The‑Algorithmic‑Trader.com: Key Investment Concerns

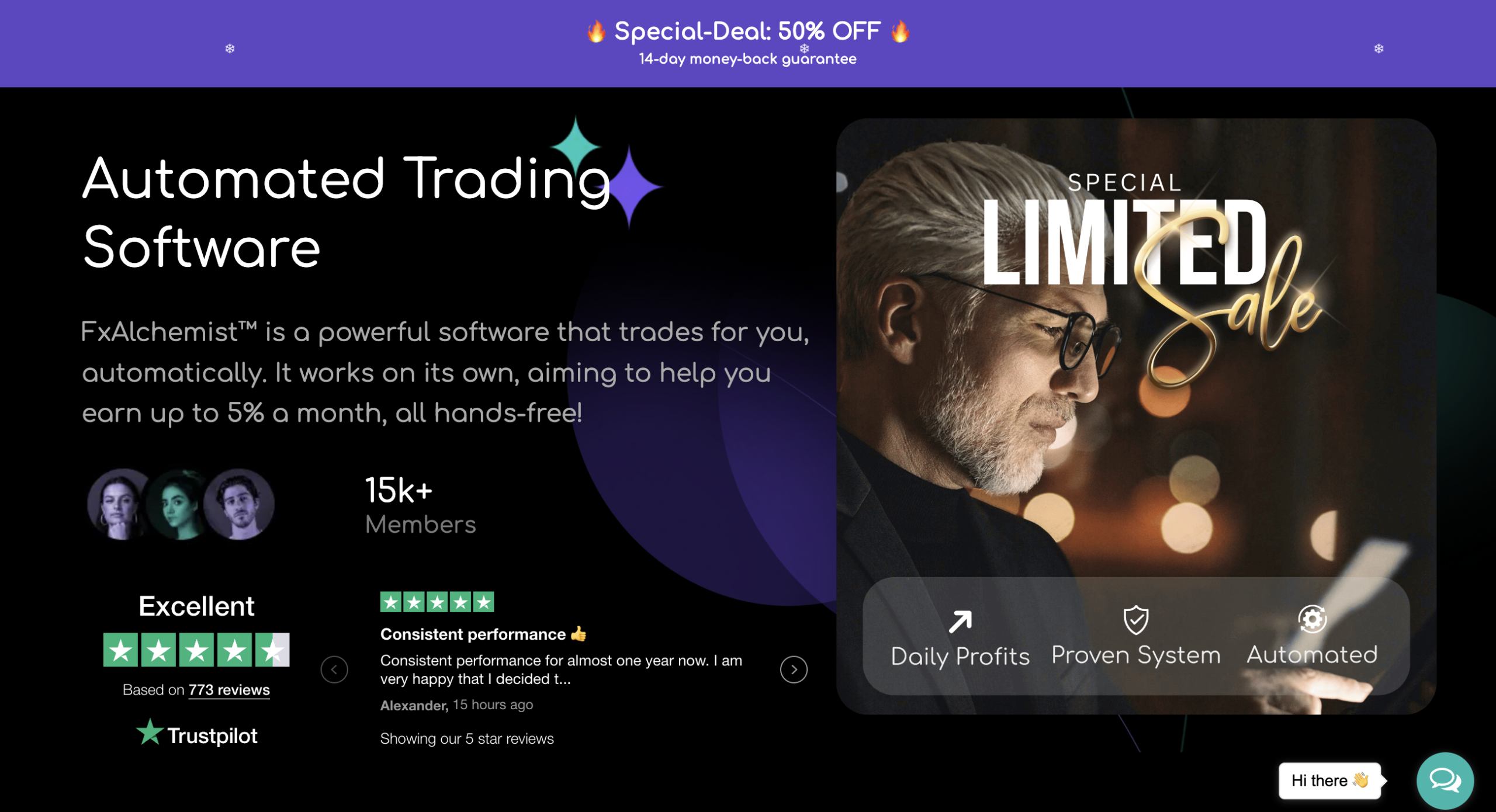

In the expanding world of automated and algorithmic trading systems, platforms claiming to use artificial intelligence or proprietary “bot” engines to generate steady profits are increasingly prevalent. One such service that has attracted attention recently is the‑algorithmic‑trader.com. While the site promotes an automated AI‑powered trading tool called Alchemist™, deeper investigation raises serious concerns about the platform’s legitimacy, transparency, and risk to users.

This review breaks down the major warning signs associated with The‑Algorithmic‑Trader.com and explains why investors should proceed with extreme caution or avoid the platform entirely.

Regulatory Warnings and Lack of Authorization

One of the most decisive factors in evaluating any trading or investment platform is whether it is regulated by an acknowledged financial authority. Regulation ensures oversight, enforceable investor protections, and compliance with financial laws.

