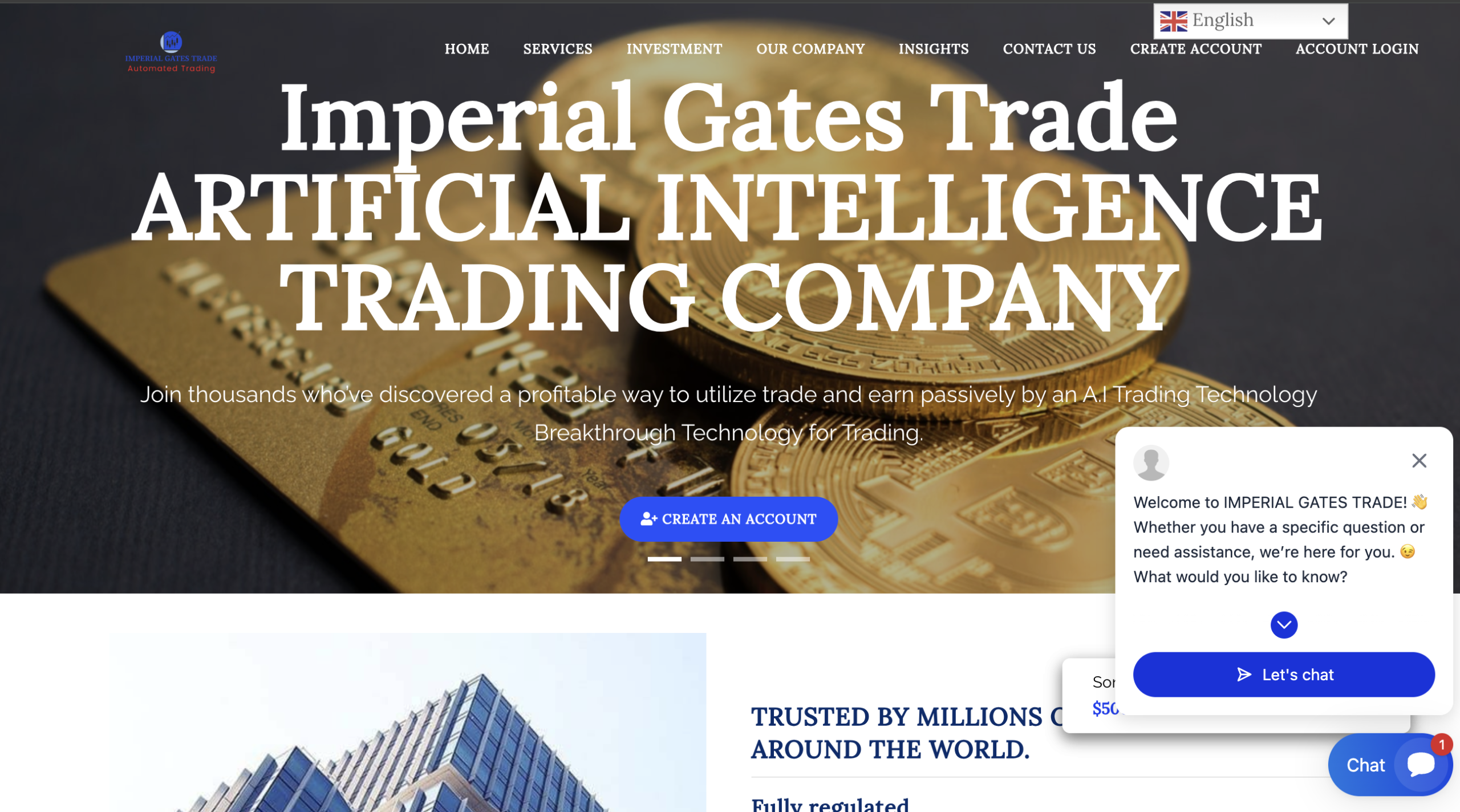

ImperialGatesTrade.com Legit or Scam? Full Review

As online investing continues to grow, many platforms emerge claiming to offer easy access to global markets and high returns. Some of these services are legitimate, but others use polished branding and bold promises to lure investors into risky or fraudulent schemes. ImperialGatesTrade.com is one such platform that raises serious concerns. Despite its professional presentation and ambitious claims, this review shows that ImperialGatesTrade.com exhibits multiple warning signs associated with untrustworthy investment platforms. Investors should exercise caution and avoid this service.

Bold Promises and Marketing Tactics

ImperialGatesTrade.com promotes itself as a cutting‑edge trading platform that provides access to forex, cryptocurrency, commodities, and other financial markets. Its marketing emphasizes advanced trading tools, profitable signals, and opportunities for almost effortless growth. The homepage suggests that users can achieve significant returns regardless of experience level.

However, the site’s promotional language relies heavily on broad assertions and emotional appeal rather than verified facts. Terms like “rapid growth,” “unlimited potential,” and “expert automated tools” suggest certainty of strong returns while downplaying or ignoring necessary risk disclosure. Financial markets are inherently unpredictable, and no legitimate platform can guarantee consistent profit without exposing users to risk. Unrealistic return language should immediately raise skepticism.

Lack of Regulatory Transparency

One of the most critical indicators of a trustworthy investment platform is clear regulatory status. Reputable financial services operate under licences issued by recognised authorities that enforce standards for client fund protection, disclosure, and ethical conduct.

