SmartCash Analysis – Warning Signs Every Investor Should Know

In the rapidly evolving world of digital finance, many online platforms have emerged claiming to offer innovative trading opportunities, high returns, and advanced investment tools. Among them, SmartCash has attracted attention for presenting itself as a sophisticated platform that allows users to invest in cryptocurrencies, forex, and other financial instruments. However, multiple warning signs and user complaints have surfaced, prompting serious concerns about the platform’s legitimacy.

This review provides a comprehensive examination of SmartCash, its operations, promises, user experiences, and red flags. Understanding these factors is essential for anyone considering investing their money online.

What SmartCash Claims to Offer

SmartCash markets itself as a modern investment platform, highlighting a variety of features:

-

Access to cryptocurrency, forex, and commodities markets

-

Advanced trading tools and dashboards

-

Automated trading algorithms and signals

-

Multiple account types with tiered benefits

-

Fast profits and withdrawal options

-

Expert guidance and market analysis

While these features may appear appealing, further investigation reveals that many of these claims are exaggerated or unverified.

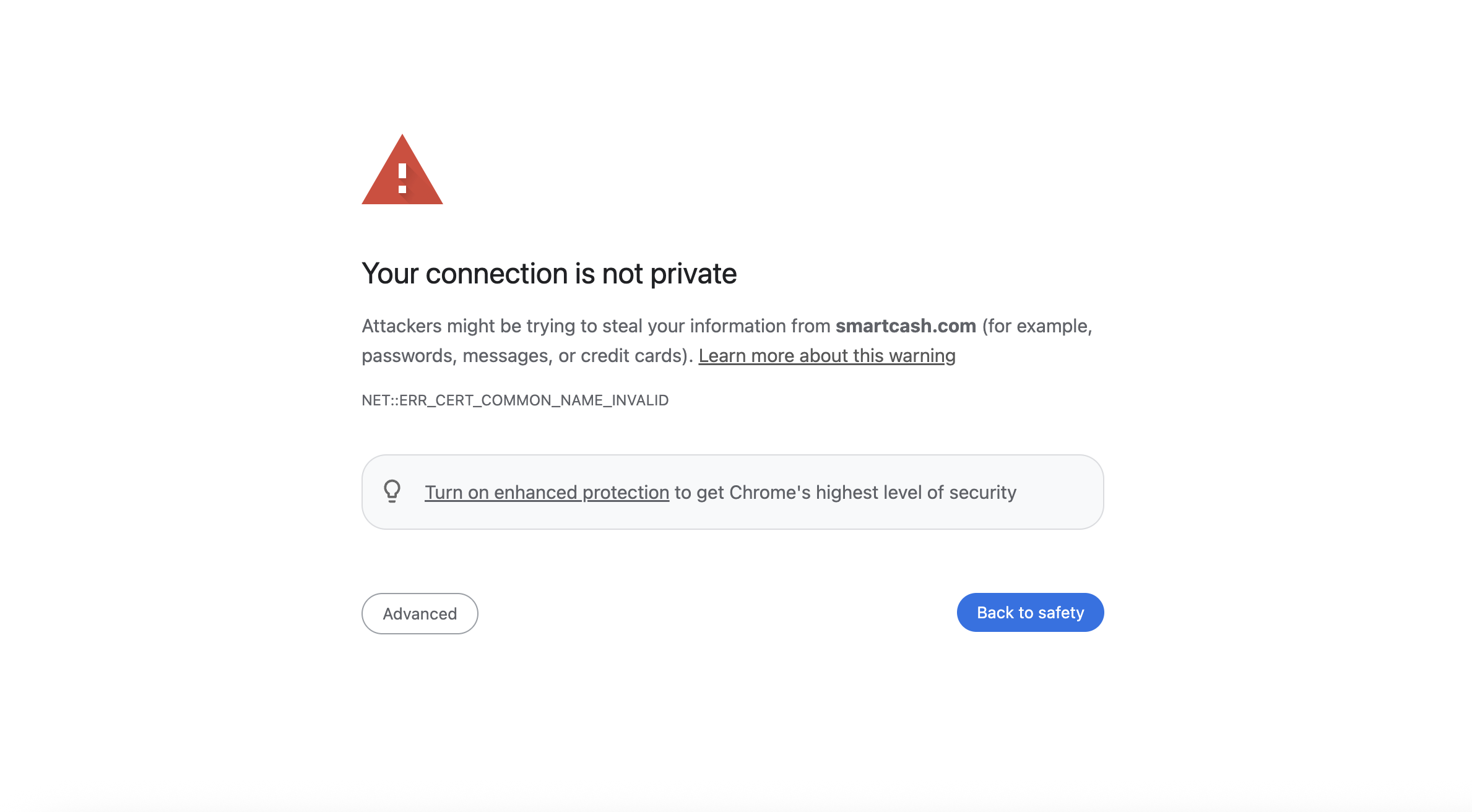

Lack of Regulatory Oversight

One of the most significant concerns regarding SmartCash is the absence of verifiable regulatory approval. Legitimate trading platforms are typically registered with recognized financial authorities to ensure investor protection, operational transparency, and compliance with laws.

