CapitalBridgeInvest.com: An Unregulated Investment Site

In an increasingly complex and crowded digital investment landscape, fraudsters and illegitimate brokers continue to proliferate, targeting uninformed consumers with promises of high returns and effortless profits. Among the newer entrants attracting unwanted regulatory attention is CapitalBridgeInvest.com, a platform that purports to offer financial services and investment opportunities. However, a closer examination reveals fundamental problems that make this site a serious risk for anyone considering investing through it. This article examines the key issues associated with CapitalBridgeInvest.com and explains why people should steer clear of this platform.

What Is CapitalBridgeInvest.com Claiming to Be?

CapitalBridgeInvest.com presents itself as an investment and trading platform, suggesting to prospective users that they can engage in financial markets and grow their capital through the tools and services offered on the site. Investment platforms of this kind typically promise access to sophisticated markets, trading dashboards, portfolio management tools, and potentially attractive returns. However, there is an important distinction between legitimate, regulated brokers and unverified platforms that operate with little to no oversight.

Lack of Regulation: A Critical Red Flag

One of the most serious concerns about CapitalBridgeInvest.com is that it is not authorised or regulated by the United Kingdom’s Financial Conduct Authority (FCA), a primary regulator for financial services firms operating in the UK. The FCA’s Warning List explicitly notes that this entity is not on its register of authorised firms. This means that CapitalBridgeInvest.com does not have permission to provide financial services or investment products in the UK. Regulatory oversight exists precisely to protect consumers from fraud, ensure transparency, and enforce standards of behaviour. Without this oversight, there is no legal requirement for the platform to operate fairly, honestly, or in the best interests of its users. FCA

This lack of authorisation has serious implications for anyone considering investing through the platform. Clients of regulated firms benefit from clear rules governing how money is held, how complaints are handled and — in many cases — mechanisms for compensation in the event that a firm fails. With an unregulated firm, none of these protections are guaranteed, leaving investors completely on their own.

Fake or Misleading Claims

Scam investment platforms frequently attempt to project credibility by suggesting that they are regulated, compliant, or affiliated with recognised financial authorities, when they are not. In many instances involving fraudulent brokers, operators will use language or visual elements that mimic legitimate regulatory frameworks. Users might see references to licence numbers, regulatory bodies, or compliance badges that either do not exist or belong to other companies entirely.

While specific documentation associated with CapitalBridgeInvest.com is not available for public verification through recognised regulators, the very fact that the FCA lists this entity as unauthorised suggests that any claims about official regulation or licensing ought to be treated with extreme scepticism. Without clear, verifiable authorisation from recognised financial authorities, there is no reliable confirmation that the operation meets basic industry standards.

Limited Transparency and Company Information

Another common sign of a potential scam broker is a lack of basic corporate transparency. Legitimate investment firms provide clear information about their corporate structure, registered offices, senior management, and regulatory status. In contrast, high-risk platforms often obscure their ownership, list unverifiable contact details, or fail to provide any meaningful background about who runs the business.

With CapitalBridgeInvest.com, publicly available information is minimal, and the lack of verifiable presence on registration databases and professional financial directories makes it extremely difficult to assess the legitimacy of the operator behind the website. This opacity is not a trivial concern — if you cannot confirm who is running the platform or where they are based, you have no basis to determine whether they are trustworthy.

No Consumer Protection Mechanisms

Investment platforms that operate legally within regulated jurisdictions are typically required to participate in consumer protection schemes. For example, in the UK, firms regulated by the FCA may participate in the Financial Services Compensation Scheme (FSCS), which offers protection to eligible consumers if a firm fails. Because CapitalBridgeInvest.com is not on the FCA’s register, investors would not have access to these protections if something goes wrong. FCA

This absence of protection amplifies the risks. In the event of a dispute, financial loss, or operational failure, investors would be left without formal recourse to recover any losses. This is a risk that prudent investors would never take with reputable brokerage firms.

Common Behaviour Patterns of Scam Investment Platforms

While specific transactional data for CapitalBridgeInvest.com may not be widely documented, the pattern of behaviour associated with unregulated brokers globally provides relevant context for why caution is essential. Fraudulent platforms often exhibit the following characteristics:

1. Unrealistic Return Promises: Scams frequently lure victims with guarantees of high returns and minimal risk, appealing to the fear of missing out.

2. Withdrawal Barriers: After deposits are made, users may experience significant delays or outright refusal to permit withdrawals. In some cases, additional “fees,” “taxes,” or “verification charges” are demanded before funds can be released.

3. Pressure Tactics: Users may be contacted persistently through unsolicited calls, emails, or messages on social media to encourage further deposits.

4. Misleading Interfaces: Scam sites may feature professional-looking dashboards that show fabricated account balances and profits, designed to build trust and encourage deeper investment.

