SmartFX.com Scam Review – Major Red Flags Exposed

Online trading continues to grow worldwide, attracting millions of new users each year. While this creates opportunities, it has also opened the door for a wave of fraudulent platforms that lure inexperienced traders with promises of instant profits. One name that has surfaced repeatedly in scam discussions is SmartFX.com—a trading platform that claims to offer professional tools, competitive spreads, and a trustworthy trading environment. But do these claims hold up under scrutiny?

This comprehensive SmartFX.com Scam Review takes a closer look at how the platform operates, the red flags surrounding it, and why many traders believe it is far from legitimate.

What Is SmartFX.com?

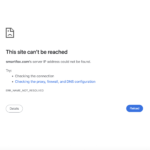

SmartFX.com presents itself as an online forex and CFD broker offering access to various trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. The website portrays a clean layout, sleek design, and professional branding meant to give visitors confidence in its legitimacy.

At first glance, SmartFX.com appears user-friendly. It claims to have advanced trading tools, fast execution speeds, and an efficient support team. These marketing tactics are typical among online trading platforms, both legitimate and fraudulent. However, the real question is whether SmartFX.com truly offers what it advertises—or simply uses flashy design and promises as bait.

Lack of Transparent Licensing

One of the biggest red flags with SmartFX.com is the absence of clear regulatory oversight. Trustworthy brokers typically highlight their licensing information clearly, often on their homepage or in dedicated sections. This information includes the name of the regulator, license number, and jurisdiction.

SmartFX.com, however, provides no verifiable licensing information. Any platform offering financial trading services without proper regulation is highly risky. Regulation is what ensures client funds are protected, trading rules are enforced, and brokers operate fairly. Without it, traders have little to no protection if something goes wrong.

Unregulated brokers have been known to:

-

Manipulate trading prices

-

Block withdrawals

-

Use aggressive marketing tactics

-

Disappear overnight with client funds

The lack of accountability makes unregulated platforms extremely dangerous, and SmartFX.com fits this concerning pattern.

Overly Promising Marketing Tactics

SmartFX.com relies heavily on marketing messages that feel too good to be true. It promotes features such as instant withdrawals, guaranteed profit opportunities, and easy trading for beginners. These claims are meant to appeal to users who may not fully understand how financial markets work.

No honest trading platform can guarantee profits. Markets are volatile and unpredictable, and any platform claiming otherwise is likely using this strategy to lure unsuspecting users into depositing money quickly.

Some users report that SmartFX.com representatives use high-pressure tactics, such as persistent phone calls, urging them to deposit more funds to “unlock bigger returns.” This type of pressure is a classic trait of fraudulent brokers.

Red Flags in the Registration and Onboarding Process

Legitimate brokers typically require proper documentation during registration to comply with verification standards. This includes identification, proof of residence, and sometimes additional verification steps.

With SmartFX.com, the registration process seems deliberately simple at the start. However, once users attempt to withdraw funds, they are suddenly asked for additional documents or subjected to complicated verification procedures. This contradictory approach raises suspicions.

These tactics often serve two purposes:

-

To make depositing money as easy as possible

-

To make withdrawing money extremely difficult

Several users report being unable to access their funds after multiple attempts to withdraw, often being told that their documents were “insufficient” or “pending review.”

Reports of Blocked or Delayed Withdrawals

A major warning sign with SmartFX.com is the widespread complaints about blocked or delayed withdrawals. Users state that even small withdrawal requests are ignored or stalled for weeks.

In many cases:

-

Support stops responding once users request withdrawals

-

Accounts become “under review” indefinitely

-

Traders are asked to deposit additional funds before withdrawals can be processed

These are all common techniques used by scam brokers to prevent users from retrieving their money. When a platform controls withdrawals and can refuse them without explanation, traders are at high risk.

Questionable Trading Behavior

Some customers of SmartFX.com claim their trades were manipulated or closed without warning. Others report sudden balance changes, unexplained fees, or charts that do not match market conditions.

Unregulated brokers often use manipulated trading software that allows them to control client outcomes. They can:

-

Create artificial losses

-

Slow execution to impact trade outcomes

-

Inflate spreads

-

Introduce phantom fees

If SmartFX.com is indeed using manipulated systems, this would severely compromise the integrity of the platform and indicate fraudulent behavior.

Unprofessional or Unresponsive Customer Support

Reliable brokers invest heavily in customer support to ensure smooth operations for their users. SmartFX.com, however, has been reported to provide inconsistent and often unhelpful support.

Many users claim:

-

Agents stop responding once funds are deposited

-

Phone lines appear inactive at certain times

-

Email responses are generic and do not address specific issues

-

Support provides contradictory information

Poor communication is another strong indicator of an unreliable platform. When a company avoids accountability, it often means it has something to hide.

Fake Reviews and Testimonies

SmartFX.com appears to rely on fabricated reviews to build trust. Numerous glowing testimonials can be found online, but many follow a similar pattern, use generic language, or come from accounts with no verified history.

Scam platforms often pay for or generate fake reviews to create an illusion of legitimacy. They may also suppress negative reviews through intimidation or fake copyright claims.

Genuine brokers do not need to rely on fabricated praise to attract clients.

Suspicious Terms and Conditions

A closer look at SmartFX.com’s terms and conditions reveals vague or unfavorable clauses. Some include broad statements that give the company unilateral power over trading accounts, funds, and withdrawal conditions.

Common problematic clauses include:

-

The ability to reject withdrawals

-

Fees that are not clearly explained

-

Mandatory trading volume requirements

-

“Dormant account” penalties

These policies are designed to trap users and block withdrawals, making it nearly impossible for them to recover their funds once deposited.

Common Patterns Identified in SmartFX.com Complaints

After analyzing numerous reports, several consistent patterns emerge:

-

Easy deposits but impossible withdrawals

-

Aggressive demands for additional deposits

-

Manipulated trades that lead to losses

-

Useless customer support

-

Fake promises of guaranteed returns

-

Sudden account freezes

These patterns are typical of scam brokers and indicate that SmartFX.com is likely operating with malicious intent.

Final Verdict – Is SmartFX.com a Scam?

Based on the overwhelming number of red flags—lack of regulation, blocked withdrawals, unrealistic promises, suspicious trading activity, and unresponsive customer support—SmartFX.com appears to be highly unsafe and likely fraudulent.

The platform behaves like many unregulated scam brokers that aim to attract deposits and prevent withdrawals. Users should exercise extreme caution and avoid investing money in platforms that cannot demonstrate transparency or regulation.

Online trading can be profitable, but only when done through legitimate brokers with strong regulatory oversight. SmartFX.com does not meet these standards and presents significant risks to anyone who engages with it.

Report. Smartfx.com And Recover Your Funds

-

If you have lost money to smartfx.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like smartfx.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.