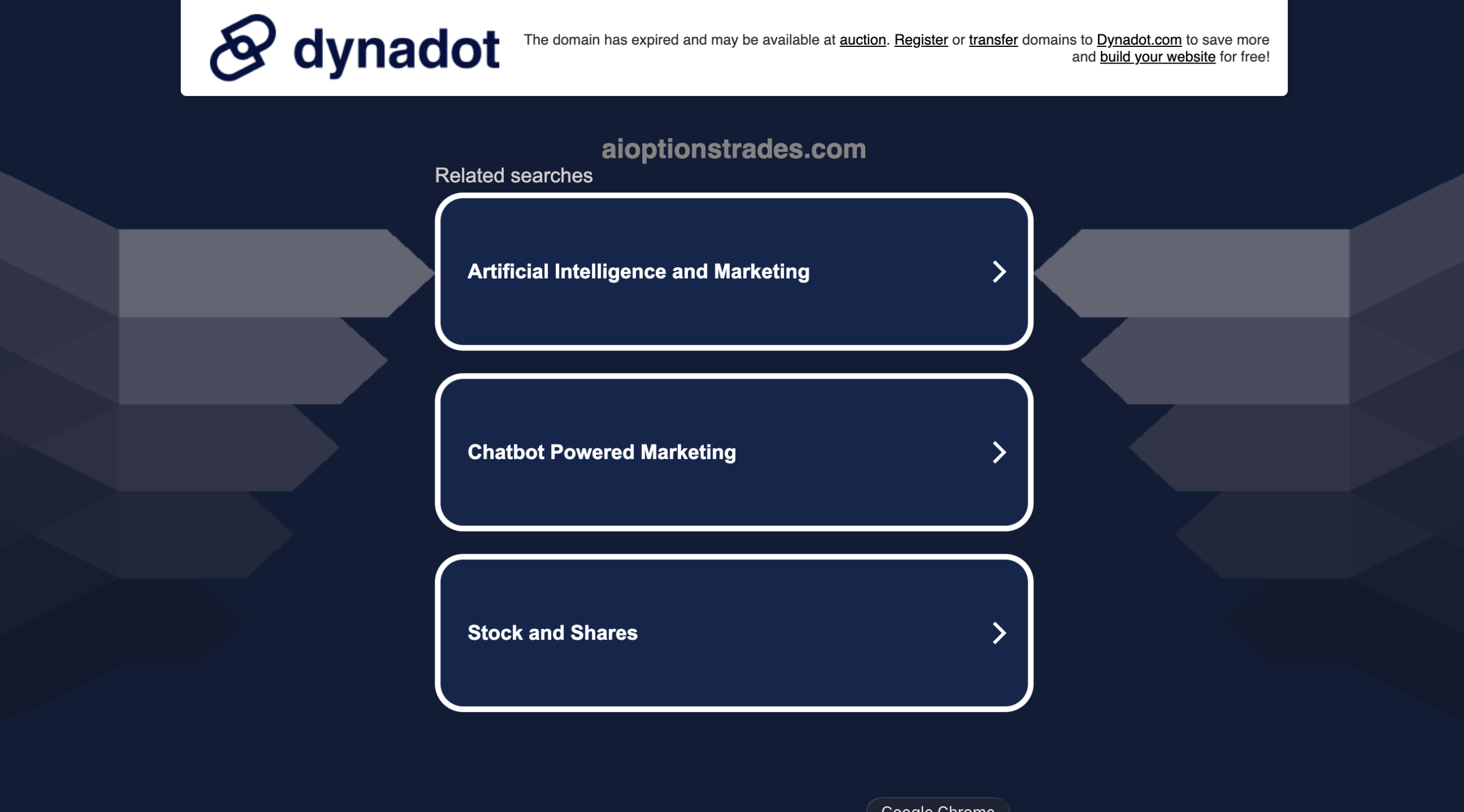

AIOptionsTrades.com Investor Warning

The rise of online trading platforms has brought access to financial markets within reach of many individuals. However, not all platforms operate with integrity. One such website that has generated mounting concern among traders and industry observers is AIOptionsTrades.com. While the platform markets itself as a cutting-edge, AI-driven investment service, deeper investigation reveals multiple red flags that suggest it is a high-risk and potentially fraudulent operation. In this review, we outline the problematic aspects of AIOptionsTrades.com and explain why potential investors should steer clear.

Misleading Marketing and Unrealistic Promises

Upon visiting AIOptionsTrades.com, users are met with marketing language that suggests advanced technology, automated profit generation, and easy trading success. The platform claims to use artificial intelligence to analyze markets and execute profitable trades on behalf of users. It emphasizes speed, accuracy, and superior returns, often implying predictable gains without significant effort.

Such messaging is common among high-risk or fraudulent investment schemes. In legitimate financial markets, there are no guarantees of profit, regardless of technology employed. Financial markets are inherently volatile, and even sophisticated algorithms cannot reliably produce consistent gains with minimal risk. Claims of near-perfect accuracy or guaranteed returns should immediately raise skepticism.

In addition to leveraging buzzwords like “AI” and “automation,” AIOptionsTrades.com may present glowing testimonials and success stories. These testimonials often lack verifiable details about actual people, trades, or performance history. Fabricated or generic success stories are a well-known tactic used to create a sense of credibility and persuade visitors to make deposits.

Lack of Transparency and Regulatory Oversight

Regulatory licensing serves as a foundational safeguard in financial services. Reputable trading platforms operate under the supervision of recognized regulatory bodies that impose standards for investor protection, fund handling, reporting, and dispute resolution. However, AIOptionsTrades.com does not provide evidence of regulation by any major financial authority.