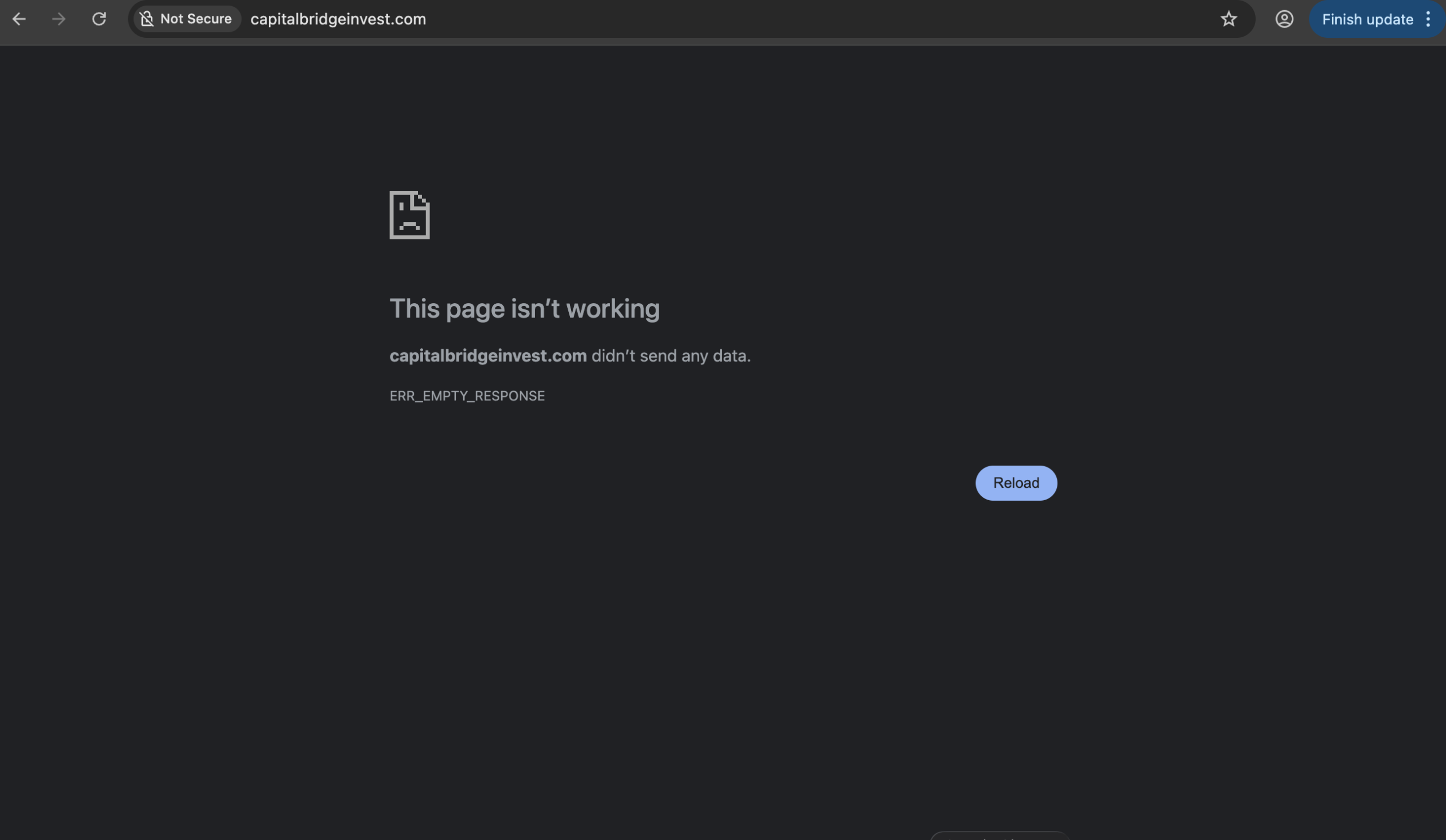

These behaviours are well-documented in regulatory warnings and consumer reports about fake investment platforms. In many cases, once users attempt to withdraw significant amounts of money, communication from the platform ceases, and the site may disappear entirely.

Assessing the Risk

When evaluating any online investment platform, due diligence is essential. Being cautious with any service that lacks independent verification is not only prudent — it is necessary to protect personal finances. CapitalBridgeInvest.com’s absence of regulatory registration and the lack of publicly verifiable credentials make it impossible to categorise the platform as a legitimate brokerage.

Investors should consider the following questions before engaging with any broker:

-

Is the platform licensed by a recognised financial authority?

-

Are there verifiable company details, including a physical address and registered management?

-

Do independent reviewers or regulators list the service as safe?

-

Has the platform been subject to consumer complaints or fraud alerts?

If the answer is negative, the risks far outweigh any potential benefits.

Final Thoughts: Steer Clear

In summary, CapitalBridgeInvest.com lacks the regulatory credentials, transparency, and consumer protections that are fundamental to legitimate investment firms. Its listing on the FCA’s Warning List as an unauthorised entity strongly suggests that it is not operating within established financial guidelines. FCA Without proper oversight, users are exposed to unnecessary risk, including the possibility of losing any money they deposit.

For anyone navigating online investment opportunities, prudence, scrutiny, and the use of well-regulated platforms are essential. In contrast, entities like CapitalBridgeInvest.com should be approached with extreme caution or avoided altogether.

Report Capitalbridgeinvest.com And Recover Your Funds

If you have lost money to capitalbridgeinvest.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like capitalbridgeinvest.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.