DominionVirtualAssets.com: Investor Caution Needed

The online world of digital asset investing and trading continues to attract new platforms every year. While some entities provide legitimate services, others use the veneer of modern financial technology to lure unsuspecting users. DominionVirtualAssets.com has emerged in late 2025 and early 2026 as a questionable financial service that raises multiple concerns for investors and traders. In this detailed review, we’ll unpack key issues related to its regulatory status, transparency, trustworthiness, and operational legitimacy.

Based on current regulatory warnings and independent assessments, DominionVirtualAssets.com appears to be an unregulated platform fraught with risk for those considering depositing funds or entering into trading activities.

Regulatory Warnings and Lack of Authorisation

One of the most critical components investors should check before using any financial services platform is its regulatory standing. Licensed financial firms operating in the United Kingdom, Europe, or other major markets must register with recognized authorities, such as the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), or similar bodies.

In the case of DominionVirtualAssets.com:

-

The UK FCA has issued a public warning stating that the firm may be providing or promoting financial services without its permission. These warnings explicitly alert consumers that they are dealing with an entity that is not authorised to offer regulated financial products in the UK. Nathan Reclaim LLC+1

-

The platform’s claim to be regulated by bodies such as the Seychelles Financial Services Authority or CySECcannot be verified in official regulator databases. Independent checks show no record of valid licences under these regulators matching the company’s name or website domain. FastBull

In essence, DominionVirtualAssets.com operates without legitimate regulatory oversight, meaning users have no formal protection, no compensation schemes, and little legal recourse if the platform fails or withholds funds.

Transparency and Corporate Clarity Are Absent

Reputable financial services providers disclose clear company information: registered corporate names, physical addresses, executive teams, compliance personnel, and detailed regulatory licence numbers. DominionVirtualAssets.com, by contrast, lacks transparent corporate information that can be verified independently.

Domains that are poorly transparent or use concealed WHOIS data often indicate an attempt to obscure ownership and operational responsibility — a common tactic used by high‑risk platforms and fraudulent entities to avoid accountability.

Trust and Online Risk Signals

Domain and trust assessment tools that analyse site history, hosting, domain age, and online associations frequently highlight DominionVirtualAssets.com as a low‑trust and high‑risk website.

-

Independent broker assessment platforms have labelled DominionVirtualAssets.com as an unregulated broker and a risky entity, further echoing the concerns raised by regulatory authorities. FastBull

-

Moreover, the platform’s pattern — new domain, dubious regulatory claims, and minimal verifiable presence on reputable financial service registries — matches other online services historically linked to misleading investment offerings.

These risk indicators suggest that potential users should treat the platform with extreme caution, especially when compared with established, licensed alternatives.