In December 2025, the UK Financial Conduct Authority (FCA) issued an official warning stating that The Algorithmic Trader / FxAlchemist may be providing or promoting financial services without any permission from the regulator. The FCA specifically advised the public to avoid dealing with this firm. FCA

This means that under UK law the platform is operating outside the scope of legitimate financial oversight and is not authorized to offer trading services to consumers. Any firm offering financial products without proper licenses should immediately raise red flags.

Unverified Regulation and Misleading Claims

On its website, The‑Algorithmic‑Trader.com markets a fully automated AI trading tool with claims of consistent monthly returns and user benefits. However, no credible regulator has confirmed that this platform holds a valid trading license or oversight status. Independent reviews note that the company does not provide clear regulatory credentials or verifiable registrations in recognized databases. Reliable Forex Broker

The absence of verifiable regulatory status, despite the platform’s promotional language suggesting professionalism and legitimacy, suggests the platform could be using misleading claims to create a false impression of authority. This is a common tactic used by high‑risk services to lure in unsuspecting users.

Opaque Ownership and Limited Transparency

Reputable financial service providers disclose detailed information about their ownership, corporate structure, physical office locations, and leadership. In contrast, The‑Algorithmic‑Trader.com hides its ownership information using private WHOIS registration services and provides minimal corporate visibility. ScamAdviser

This lack of transparency prevents potential investors from assessing who is behind the platform, where their funds are held, and what legal jurisdiction governs operations. Without this information, there is no accountability if user funds are mismanaged, lost, or withheld.

Unrealistic Promises and High‑Risk Marketing Tactics

Independent analyses highlight that The‑Algorithmic‑Trader.com promotes unrealistically high monthly returns through its automated system—up to 12% per month according to some descriptions on the site. ScamMinder

High and guaranteed return claims are widely recognized as hallmarks of risky or deceptive investment schemes, especially when offered with limited explanation of the underlying trading methodology or risk control strategies. Legitimate financial services always disclose that past performance does not guarantee future results and provide detailed risk warnings, which are notably absent or insufficient here.

Additionally, some offers emphasize “limited‑time deals” or urgency to invest, which is a marketing technique frequently used in deceptive platforms to pressure visitors into quick decisions without proper vetting. ScamMinder

Questionable Reputation and External Reviews

Trust and reputation tools that assess website safety and credibility place The‑Algorithmic‑Trader.com in a high‑risk category:

-

Some technical trust models assign the site a very low trust score, highlighting blacklist flags, limited reputation footprint, and suspicious operational indicators. Gridinsoft LLC

-

Independent security risk reports note lack of quality content, unclear ownership, and potential threats related to malware or data collection without safeguards. Gridinsoft LLC

-

Reviews on platforms like Trustpilot, although limited, have only negative user feedback, with reviewers describing the site as “totally fake” and alleging that its primary goal is to take money and restrict user access afterward. Trustpilot

These reputation signals, combined with the absence of authoritative validations, indicate that many third‑party sources treat the platform as untrustworthy.

Lack of Verifiable Trading Infrastructure

Despite claiming to offer an automated AI trading product, there is no credible evidence that the platform engages in real, verifiable trading on regulated markets. No audited performance records, no independent third‑party reporting, and no accessible trading infrastructure details are found on the site.

Without verifiable data or transparency into how algorithms execute trades, what markets they participate in, or how profits are generated, users have no way to confirm whether the service functions as advertised or is simply a promotional facade.

Investor Takeaways and Risk Summary

Taken together, the following risk factors suggest The‑Algorithmic‑Trader.com is a platform that investors should be extremely wary of:

-

Regulatory warning from a major authority indicating the platform may be operating without authorization. FCA

-

Misleading or unverified compliance claims with no legitimate licensing in public registries.

-

Opaque corporate identity with private WHOIS and no transparent legal entity information. ScamAdviser

-

Unrealistic return promises common to high‑risk marketing schemes. ScamMinder

-

Low trust scores on independent reputation and security analyses. Gridinsoft LLC

-

Negative user reports suggesting the platform may withhold access after deposits. Trustpilot

These indicators collectively point to a platform that does not meet basic criteria of transparency, oversight, or investor protection.

Conclusion: Avoid The‑Algorithmic‑Trader.com

Anyone considering engagement with The‑Algorithmic‑Trader.com should reconsider. With regulatory warnings, unverified promises, hidden ownership, and poor reputation signals, the platform does not present the transparency or legitimacy required for prudent investors.

For anyone exploring automated or algorithmic trading tools, it is essential to limit your choices to platforms that are fully regulated, disclose verifiable corporate information, and provide independently audited performance data. The absence of these safeguards in The‑Algorithmic‑Trader.com suggests it is too high‑risk for involvement.

Proceed with caution, and prioritize platforms with strong compliance records and transparent operations.

Report The-algorithmic-trader.com And Recover Your Funds

If you have lost money to the-algorithmic-trader.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like the-algorithmic-trader.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.