experiences. One user bluntly wrote:

“Wefunder is terrible. These companies go silent on all their investors. Do not use it.” Reddit

Such testimony paints a picture of startups disappearing after raising funds — leaving investors with no communication, no updates, and often, no way to recover their money.

Formal complaint records show similar patterns of dissatisfaction. According to a business-review bureau’s summary, Wefunder is not accredited — and has seen multiple complaints over issues including delays or failures in processing withdrawals or returns. Better Business Bureau+1

Why Wefunder’s Legitimacy Doesn’t Eliminate Risk

It’s true that many sources and reviews describe Wefunder as legitimate. The platform is widely known, operates under the legal structure of equity crowdfunding, and offers access that previously only wealthy investors had. Medium+2Wikipedia+2

But legitimacy does not equal safety. Just because a platform is “legal” does not mean it’s safe or that investments will perform. The core issue is: Wefunder’s model depends entirely on startups — which by nature are volatile, failure-prone, and unpredictable.

In effect, you are using a regulated system to place a speculative bet — much riskier than buying shares of established, publicly traded companies.

Who Wefunder Might “Work” For — and Who Should Definitely Avoid It

Wefunder tends to attract:

-

Investors who are comfortable with high risk

-

People intrigued by early-stage startups and potential high returns

-

Those with disposable income they can afford to lose

-

Investors with a long-term horizon and patience

However, for most ordinary investors — especially those who rely on their money, need liquidity, or can’t afford major losses — Wefunder is a poor fit.

If you value stability, transparent data, predictable returns, or want to avoid gambling-like risks — then Wefunder is not for you.

Why You Should Steer Clear of Wefunder

Given everything above, here’s why Wefunder should be approached with extreme caution — or avoided entirely:

-

You risk losing 100% of your investment — many startups fail or underperform.

-

There’s no guarantee of liquidity or returns — you may wait years, if ever, to see any value.

-

High fees and uncertain incentives may work against you, not with you.

-

Financial data and transparency are often limited or difficult to verify.

-

Real investors report negative experiences: silence after funding rounds, poor communication, and unresponsive startups.

-

In effect, you’re participating in a high-stakes gamble disguised as investing.

For most people, treating Wefunder like a safe, passive investment platform would be a serious mistake.

Final Verdict: Wefunder = High-Risk → Treat as Speculation

Wefunder may be legal and widely used — but that does not make it safe. The platform operates like a public marketplace for speculative bets on early-stage companies, many of which never deliver.

If you’re looking to preserve capital, avoid high risk, or build a stable, long-term portfolio — Wefunder is a poor choice. The odds are strongly stacked against the investor.

If you tap Wefunder, treat it like a lottery: only invest money you can afford to lose, expect full losses, and don’t count on returns. The promise of big rewards is real — but so is the danger.

Report Wefunder.com And Recover Your Funds

If you have lost money to Wefunder.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Wefunder.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.