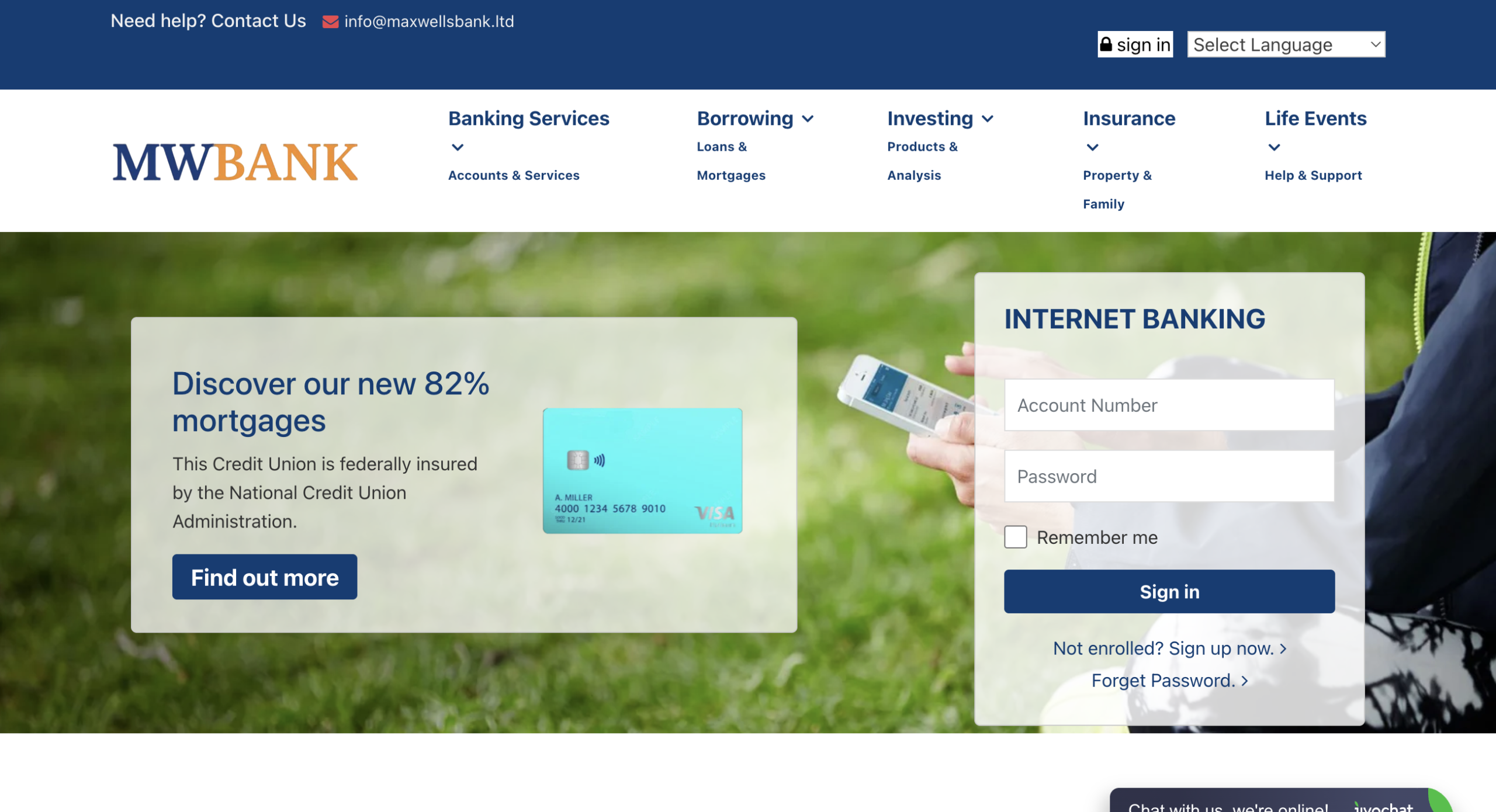

Maxwellsbank.ltd Transparency and Legitimacy

In recent years the proliferation of unregulated online financial platforms has surged, preying on unsuspecting individuals eager for investment returns or banking services. Among these dubious operators is Maxwellsbank.ltd (also referred to as Max Wells Bank by authorities), a website purporting to offer financial services and products. Despite its polished facade, regulatory findings and risk assessments make it clear this is not a legitimate financial institution. This review examines why Maxwellsbank.ltd should be considered a scam platform and why investors and savers should avoid it entirely.

