86fxglobal Review: What You Should Know

The online investment landscape can be attractive. Promises of high returns, easy access to global financial markets, and the potential to earn on forex, crypto, or asset trading sound enticing. Unfortunately, not every platform that markets itself as a financial broker or investment solution is legitimate. 86fxglobal.com is one such platform that has drawn significant scrutiny, skepticism, and warnings from financial watchdogs, independent reviewers, and people who have interacted with the service.

In this review, we break down what 86fxglobal claims to offer, what independent checks and critics have discovered, and why potential investors should avoid engaging with this platform.

What 86fxglobal Markets to Investors

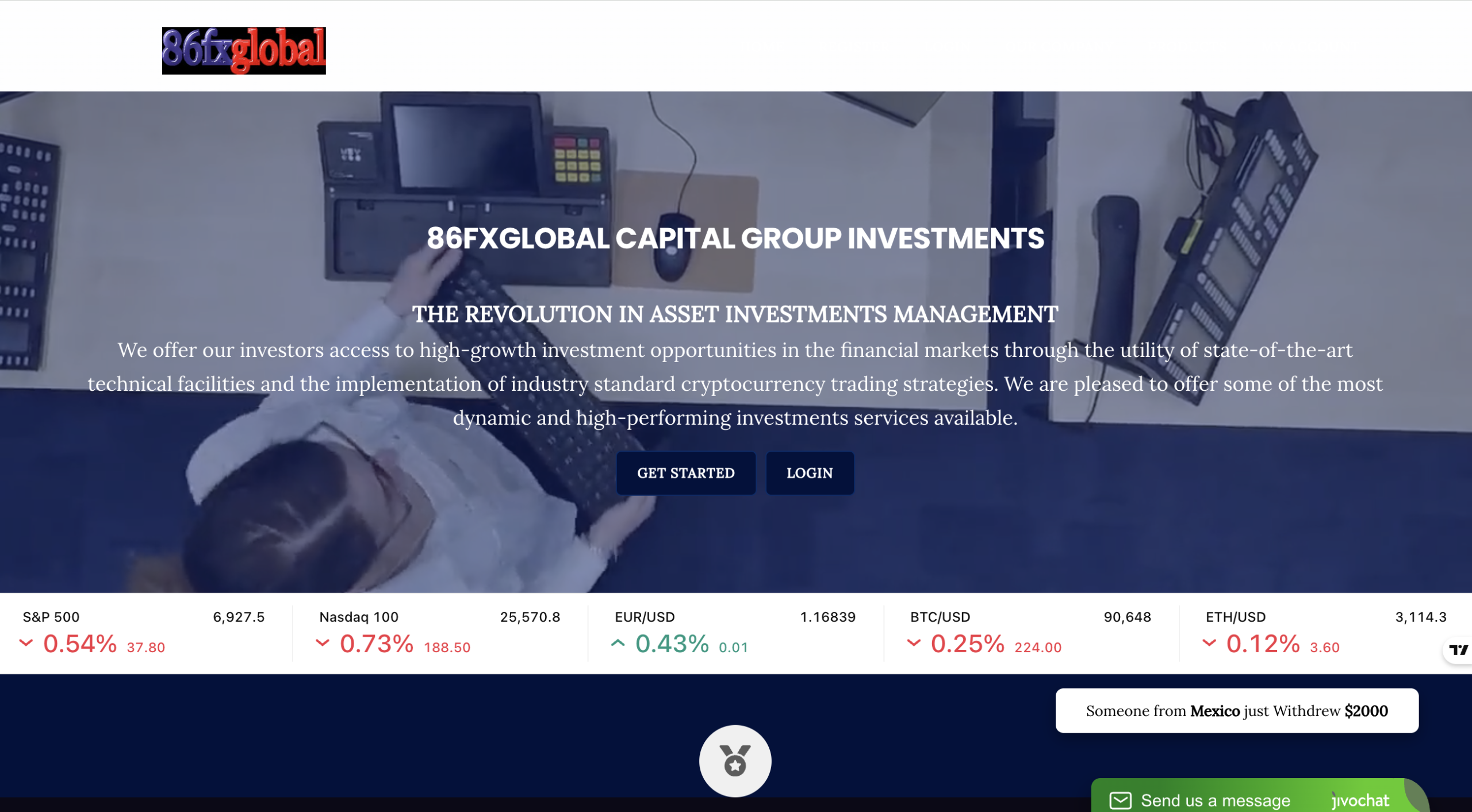

On the surface, 86fxglobal presents itself as a professional investment and trading platform. Its website showcases a sleek interface, promises access to high‑yield financial products, and markets itself as a globally licensed and regulated investment firm offering services in forex trading, cryptocurrency, and other financial markets. It also touts features like “ultra‑low spreads”, “negative balance protection”, and educational resources for traders. 86fxglobal.com

The platform boasts multiple account tiers with varying minimum investment requirements — from a “Starter” account with a high deposit threshold to more expensive “Pro” or “Executive” accounts. It also promotes a referral system that pays bonuses for bringing in new investors. 86fxglobal.com

However, there is a stark contrast between the polished marketing language on the site and what independent evaluations and regulatory bodies have found.

