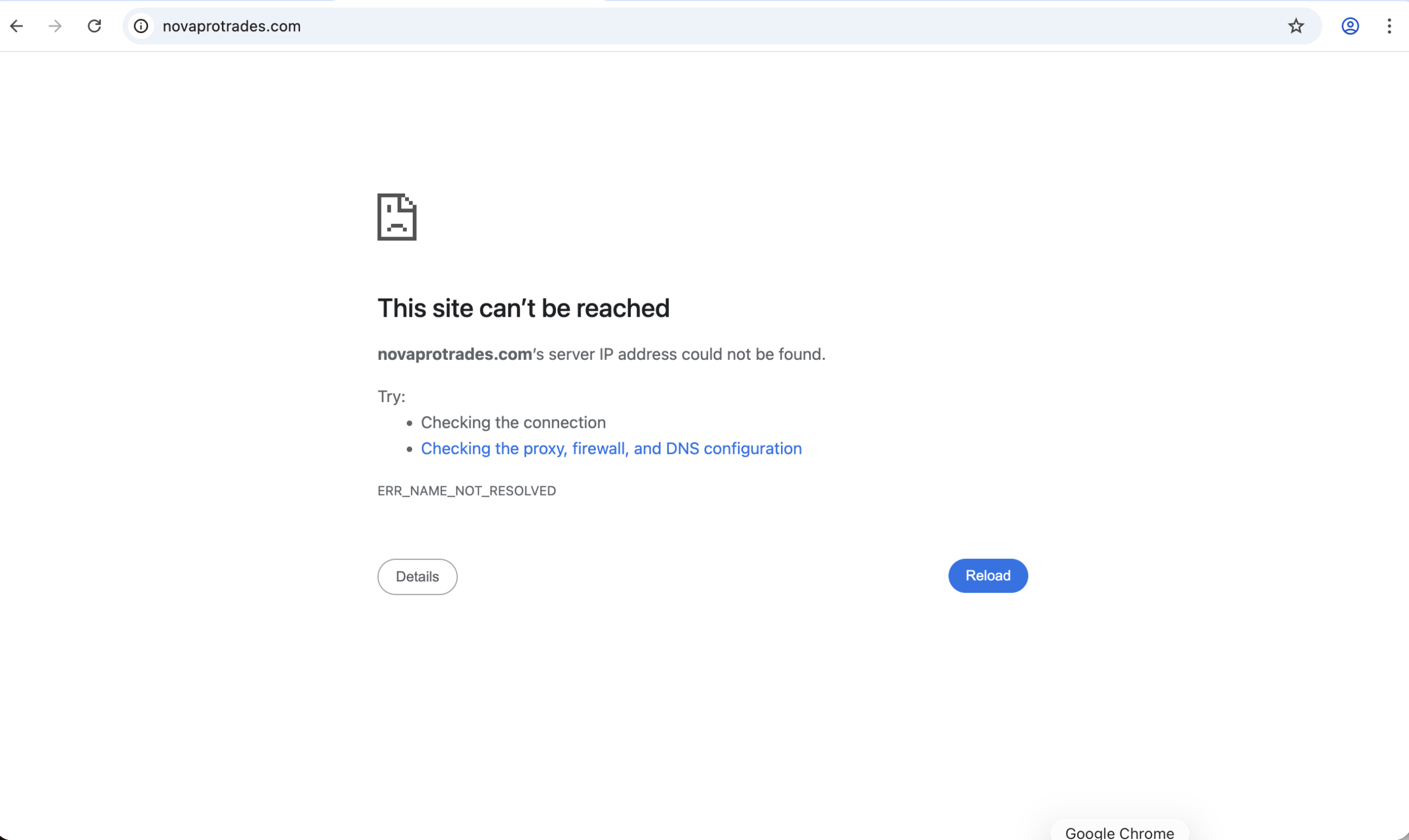

Novaprotrades.com: User Safety Concerns

When investors seek out online trading or investment platforms, it is essential to distinguish between reputable brokers and high-risk, unregulated entities. Novaprotrades.com is one such platform that has raised significant concerns among independent watchdogs and financial oversight reviewers. While it may present itself as a legitimate trading service, closer evaluation reveals multiple issues that suggest users should approach this platform with a high degree of caution and avoid financial engagement.

The following review assesses Novaprotrades.com’s credibility, structural weaknesses, and why many indicators point toward a risky and potentially harmful platform.

1. Extremely Low Trust Rating from Independent Analysts

Independent online risk assessment services have flagged Novatrades (the core domain for Novaprotrades.com operations) with a very low trust score of approximately 20.8/100. This rating reflects aggregated analysis of dozens of risk factors, including threat profiles, phishing tendencies, suspicious coding patterns, and proximity to other high-risk web properties. A score this low places the platform in the “suspicious” and “unsafe” category in automated security models. Scam Detector

Such low trust indicators are not merely technical: they reflect combined signals that digital safety engines use to classify sites associated with phishing, malware, or other deceptive behaviours.