Regulatory Warnings: A Major Red Flag

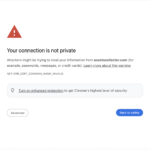

One of the most critical indicators of a scam or risky financial service is the absence of authorization from recognised financial regulators. In December 2025, the United Kingdom’s Financial Conduct Authority (FCA) publicly listed Max Wells Bank / www.maxwellsbank.ltd as an unauthorised firm, warning that it appears to be promoting financial products or services without permission from the FCA. According to the regulatory notice, individuals are advised to avoid dealing with this firm and beware of scams, as it is not authorised to operate in the UK financial services market. Moreover, you would not have access to protections such as the Financial Ombudsman Service or the Financial Services Compensation Scheme if you engage with this entity. FCA

This absence of official regulation is not a trivial compliance detail — it strikes at the foundation of trust and investor protection. Financial regulators exist to enforce strict rules on transparency, client fund segregation, reporting, risk management, and dispute resolution. A firm that operates without this oversight has no legal obligation to protect its clients’ monies, report its financial health, or adhere to clear operational standards. That lack of oversight opens the door for outright fraudulent activities.

False Legitimacy and Lack of Transparency

Scam platforms often borrow legitimacy by presenting professional-looking websites and claiming to be based in respected jurisdictions such as the United Kingdom. Maxwellsbank.ltd lists a UK address and contact email, yet closer scrutiny reveals that these details cannot be verified through official corporate registries or financial authority databases, and the regulatory warning itself underscores the lack of genuine authorization. FCA

This tactic is common among online scams: present a credible address, email, and website layout to give the illusion of trustworthiness, while keeping real verification and documentation out of reach for prospective clients. Genuine banks and regulated financial entities publish verifiable licensing details, oversight information, and clear legal disclosures. The absence of these transparent markers on Maxwellsbank.ltd suggests that it is not a bona fide bank or financial institution.

Unrealistic Promises and Risky Claims

While specific details about Maxwellsbank.ltd’s product offerings are thin, platforms of this type typically solicit deposits with promises of unusually high returns or effortless gains. Even if the exact claims vary, there is a consistent pattern among scam sites to allure users with the promise of high yields, guaranteed profits, or exclusive investment opportunities. Legitimate financial institutions never guarantee returns, and reputable brokers always include clear warnings about investment risks.

The FCA and similar regulators consistently caution the public that any financial firm making bold claims about profits without commensurate risk disclosures should be approached with extreme skepticism. Many fraudulent platforms also avoid publishing any meaningful client risk notices, legal disclaimers, or detailed terms of service — a red flag for anyone familiar with regulated financial services.

Fake Contact Information and Limited Support

A hallmark of scam platforms is the use of fake or unverifiable contact information. Although Maxwellsbank.ltd lists an email and address, there is no reliable evidence that these are affiliated with a real, functioning financial organization. Real banks and investment firms maintain active customer support channels, including phone lines, live chat, and offices that can be verified through corporate filings and searches in official business registries. The lack of transparent and verifiable means of contact increases the risk that once a client makes a deposit or begins engaging with the platform, they will be unable to reach anyone who can meaningfully assist them.

Lack of Legal Protections and Fund Safety

One of the most dangerous aspects of dealing with unregulated platforms is that funds sent to them are not protected by consumer protection schemes. In regulated markets, client funds are often held in segregated accounts or covered by compensation schemes in case of insolvency or misconduct. Because Maxwellsbank.ltd operates without any known regulatory oversight, there is no assurance that deposited funds are held securely or can be recovered if the platform disappears.

The FCA warning explicitly notes that dealing with this firm means you would not have access to essential recourse mechanisms should disputes, losses, or insolvency occur — an unacceptable level of risk for anyone entrusting money to an online financial entity. FCA

Patterns of Deception in Similar Platforms

Although the regulatory warning applies specifically to Maxwellsbank.ltd, the broader ecosystem of similar platforms betrays common scam tactics. Fraudulent brokers and unregulated trading sites often:

-

Present professional or slick user interfaces to mask their illegitimacy.

-

Provide unrealistic profit claims or encourage rapid deposit increases.

-

Use unverifiable contact information or anonymous domain registrations.

-

Prevent or delay withdrawals of funds under various pretexts.

-

Display fake or boosted testimonials to entice new investors.

Regulators worldwide caution against engaging with any entity lacking proper licensing, and reports of scams in unregulated financial markets continue to increase as fraudsters adapt to use new branding or domain names.

Conclusion: Avoid Maxwellsbank.ltd Completely

Maxwellsbank.ltd exhibits all the hallmarks of a scam or high-risk unauthorised financial platform: it is not regulated by recognized financial authorities, it lacks verifiable corporate legitimacy, and it offers no protection for client funds. The UK financial regulator’s warning alone should be sufficient cause for serious concern and avoidance. FCA

For anyone considering financial services or investment platforms, the single most important criterion should be verified regulatory authorization from a recognized body such as the FCA, SEC, or similar entity in your jurisdiction. Maxwellsbank.ltd meets none of these essential requirements. Investors and consumers should steer clear of this platform and instead seek out established, transparent, and fully regulated financial service providers.

Report Maxwellsbank.ltd And Recover Your Funds

If you have lost money to maxwellsbank.ltd, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like maxwellsbank.ltd continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.