ImperialGatesTrade.com does not provide verifiable regulatory licensing information. The website does not mention any credible financial authority overseeing its activities, nor does it share licence numbers or links to regulatory verification pages. The absence of proper regulatory transparency leaves investors without assurances that the platform operates under standard industry safeguards.

A lack of regulation means there is no external oversight to enforce compliance with financial laws, protect client funds, or investigate potential misconduct. This gap places investors in a vulnerable position, as there are no clear avenues for accountability.

Opaque Corporate Identity

Trustworthy investment platforms provide clear information about ownership, legal structure, and management personnel. ImperialGatesTrade.com, by contrast, does not disclose verifiable details about its corporate entity, leadership team, or operational headquarters. There are no publicly confirmed names of executives or transparent contact information beyond generic email or web form options.

This lack of corporate identity makes it difficult for users to assess who controls the platform and whether those individuals or entities have the expertise or integrity to manage financial services. Scammers often hide ownership behind privacy tools and anonymous registration data to avoid accountability. When a company refuses to share basic corporate information, it reduces investor trust and increases risk.

New Website With Limited Operational History

ImperialGatesTrade.com appears to be a relatively new platform without a long history in the financial space. Legitimate investment services build reputation and credibility over years of operation, with documented market presence, user engagement, and performance records. A platform that suddenly appears with little traceable history and immediately solicits deposits should be approached with caution.

Established firms can point to track records, verified performance data, and independent reviews from reliable sources. In contrast, platforms with limited online footprints often lack verifiable data about user experiences, operational reliability, or historical performance, making it impossible to evaluate the substance behind their claims.

Unclear Investment Terms and Disclosures

Trustworthy financial platforms provide transparent details about fees, account policies, withdrawal conditions, and risk disclosures. ImperialGatesTrade.com’s terms are vague and offer little substantive clarity. Essential information about how trades are executed, how profits and losses are calculated, how fees are assessed, and how withdrawals are processed is either obscured or omitted.

Without clear terms, investors cannot fully understand their rights, obligations, or the mechanics of how the platform functions. This lack of clarity can lead to unexpected costs, denied withdrawals, or other adverse outcomes that users did not anticipate.

Unrealistic Return Claims and Lack of Performance Verification

ImperialGatesTrade.com markets itself with suggestions of high returns and consistent profit generation. However, the platform does not provide any verifiable performance history or independent auditing of returns. Legitimate trading services often publish historical performance data, audited results, or third‑party performance metrics to substantiate their claims.

Absent this transparency, return promises should be treated as unverified assertions. Users have no reliable way to confirm whether the platform’s trading strategies generate any real profits or if performance figures are exaggerated or fabricated. Investing based on marketing language alone places users at risk of financial loss.

High‑Pressure Marketing and Urgency Signals

ImperialGatesTrade.com uses language designed to create a sense of urgency, encouraging users to act quickly to secure “exclusive opportunities” or “limited access.” High‑pressure appeals are commonly used by high‑risk trading operators to push individuals toward hasty decisions without allowing time for due diligence.

Investment decisions should be based on careful research, risk analysis, and verification of credentials. Platforms that pressure users into quick choices often do so to prevent them from discovering regulatory gaps or opaque terms.

Questionable Technology Claims

The platform frequently mentions advanced tools, trading robots, and smart signals as part of its offering. However, there is no independent verification or technical documentation available to support these claims. Assertions about proprietary technology remain unproven without third‑party validation or performance audits.

Technical superiority can be a legitimate advantage for a trading service, but without evidence or proof of concept, such claims are merely marketing statements.

Lack of Credible User Feedback

One of the ways investors assess a platform’s reliability is through independent user feedback. Platforms with long operational history gather reviews from users on investment forums, social networks, and financial communities. Positive and negative experiences from real users help paint a picture of what to expect.

ImperialGatesTrade.com lacks credible, verifiable user testimonials. The absence of authentic user feedback makes it difficult to independently assess the platform’s performance, customer service quality, or reliability.

Why These Red Flags Matter

When multiple areas of concern cluster together — lack of regulation, opaque corporate identity, unrealistic claims, vague terms, and absence of verifiable data — a clear pattern of risk emerges. Investors should not assume that a platform’s professional appearance equates to legitimacy. A polished website cannot compensate for a lack of regulatory oversight, transparent policies, and verifiable performance.

Risky platforms often target individuals who are new to investing or who seek high returns without fully understanding the associated dangers. Education, due diligence, and independent verification are essential before committing capital to any financial service.

Conclusion: Avoid ImperialGatesTrade.com

ImperialGatesTrade.com may present itself as an attractive option for trading and investment, but its foundation lacks the core qualities of a trustworthy financial service. The absence of regulatory credibility, opaque ownership details, unrealistic return language, and unclear operational terms all point to significant risk. Investors should approach this platform with extreme caution and consider it unsuitable for safe investment.

Choosing a legitimate investment service requires verifying regulatory status, understanding corporate transparency, reviewing clear terms and conditions, and evaluating performance data. ImperialGatesTrade.com does not meet these essential criteria, making it a platform that serious investors should avoid.

When it comes to financial decisions, scepticism and due diligence are your first lines of defence. In the case of ImperialGatesTrade.com, the risks clearly outweigh any perceived opportunity.

Report imperialgatestrade.com And Recover Your Funds

If you have lost money to imperialgatestrade.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like imperialgatestrade.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.