2. No Recognised Regulatory Oversight

A fundamental principle in legitimate financial services and online trading is regulation by recognised authorities such as:

-

UK Financial Conduct Authority (FCA)

-

Australian Securities and Investments Commission (ASIC)

-

United States Securities and Exchange Commission (SEC)

-

Cyprus Securities and Exchange Commission (CySEC)

Novatrades (the platform behind Novaprotrades.com marketing) is not licensed or regulated by any major financial authority. In fact, the FCA has issued warnings about firms offering financial services without authorisation, including sites linked with similar names in the Novatrades ecosystem. FraudsTracker

Without proper registration, there is no external oversight of trading practices, client fund segregation, or compliance with financial safeguards. This exposes investors to unchecked operational risk and eliminates the legal protections available through reputable regulatory systems.

3. Anonymous Operation and Hidden Ownership

Legitimate brokers disclose transparent corporate information: registered company names, physical office locations, executive leadership, compliance officers, and verifiable corporate identities. Novaprotrades.com does not provide clear, verifiable ownership or registration details. Domain registration and associated documentation are either masked or absent, which is a common tactic used by high-risk or fraudulent operations to avoid accountability. Scam Detector

Obscured identity makes it difficult to verify who is responsible for operations, where funds are held, or how disputes might be resolved — all critical factors in evaluating financial platforms.

4. Unregulated Platforms Often Restrict Withdrawals

One of the most concerning patterns reported across similar unregulated sites is that users frequently encounter withdrawal difficulties. Independent reviews and complaint clusters on online forums note that unregulated brokers may allow small withdrawals initially to build trust, then impose hurdles when users attempt to access larger amounts. Such barriers often include arbitrary verification requirements, unexpected “fees,” or unexplained delays — all tactics used to frustrate users and retain control of deposited funds. FraudsTracker

These operational practices significantly heighten the risk of financial loss, particularly for users depositing substantial funds.

5. Aggressive Marketing With Unrealistic Promises

Novatrades-related platforms often market themselves with aggressive language about high returns, sophisticated trading systems, or “executive advisory services” that can maximise investor gains. However, no credible regulated broker can legitimately guarantee profits or “risk-free” returns in volatile markets like forex or cryptocurrencies. Common features of such marketing include:

-

Promises of quick or guaranteed profits

-

Suggestions of insider trading tools

-

Claims of “professional account managers”

-

Pressure to deposit before full account activation

These tactics align with typical high-risk investment solicitations rather than legitimate broker offerings. FraudsTracker

6. Unregulated Platforms Lack Investor Protections

Regulated financial firms typically bond with investor compensation schemes or dispute resolution frameworks that help clients recover funds if a broker fails or engages in malpractice. Because Novaprotrades.com and associated brands lack any recognised licence, these protections do not apply. Clients have no recourse through a recognised regulator if funds are withheld, mismanaged, or lost. FraudsTracker

In jurisdictions like the UK, using unapproved firms means losing access to consumer protection mechanisms such as the Financial Ombudsman Service and compensation schemes.

7. User Feedback and External Indicators Raise Doubt

On independent review platforms, versions of the Novatrades name exhibit predominantly negative user experiences, including claims of lost funds and failed withdrawals. Trustpilot has very limited reviews for a related Novatrades domain, but the available feedback leans negative, with users reporting that their interactions led to financial loss or frustration. Trustpilot

Limited and adverse real-user feedback further undermines confidence in platform reliability.

8. Opaque Business Model and Domain Variants

It is common to see similar domain variants and mirror sites around unregulated operations. This pattern complicates traceability and often signals attempts to evade scrutiny or rapidly shift branding in response to negative exposure. Such practices — including numerous variations of “Novatrade,” “NovaTrades,” and similar spellings — reinforce the perception that these platforms are not stable, transparent services but opportunistic entities profiting from investor uncertainty.

Conclusion: High Risk and Caution Advised

Based on independent assessments and industry signals, Novaprotrades.com exhibits multiple characteristics that make it unsuitable for serious financial engagement:

-

Extremely low independent trust scores

-

Absence of credible financial regulation

-

Hidden ownership and opaque corporate identity

-

Reported withdrawal and fund access issues

-

Unrealistic marketing claims

-

Lack of investor protection mechanisms

-

Negative or limited real-user feedback

These factors combined paint a consistent picture of high operational risk and a lack of safeguards typical of reputable brokers. Individuals considering online trading or investment platforms should prioritise regulated, transparent services with verifiable track records and compliance with recognised financial authorities.

Report Novaprotrades.com And Recover Your Funds

If you have lost money to novaprotrades.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like novaprotrades.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.