Regulators such as the Financial Conduct Authority in the United Kingdom or equivalent agencies globally are designed to protect investors from fraud and malpractice. A platform operating without such oversight leaves users without formal protections if issues arise. The absence of credible licensing is a critical concern because it suggests that AIOptionsTrades.com can operate without transparency or accountability.

In addition to lacking clear regulatory status, the platform often provides limited corporate information. Legitimate brokers make it easy to find details about their corporate structure, leadership team, audited financial statements, and operational history. In contrast, AIOptionsTrades.com offers minimal verifiable information about who runs the platform, where it is legally based, or how it safeguards client funds. This anonymity is a hallmark of high-risk schemes that prioritize attracting deposits over establishing trust.

Questionable Operational Practices

Beyond marketing and regulatory gaps, several operational issues associated with AIOptionsTrades.com fit well-documented patterns seen in fraudulent trading websites.

Fabricated Trading Interfaces

Many scam platforms display dashboards that show user balances increasing automatically, often independent of real market activity. This creates an illusion of growth, encouraging users to deposit larger sums. However, there is no reliable evidence that AIOptionsTrades.com executes genuine trades linked to market exchanges or uses recognized trading software. The lack of verified trading records means that displayed performance metrics should be viewed with caution.

Withdrawal Barriers and Hidden Conditions

A repeated theme in high-risk investment platforms involves difficulty accessing deposited funds. Users may be encouraged to make deposits easily, but when they attempt to withdraw their funds, they encounter sudden obstacles. These can include opaque conditions, unclear “verification” requirements, or unanticipated fees. In many cases, requests for withdrawal are delayed indefinitely or ignored entirely.

Reports concerning platforms with similar operational profiles indicate that withdrawal challenges are among the strongest indicators of a scam. When a website makes deposit easy but withdrawal difficult or impossible, it suggests that the priority is capturing funds — not facilitating fair trading.

Pressure Tactics and Urgent Incentives

AIOptionsTrades.com, like many questionable brokers, may use urgency and pressure tactics to influence investor decisions. Promises of “limited-time” opportunities, “exclusive” tiers, or forced deadlines are common tactics intended to accelerate deposits without allowing users time for due diligence. Responsible financial services avoid manipulative tactics, instead providing clear, balanced information so that investors can make informed decisions.

Absence of Real Performance Data

Legitimate brokers and trading platforms provide comprehensive historical performance data audited by independent third parties. Widely recognized tools and platforms for tracking trading results — such as third-party trade loggers or performance verification services — are absent in AIOptionsTrades.com’s public disclosures. Without independently verified performance, there is no reliable way to assess whether the platform’s technology actually functions as advertised.

In contrast, high-risk platforms frequently rely on generic claims and static charts that do not reflect real market activity. Users have no way to confirm whether trades are executed at actual market prices, whether profits are realized, or whether losses are accurately reported. This lack of transparency elevates the danger of entrusting funds to such an operation.

Template-Style Website and Corporate Ambiguity

Another significant concern is the design and structure of the platform’s website. AIOptionsTrades.com shares common characteristics with numerous template-based investment sites that have been linked to scams. These include:

-

Stock imagery and generic corporate slogans rather than specific operational information.

-

Vague descriptions of technology and methodology without whitepapers or technical explanations.

-

Minimal legal documentation or terms that are unclear or missing.

-

Unclear or unverifiable corporate addresses and contact information.

These features create an impression of professionalism while masking the absence of substantive operational controls. Without verifiable details about leadership, ownership, or legal standing, users cannot assess the legitimacy of the entity behind the platform.

AI Buzzwords Without Substance

The frequent invocation of artificial intelligence and automated trading strategies is a marketing tactic rather than an indicator of real innovation. In the financial markets, the use of AI requires rigorous testing, transparent methodologies, and compliance with regulatory standards. Simply labeling a platform as “AI powered” does not confer legitimacy or reliability.

Fraudulent operations often exploit buzzwords to appeal to investors’ desire for cutting-edge solutions. They imply that complex technology guarantees results, even though no evidence supports such assertions. A cautious investor should demand verifiable documentation explaining how any claimed technology works and whether its performance is subject to independent audit.

Why You Should Steer Clear

Considering the factors above, AIOptionsTrades.com presents numerous warning signs consistent with high-risk or fraudulent trading platforms. Lack of regulation, opaque corporate identity, questionable operational practices, and unverifiable performance claims combine to create a profile that is far from trustworthy.

Investors should prioritize platforms that demonstrate clear regulatory compliance, transparent operational procedures, independent audit of performance, and accessible customer support. Absent these fundamentals, entrusting funds to an online trading service exposes you to unnecessary and avoidable risk.

Final Thoughts

AIOptionsTrades.com markets itself with polished language, bold claims, and promises of cutting-edge technology. Yet beneath the surface, the platform lacks the essential attributes of a legitimate financial service provider. It operates without credible oversight, offers no proof of real trading success, and relies on promotional tactics common to fraudulent schemes.

For anyone considering online trading, the safest course of action begins with due diligence. Scrutinize licensing, demand transparent documentation, and verify performance independently before committing funds. Based on the patterns and red flags associated with AIOptionsTrades.com, the prudent decision is to avoid this platform altogether and seek alternatives that prioritize transparency, accountability, and investor protection. wikifx.com+3scam-detector.com+3zoryacapital.com+3

Report Aioptionstrades.com And Recover Your Funds

If you have lost money to aioptionstrades.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like aioptionstrades.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Author