Regulatory Status: A Major Red Flag

A core indicator of whether an online broker is trustworthy is its regulatory status. Legitimate brokers must be licensed and supervised by recognized financial authorities such as the UK’s Financial Conduct Authority (FCA), Cyprus’s Cyprus Securities and Exchange Commission (CySEC), the Australian ASIC, or similar regulators in other jurisdictions.

In the case of 86fxglobal, independent checks reveal no evidence that it is regulated by any established financial authority. According to third‑party broker review sites, the company claims on its own website to be regulated by both the FCA and CySEC — but searches with these regulators do not show any valid registrations or licenses matching 86fxglobal. Moreover, the FCA itself issued a warning in December 2025 alerting the public that 86fxglobal may be operating without the required authorization to offer financial services. FastBull

This lack of genuine regulatory oversight is a serious concern for any investor. When a platform is unregulated:

-

Your funds are not protected by a regulated custodian.

-

There’s no guarantee your money is segregated from the company’s operating funds.

-

Legitimate dispute or compensation mechanisms typically do not apply.

Trust and Transparency Issues

Beyond the regulatory status, there are structural trust issues with 86fxglobal’s online presence:

-

Hidden Ownership: Whois lookup data for the domain shows that the identity of the website’s owner is hidden, which is atypical for a transparent financial services provider. ScamAdviser

-

Very Low Trust Score: Scam detection services have flagged 86fxglobal with an extremely low trust score, suggesting that the site may be unsafe or fraudulent. This assessment considers factors like site age, unexpected server neighbors with poor reputations, and high‑risk content. ScamAdviser

-

New and Young Domain: The domain was only recently registered, further raising red flags since high‑risk or fraudulent sites often appear overnight and change names frequently once flagged. ScamAdviser

These findings should make any investor pause before considering depositing funds.

User Reports and Withdrawal Problems

While there may not be large, widely publicized mainstream complaints about 86fxglobal yet, there are growing reports on specialized review platforms and complaint forums detailing issues people encounter after depositing money.

The most recurring concern is withdrawal difficulty. Accounts may show gains on paper, but users have reported extended delays, requests for additional fees (such as unspecified verification or “liquidity” charges), and sudden account restrictions when attempting to withdraw funds. These are classic patterns seen in cases of deceptive brokers. equityrecourse.com

These withdrawal obstacles often escalate into emotional and financial stress for affected investors who feel trapped and are unable to access their assets.

Terms & Conditions Expose Additional Risks

Even a cursory look at 86fxglobal’s terms and conditions reveals clauses that strip clients of protections typically offered by regulated brokers. One particularly alarming clause states that funds you transfer belong to the company immediately, potentially enabling the company to use client deposits for its own purposes rather than holding them in segregated accounts. 86fxglobal.com

This type of legal language is incompatible with reputable investment firms that must hold client funds separately and transparently under financial regulation.

The Bottom Line: Steer Clear

Based on current evidence, here is a concise summary of why 86fxglobal.com should be approached with extreme caution:

-

Unregulated operations: There is no verifiable registration with reputable financial authorities. FastBull

-

Regulatory warnings: Official entities such as the UK’s FCA have warned about the platform. FastBull

-

Low trust and hidden ownership: Independent risk tools indicate serious trust issues. ScamAdviser

-

Withdrawal problems: Multiple user reports highlight difficulty getting funds out. equityrecourse.com

-

Terms that disadvantage clients: Legal language suggests clients have limited rights over funds. 86fxglobal.com

Investing in financial markets can be legitimate and profitable when done through regulated and transparent brokers. Investors should prioritize platforms that clearly disclose their licensing, have a long track record of compliance, and provide transparent terms for fund protection.

Given the evidence to date, 86fxglobal.com does not meet these basic standards, and potential investors should avoid using it entirely. If you are considering entering online trading or investment, take the time to conduct independent checks, consult verified reviews, and use brokers regulated by recognized authorities to safeguard your capital.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to 86fxglobal.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like 86fxglobal.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.