SiaCashCoin Scam Review: An In-Depth Analysis

The rapid growth of cryptocurrencies over the last decade has brought about both innovative technologies and fraudulent schemes. While some digital currencies have created genuine opportunities, others have leveraged the excitement around blockchain to mislead investors. SiaCashCoin is one such project that has attracted attention due to its ambitious claims and growing investor skepticism. Marketed as a decentralized digital currency with advanced blockchain features, SiaCashCoin promised high returns and technological innovation. However, reports and analysis suggest that the platform may not be as reliable or legitimate as it claims.

This review explores SiaCashCoin in detail, highlighting its claims, the warning signs that raised doubts, and why investors should exercise caution.

Understanding SiaCashCoin’s Promises

SiaCashCoin was promoted as a next-generation cryptocurrency that combined secure transactions, privacy features, and decentralized governance. The project claimed to offer fast and low-cost transactions, making it suitable for everyday use, while also providing investment opportunities for early adopters. According to its promotional materials, SiaCashCoin aimed to differentiate itself from other cryptocurrencies by emphasizing technological innovation and community-driven development.

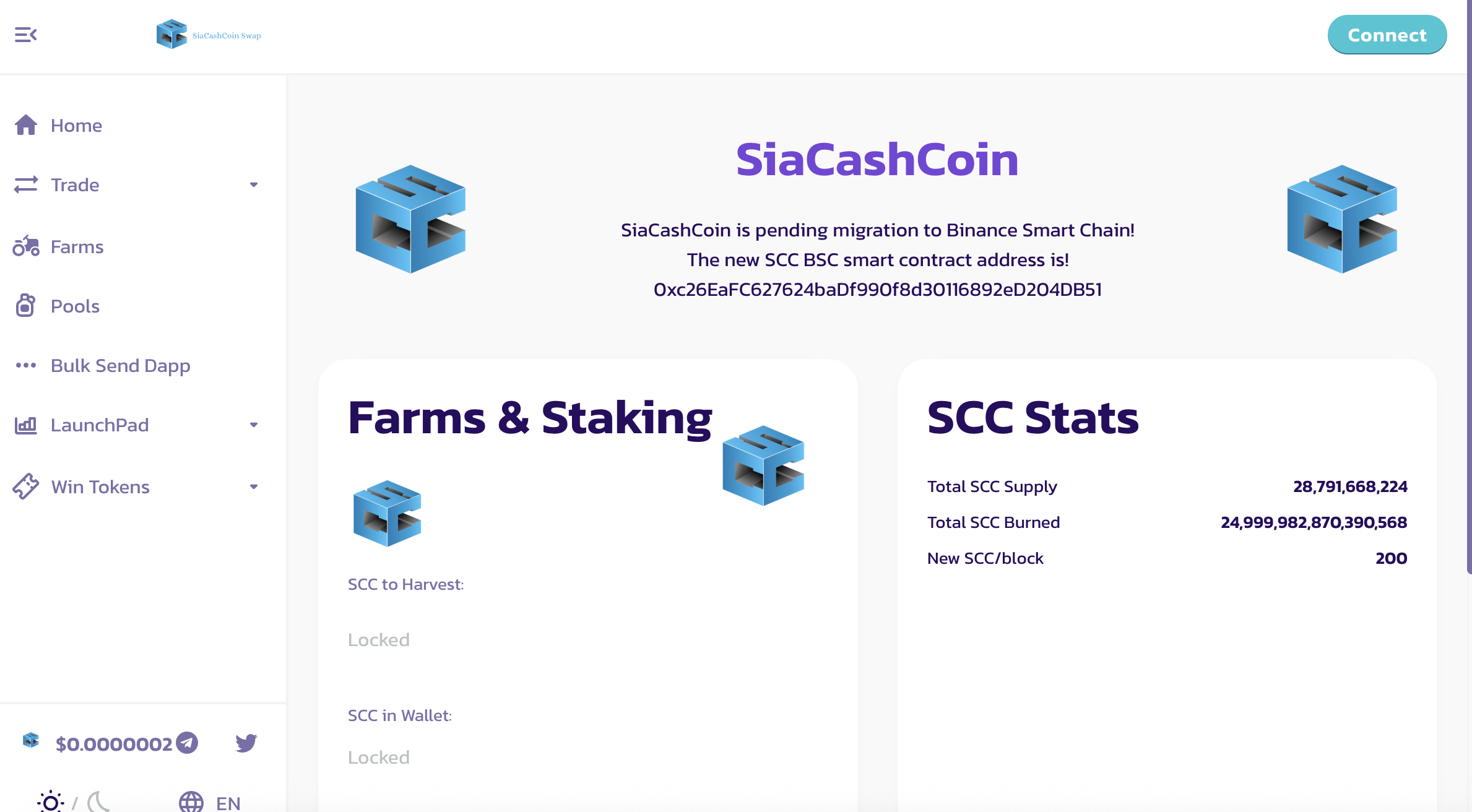

The platform issued its own native token, the SCC token, which was central to the ecosystem. Investors were encouraged to acquire SCC tokens, with the promise that their value would grow as the network expanded. Marketing materials highlighted potential partnerships, mining opportunities, and staking programs, all designed to entice users and generate interest in the token.

Red Flags and Warning Signs

Despite its appealing narrative, several aspects of SiaCashCoin raised concerns within the cryptocurrency community. These red flags indicate why skepticism around the project has grown.