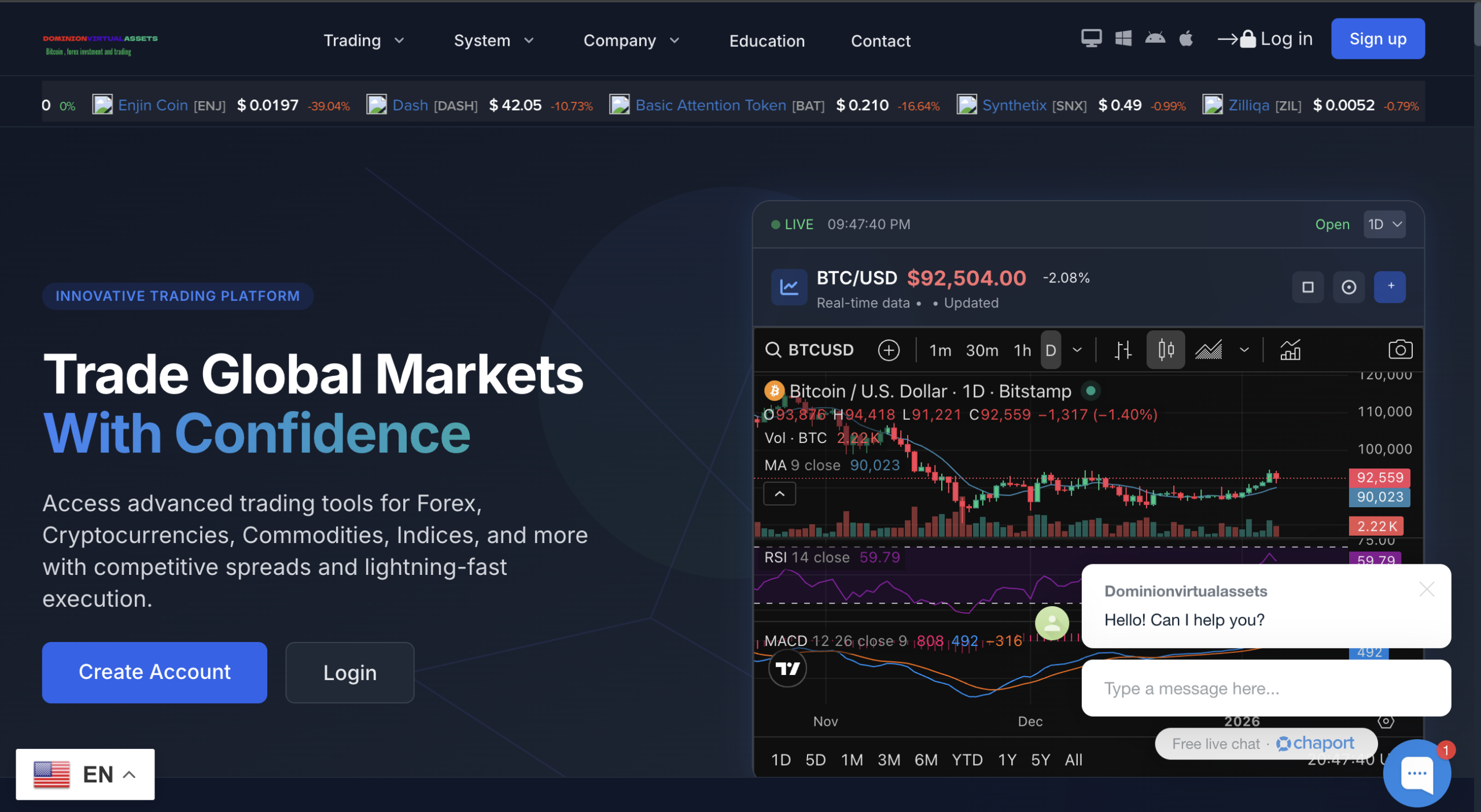

Marketing Claims vs. Verifiable Facts

DominionVirtualAssets.com markets itself as a solution for digital asset trading and investment. However, its marketing claims do not align with documented facts:

-

The site often suggests broad regulatory compliance or international licences that, upon scrutiny, do not appear in any official public databases maintained by global regulators.

-

The presentation of high return potential, diverse financial products, or “expert advisory support” is not accompanied by audited performance data or independent confirmations.

Such discrepancies between what is claimed and what can be verified are hallmarks of high‑risk operations that prioritise sales over transparency.

Operational Risks for Investors

When a platform operates without regulation or verifiable oversight, several practical and financial risks arise:

-

No Deposit Insurance or Protection

Investors’ funds are not protected by legal compensation schemes that cover losses due to insolvency or platform failure. -

Unverified Withdrawal Processes

Without user‑reported evidence or regulated procedures, there’s no assurance that deposited funds can be withdrawn reliably in full. -

Opaque Terms and Conditions

Unregulated platforms often embed complex clauses or restrictions in their legal terms, which can be used later to deny withdrawal requests or charge unexpected fees. -

Limited Accountability

When problems occur — such as frozen accounts or disputed transactions — users are left with no financial ombudsman or arbitration authority to escalate complaints.

These risks compound the uncertainty around DominionVirtualAssets.com and create an environment where financial loss is not only possible but likely if adequate due diligence is overlooked.

Why Due Diligence Matters

Before engaging with any platform that solicits deposits, trading, or investment activities, it is crucial to verify:

-

Regulatory registration with recognised authorities

-

Physical and corporate transparency

-

Clear, independent user reviews from trusted financial communities

-

Terms that protect investors’ rights and funds

Platforms that lack these fundamentals — including DominionVirtualAssets.com — fall short of industry standards and often expose users to unnecessary financial risk.

Final Verdict: Unregulated and High Risk

In summary, DominionVirtualAssets.com exhibits several concerning characteristics that make it an unsafe choice for prospective investors:

-

No verifiable regulatory status

-

Opaque ownership and business structure

-

Misleading claims of regulation

-

High‑risk indicators from independent assessment tools

These findings indicate that DominionVirtualAssets.com is not a trustworthy financial services provider and carries significant potential for financial harm. If you are considering using an online investment or trading platform, prioritise entities that are properly regulated, transparent, and well‑established in the financial industry.

By staying informed and vigilant, you can better protect your financial interests and avoid platforms that pose unnecessary risks.

Report Dominionvirtualassets.com And Recover Your Funds

If you have lost money to dominionvirtualassets.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like dominionvirtualassets.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.