SmartCash does not provide any evidence of:

-

Registration with a recognized financial regulator

-

A valid license number

-

Compliance with local or international financial regulations

The lack of regulatory oversight exposes investors to significant risks, including:

-

Loss of deposited funds

-

Unverified trading operations

-

No legal recourse in case of disputes

Operating without regulation is a major warning sign, as it suggests the platform is not legally accountable for its actions.

Anonymous Ownership and Management

SmartCash provides minimal information about the people or entities behind the platform. Details about directors, account managers, and operational staff are often missing or unverifiable.

In legitimate financial services, transparency about the team and leadership is crucial. The anonymity seen with SmartCash raises concerns about accountability and the credibility of its operations.

Unrealistic Profit Claims

SmartCash promotes unusually high profits, often implying that investors can achieve significant returns quickly and with minimal risk. These claims include:

-

Guaranteed high returns

-

“Risk-free” investments

-

Automated systems that supposedly outperform the market

No genuine trading platform can guarantee profits, as financial markets are inherently volatile. Such unrealistic claims are typical of platforms designed to attract deposits without providing real investment opportunities.

Aggressive Marketing Tactics

Users report that SmartCash employs high-pressure marketing and sales tactics to encourage more deposits. Common approaches include:

-

Urgent messages about limited-time opportunities

-

Persistent contact from account managers

-

Pressure to upgrade accounts for “exclusive benefits”

-

Promises of bonuses or enhanced profits for higher deposits

These tactics aim to manipulate users into making quick decisions without conducting proper research, a common strategy in fraudulent platforms.

Suspicious Trading Tools and Dashboard

Several users have raised concerns about the trading tools offered by SmartCash:

-

Charts and market data often do not match real-world conditions

-

Trading dashboards may appear poorly developed or unprofessional

-

Account balances fluctuate in ways that seem unrealistic

Such inconsistencies suggest that the platform may be manipulating trading data to create the illusion of profits and activity, rather than facilitating genuine trades.

Withdrawal Problems

A critical indicator of potential fraud is the difficulty users face when trying to withdraw funds. Complaints related to SmartCash include:

-

Withdrawals taking unusually long to process

-

Requests for additional documentation or “verification fees”

-

Accounts being blocked or frozen after attempting significant withdrawals

-

Customer support becoming unresponsive during withdrawal issues

Legitimate trading platforms process withdrawals reliably and transparently. Repeated withdrawal difficulties are a major red flag.

Fake Testimonials and Misleading Reviews

SmartCash often displays testimonials and success stories on its website. However, these are frequently suspicious:

-

Generic statements without specific details

-

Stock images of supposed users

-

Identical reviews across multiple sites

-

Claims that appear too good to be true

These fabricated testimonials are designed to build artificial credibility and entice new investors to deposit funds.

Lack of Transparency

Transparency is essential for assessing the credibility of any trading platform. SmartCash shows significant gaps in this area:

-

No clear explanation of fees, commissions, or spreads

-

Vague terms and conditions regarding accounts

-

Limited information about security measures or fund protection

-

Absence of independent audits

Without transparency, users cannot make informed decisions or trust that their funds are being managed appropriately.

Psychological Tactics Used by SmartCash

SmartCash appears to use several psychological tactics to influence investor behavior:

-

Fear of Missing Out (FOMO): Users are told that opportunities are limited and must act quickly.

-

Authority Appeal: The platform presents itself as expert and technologically advanced.

-

Complex Jargon: Sophisticated trading terms are used to impress users, regardless of actual functionality.

-

Guaranteed Returns: Highlighting profits instead of risks encourages impulsive investments.

These tactics are common among fraudulent platforms designed to extract deposits rather than provide legitimate trading services.

User Experiences and Complaints

Reports from investors provide insight into the real-world operation of SmartCash:

-

Delayed or Blocked Withdrawals: Many users have difficulty accessing their funds.

-

Pressure from Account Managers: Users feel pushed to deposit more than they initially intended.

-

Opaque Trading Conditions: Lack of clarity regarding leverage, trades, and fees.

-

Unresponsive Support: Customer service often fails to address issues or disappears entirely.

These experiences suggest that SmartCash prioritizes acquiring deposits over delivering a legitimate trading experience.

Lessons for Investors

The SmartCash case highlights several key lessons for anyone considering online investments:

-

Verify Regulatory Compliance: Always ensure platforms are licensed by recognized authorities.

-

Be Skeptical of Guaranteed Returns: Unrealistic profit promises are a major warning sign.

-

Check for Transparency: Confirm that ownership, fees, and operational practices are clear.

-

Test Withdrawals First: Ensure deposits and withdrawals work reliably before committing large sums.

-

Research User Feedback: Independent reviews can reveal potential issues and scams.

Due diligence is essential to avoid falling victim to fraudulent schemes.

Conclusion

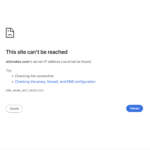

SmartCash exhibits multiple red flags, including anonymous ownership, lack of regulation, unrealistic profit claims, withdrawal difficulties, and fabricated testimonials. These warning signs suggest that the platform is high-risk and potentially fraudulent.

While online trading can be a legitimate way to invest, SmartCash demonstrates the importance of thorough research, skepticism, and careful consideration before depositing funds. Investors should always prioritize transparency, regulatory compliance, and credibility over flashy promises and high-pressure tactics.

Report. SmartCash And Recover Your Funds

-

If you have lost money to smartCash, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like smartCash continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.