1. Unverified Partnerships and Claims

SiaCashCoin frequently claimed to collaborate with established blockchain projects, technology firms, or financial institutions. However, these claims were largely unverifiable. Legitimate partnerships are usually documented and can be confirmed through independent announcements or press releases, yet in the case of SiaCashCoin, such proof was minimal or absent. Ambiguous statements about partnerships are often used by scams to project legitimacy without providing real evidence.

2. Overambitious Technological Promises

The project promised a range of technological advancements, including ultra-fast transactions, high scalability, and privacy features superior to established cryptocurrencies. While these promises sound appealing, experts in blockchain technology questioned their feasibility. Implementing such features requires substantial technical expertise, development resources, and rigorous testing—elements that were not clearly demonstrated by SiaCashCoin. Overpromising without delivering tangible results is a common red flag in questionable crypto projects.

3. Aggressive Marketing Tactics

SiaCashCoin’s marketing strategy relied heavily on hype. The platform focused on high returns, innovative technology, and quick adoption rather than providing evidence of operational progress. Social media campaigns, email promotions, and online discussion forums were used to entice investors. Projects that emphasize marketing over transparency and actual product development often raise concerns about their legitimacy.

4. Lack of Transparent Team Information

A trustworthy blockchain project typically has a transparent team with verifiable experience in technology, finance, or blockchain. In the case of SiaCashCoin, many of the listed team members lacked verifiable credentials or prior experience relevant to cryptocurrency development. An anonymous or unverifiable leadership structure is a significant red flag, as it prevents investors from confirming whether the team has the expertise to execute the project’s ambitious roadmap.

5. Tokenomics Concerns

The SCC token was presented as the foundation of the SiaCashCoin ecosystem, but its tokenomics raised concerns. Distribution appeared heavily skewed toward early investors and insiders, allowing potential manipulation of the token’s market value. Additionally, the token’s practical utility was unclear beyond trading or speculative investment. Tokens without clear use cases or balanced distribution mechanisms are prone to volatility and investor losses.

Investor Experiences and Complaints

Multiple investors who engaged with SiaCashCoin reported issues with accessing their tokens, unclear investment terms, and unresponsive customer support. Complaints ranged from delayed transactions to difficulties in understanding how staking and mining programs operated. Online forums and community discussions revealed that many users felt misled by marketing claims, further amplifying suspicion around the project.

Some investors pointed out that SiaCashCoin’s development progress appeared inconsistent with the promises made in its roadmap. While promotional materials showcased technical designs and future features, independent verification of these developments was limited. This discrepancy between marketing claims and actual execution created a sense of mistrust among the community.

Psychological Tactics Used by SiaCashCoin

SiaCashCoin employed several strategies commonly seen in questionable crypto projects to attract investment:

-

Fear of Missing Out (FOMO): The platform emphasized early adoption benefits and exclusive opportunities, prompting users to invest quickly.

-

Appeal to Authority: References to unspecified partnerships with tech firms and blockchain experts lent credibility.

-

Complexity and Jargon: Technical terminology created an aura of sophistication, making it harder for casual investors to evaluate the project critically.

-

High Return Promises: Marketing focused on potential profits rather than practical token utility or project milestones.

These tactics are designed to generate rapid investment inflows, often prioritizing financial gain for insiders over delivering a working product.

Transparency and Communication Issues

Transparency is a critical factor in evaluating any cryptocurrency project. SiaCashCoin demonstrated shortcomings in this area. Project updates were irregular, technical documentation was limited, and questions from investors were often answered vaguely or not at all. Legitimate blockchain projects typically provide regular updates, transparent audits, and verifiable progress, which were largely absent in the case of SiaCashCoin.

Regulatory and Legal Considerations

Blockchain projects operate within an increasingly regulated environment. Investors should be aware of legal compliance when participating in cryptocurrency ventures. SiaCashCoin did not provide clear information about regulatory adherence, licenses, or compliance in the jurisdictions it operated or solicited users from. Lack of regulatory clarity adds to investor risk, particularly if legal actions arise that may affect the token or platform’s functionality.

Lessons from SiaCashCoin

The SiaCashCoin case highlights several important lessons for investors considering cryptocurrency opportunities:

-

Conduct Thorough Research: Verify claims about team members, partnerships, and technical capabilities before investing.

-

Be Wary of Overpromises: Revolutionary claims with minimal proof should be approached with caution.

-

Assess Token Utility: Tokens should have practical use within the ecosystem beyond speculation.

-

Check Transparency: Projects that fail to communicate regularly or provide verifiable updates may be risky.

-

Understand Legal Compliance: Ensure the project operates within applicable regulatory frameworks to reduce risk.

Conclusion

SiaCashCoin exemplifies the risks associated with speculative cryptocurrency projects that prioritize marketing and hype over genuine technological development. Despite promising fast transactions, decentralized governance, and innovative features, the project displayed multiple warning signs, including unverifiable partnerships, ambitious technological claims, aggressive marketing, opaque leadership, and questionable tokenomics. Investor complaints and inconsistent progress further reinforce concerns about its legitimacy.

While the cryptocurrency industry has enormous potential, SiaCashCoin serves as a reminder that due diligence, skepticism, and careful evaluation are essential. Investors must focus on verifiable evidence, transparency, and realistic promises to protect themselves from potential scams. Enthusiasm for innovation should never override prudent financial decision-making.

Report. SiaCashCoin And Recover Your Funds

-

If you have lost money to siaCashCoin, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like siaCashCoin continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.